digital account

How to open Bitz digital account

The Bitz digital account is an option that offers you many facilities and advantages when making purchases and managing your finances. Find out in this post how you can open an account.

Advertisement

Bitz digital account: see the step by step to open yours!

The Bitz digital account emerged to be an option that facilitates the way you handle finances. To do this, it makes all its processes simpler and without much bureaucracy.

It is an innovative option that has several features and advantages to make your financial life lighter and simpler. In addition, it is managed by Bradesco bank, so it is a safe and reliable option.

| open rate | Exempt |

| minimum income | not informed |

| rates | R$7.90 per withdrawal |

| credit card | Yes |

| Benefits | Free 100% digital account Earn more than savings Offers cashback on all purchases |

If you already know all the advantages of this digital account, you must be anxious to know how to open yours. To do this, just check the article below for the complete step by step to create your Bitz digital account!

open by application

The opening of the Bitz digital account can be done from the application that the account makes available for Android and iOS devices. In this way, it is much easier, practical and safe to open your account.

To do this, you must go to your cell phone's app store and look for the Bitz digital account. When you find it, just download the application and then access it asking to create an account.

From there, you just need to follow the very explanatory instructions that the application goes through to carry out all the steps of creating an account. Here, you will also be asked to send a document with a photo to identify you, in addition to a selfie of you in real time.

After sending all the necessary records, just wait for the bank to confirm that your digital account has been created and is ready for use.

open online

Currently, the only way to open a Bitz digital account is from the bank's own application that is available to the public. You can download it both on Android and iOS systems and enjoy all its advantages.

But, from the official website of the digital account, you can access the links that go straight to the application page on Google Play or Apple Store. That way, just install it on your smartphone and perform all the registration steps!

open via phone

At the moment, it is also not possible to open this digital account using a telephone call. Bitz was created to be not only easy, but also a very safe option.

That way, your future account holders don't have to risk sharing personal data from their phone, as many scams are done that way.

Thus, the only way to open a Bitz digital account is only through the application that the bank makes available.

Nubank digital account or Bitz digital account: which one to choose?

Another well-known digital account option on the market is Nubank, also known as Nuconta. From it, you can also access some very interesting advantages.

With the Nubank digital account, you can have your money earning 100% of the CDI every day, which is a higher rate than savings. In addition, you can choose to receive your salary in the account and also carry out transactions without any cost.

Check the table below for more information about the Nubank digital account and its comparison with the Bitz digital account.

| Nubank digital account | Bitz digital account | |

| Minimum Income | not informed | not informed |

| Monthly cost | Free | Free |

| credit card | Yes | Yes |

| Benefits | Yield 100% of the CDI It has free salary portability100% | Free 100% digital account Earn more than savings Offers cashback on all purchases |

About the author / Leticia Jordan

Reviewed by / Junior Aguiar

Senior Editor

Trending Topics

How to apply for a car loan with BV Financeira

Find out how to apply for a loan with a BV Financeira car guarantee and take advantage of the credit to put your finances in order, check it out!

Keep Reading

How to improve your Serasa Score 2.0 in 2021

Do you know what score is? Don't even know what that is? Then continue reading because we are going to explain everything about Serasa score 2.0! Check out!

Keep Reading

Learn about the Amazonas State Aid benefit

Want to know what the Amazonas State Aid benefit is? In this article we will explain how it works. Read now and find out!

Keep ReadingYou may also like

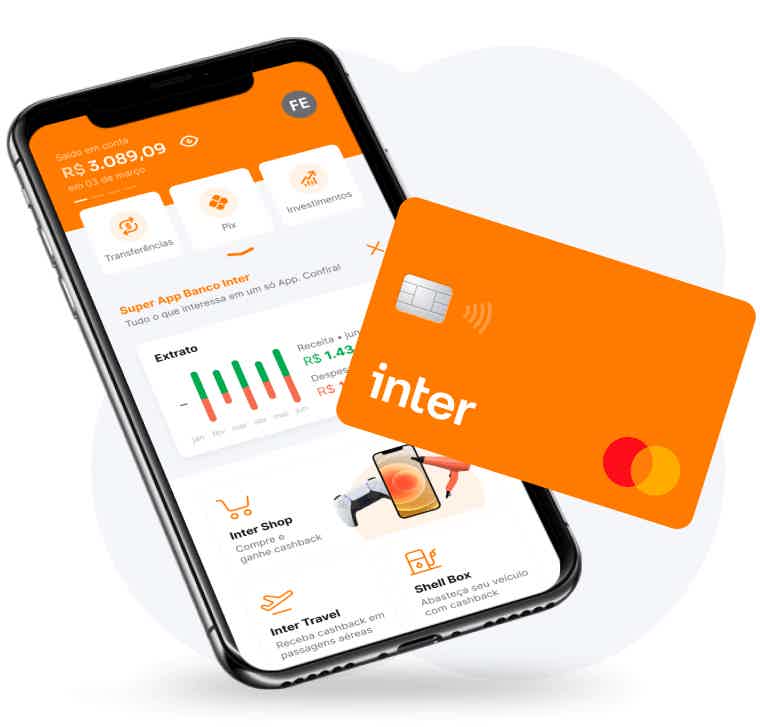

Discover the Inter Limite Investido credit card

With the Inter Limite Investido credit card, you set the limit when investing your money and also have several advantages, such as international coverage, Mastercard brand and even control your finances online 100%. Check out its main features here!

Keep Reading

Millennium Personal Credit APR 11% for €5,000

Personal credit is a good way out for anyone who wants to make dreams come true or is experiencing financial difficulties. With that, Millennium Personal Credit can help you! Continue reading and learn everything about it.

Keep Reading

Get to know the curiosities and behind-the-scenes secrets of the new version of Rebelde on Netflix!

If you are a fan of the 2004 telenovela Rebelde, you will definitely love this reboot. With many references to the original story and a few hidden goodies, the new version arrives with everything this month on the streaming service. So, check out some Rebel Netflix curiosities right now and learn all about the series!

Keep Reading