finance

CDB PicPay: one of the best yields on the market

Do you know CDB PicPay? If not, it's time to get to know this daily liquidity yield that is considered one of the best on the market. Know more!

Advertisement

CDB PicPay Daily Liquidity: understand

You know that hard-earned money of yours that's been in savings lately? Well then, you don't have to leave it there! At CDB PicPay Daily Liquidity, your investment yields much more and you can also withdraw it at any time. Too good, isn't it? So, learn more about it and see all its advantages.

What is CBD?

Before we get into the merits of CDB PicPay Liquidez Diária, it is necessary to understand what the product is. After all, there's no point in writing about it if you don't even know what a CBD is. So, for that very reason, let's clear up any doubts about it now!

Acronym for Bank Deposit Certificate, the CDB is nothing more than a title issued by banks with the aim of raising money. That is, it works as a loan of your money to the financial institution to finance the activities of the issuing bank, such as projects, growth and debt payment. In return, you receive a return rate that is set at the time of purchase.

Because it offers investors great stability and security, the CDB is considered, then, an investment option in fixed income due to the fact that they are characteristics of this class of investments. By the way, it is usually a title as safe as savings, but, in general, with higher yields.

As for the remuneration, the CDB can offer three different types of yield: the prefixed, with an annual interest defined before the purchase, and the post-fixed, linked to the variation of an index, which, generally, is the CDI (Certificate of Deposit Interbank). There is also the hybrid, which mixes the two forms.

By the way, attention! For those who don't know, CBD is not synonymous with CDI, okay? While the first is the investment we are talking about, the CDI is the index used to remunerate it, being, in fact, the loan title between banks and financial institutions.

In general, the CDI closely follows the Selic Rate, which is the economy's basic interest rate. So, if a CDB security promises a return of 100% from the CDI, it practically pays the Selic variation. Furthermore, it should be noted that those with longer maturities tend to have more attractive returns. The exception to the rule is the PicPay Daily Liquidity CDB. Let's see!

And what is CDB PicPay Daily Liquidity?

Now that you understand the product, it remains to understand more about CDB PicPay Daily Liquidity. You will see that it is much simpler than you think and much better than you might expect!

First of all, do you know what PicPay is? After all, we are talking about an investment that you will lend to the PicPay company, so nothing fairer and more correct than understanding what it actually does and if it is reliable. Do not forget that we are dealing with your money, which must be handled very carefully.

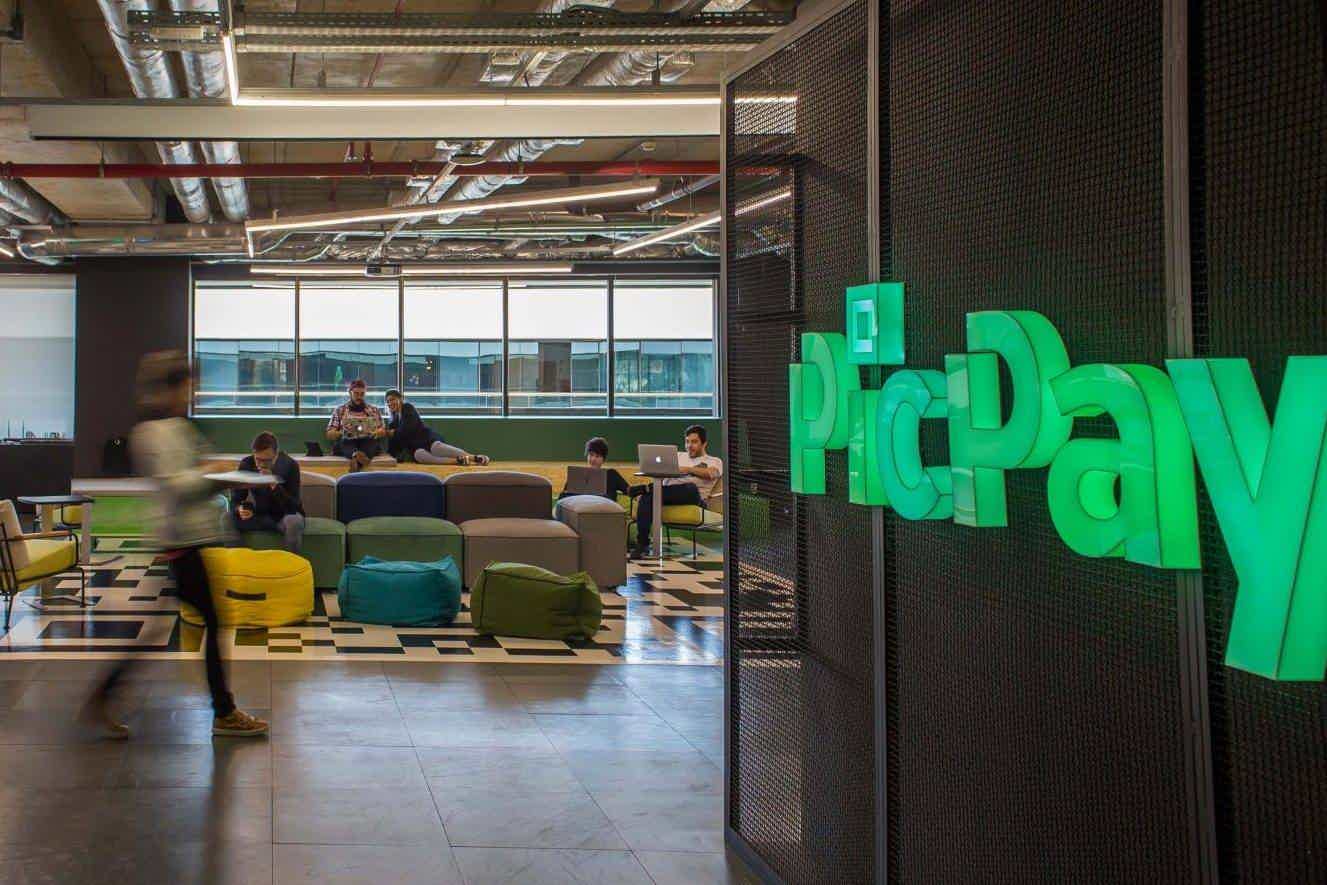

Well then, for those who don't know, PicPay is a Brazilian fintech application launched in 2012 that works as a digital wallet, being one of the first wallets with QR Code in the world. Currently, the startup has 36 million users, which makes it the largest number of users in a payment application in Brazil, moves R$2 billion in transactions per month and is present in more than 3 million establishments. In other words, it is undeniable that this is a very serious, reliable and solid company.

Aware of what PicPay is, let's talk about CDB PicPay Daily Liquidity. Also, something you need to keep in mind is that when we talk about daily liquidity, it means that you can withdraw your investment at any time. That's because there are several types of CDB, whose maturity dates vary.

As previously mentioned, the longer you lend your money to the bank, that is, the longer the term of the CDB, the greater the return on your invested money. However, as we have already mentioned, one of the few cases of exception to the rule is precisely the CDB PicPay Liquidez Diária. With the possibility of redeeming your money at any time, this application has one of the highest returns on the market, even taking into account those with longer terms.

For example, the 5-year post-fixed CDB of the digital bank C6 Bank, which is one of the highest, yields 136% CDI. But pay attention to one detail: you will leave your money standing there and yielding for a long 5 years. Too long, don't you think? What if something happens to you in the meantime? Screw it!

Now, amaze! Do you know how much the CDB PicPay Daily Liquidity is? 210% CDI! Yes, that's exactly what you read. In addition to yielding much more than the market average, you can still redeem your money at any time, not being tied to the maturity date. Wonderful, don't you agree?

How to invest in CDB PicPay Daily Liquidity

With the super aggressive yield of 210% CDI and the possibility of redeeming your money whenever you want, there is no doubt that CDB PicPay Daily Liquidity is a somewhat tempting offer. So, the question remains: how to make this investment? That's what you'll find out by clicking the button below and reading our next text.

About the author / Priscilla de Cassia

Reviewed by / Junior Aguiar

Senior Editor

Trending Topics

How to know if a financial institution is reliable?

Invest in simple actions on how to know if a financial institution is reliable and avoid scams and financial losses. Check out the tips here.

Keep Reading

How to Apply for Spotify Credit Card

To apply for the spotify card, you can do it completely online. So, see here what are the ways to secure yours!

Keep Reading

Release the inner artist in you: discover the online karaoke apps that will blow your mind

Discover the thrill of singing on your cell phone with the free karaoke app. Unleash your vocal potential and have fun with friends!

Keep ReadingYou may also like

10 best high limit cards of 2021

With a multitude of cards, the market offers multiple credit options. Among them are high limit cards. See which one best fits your profile!

Keep Reading

Financial control worksheet: how to assemble

Learn how to set up a financial control worksheet and start changing your life today.

Keep Reading

Discover the Fiat consortium

Initially, knowing more about the Fiat consortium is the first step towards realizing a dream. So, see here what it is about and what to do to acquire your new car.

Keep Reading