Cards

8 cards for civil servants 2021

If you are a public servant and still don't know which credit card option is best for you, know that we have selected the best options on the market for you. They have annuity exemption, international coverage, absence of SPC and SERASA consultation and much more! Read!

Advertisement

Discover the best cards on the market for you

So, the number of civil servants has been growing more and more and, in the midst of so many new contests, this number will continue to grow. Therefore, we are going to present here the 07 card options for public servants that are among the best in the market.

So, if you fall into this category and don't know which card to choose, read on to check out our selection of financial products that are ideal for you. Let's go!

What are the best card options for public servants in 2021?

So let's get to know the 08 options available on the market below.

1. Bradesco

So, the Bradesco card is a card created by Banco Bradesco in the form of a payroll card, which makes it our first choice among cards for public servants.

But it is worth mentioning that the payment of your invoice is deducted from the payroll or from the INSS benefit.

And, in addition, the card has the Elo brand, international coverage, discounts and offers from Banco Bradesco and Elo brand partners, as well as 24-hour service at the Call Center indicated on the back of your card.

Finally, the Bradesco card is a great option for a credit financial product, if you are a public servant, as it has several benefits for customers, such as annuity waiver.

| minimum income | Minimum wage |

| Annuity | Exempt in the 1st year |

| Flag | Link |

| Roof | International |

| Benefits | No consultation at SPC and Serasa; Partner network discounts |

How to apply for the Bradesco Elo Consignado card

Learn how to apply for your Bradesco Elo Internacional Consignado card, so you can pay your debts in installments and also make withdrawals of up to 70%.

2. BMG

Well then, the BMG Card is also a great card option for public servants as it works as a payroll card.

Thus, you need to prove income to gain access to the institution, but it is not necessary to present any counterproof, and it may even be negative.

And, in addition, the card's fees are very low compared to other cards, because the withdrawal fee is R$15.00, as well as the maximum interest rate per year is 84.9% and the limit of withdrawal and tele withdrawal is up to 98% of the total limit.

So, the card that still has international coverage and the Mastercard brand, also has the lowest interest rates in the market and partnership with more than 30 million establishments.

| minimum income | Minimum wage |

| Annuity | Exempt |

| Flag | MasterCard |

| Roof | International |

| Benefits | Discounts; Mastercard Surprise; International coverage; Cashback Program |

How to apply for BMG card for negatives?

The BMG credit card for negatives is a card that offers ease of approval and can be personalized. Find out how to apply here!

3. pan

So, Banco Pan offers the option of the Pan card, which is also an excellent card for public servants, as it works in the payroll mode.

This is because it is intended for civil servants, retirees and INSS pensioners.

Thus, the payment of the minimum card bill will be deducted directly from the payroll or from the INSS benefit.

That is, you don't have to worry about paying the card, because even before you receive your payment, the card will have already been paid.

Thus, it is a way of giving the institution more security that you will honor your commitments.

And, in addition, Banco Pan allows you to adjust your limit directly through the bank's application, but this adjustment will be subject to approval and the transactions you carry out with the card.

Furthermore, through Banco Pan you have access to one of the best applications on the market. That's because, through the application you can: have control of all your expenses in real time. Furthermore, it has access to the card's monthly bill, can adjust the limit subject to approval, as well as take out personal credit subject to approval.

| minimum income | Minimum wage |

| Annuity | Exempt |

| Flag | Visa |

| Roof | International |

| Benefits | easy approval |

How to apply for the Pan Consigned Card

Do you want to know how to apply for the Pan credit card and make your purchases and payments easier? So, watch the step-by-step right now.

4. Daycoval

Well, the Daycoval card is also an ideal card for public servants and works like a payroll card, that is, the minimum amount of the card bill is deducted from your salary.

And, in addition, the card has the lowest interest rates on the market, as well as being exempt from charging an annuity fee, it does not consult credit protection agencies and you can even make unlimited withdrawals on the Banco24Horas network.

| minimum income | Minimum wage |

| Annuity | Exempt |

| Flag | MasterCard |

| Roof | International |

| Benefits | No Consultation with SPC/SERASA; Lowest interest rates on the market; Minimum payment deducted from the payroll; Withdrawals on the Banco24Horas network |

How to apply for the Daycoval card

Do you want to know how to apply for the Daycoval payroll card? If yes, then read this text and be closer to the card with the lowest interest rates on the market!

5. Simple Box

Therefore, Caixa Econômica Federal also offers an ideal credit card for public servants with all the credibility that Caixa brings to customers in all the products and services it offers.

Thus, it is a card intended for INSS retirees or pensioners under 75 years of age, with a credit limit linked to the INSS benefit.

And, in addition, this card also offers several benefits, such as the advantages of the Elo flag. However, there is a fee for issuing the card in the amount of R$ 15, which can be paid in up to three installments on the invoice.

However, a negative point is that the Caixa Simples card does not offer additional cards, nor does it have a points program.

| minimum income | not required |

| Annuity | Exempt |

| Flag | Link |

| Roof | International |

| Benefits | Without consultation with the SPC/Serasa; Lower interest; Clube Elo Mania Caixa |

How to apply for the Caixa Simples card

The long-awaited time has come to find out how to apply for your Caixa Simples card, ideal for INSS retirees and pensioners with negative annuity fees.

6. Cetelem

Well, Banco Cetelem also created the Cetelem card, ideal for public servants.

Thus, depending on the amount of your benefit or monthly salary, you will have a credit limit to use when shopping or paying bills.

And, in addition, if you are already a customer of the financial institution, you can simulate or contract the card through WhatsApp at the number (11) 98928 0733.

In addition, through the institution's website, you can also generate a payment slip, unlock your card, access your contract and invoices, among many other services.

| minimum income | Minimum wage |

| Annuity | Exempt |

| Flag | MasterCard |

| Roof | National |

| Benefits | Mastercard Surprise; National Coverage; Low interest of 2,35% per month; Duty free |

How to apply for the Cetelem Payroll Card

Zero annuity and benefits for you. Request Cetelem now and use this step by step to order yours from home.

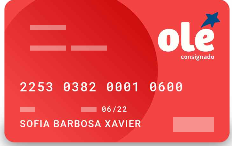

7. Olé Consignado

So, another ideal card option for public servants is the Olé Consignado card, because it works in the payroll mode.

Thus, among the various advantages that the card has, we have that it works by deducting the minimum amount of the invoice from the paycheck or from the INSS benefit.

Just as it has low interest rates with a consignable margin of 5%, and yet, it does not consult credit bureaus, opening up the range of people who can access the card.

| minimum income | Minimum wage |

| Annuity | Exempt |

| Flag | Visa |

| Roof | International |

| Benefits | Discounts on the Olé partner network; Track everything through the app |

How to apply for the Olé Consignado credit card

You already know what the benefits of the Olé Consignado credit card are, so it's time to find out how to apply for it. After all, he is free of annuity.

8. Santander SX

Well, the Santander SX card is a card issued by Banco Santander that was created to replace the Santander Free card.

Thus, it is a card that has a Visa or Mastercard flag and international coverage, that is, you can make purchases in national and international stores.

Furthermore, to have access to the card, you are not required to be an account holder at the institution, but, if you have one, it will be easier for you at the time of approval.

And, in addition, the card still features contactless technology, which allows payment by approximation, bringing more technology and innovation.

| minimum income | R$ 500.00 for account holders R$ 1,045.00 for non-account holders |

| Annuity | 12x of R$33.25 (Exempt if you join the PIX system or with a minimum spend of R$ 100) |

| Flag | Visa or Mastercard |

| Roof | International |

| Benefits | Discounts at Esfera partner stores |

How to apply for the Santander SX card

Learn how to apply for the Santander SX card by following the post step by step. In it, you have access to Visa or Mastercard flags, international coverage and discounts.

About the author / Joyce Viana

Reviewed by / Junior Aguiar

Senior Editor

Trending Topics

Famous investors: 15 Brazilian celebrities who invest their money

Do you know where Brazilian celebrities invest their money? So, read this post and check out our list of famous investors.

Keep Reading

How to apply for C6 Rainbow card

Request the C6 Rainbow card, which has no annual fee and you still support the LGBTQIA+ community in many ways. Follow!

Keep Reading

All the benefits that Brazilians are entitled to

Get to know all the benefits that Brazilians are entitled to and find out right now how you can request them quickly and easily.

Keep ReadingYou may also like

Mr Finance compared Superdigital to other card options

The Superdigital card is free of annual fees and has good advantages, see the comparison between it and similar ones: Santander SX and Nubank.

Keep Reading

Find out what LCA, LCI is and how to invest

Do you want to make an investment and not pay income tax? Then the best choice is LCAs and LCIs. Check out!

Keep Reading

How to be Itaú Uniclass?

There are several exclusive account options for those with high incomes. In fact, they offer numerous benefits to their users. One of them is Itaú Uniclass. Want to know more? Read today's article!

Keep Reading