Cards

Zencard card or Atacadão card: which is better?

If you are in doubt between the Zencard card or the Atacadão card, then check out our content and compare their main features, as well as advantages and disadvantages. Finally, choose the best one for your financial profile!

Advertisement

Zencard x Atacadão: find out which one to choose

If you are in doubt between the Zencard card or the Atacadão card, then check out our content below and find out which one best suits your financial needs. In that sense, both are affordable cards that offer exclusive benefits.

Well, the Zencard card or the Atacadão card offer benefits, such as the brand points program. By the way, both offer international coverage. This means that you can also make your purchases outside the country.

It is worth noting that there are several credit card options and it is important to do a lot of research before applying for a card. Therefore, we have brought here the main characteristics, as well as advantages and disadvantages of the two cards, so that you can decide which one is ideal for your profile. Check out!

How to apply for the Zencard card

The Zencard card is international and offers a reward program. If you liked the advantages, see the step by step to request it right now.

How to apply for your Atacadão card

Find out right now everything you need to do to apply for your wholesale card. Our team has separated the step by step for you to be able to submit your request.

| Atacadão Card | Zencard card | |

| Minimum Income | not informed | not informed |

| Annuity | 12x of R$11.99 | Exempt |

| Flag | Visa or Mastercard | MasterCard |

| Roof | International | International |

| Benefits | Exclusive discounts; Benefits program. | Discount club; Mastercard Surprise Program. |

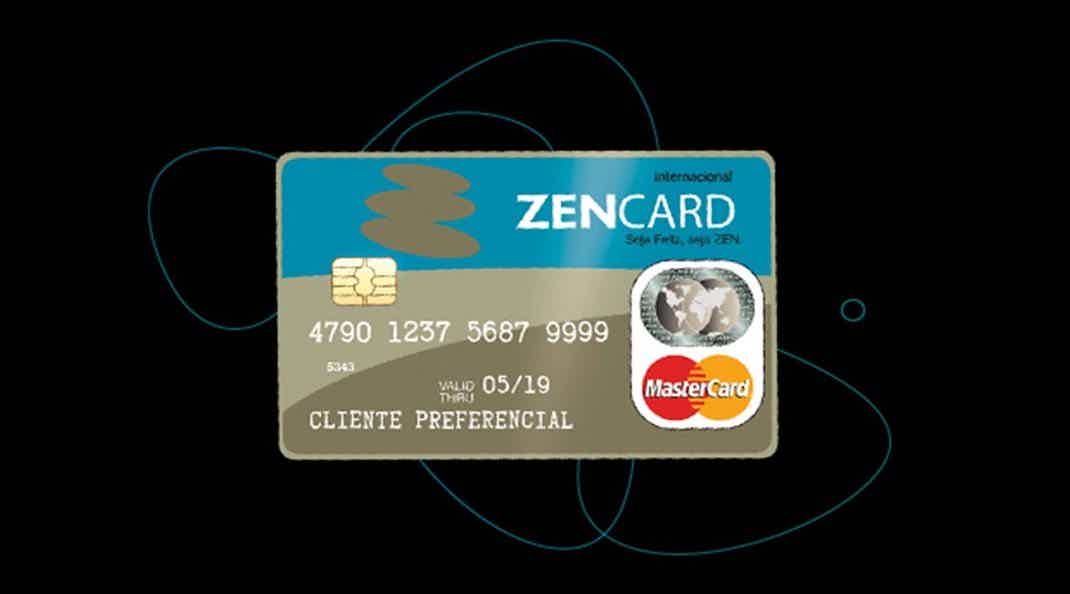

Zencard card

So, the Zencard card is a prepaid credit card that emerged in partnership with CredLuz. That is, he is ideal for those who need a quick credit to get out of the red.

Thus, it is possible to obtain personal credit for both individuals and legal entities. In this way, you use the amount on your Zencard credit card and the loan installments are deducted directly from your electricity bill. But it is worth noting that this loan is optional, you can also recharge normally in plastic.

Therefore, you can go to the Zencard website and apply online by filling out a form. If approved, you will receive the card at the address provided with the requested amount.

However, it is important to inform you that, as it is a prepaid card, you will not be able to pay your purchases in installments. By the way, you cannot withdraw the amount of personal credit in cash either. Therefore, you must use it as a credit on demand.

Furthermore, the card is issued under the Mastercard brand and offers an annual fee exemption, but charges a monthly fee of R$ 7.90. By the way, you can participate in the brand's benefits program, just register your card on the Mastercard website.

Atacadão Card

First of all, it is important that you know that the Atacadão supermarket chain belongs to the Carrefour chain. Therefore, the Atacadão card is issued by Carrefour Soluções Financeiras and is therefore a completely secure product.

So, the network issues the card in the Visa or Mastercard flags and offers international coverage. That is, this means that you can make purchases with your Atacadão card both in Brazil and abroad.

In addition, you can apply for your card online, through the official website of Atacadão stores. Or, you can go to a physical store and order yours. In this sense, the credit analysis is quick and, if approved, you can leave the store with your card in hand.

By the way, the card is quite modern and has its own application. In this way, you can download the app through the Play Store or the App Store, as it is available for both Android and iOS.

Furthermore, the card charges an annual fee of R$11.99 per month. However, this amount may be worth it if you make frequent purchases at Atacadão stores. But if you still have doubts between the Zencard card or the Atacadão card, continue reading and find out more details about these two products.

What are the advantages of the Zencard card?

Well, the main advantage of the Zencard card is that it accepts negatives. Furthermore, as the optional personal credit is deducted directly from your electricity bill, even if you have some restriction in your name, you have a great chance of approval.

In addition, the card offers annuity exemption in addition to having international coverage. That is, you can use your card both inside and outside the country. In addition, you have access to the Discount Club in which there are unlimited coupons to buy in accredited stores.

By the way, you can also use your Zencard card to participate in the Mastercard Surpreenda benefits program. Thus, you can accumulate points and exchange them for discount vouchers at partner stores.

However, if you are still not sure whether to choose the Zencard or the Atacadão card, check out the disadvantages of both products below. This way, you will be more prepared when choosing one of these products.

What are the advantages of the Atacadão card?

Initially, the most attractive advantage of the Atacadão card are the benefits it offers to those who frequently shop at the chain's stores. In this sense, the card entitles you to exclusive discounts, in addition to special installments for some items in the store.

In addition, the card also offers service and management through its exclusive application. In addition, you can also participate in the brand benefits program, such as Vai de Visa or Mastercard Surpreenda. That way, you just need to register your Atacadão card on the official website of the brands and start using it!

What are the disadvantages of the Zencard card?

Well, the main negative point of the Zencard card is the interest. In this sense, if you opt for the personal credit available on the card, you will pay interest according to the requested credit installments. In fact, the amounts will be deducted directly from your electricity bill, as Zencard has a partnership with CredLuz.

Furthermore, it is important to remember that you will not be able to pay for any purchases with the Zencard card, in addition to not being able to withdraw the personal credit amount in cash. However, if you recharge the card normally, you can withdraw without any problems, but there is a fee of R$ 6.90 per transaction. In addition, it does not charge an annuity, but has a monthly fee of R$ 7.90.

What are the disadvantages of the Atacadão card?

So, the main negative point of the Atacadão card is the annual fee. In this sense, the card charges a monthly fee of R$11.99 from its customers. Incidentally, there are other credit card options on the market that are exempt from this fee.

In addition, the card charges interest in case of late payment on the invoice. Thus, the amounts charged are quite high. So be careful and don't delay the payment, or you could end up in debt!

Zencard card or Atacadão card: which one to choose?

Finally, both the Zencard card and the Atacadão card offer positive and negative points. However, they are different products for different financial profiles.

That way, if you have a low score or some restriction on your name, then maybe the Zencard card is more suitable for you. In this sense, you can be approved even if you are negative and the amount of personal credit can help you get out of trouble.

However, if you are a frequent customer of the Atacadão network, then the Atacadão card may be more worthwhile for you. Thus, the card offers many benefits to network customers.

But if you still have doubts about which card is ideal for you, check out our content below and discover more options!

Atacadão card or Access card: which is better?

Choose between the Atacadão card or the Acesso card. Both offer low rates and international shopping. Read this post and check out all its features.

About the author / Aline Barbosa

Reviewed by / Junior Aguiar

Senior Editor

Trending Topics

LATAM Pass card miles: how to convert points into miles?

Find out how you can get miles from the LATAM Pass card and check out how you can use them to buy cheap tickets!

Keep Reading

Discover the Bradesco Platinum card

Discover the pros and cons of the Bradesco Platinum card and decide if this is the ideal option for you. Read the post now and find out more!

Keep Reading

How to get an unlimited credit card

Do you know if there is an unlimited credit card? Read the post and find out the answer to this question and also check out 3 ways to get a high limit.

Keep ReadingYou may also like

How to apply for the Super card

If you have a low or negative score, the Supera card can be a great alternative. It does not require a minimum income and is exempt from annuities. Find out the step-by-step process to apply below.

Keep Reading

How to apply for the Midway personal loan

With the Midway personal loan, you can pay up to R$ 6 thousand in up to 21 months. Want to know how to order it? So, read on and check it out!

Keep Reading

Bradesco Visa Infinite Card Review 2022

The Bradesco Visa Infinite card is accredited by Visa and gives access to VIP rooms, purchase protection and the Livelo program. Want to know more? Continue reading and check out our review.

Keep Reading