finance

How not to waste money in 2021?

Are you tired of wasting money and watching life go downhill? Then see 5 important tips to avoid being in the red in 2021.

Advertisement

Wasting money can get you into debt

When a new year begins, our wish is always to do something different and not waste money anymore. That's why we set goals, we want to make dreams come true and we work hard so that at the end of the year we feel it was worth it.

And if saving money or paying off debt is among your goals for 2021, this article is ideal for you.

The way Brazilians deal with money is not the most organized, so much so that we have more than 60 million people with some overdue debt. This is due to the fact that they hardly teach about financial education and when people learn to take care of their own money they are probably already in bad shape, covered in debt.

One of the many reasons for getting into debt is wasting money. When you buy unnecessary items that you could leave for later or that were simply on sale and you wanted to spend on them, it means that in the future this bad habit could complicate your life. Before going into debt, you should analyze your financial situation, whether you will be able to pay and whether it is worth spending on it.

If you waste money on unnecessary things, you may not have money for something that you really want to buy and is on sale these days, for example. And in addition to being in debt, you run the risk of getting your name dirty for completely avoidable nonsense.

And thinking about it, today we want to teach you simple habits, but that will make a total difference in the way you handle your finances. Therefore, in addition to learning how not to waste money, you will also be aware of 5 actions to avoid this waste, avoiding debts and headaches at the end of the month.

How not to waste money in 2021?

When you don't have financial planning, a spreadsheet or any sheet of paper to record fixed, variable and emergency expenses, it is likely that control will be lost. Because there is no way to know all your debts for the month if you don't record them anywhere, so this type of carelessness opens the door to bad habits that can complicate you in the future.

Undue expenses, installments in several months, lightning promotions, all this leads you to unconscious consumption, the one you spend without even feeling it. In this way, feeding these habits of not registering your debts and spending like there's no tomorrow makes you a potential underpayer in the future.

Waste has to do with habits that need to be changed and to avoid this you need to have control over what you buy, have discipline and a lot of moderation, especially if you can't afford it. The rule is clear, never spend more than you earn, that way you will never get into debt.

But that doesn't mean you'll only be able to buy basic and extremely necessary things. Of course, you can and should spend it leisurely or take advantage of that seemingly perfect promotion. However, these things can only be done if there is money for it and if your budget allows it.

Thinking about helping you not to waste money in 2021, we're going to give you 5 very important tips on actions that you should follow to control your financial expenses and consume consciously.

5 actions to not waste money

See now 5 actions to not waste money in 2021 and organize your finances.

discipline

The first tip is to be disciplined. The best thing to make your life easier is to plan your expenses, so whenever you want to buy something, make a habit of writing it down.

Start with two lists, one to write down what you want and the other for what you need, so distribute the items to the lists and give priority to those that stay in the part you "need" and if your money still gives for spend on items you want can start adding them to cart.

This type of exercise helps you plan, set goals and follow them with ease, knowing exactly what you're doing. Besides, it saves you from spending money on unnecessary things.

So, control yourself and avoid going out with your credit card if you haven't planned to buy anything. This makes you always make conscious purchases, avoiding buying on impulse.

Not maintaining discipline with expenses that seem silly, such as spending lunches out or orders for delivery, at the end of the month they can generate quite an expense if you calculate it. Therefore, whenever you can prepare your own lunch and take it to work, this way you avoid expenses and still have more reliable food.

conscious consumption

Advertisements are full of mental triggers, which make you believe that you need that product at all costs or that you will lose if you don't buy it in 5 hours. That's why it's important not to fall into this type of conversation, promotions exist all year round and if you don't have money at the time, the item will probably go on sale again at events like Black Friday.

Conscious consumption is knowing how to say no when there is no money. Therefore, beware of purchases on impulse, out of emotion or out of necessity.

When we talk about conscious consumption, we are also talking about spending on transport by app, delivery and all these new services that make life easier and provide convenience for the consumer. But if you really want to save money in 2021, avoid these types of expenses whenever you can, prefer homemade food and ride the bus or bicycle.

In addition, it is also important to be aware of the “cheap that is expensive”, of course there are cheap quality products, but knowing how to recognize it is extremely important. What's the point of spending money on something you know will break easily? Therefore, it is more feasible to pay a more expensive amount than to buy any product because it is cheap.

Impulse purchases: how to control?

Shopping can be a very satisfying moment, however, for some people it can become a big problem or serious illness. Let's understand how it works

Control when installments

It is very important not to go around paying everything you see ahead in 10 or 12 installments just because there is no interest. We know that it seems like a silly amount when we divide the installments, but this can lead to a great lack of control if you combine it with other expenses that you will need to make in the following months.

This is a big mistake of most Brazilians. Because it already commits money that you don't even know if you will have. Therefore, when you go to buy something, prefer to pay in cash and realize how much your financial life will improve with this attitude. But be careful, if you have financial control based on your invoice, ignore this tip.

Installment is really a danger, so if you have money to pay in cash, do it. Because in addition to being able to ask for discounts on the purchase, you don't compromise your invoice with one more expense to pay at the end of the month.

For even more control over what you spend, choose to have just one credit card, so all your debts will be stored on one bill. And this prevents you from getting confused and forgetting about the debt you incurred on a store card a long time ago, for example.

Leisure is good, but sparingly

Have you ever heard that less is more? That's right, it's worth it for us to enjoy a quality tour than to spend on something just because it's cheap. The idea here is to make you see that it's not always what's good for your pocket what's fun for you.

Therefore, it is not every time that you will have money to go out with friends every weekend, and there is nothing wrong with refusing and saving that amount for a more meaningful outing. Hanging out with friends is always good, but we also need to be responsible for our financial choices. So there's no use going out to have fun and then not being able to pay the bill, so you'll just be choosing to have headaches to close the bills at the end of the month.

Say no to invitations that your budget cannot meet. This does not mean giving up your social life, but understanding when an event is beyond your financial capacity – and that participating in it will only serve to get you into debt.

That's why we advise you, go out less. Going to bars, restaurants and other places can weigh on your pocket. Therefore, to save money, exchange these outings for a home-cooked meal, a movie in the living room or something else. There are several ways to have fun at home, call friends or gather the family for dinner with table games and lots of conversation.

In addition to being fun, you will save a lot with these meetings at home, even more so if you split the bill.

Beware of promotions

To save money, one must be disciplined. In practice, this means eliminating impulse spending and learning to say no to yourself and family members whenever you want to buy something that is out of your budget.

This ability to say no to unnecessary expenses can completely change your relationship with money, transforming you into a more balanced person who is always prepared for any financial emergency.

It is also part of this journey to be very careful with promotions, as they are the trigger for impulse purchases, that product you don't even need, but want to take because it's at a great price. In the end, you end up not using it because you simply didn't need to buy it, and that's when regret sets in.

A great alternative for this is to buy only during sales, let the end of the year pass and take advantage of the January sales (where stores usually sell out). Or spend some time comparing prices to buy cheaper on Black Friday. It's these little habits that help you save a lot at the end of the month and also show that you know how to use your money.

The thrift store is another interesting option, as in addition to reusing a piece in good condition, you can find items for all styles and budgets. It is worth digging and following the online stores. Often even expensive items from renowned brands are available at a thrift store for a friendly price that is worth buying.

Why Wasting Money Can Get You Indebted?

It seems like a dream to have money to pay the bills and still have fun, but this is very possible, depending on your spending, significant cuts can be made. So making sure you can pay the bills and still have reasons to smile.

When you waste and spend money like there's no tomorrow, in addition to running the risk of needing funds for an eventual emergency and not getting it, you can also lose control and not be able to close the accounts at the end of the month. Thus, being able to enter a large interest snowball that only grows and becomes increasingly difficult to pay.

In addition, wasting money also prevents you from investing in important stocks and using your savings to generate a bigger amount.

It might seem like a good idea to spend money on things you can enjoy right away. But it's worth saving money to carry out future plans that depend on extra money.

You may have the dream of owning your own home, taking an international trip, having children or taking a course that is expensive but worth it. Calculate the value of your dreams, plus how and when you want to realize them, and save money for it.

Saving money means financial independence and peace of mind for your life. Because it makes you not depend on cards and loans at all times to make your payments, giving you security even in emergencies.

Finally, start putting our tips into practice now, save your money and achieve your financial goals. Don't forget to write down each of the most important tips forThe you and don't miss anything.

Financial psychology: how it affects you

Did you know that financial psychology can affect your pocket? So learn how to use it positively to improve your finances.

Reviewed by / Junior Aguiar

Senior Editor

Trending Topics

Check out how to buy a ticket on Decolar with up to 60% discount

Understand how to buy airfare at Despegar and save a lot of money, discover all the services on the site and see if it's worth it.

Keep Reading

How to earn miles with the Gol Smiles card: understand the process

Find out how to get miles with the Gol Smiles card, how the card works and what benefits it offers to those who request it!

Keep Reading

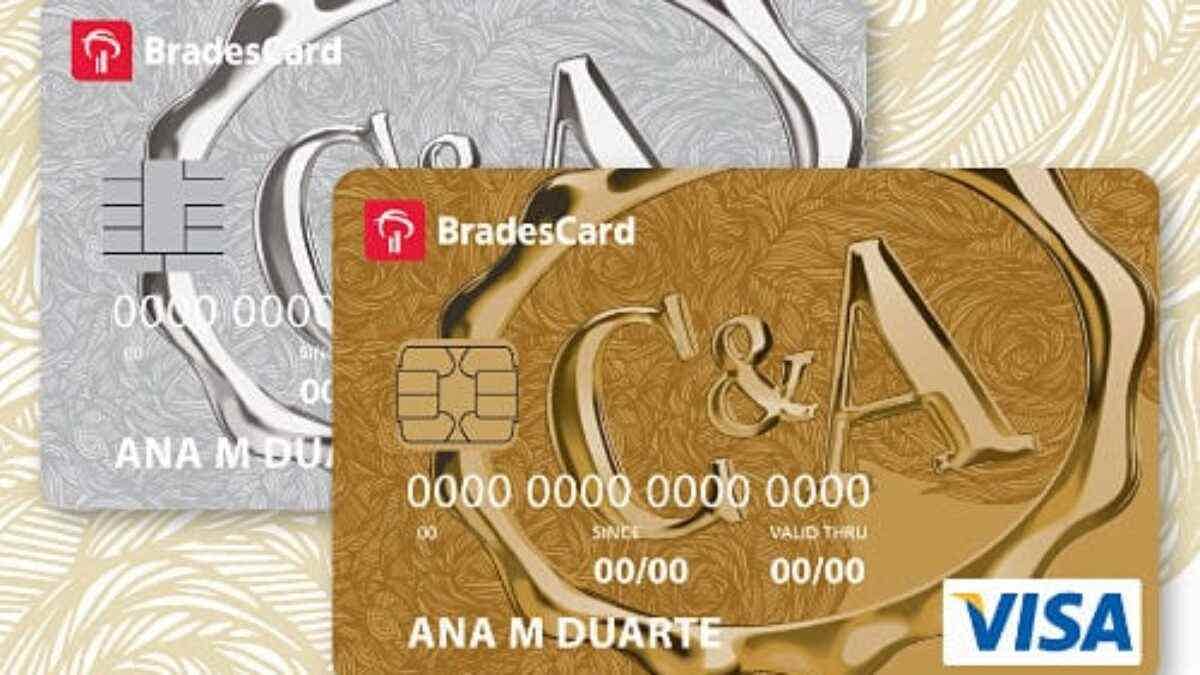

CEA 2021 Card Review

Check out our CEA card review and discover its facilities, exclusive discounts, as well as how to apply for one. Check out!

Keep ReadingYou may also like

When will the emergency withdrawal of R$1,000 from the FGTS be released?

In a strategy to minimize the inflationary impacts that have gripped the country in recent months, President Jair Bolsonaro is expected to sign a Provisional Measure authorizing a new round of FGTS withdrawals. Understand more here.

Keep Reading

Get to know Ágora investment brokerage

Do you want to concentrate all your investments in just one brokerage? So, take the opportunity to get to know Ágora, a brokerage that has investments in all sectors, from fixed income to variable income. Learn more below.

Keep Reading

How to make money without cutting costs in 2021

If you want to earn money without cutting costs, we have some interesting options for you! So check out the best ways to boost your finances and achieve your financial autonomy in 2021. Don't miss out!

Keep Reading