Cards

How to choose the best credit card for you?

See below a complete text with several options for you to choose the best credit card for you and your needs.

Advertisement

Choosing the best credit card for you?

Choosing the best credit card for you is an important mission in financial life. This is because, this choice defines how much you will pay in interest, annuity, how this payment will be and other issues.

The card is indeed a great ally of our savings, but it can also become a great villain when it is not chosen well. The company that manages and offers it also counts a lot for the future.

Therefore, if you are intending to apply for a credit card, we have separated some options, with advantages, disadvantages and characteristics that you need to know about. In the end, then, you will know the best option for your case. Follow!

What is the best credit card for me?

Until recently, credit card options were not even half of what they have today. But the success of new financial institutions and the increasing demand for more advantageous cards resulted in a large number of options in the market.

A survey carried out by the Credit Protection Service (SPC Brasil) and the Meu Bolso Feliz portal throughout Brazil showed that, in 2017, 52 million Brazilians already used credit cards as a payment method.

But with so many options on the market, what are the criteria to use when choosing a credit card? Well, this can vary according to each person's need.

For what purpose are you purchasing a new card? To accumulate points? If so, it's worth looking for the brand with the best points program.

To get benefits? So pay attention to the advantages offered by each operator. To make large purchases in installments? In this case, the one with the lowest interest rates is better.9

What is the purpose of a credit card?

Credit cards are products widely used by consumers of different age groups and different social classes because they offer a series of advantages such as the possibility of buying more expensive items in installments, paying for several purchases only when the invoice expires, virtual purchases and delivery apps of food and other products, discounts in establishments.

In short, the function is to replace money momentarily. In other words, when you want to buy something, the credit card works and even allows you to pay in installments. Then, on the date agreed with the company that granted the same, the amount used will be paid.

In addition, of course, to the points and mileage programs that many of them offer, converting expenses into benefits such as travel and products

There is also the security issue. Carrying a credit card can be safer than going around with cash in case you need it. Cash withdrawals can be made at banks and ATMs.

The cards are insured against fraud and against loss and theft, and it is possible to question unrecognized expenses directly with the card operator.

And for those who like to have control over finances, all purchases are detailed on the invoice. Nowadays, it is possible to follow all purchases in real time via app and SMS that notify, via cell phone, each new expense. That way you can know how much you've already spent and plan future purchases.

Expired credit card debt?

Do you have an old credit card debt? See if your credit card debt expires now!

5 tips for choosing the best credit card

When applying for a credit card for daily use, it goes far beyond simply applying. You need to know how to analyze and choose the best one for your needs.

The market today has hundreds of options, however they meet specific profiles. Knowing how to choose the right card saves time, money and a lot of headaches over the years.

Therefore, to help you in this endeavor, we have prepared 5 tips to follow when choosing yours and manage to avoid the mistake as much as possible. Pay close attention and follow the tips to the letter!

Identify your need

This is the first step in making a good choice. You need to assess well what your real needs are with a card. An alternative is to put on paper what is expected of a product like this. What are you going to use it for? Also, analyze each function that a card must have to serve you. Does it need to be credit or would it be better debit?

It's questions like these that will help you arrive at a logical choice. Thinking about these details makes you not fumble and select the most interesting card. In this way, the ideal is to choose a product in which all opportunities are taken advantage of. And of course, they need to fit your financial reality.

Compare fees, rates and annual fee

Another fundamental point when choosing a card. Most of them have fees, tariffs and annuities. Therefore, it is very important that you compare these elements. Believe me, they weigh a lot on the pocket. Currently, there are many credit tools that do not charge annuities, for example.

In addition, some also do not usually charge fees. In any case, it is necessary to evaluate each product. Sometimes you can find a card full of opportunities. However, the fees are absurd. So, be very careful before making any decision.

Check the miles and cashback programs

Cards are innovating more and more. Therefore, the miles and cashback functions are already quite popular nowadays. Soon, they help you to enjoy more of this tool. It is undoubtedly one of the most interesting ways to enjoy your card.

So, the accrual of miles is perfect for those who enjoy traveling. Also, imagine getting part of the value of your purchase back? That's what the cashback option does. Therefore, they are very cool alternatives that also need to be taken into consideration.

Rate credit card banner

To choose the best credit card, you should always pay attention to its flag. The latter will dictate virtually all transactions with this tool. Therefore, there is no point in choosing a flag that is little known in the market. This will make it impossible for you to do many things.

Shopping in some places is a good example. Therefore, never choose a card without evaluating this point first. Believe me, you can regret it a lot.

Check the bank's credibility

Not every bank deserves your trust. Unfortunately, customer commitment is not intrinsic to every financial institution. That said, be very careful when choosing the card and, consequently, your bank. A tip is always to evaluate the reputation of the latter.

Today, the internet allows you to search for virtually anything. So, invest some time studying what people are saying about your card group.

How to use credit card wisely?

You may have heard the saying “keep your feet on the ground”. To use this tool, you need to have a complete sense of your financial reality. A card can help you work your income better. However, when used irresponsibly, it can get you into a lot of debt.

So, only spend what you can actually afford. Installment is an interesting tool. However, she also requires care. Still, many people believe that the credit card is the key to dealing with financial problems. However, things don't work out like that.

Planning is needed to end up getting lost in shopping. So always use your sense of responsibility. It is the best alternative to enjoy this tool without any damage.

5 best credit card options

As mentioned above, today the credit card market is only growing. Thus, there are many options available. In fact, many people are confused, not knowing which tool to choose.

In order to help you, we have separated some of the best card options. Then, see the characteristics of each one of them and analyze if they fit your current needs.

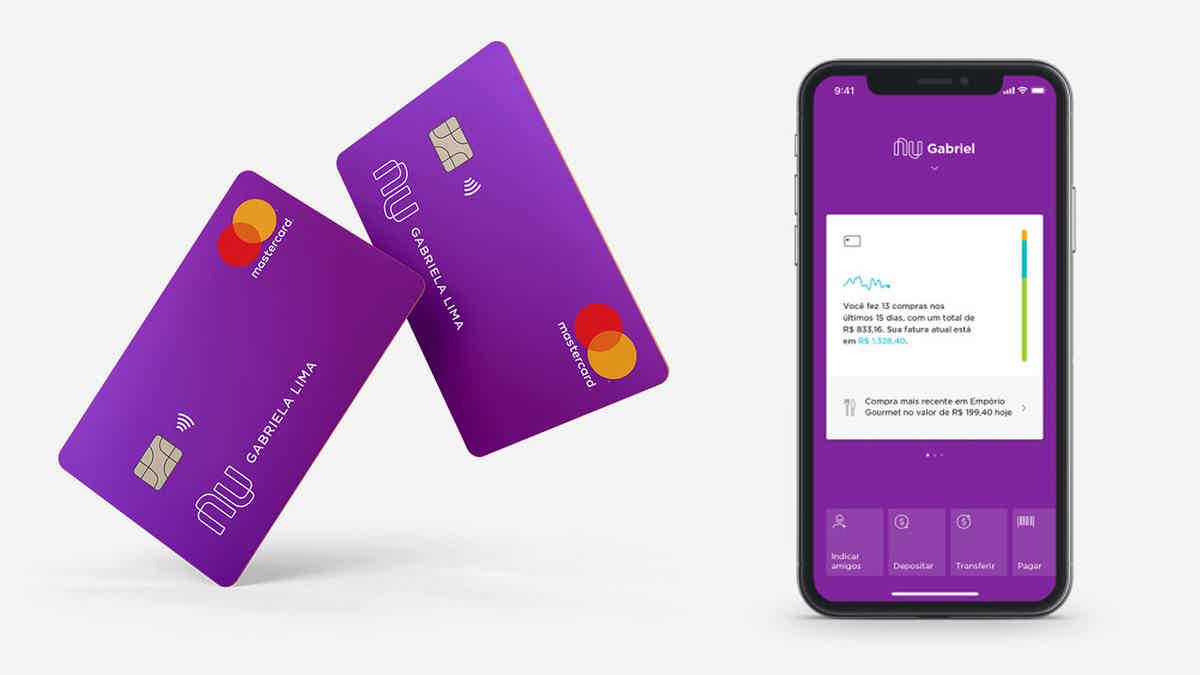

Nubank

Nubank is a company that has been in the market for over 7 years. Its reputation is very good indeed. So, we already have the first favorable point here. With a Fintech card, you are free of annual fees and maintenance fees. In addition, the company provides an application.

In this way, it is possible to monitor all transactions in real time. Still, you can make payments, make transfers, anticipate installments and so on. Another interesting point of this credit card is that you can request an increase in your limit. All with just a few clicks.

Also, you can easily do DOC and TED, as no fees are charged for these transactions. Now, the benefits don't end there. This is a credit and debit card. So, making purchases and withdrawals at ATMs is also a reality. A word that sums up the card and NuConta combination is practicality.

How to apply for a Nubank card for negatives

Free annuity, easy request and withdrawal possibility. Claim your purple now!

Inter

The main advantage of this card is also its practicality. With it, you don't need to move to carry out a transaction. Inter has a digital version that is very intuitive to use. Just access the application and that's it, you can do everything there. Still, it doesn't matter if you have Android or iOS, this version works on both systems.

In addition, the card fees are very interesting. First of all, with it, you don't pay annuity. Not to mention the countless free and unlimited services. Also, this is an international card. That way, if there's one thing that won't be a problem, it's shopping.

You have thousands of stores at your disposal. Therefore, the best thing is that with each purchase, you accumulate points in the Mastercard Surprise program. The Inter card also offers the option of free withdrawal. Lastly, you can do this at any 24-hour bank.

How to apply for the Inter payroll card

Do you want to know how to apply for the Inter payroll card easily and quickly? Check it step by step

Neon

The first thing you must do to take advantage of this card is create a neon account. Then, when you deposit at least R$ 100.00, 2 cards arrive at your home, both with Visa International flag.

The debit version is a physical card. So, its operating scheme is nothing different from other products with the same proposal. Now, let's say you want to shop online.

In that case, just use your virtual card. However, beware, this is a prepaid version. Therefore, it is ideal for those who want to have more control of their expenses. After all, installments are not an option, so you only spend what you have available in your account.

How to apply for the Neon card step by step

Discover now how to order your Neon card, step by step. With zero annuity and no fees.

C6 Bank

The bank offers a free digital account with no fee withdrawals. To open your account, you just need to download the application and register. Once this is done, you can start using your card. Thus, TEDs made from the bank are operations that do not charge any fees.

However, it may be that to send money to C6, it is necessary to pay an amount. This will depend on the institution. Anyway, your card is credit and no annual fee. Still, there is another version, more elaborate, called Mastercard Carbon Internacional card. It offers 3 months of free membership. After that you pay 12x of R$ 85.00.

How to apply for the C6 Bank credit card

Find out now in this article how to apply step by step for your c6 bank card without complications.

PagBank

A card also without annuity. Soon, the institution offers you 3 versions of this tool. The first is the account card. With it, you use your balance to make purchases, payments and withdrawals. Thus, the limit is the amount you have available in the account. Also, this card is international and free.

The other version is the prepaid card. So, here the top-up system operates. You don't need to pay any maintenance fees. However, a small fee is charged upon request. Lastly, your other option is the credit card. It is free and does not require proof of income.

Finally, you already know everything about the subject. Now, it's your turn to choose the best credit card. Remember the tips given above and be sure to put them into practice. Go in search of further improving your financial life.

How to apply for the PagBank prepaid card

If you liked the options and advantages of the Pagbank prepaid card, find out right now how to apply without bureaucracy.

Reviewed by / Junior Aguiar

Senior Editor

Trending Topics

How to open a Santander university account

Do you want to know how to apply for your Santander university account and enjoy all its benefits? We tell you here, check it out right now!

Keep Reading

Nubank card or Agibank card: which one to choose?

Do you want to choose between Nubank card or Agibank card? Because both are Mastercard branded cards, reliable and safe! Check out!

Keep Reading

How to advance FGTS through Daycoval? Check the process

Check out in this article how you can anticipate the FGTS through Daycoval in a simple, quick way and without contracting a new debt!

Keep ReadingYou may also like

Pan Payroll credit card: how it works

Banco Pan has a card for those who are on loan who do not have an annuity, have a Visa flag and even negatives can apply. See how it works below.

Keep Reading

Discover the Sicoob Cabal Classic credit card

The Sicoob Cabal Clássico credit card is a complete solution to manage your finances and offer the resources you need to stay calm in case of unexpected expenses. To find out more, just continue with us throughout the article!

Keep Reading

How to open an OpenBank Savings Account Welcome

Check out how to open your OpenBank account Welcome and start your savings without having to pay maintenance commission and with remuneration of up to 2% (TANB) in the first semester of the contract. Learn more in the post below.

Keep Reading