Cards

How to apply for the Bradesco Neo card step by step

Discover the step-by-step process on how to apply for the newest Bradesco bank card, the Neo credit card.

Advertisement

Characteristics of the Bradesco Neo card

Bradesco Neo (from the Bradesco bank) seeks, above all, to bring greater practicality and ease to its customers so that, in this way, they can enjoy the benefits and advantages that the card offers in the best possible way.

Therefore, the brand of the Bradesco Neo card is Visa. With it, you will have access to almost all stores and establishments in Brazil and even in the world.

Yes, that's right! You get access to different products around the world. This happens because the card has international coverage, that is, it offers the possibility of buying products and services that are only found in countries abroad.

Even today, most traditional companies charge their customers the card's annual fee. So, users need to pay, as the bank asks, a certain annual amount to be able to use the card and enjoy its benefits.

However, if you buy the Bradesco Neo card, it is possible that you will not pay the annual fee for the card, that is, you can be exempt from paying a certain amount to use the card once a year.

For this to happen, that is, for you not to pay the card's annual fee, you will need to spend at least R$50.00 reais per month using the card.

If this does not happen, you will unfortunately have to pay the card's annual fee, which currently costs R$240.00 reais, or 12 times R$20.00 reais.

Finally, you can, with the Bradesco Neo card, pay your invoices within 40 days of purchasing a product. The best thing about it is that you don't have to pay any kind of interest to access this benefit.

See below how to apply for the Bradesco Neo card, which is growing more every day in Brazil.

Who can apply for the Bradesco Neo card?

For you to be able to apply for the Bradesco Neo card, you must first meet some requirements that the bank itself charges.

You must be at least 18 years old; therefore, if you are a minor, your card application will be denied.

In addition, you must have a valid CPF and RG; otherwise, your request will also be denied.

Finally, you need to earn at least R$1.045 reais, that is, a minimum wage.

Request a Bradesco Neo card online

First of all, go to the official website of Bradesco bank.

After that, fill in the form with all your personal data and documents.

Then, after sending all your data, the bank will analyze your profile; if you have a dirty or negative name, your request will most likely be denied.

If your profile is approved, click on “Order Now”.

Contact number

If you have any questions about the card or how to apply for it, please contact the following numbers:

- Capitals and metropolitan regions: 3003 0237

- Other locations: 0800 701 0237

What did you think of the card? Like it and want to order yours? If yes, then click on the button below and you will be redirected to the official website of the Bradesco Neo card:

About the author / Gustavo Cezar

Reviewed by / Junior Aguiar

Senior Editor

Trending Topics

Online Blue Card: with special and exclusive advantages for travel

Learn about the main advantages that the Blue card online can offer you, in addition to knowing how to apply for this card!

Keep Reading

Discover the Caixa Elo Nanquim card

Discover the Caixa Elo Nanquim card here and all the possibilities you will have when applying for this card with an initial limit of R$15,000.00.

Keep Reading

How to open a PicPay account

Learn how to open a PicPay account through your cell phone, without paying anything for it and still guaranteeing benefits such as cashback. Check out!

Keep ReadingYou may also like

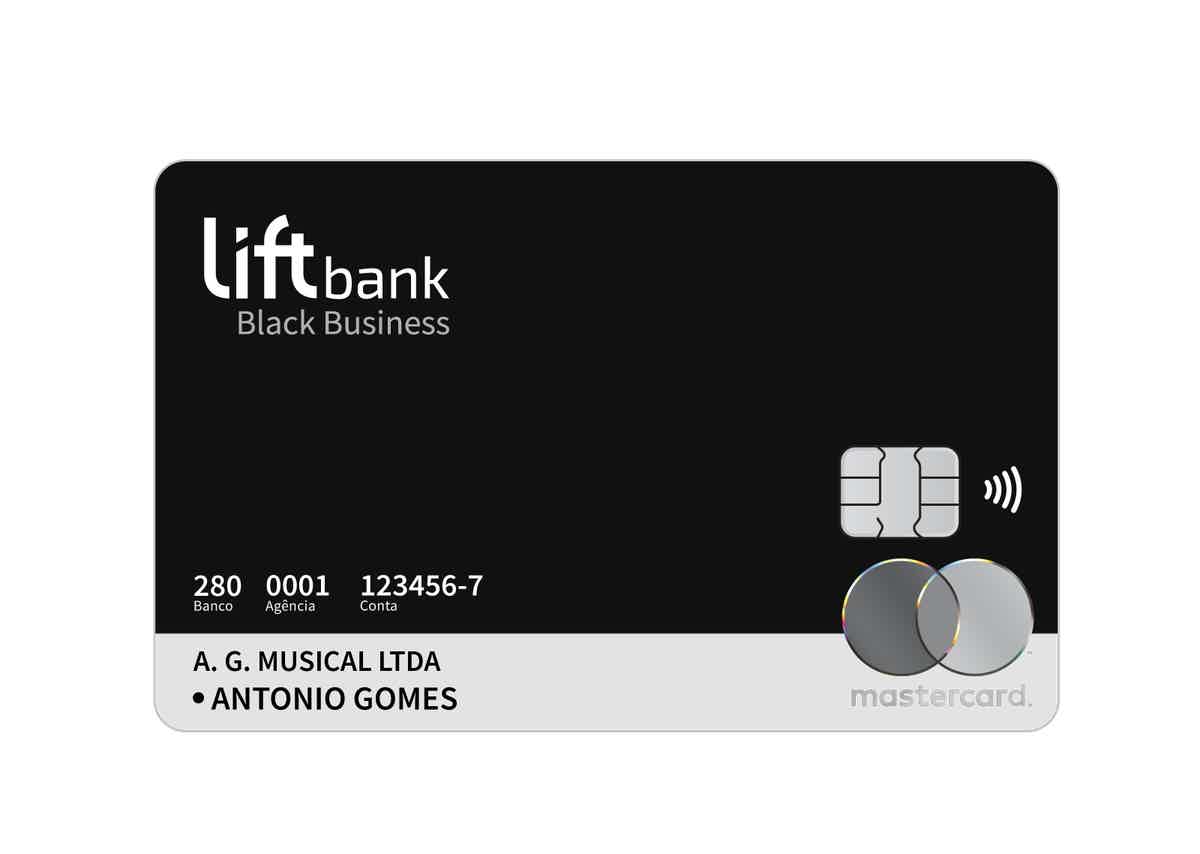

Discover the LiftBank credit card

Do you know the LiftBank credit card? It is international with a Mastercard flag, as well as being exclusive to entrepreneurs. Continue reading this text and learn all about it.

Keep Reading

Discover the Decathlon credit card

The Decathlon credit card offers excellent payment conditions for the brand's customers. In addition, you can enjoy a good Cashback Program. Want to know more? So, read this post and check it out!

Keep Reading

How to open a current account CEMAH Especial Particulares

Are you looking for a current account designed for you and with less commissions? Then see how to open your Special Particulars account at CEMAH and have access to everything you need. See more information below.

Keep Reading