finance

How to Negotiate Overdraft Debt

Learn right now how to negotiate overdraft debt and get out of the red once and for all. Discover practical tips for negotiating your debt below.

Advertisement

Debt on special check

To present overdraft debt it's not something out of the ordinary. This is a big concern for many people. Whether it's because you spent too much or suffered to pay the bills.

In any case, it is necessary to get rid of this situation as soon as possible. For this, there are some very interesting alternatives. However, understanding how they work requires some research.

Therefore, the purpose of this post is to help you negotiate overdraft debt. Here, you will see how this can be a simple and practical process. Don't let it get in the way of your financial life.

What is an overdraft?

First of all, it is very important that you understand what this term is. Basically, the overdraft is a line of credit pre-approved by the bank.

The latter offers this alternative, from the moment you open a checking account. That's even if nothing was asked. In this way, we are talking about a type of loan.

However, here access to it does not depend on analytics like the others. Most of the time, it is used as a quick way to get rid of a certain situation.

Also, that's not the only name released. Many people don't know, but the overdraft is also called LIS, blue check and pre-approved limit.

Therefore, it works like an auto loan. When you use your account balance, the bank gives you a certain amount to continue consuming.

That's where the danger is. Of course, there will be charges on top of everything you decide to use. Let's say your balance was R$ 500. However, you paid a bill worth R$ 600. In this case, R$ 50 from your overdraft was used.

Then, as soon as your account has money again, this amount must be returned. This would be the original amount plus interest. It is very common for people to use this alternative without any planning. The result is accumulated debts.

Who determines the limit that can be used is each financial institution. So it does this based on information about each customer. Generally, monthly income is what matters most.

This lack of criteria makes this modality have the highest interest rates on the market. So you need to learn to trade overdraft debt.

How is interest charged on overdraft?

Some institutions use a very interesting tactic. They offer a few days for you to use the overdraft. During this period, no interest will be charged.

However, afterwards, these fees can reach up to 300% per year. Undoubtedly something absurd just to consider. It's nice to get some data to make a simple comparison.

O loan with property guarantee will be the example here. It can carry interest of up to 12% annually. The difference is surreal. Now, check out some other information, with approximate values, that follow this same logic.

- Overdraft: 318% per year;

- Credit card revolving: 300.3% per year;

- Credit card installments: 175.2% per year;

- Personal credit: 119.5% per year;

- Payroll Loans: 22.5% per year;

- Loan with vehicle guarantee: 17,88% per year.

You saw how the overdraft scheme works. It is automatically released. Thus, the bank has no guarantee that you will actually return the money. That's why the values are so high.

It is an inversely proportional relationship between trust and collection. In this way, institutions do not like to take risks of default. Therefore, the responsibility passes all to you, in the form of absurdly high fees.

So, it is the nature of this modality that makes it so impracticable in almost all cases. Therefore it is necessary to be very careful. Now, it's time to understand how to calculate the interest involved here.

Calculating overdraft interest

Any type of loan requires you to pay attention to interest rates. This applies mainly in this case, after all, it is a line of credit that is different from the others.

Remember that here, fees are added to the principal amount monthly. However, you are charged per day based on a compound interest calculation.

Thus, an interesting conclusion is reached. On the first day the overdraft is used, the fee will be applied to the initial total due. However, the next day, the previous day's interest is added.

It is for this reason that the final result is a very high value. Also, know that there are some institutions that do not charge interest in the first days of using the overdraft.

However, you will always pay more. When you join this modality, the bank charges what is called IOF.

Thus, this term means Financial Operation Tax. It is a government mandated fee, so there is no way around it. Thus, it will integrate your overdraft debt.

Falling into the pre-approved limit is easier than you think. Sometimes, without even realizing it, you can take more money than you really have. That's why he's so dangerous. Therefore, great care is needed.

However, there are some strategies you can use to get rid of this type of credit. They, when applied correctly, are very effective.

Follow each one of them in the next topics and see that with planning anything is possible. The tips below apply to any type of financial situation you find yourself in. So stay calm and put them into practice.

1- Try to negotiate the overdraft

This tip is the focus of this article. It is aimed at you who are in debt. As you read this, you will know exactly how to do this type of negotiation smartly.

When the debit is identified, it is recommended that you try to talk to your manager. He will be key player here. Together, they can find a way to negotiate payment.

Most of the time, this is a simple process. Institutions want you to settle your debt. Therefore, they tend to facilitate in some respects. Now, it is necessary to pay close attention here.

Remember that your monthly budget cannot be compromised. That way, you can come up with a good proposal both for yourself and for the bank.

2- Opt for a modality with lower interest rates

Let's say that you unfortunately will not be able to pay off the full amount of your debt. In this case, it is important to be as rational as possible. There are other more interesting modalities. They have lower interest rates.

Therefore, you can exchange an expensive debt for a cheaper one. Of course, many times, the term is longer. Even so, it is an advantage in most cases.

However, always calculate everything before anything else. See if it is indeed a worthwhile process. Don't forget to consider all of your options. This is very important for you to make a deal that is interesting for your pocket.

It is interesting to have knowledge on the subject. This is because the institution will hardly put your situation as a priority. So it's important that you do. Your overdraft debt can be much smaller with this action.

3-Reduce your overdraft limit

Overdraft is a very profitable strategy for banks. Therefore, they tend to make it very easy for you to continue using this modality. However, this is a trap.

Ideally, you ask the institution to reduce the check limit. Or, choose to cancel the service. This way, you can quickly get rid of any future problems. In fact, this is the best alternative.

Debts will always show up if you don't plan your financial life. Very careful planning is required to avoid this type of situation. So invest some time in this process.

It's important then that you review your monthly expenses and how they affect your income. The overdraft is useful when you are in a scenario of desperation for money.

That way, if you make a good plan, it's possible you won't need it once. This is the most effective way to get rid of this modality. There are numerous ready-made spreadsheets that help you organize your finances.

However, paper and pen do the same thing. The important thing is that you don't stop thinking about this area of life very carefully. Thus, it is even possible to plan future purchases and personal projects.

How to Negotiate Overdraft Debt

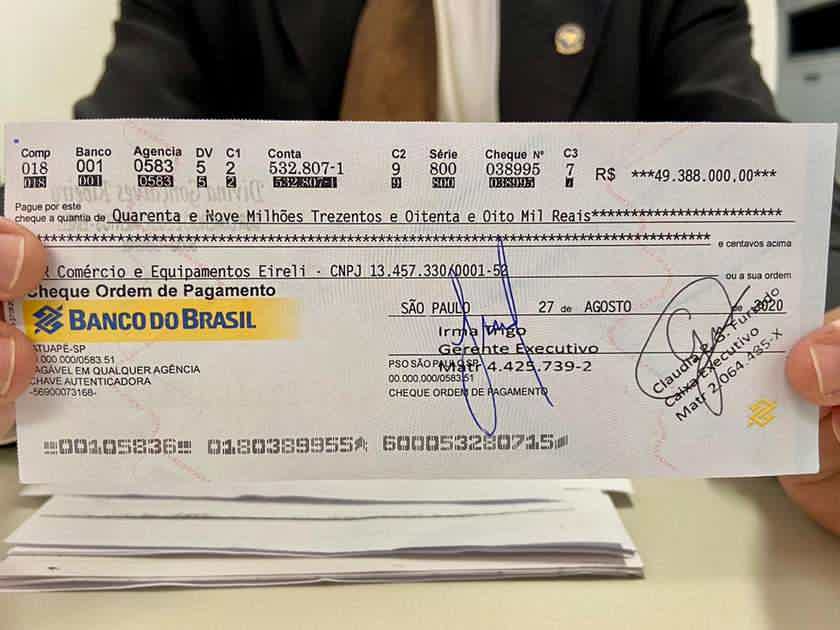

Imagine that you already have a high debt in this modality. However, your desire is to negotiate a better payment method. For this, the alternatives given above are very useful.

However, there are 2 more possibilities that can help you. Know what they are and find the one that best suits your current situation.

1- The famous credit portability

This is a technique used by many people looking to reduce their debt. A credit portability It is an operation like any other. It is characterized by the transfer of a debt from one bank to another.

The latter should always offer lower interest rates than the former. More interesting rates is then the key to this transaction. Therefore, you need to ensure that your exchange is actually being advantageous.

Also, always evaluate the strengths and weaknesses of each institution. It's the best way to not regret it in the future. One of the good things about portability is that there is no IOF charge. Not to mention the reduction in installments.

2- Extra funds

Using extra resources to pay off a debt is always a good idea. That's where you need to save as much as possible. Unfortunately, for those who are in debt, this is practically an obligation.

Let's say you've already looked for the manager and managed to negotiate your debt. Now, it's time to do everything to avoid falling into the same trap. For this, count on bonuses at work, 13th salary and so on.

With them, your overdraft debt It's getting closer and closer to disappearing. These options must be applied to your debt. That way, you get rid of it faster.

Without a doubt, until the payment is complete, the scenario will not be the most flexible in terms of expenses. However, this is a worthwhile effort, believe me.

General precautions when negotiating a debt

You already know how to handle a negotiation process. Still, it's important to know that all care is little. Some points should always be a priority for you. Some of them are highlighted in the next topics.

1- Total amount of your debt is very important

Many people usually go to the bank to talk to the manager without even knowing how much they owe. This is then a very serious mistake and can bring you several losses. So, first of all, know your debt.

However, don't leave everything to the manager. Remember that he will always do what is best for the bank and not for you. Thus, it is necessary to actively participate in the negotiation.

2- Understand that not every proposal will be advantageous

You don't have to sign the first agreement that comes along. The ideal is to calmly analyze the proposal. If you are not satisfied, study another possibility and present it to the institution.

Reasons to negotiate your overdraft debt

It is common, then, for people to find this negotiation process too laborious. However, this is not true. Not to mention that it brings numerous advantages. Know the 2 best reasons to start this step.

1- Clear your name: Nobody likes to be negative. This is a status that can bring a lot of headache. So it's always good not to have any pending. This makes it easy even when making a larger purchase.

2- Invest in new projects: It's very difficult to think of new plans with the burden of debt getting in the way. Therefore, seek to remove it as soon as possible from your life.

Conclusion

Finally then, you already know very well how to negotiate your overdraft debt. Now it is your turn. Take all the knowledge passed here and get rid of this problem once and for all. And if you need bad credit loan to negotiate, know that it is possible to request.

Reviewed by / Junior Aguiar

Senior Editor

Trending Topics

What is the relationship between financial education and emotional security?

Understanding your finances better is the key to good emotional security and stability in other aspects of life. Learn more here!

Keep Reading

How to open PagBank account

The PagBank account is very simple to request. In this article, we'll show you step-by-step how to get one. Check out!

Keep Reading

How do I sign up for Internet Celebrity Wanted? See the process

Find out in this post how to sign up for Internet Famous People and thus have a chance to win up to R$ 3 thousand in the program!

Keep ReadingYou may also like

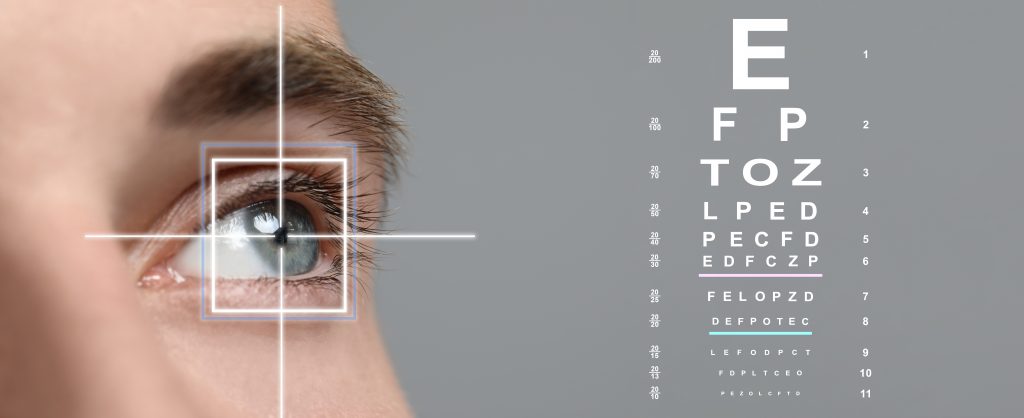

Smart Optometry: discover the online vision test app

Awaken to the future of eye health with Smart Optometry. Perform innovative vision tests, receive instant results, and care for your eyes with convenience. Download now and clearly see the path to healthier vision!

Keep Reading

Discover the Banco Inter loan

Do you have a dirty name in the square? Get to know the loan for bad debt from Banco Inter. Expect low fees and a hassle-free application process.

Keep Reading

Conforama credit card: what is Conforama?

The Conforama credit card offers many advantages to customers, such as exclusive discounts and special payment terms. Do you want to know more about him? So read our post and check it out!

Keep Reading