Cards

How to apply for your Atacadão card in a simple way

Find out right now everything you need to do to apply for your wholesale card. Our team has separated the step by step for you to be able to submit your request today.

Advertisement

See how to apply below.

The Atacadão card is a simple but very functional card with great advantages, especially for those who are already customers of the chain. Today you will learn all about how to order yours.

Today's article is very straight to the point, so you'll learn step by step everything you need to apply for your Atacadão card.

This card is an excellent option for those who make frequent purchases on the Atacadão chain as a whole, that is, wholesale at drugstores and gas stations.

If you want to apply for the card right now, just click below

It is important that you know exactly the advantages and disadvantages of having the card so that you can make the right decision and not have problems in the future.

Documents required to apply for the Atacadão credit card

- Personal identification documents: CPF and RG or identity card.

- Proof of address.

- Proof of income

How to apply for an Atacadão credit card

You can apply for the Atacadão card at any of the chain's stores.

The answer on the credit analysis is instantaneous and you can leave the store with your card. You can also apply online, as follows:

1 – Access the Atacadão Card website and click on “order yours” to request your Atacadão card

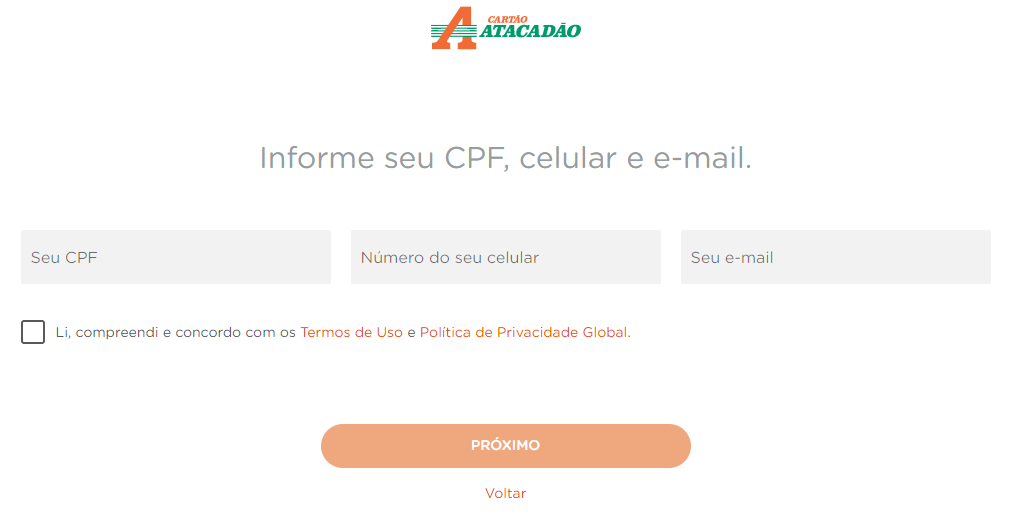

2 – After that, you will start to fill in the first data to continue the process to request your Atacadão card.

In this initial stage, you will provide your CPF, your cell phone number and your email as shown in the photo below.

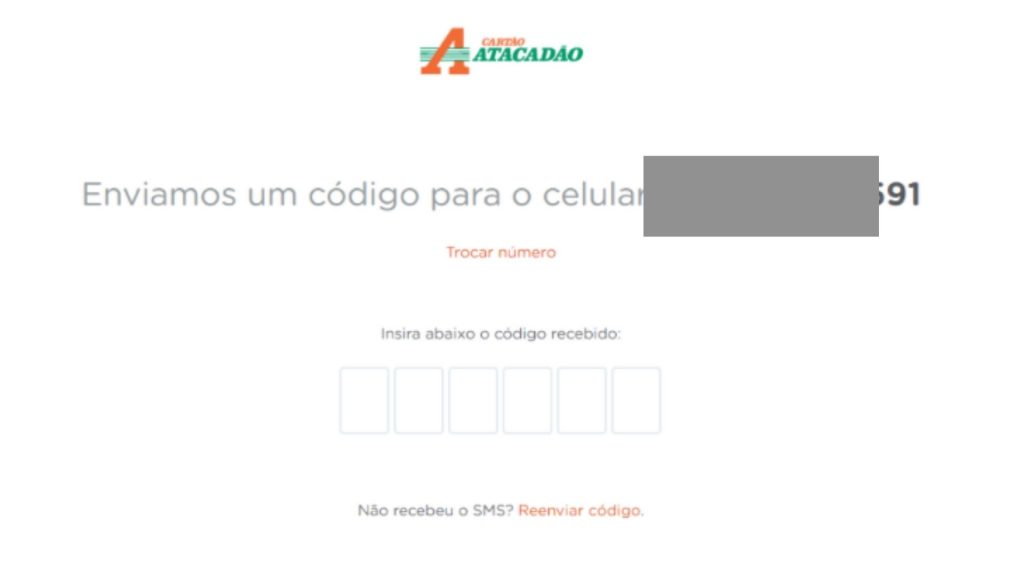

3 – They will send a confirmation code on your cell phone and you will fill it in normally.

If the code doesn't arrive on your cell phone, just ask them to resend the code. Thus, you will fill in the data to request the Atacadão card.

4 – After that, they keep asking for more personal information for the process to continue.

Here you will need to enter your full name, what you would like to be called, your gender and your date of birth.

5 – If necessary, you will provide more data and then just wait for more information via your email.

In general, the process to apply for the Atacadão card is very simple, you just need to provide your details and follow all the necessary steps. No major difficulties.

extra information

- To clarify doubts about the use of the Atacadão Card call: 4004-8899 – Metropolitan areas or 0800-722-8472 – Other locations.

- You are subject to credit analysis by the CSF SA bank, which is a financial institution that takes care of Carrefour and Atacadão cards.

If you want to clear up any doubts, want access to other technical information or even want to apply for the Atacadão card, just click on the button below and you will be redirected to the card's official website.

About the author / Gustavo Cezar

Reviewed by / Junior Aguiar

Senior Editor

Trending Topics

Get to know the cell phone maintenance course

Are you looking for a career and income opportunity? So, check out more about the cell phone maintenance course and secure your place in the area!

Keep Reading

What is Serasa Score 2.0?

Serasa Score 2.0 is the scoring system that several companies use to analyze whether or not you are a good payer. Understand here how it works!

Keep Reading

Get to know Bari real estate credit

With Bari real estate credit you have up to 240 months to pay. It also finances 70% of the value of your property. Check the details here!

Keep ReadingYou may also like

How to apply for Younited consolidated credit

Do you want to apply for Younited consolidated credit to organize your finances? The company has credit of up to 50,000 euros, so you can use it however you want, and pay in up to 84 installments. In addition, the application process is simplified and 100% is digital. To learn more about it, just continue reading the article.

Keep Reading

20 best Mastercard cards with no annual fee

Mastercard cards with no annual fee are excellent options that include Mastercard Surpreenda and more benefits from the issuing bank. Check out!

Keep Reading

Know the original account

For those looking for more facilities in their routine and a safer way to manage their money, the Original account is certainly the best choice. Directly in the app, you have access to your current account, credit, personal credit, etc. All this without hidden fees and annual fees. Did you like it? So, learn more about it here.

Keep Reading