Financial education

How do I know if my name is dirty?

There's no shame in going through a financial crunch and getting a dirty name. But, many times, you may not know if this is your case or suffer undue denial. Learn how to query CPF in the text below.

Advertisement

How do I know if my name is dirty?

The term “dirty name” is a terror for Brazilians. That's because, having a dirty name means not failing to do several things, like renting a house. So how do I know if my name is dirty?

For banks, having a customer with a dirty name is also a big headache, which, if resolved, brings numerous advantages.

So, we will explain to you the importance of having a clean name, how to check the CPF, and other useful information.

Consult the CPF

According to the latest reports from the National Confederation of Trade in Goods, Services and Tourism (CNC), debt indices in Brazil reached their highest peak in the last 10 years.

This is because, in the month of August 2020, Brazil rose 67%, surpassing the month of July 2020, which would have been 64%.

So, these indicators consider debts such as commitments with post-dated checks, credit cards, overdrafts, store receipts, personal loans, car payments and insurance.

Therefore, it is so important to maintain a healthy financial life, as it directly affects the development of the country.

Let's understand better about how to know if my name is dirty:

How to consult free CPF

The CPF is the Cadastro de Pessoa Física, a document made by the Federal Revenue, used to identify taxpayers in Brazil.

In addition, it is composed of 11 digits since its issue, and only changes through a court decision, being the same for life!

So, if you intend to test for public office, enroll in a university, or get a job, you will need the CPF.

Thus, there are three ways to consult the CPF free of charge and find out the status of the name before the Revenue. Let's see below:

Step by Step to consult CPF at Serasa

So, the first way to consult the CPF is through SERASA, which is a company responsible for a large database in Latin America.

On the website, you can consult through the Me Proteja program, which costs an average of R$19.90 per month or R$10 per month in the annual plan.

Another advantage is that SERASA also allows you to consult for free on the Clean Name Online website.

Finally, there is also a way to consult in person at SERASA service stations for free, only with the CPF.

Step by step to consult CPF in SPC

Another way to query the CPF is through the SPC Brasil database, however, it is not free.

In this case, there will be a minimum fee of R$9.90 and can be done through the SPC Brasil application or website.

Now, to consult through the SPC Brasil app, just:

- Enter your cell phone's app store, available for Android and Iphone (iOs);

- Install the SPC Brasil app;

- Then register your data;

- Ready!

This STEP BY STEP also serves for the SPC Brasil website, on how to know if my name is dirty.

Then, the customer makes the payment, registers his data on the platform or through the SPC app, and will have access to the record of outstanding debts.

Another advantage is that the SPC allows consultations to be carried out in person, and still have information from the Judiciary.

Step by Step to consult in person at the SPC

Just show up in person at any of the service stations, with CPF and photo ID.

In this consultation, the person will have access to all debt statements that are in his name, as well as creditors and debt amounts.

Finally, when access to debts is released, be aware of all the data, so that you can recover mistaken debts.

That's because, the rates of people with names registered in a misleading way in these bodies is high, so stay alert.

Step by Step to consult CPF in Boa Vista

Another way to find out if my name is dirty is through the SCPC database, which is provided by Boa Vista.

Boa Vista Serviços is a credit information company responsible for managing a database that gathers commercial and registration information on more than 130 million Brazilians, including companies and individuals.

So how do I know if my name is dirty? Let's go step by step:

To query the CPF through the SCPC, go to the Consumer Positivo website, see:

STEP BY STEP to query CPF on the Positivo Consumer website:

- Enter the Positivo Consumer website;

- On the home screen of the website, in the top menu of the page, access “Consulta CPF gratis”

- Then, the data will be informed, to know if the name is dirty.

To access the site, it is necessary to login or register with your personal data, in order to be able to enter.

Furthermore, the SCPC allows the person to make the appointment in person at the service posts in Boa Vista, having to bring:

- CPF or photo document.

It can also be consulted through the Guia Bolso application, obtaining the real situation of the name, to know which paths to take.

Next, we will explain in more detail what happens when you have a dirty name, and how the debt collection is carried out.

How to know how long my name is dirty?

We have already learned how to know if my name is dirty through the platforms mentioned above.

Let's now find out how long my name has been dirty, and for that, just get in touch with the creditor who forwarded that name to the agency.

Since, from the first day of delay in paying the bill, the creditor can already contact Serasa, SPC Brasil and Boa Vista.

After that, the body is required to send a letter to the debtor to notify the deadline of ten days for discharge or debt renegotiation.

So, if the debtor does not respond, the CPF will then be added to the list of defaulters, making that name dirty.

There are numerous disadvantages to sticking with the dirty name, for example:

- There is no release of bank credit, financing and loan requests, or there are difficulties;

- Businesses that were in progress may be broken, and others may not be started;

- Impediments to purchases in certain stores;

- Not being able to issue checkbooks;

- Not being able to partner with banks;

- Mistrust of the financial market;

- Impediments for buying cars, renting houses, among others.

Ahead, let's see what happens to the dirty name over the years in the defaulter's life.

What happens to the name after 5 years in the SPC?

Let's first understand what the SPC is - Service that protects credit:

The SPC is the Credit Protection Service, an entity that receives and registers the names that are in default in:

- Commercial establishments;

- Service providers;

- trade associations;

- Banking network;

- Chambers of Store Owners (CDL).

Thus, when the CPF is registered with the SPC, it enters the list of people who were unable to honor their debts, for a period of 5 years.

So, after the deadline, he is automatically removed from the record of that debt, and thus, the creditor loses the right to claim in court!

Finally, having a clean name brings security to both creditors and debtors when carrying out a business.

Is it true that the name clears after 5 years?

To that question, the answer is: IT DEPENDS!

This is because, after that period, the creditor loses the right to collect the debt from the debtor through judicial channels.

However, if the debtor still has other pendencies with less time, the name remains dirty, and the defaulting person.

Another point is that, from the moment your name is cleared, you will have several advantages such as:

- Financing opportunity:

In this advantage, you can get financing from banks to buy cars, houses, and others that you want.

- Getting credit approved:

Another advantage is the ease of getting credit approval, since with a clean name there are no debts.

And, if there are no debts, distrust when that customer also reduces.

- Financial independence:

This advantage is really a marvel!

That's because, being able to keep the bills up to date, is all we need to gain freedom and financial independence.

- Take low interest loans:

Keeping your name clean allows you to make loans with low interest rates and thus maintain adequate financial control.

- Avoid embarrassing situations:

There's nothing more embarrassing than not being able to make purchases because the name is dirty, right? Get away from it!

- Avoid unnecessary worries:

By keeping all the bills paid, there will be no worries about debt problems.

Thus, you will only need to focus on taking care of your financial income.

- Use overdraft, when necessary, among others:

This is because the overdraft should only be used in exceptional cases, and for people who have a clean name, it is also an advantage.

So, if it's just a single debt, the name is removed from the collection agencies, the debt expires, that is, always try to settle all debts with your creditors so that you don't have future problems.

Can you collect debts after 5 years?

The Consumer Defense Code establishes that credit protection services cannot keep the CPF of negative consumers for more than five years, from the maturity of that debt, however this does not mean that the debt will be extinguished. Got confused? Let's go:

In fact, what happens is that after a period of five years, the creditor loses the right to collect that debt from the debtor through the courts, this is the so-called lapsed debt.

However, he can continue to approach the consumer, to try to remedy that debt, for example, through calls or letters.

Finally, if the debtor makes an agreement with the creditor and does not pay the installments, the term starts again from zero, because it will be the birth of a new debt.

When the debt expires does the score increase?

To answer this question, let's first understand how the score works.

The score is a form of credit analysis, through a score.

Thus, this score will define the degree of risk in a possible credit operation, however, there are some doubts about the score, see:

- The higher the remuneration, the higher the score. This does not happen, because the score will depend on the person's entire financial history;

- Asking for CPF in the note increases the score. Another lie, because there is no evidence about this;

- Paying bills in advance increases the score. Another myth, because you can get discounts from the company, but not an increase in the score.

And as for the score to increase, when the debt expires. Is this true?

No! This is because the score does not increase immediately, although the score improves with debt withdrawal, the score still takes time to increase.

There is also the fact that if one debt has been paid off but others remain, then the score will remain low.

Finally, if you want to get a good score on the score, understand that time is needed, and a good record of financial trust with companies.

About the author / Joyce Viana

Reviewed by / Junior Aguiar

Senior Editor

Trending Topics

How to enroll in Cloud courses

See in this post how enrollment in Nube courses works and check if the platform establishes criteria for you to be accepted.

Keep Reading

How to cancel Bradesco account?

Are you wanting to cancel your Bradesco account? Doing this is not always easy, so check out the steps to carry out the process here.

Keep Reading

How to subscribe to The Wall? See the process

Find out in this post how to sign up for The Wall and thus have the chance to take home the prize of more than one million reais!

Keep ReadingYou may also like

How to Apply for the Citibank Ultima Infinite Card

The Citibank Ultima Infinite card offers great benefits for those who like to travel. Want to know how to order it? Continue reading and check it out!

Keep Reading

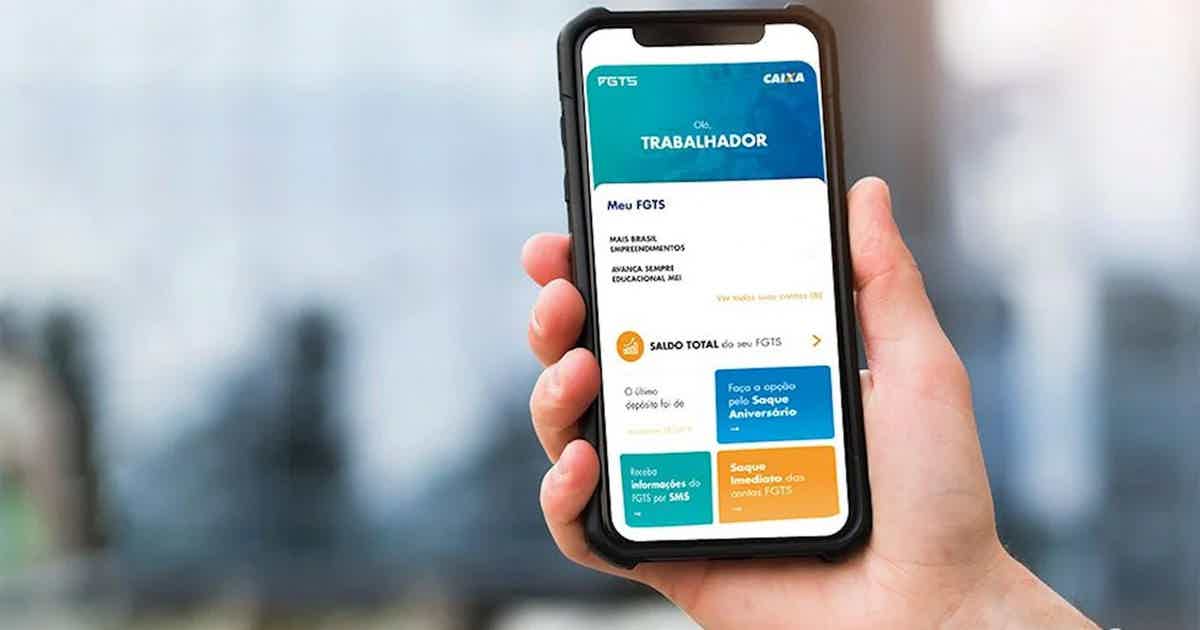

Caixa releases new emergency FGTS withdrawal for flood victims

Heavy rains and floods have caused a lot of damage in the states of Bahia and Minas Gerais since December last year. In this way, Caixa Econômica Federal released the option of withdrawing due to Public Calamity to residents of the regions.

Keep Reading