Financial education

How to get rid of restrictions on CPF

Are you having restrictions on your CPF and don't know what to do? In this post you will understand how to get rid of restrictions with a simple step by step that will help you keep your name clean. Check out!

Advertisement

CPF with restriction: understand what to do

Mister Panda today will bring you some very useful content on how to get rid of CPF restrictions. Currently, this question has become even more constant among people. After all, according to research, about 29% of people in the country have some restriction on their CPF.

This scenario intensified with the increase in unemployment, high inflation rates, the economic crisis that took place across the country, among other factors.

Therefore, due to this scenario, many people have a negative name on the market and knowing how to get rid of restrictions on the CPF and return to having a balanced financial life is the desire of many.

With the regularity of the CPF, the person will have financial breath again, will be able to apply for credits to balance finances or get some projects off the ground. However, otherwise, that is, with restrictions on the CPF, access to these opportunities becomes impossible.

But don't worry, in today's content we're going to bring some important and useful tips that will help you on this walk.

Continue reading and find out more!

What are CPF restrictions?

First of all, do you know what restrictions are on the CPF? Yeah, many people who have restrictions on the CPF don't even know what restrictions are. Because of this, they end up not being able to get rid of them and become financially incapacitated.

However, understand that restrictions on the CPF are a kind of photograph of our financial pendencies or debts. That is, they are imposed on people who are negative or who have not paid any bills. Therefore, the person suffers limitations in their financial actions, with restrictions on their CPF.

That is, the restrictions are exactly what the name says, it is a condition that the person ends up putting himself in due to non-payment of some purchase, debt, loan, negotiations, etc.

As a result, the person ends up defaulting on credit protection agencies, such as Serasa, for example. That is, it is negative, unable to request or pay for credit services and many others.

Anyway, these restrictions end up undermining the user's CPF, which is stained in various establishments and credit institutions. In this sense, having a CPF restriction has several consequences that we will talk about in the next topics.

However, the most important factor is knowing how to get rid of restrictions on the CPF and return to regular status. We will explain this to you later.

CPF protected: why invest in it?

Understand why it is important to monitor your CPF and avoid scams. Learn more here!

Why is your CPF restricted?

There are two ways to reach the status of restrictions in the CPF. First are the financials. That is, the reasons why people end up being negative is the non-payment of some specific amount, such as:

- Unpaid loans;

- Financing;

- Purchases with very long delays;

- Non-payment of bills.

These and many others are the reasons why an individual ends up in a negative situation with Serasa and other credit agencies.

In addition, there are other reasons outside the financial niche, which are registration problems that can lead to CPF restrictions for certain people. So, see what they are:

- Absence from voting in elections without justification;

- duplicate CPF;

- Undeclared income tax;

- Death;

- Between others.

With these reasons, the individual may end up in an irregular situation with the responsible bodies and, consequently, with restrictions on the CPF. This way, it will be more difficult to request simple services.

Although it is possible, it is very rare to find negative people due to these registration errors that may occur. Therefore, the most common reasons are financial, that is, non-payment of a bill or debt.

Anyway, but what happens when we have a dirty CPF? We'll cover that in the next topic!

What happens when your CPF is dirty?

Understand that the CPF is one of the main documents that we use in numerous processes to identify ourselves and show who we are to companies, banks and many other establishments.

Thus, when we are negative and with restrictions on the CPF, we are limited to carrying out procedures in specific areas.

In this case, we are talking about the financial area, considering that the user may receive these restrictions on account of debts that ended up not being settled. With this, the user gains a new profile before the companies, that of defaulter.

The person who is in default is seen by financial institutions as someone more likely to not honor their financial commitments and accumulate debts.

Therefore, it is much more complicated to apply for a credit or debit card, loans, financing and many other services in the financial niche. There are numerous restrictions for the negative.

Remembering that these restrictions end, only when the debts are paid and the credit history, instead of getting worse, begins to establish itself again at Serasa.

However, factors such as the score are decisive for someone who wants to get out of negative mode. Understand ahead how it works.

Step by step to get rid of restrictions on your CPF

Some people are desperate for not knowing how to get rid of restrictions on the CPF and put an end to the whole situation imposed by the responsible bodies.

However, this situation can be easily resolved. For this, you just need to be willing to negotiate your debts and settle them. Yes, it is important to mention that it is necessary to settle. After all, some people think that it is enough to enter Serasa and negotiate the debt to increase the score and gain access to credit again. However, it doesn't work like that.

So, see the step by step:

- First, access Serasa Limpa Nome;

- Then, enter your CPF for consultation;

- From there you will have access to your debts;

- So negotiate everything possible;

- Read all instructions carefully;

- Finally, just make the payment.

See how simple it is? When negotiating through Serasa, the institutions have already started to see you differently. From the moment the negotiation is made and the installments of this negotiation are paid on time, your score will rise. In this way, you will gradually recover your credit.

In addition, through Serasa you can access incredible offers with debt discounts, lower interest rates and much more. So this is one of the best ways to get rid of CPF restrictions.

That is, we can directly negotiate all overdue debts through Serasa. In addition, pay the bills in a simple way, by bank slip or PIX, on the website itself after the negotiations.

Anyway, now that you know how to get rid of restrictions on the CPF, go to the website and regularize your financial situation. Also, how about learning more about the content covered today? Access our recommended content and see how to check your CPF.

How to query CPF by name

It is possible to do this query only by the name of the person. Here we will show you how to consult it and also the care you should take with your CPF. Check out!

About the author / Marina Poncio

Reviewed by / Junior Aguiar

Senior Editor

Trending Topics

Master the Art of Driving: Learn to Drive with These Expert Apps

Discover how to master driving the easy and fun way. Discover the best apps to learn to drive online.

Keep Reading

Agibank loan or Superdigital loan: which is better?

Agibank loan or Superdigital loan offer excellent credit options. Check here the advantages, disadvantages and credit conditions.

Keep Reading

Understand initial limit Trigg credit card

Check here the main information about the Trigg credit card, such as its initial credit limit and the main features.

Keep ReadingYou may also like

Discover the Superdigital Loan

Superdigital loan can be an excellent choice for those who need fast and online personal credit. Check out more about him here!

Keep Reading

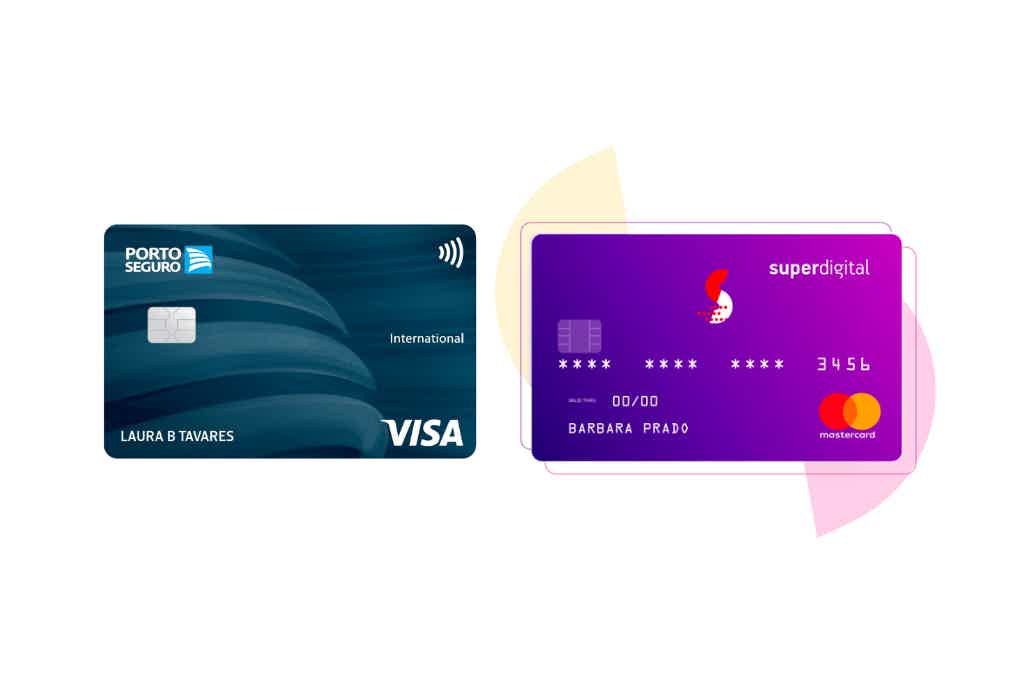

Porto Seguro Card or Superdigital Card: which is better?

If you want digital cards with different benefits for your financial life, the Porto Seguro card or the Superdigital card are two incredible options. To learn more about each of them, their benefits and disadvantages, just continue with us in the post!

Keep Reading

Discover the Havan Credit Card

Learn all about the Havan card and buy with special discounts, exclusive installment conditions and much more convenience.

Keep Reading