Cards

Online Trigg Card: with international coverage and cashback

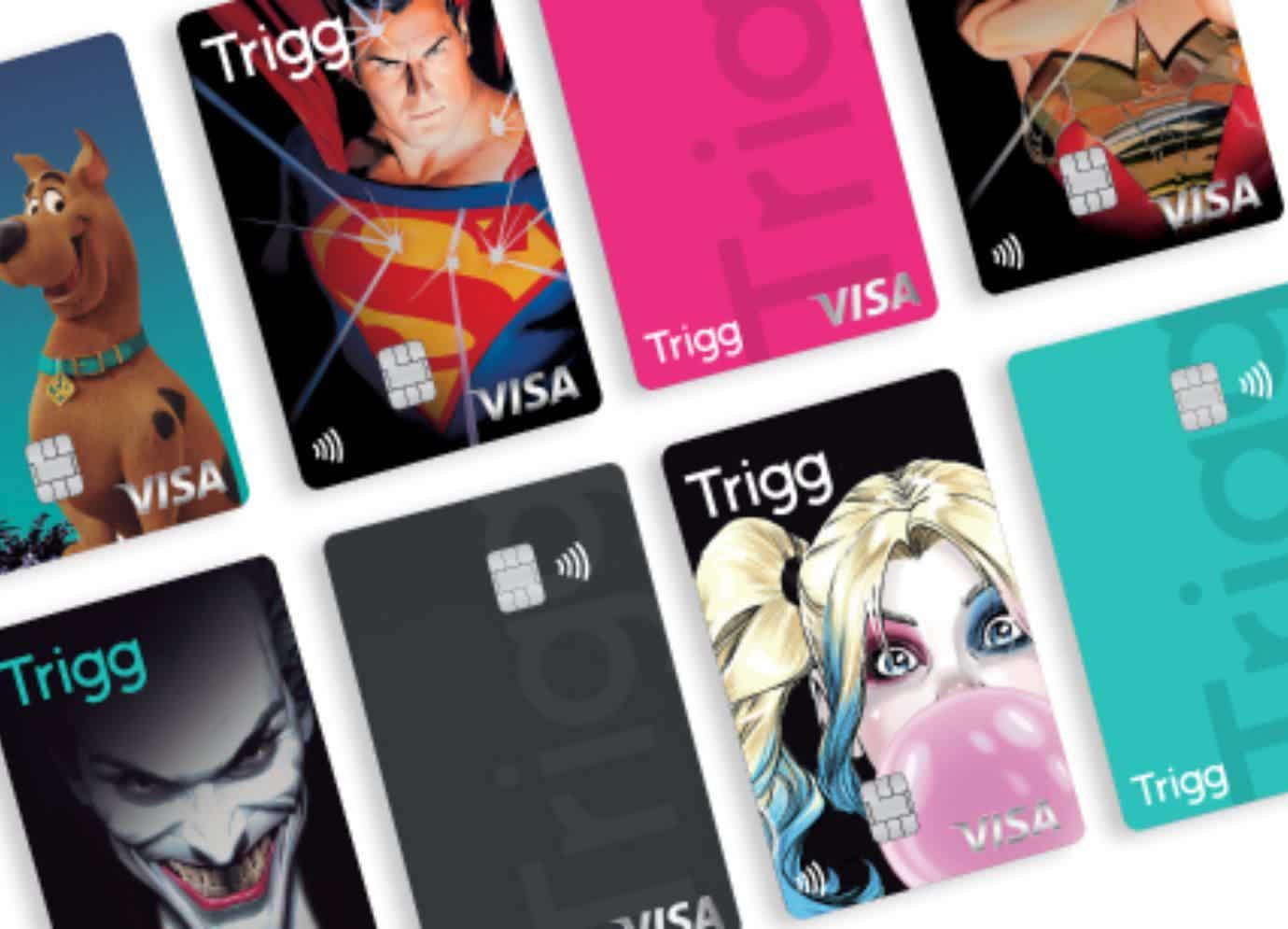

Have a collection of themed cards for yourself and take advantage of access to an unmissable bracelet that allows you to make contactless payments in a more practical way. Continue reading and learn more about the Trigg online card.

Advertisement

Themed cards ready for you to collect

If you want to have a credit card with great benefits that suits you, you might want to learn more about the Trigg online card.

With this card, you can apply for a themed credit card! This way, you can have a card with the image of Harley Quinn, Wonder Woman and even Friends.

| Annuity | 12x of R$ 13.90 |

| minimum income | not informed |

| Flag | visa gold |

| Roof | International |

| Benefits | Themed cards Go Visa Program Bracelet for contactless payments |

In addition, the Trigg online card offers cashback on your invoices and a special bracelet to make contactless payments easier.

If you are interested and want to know more about this option, check out the following post for everything about the Trigg online card.

How does the Trigg online card work?

In short, the Trigg online card is a Visa Gold credit card that allows its users to make purchases online, in person and abroad.

Therefore, it is possible to use several benefits that the brand offers, such as programs that protect purchases and offer security when traveling.

In fact, with this card you can access the Vai de Visa Program and thus have several discounts at Visa partner stores and save even more on your purchases.

But, the main difference with the Trigg online card is that it has personalized models that come with fun prints so that the card looks more like you.

This way, you can request a themed card featuring Friends, Wonder Woman, Harley Quinn, Scooby-Doo, Batman and many others.

Plus, you can have up to 11 active cards and create a collection of themed credit cards!

What is the annual fee for the Trigg card?

Namely, the Trigg online card is not exempt from annual fees. When having it, users must pay the amount of R$13.90 per month for the annual fee of their main card.

However, if he requests an additional card, he will be able to pay a lower annual fee of just 12x R$6.90 per card.

In addition to the cards, the Trig annual fee is also charged on the Band, which is a bracelet that connects to your credit card and allows you to make contactless payments.

Therefore, Trigg charges an annual fee of R$6.90 per month on the bracelet so that you can pay quickly and easily.

What is the limit of the Trigg online card?

When applying for a new credit card, the main information we want to know about it is the limit we can access.

However, it is difficult to know this information since the limit value is defined based on a credit analysis of your profile.

Therefore, if you have a good payment history and do not have a negative CPF, you may have a greater chance of reaching a higher limit.

Therefore, it is not possible to know for sure what the limit value that the Trigg online card could release for you would be.

But, if you have other active credit cards, you can use the limit you have on them as a basis.

Since this limit was also defined by credit analysis, you can consider the Trigg online card limit to be an approximate value.

However, it is important to keep in mind that each financial institution has its own rules for defining limits.

How do I increase my Trigg card limit?

If you have already requested your Trigg card online, but are not so satisfied with the limit released, you can try to request an increase in its value.

To do this, you just need to access the Trigg app and go to your card menu. In this area, you can select the “Change limit” option and then click on “I want a higher limit”.

So, when you do this, you will be redirected to a screen where you can enter the limit value you would like to access. Here you will also need to state the reason for the increase.

Once this is done, simply follow the next instructions and complete the order. This way, in a few days Trigg will contact you to inform you whether the new limit has been approved or not.

Is it worth applying for the Trigg card online?

So far you can see that the Trigg online card offers several interesting benefits and features.

However, you also need to know the negative points of this card to be sure that it is the ideal option for you.

With that in mind, we decided to separate the main advantages and disadvantages of the Trigg online card below so you can get to know it better!

Benefits

In addition to being able to have themed cards, with Trigg you can also access cashback of 0.50% on your invoices and always receive a little bit back.

But, in addition to these benefits, there are many other advantages that the Trigg online card offers!

- Flag discount program;

- Up to 180 days of protection for your purchases against theft or accidents;

- Up to 12 months warranty on products purchased with the card;

- Emergency withdrawals to make during your travels;

- Card exchanges in times of emergency when traveling;

- Special bracelet for contactless payments;

- Up to 11 active cards for you to collect.

Disadvantages

Now, looking at the negative points of the cards, we see that the annual fee can be an obstacle when it comes to collecting the company's various themed cards.

This happens because each card requested will have an annual fee, and this can be a burden on the consumer's pocket.

But, in addition to this, the Trigg online card also has other negative points:

- You have to pay for shipping the cards;

- There is no possibility of a discount on the annual fee;

- You can only have one virtual card for your purchases.

How to get a Trigg credit card?

If you liked what you learned about the Trigg online card and want to request yours, you just need to access the Trigg website or download the app to start your registration.

The financial institution will then analyze your data and credit to be able to release the card to you.

To learn more about this process, you can check out the following post for a complete step-by-step guide to requesting your Trigg card online!

How to apply for a Trigg card

Find out how to have your Trigg credit card at home and enjoy the benefits it offers!

About the author / Leticia Jordan

Reviewed by / Junior Aguiar

Senior Editor

Trending Topics

Discover the AME credit card

The AME credit card offers up to 10% of cashback and has the international Mastercard brand. Check out more about him here!

Keep Reading

How to send resume to Coca-Cola? Check it out here

Find out here how to send a resume to Coca-Cola and thus take advantage of the more than 300 open opportunities for you to get a job.

Keep Reading

Discover the Pan Mastercard Gold credit card

Discover the Pan Mastercard Gold credit card. It offers great benefits, such as the Deals Club, Mastercard Surpreenda and Pan Mais.

Keep ReadingYou may also like

Discover the PagBank loan

With the PagBank loan, you request quick money free of bureaucracy, receiving the money in up to 1 business day and with up to 24 months to pay it off. Learn more here.

Keep Reading

20 Free Personal Finance Courses

Want to invest in financial education and think it costs too much? You are wrong! Check out our list of 20 free personal finance courses.

Keep Reading

Card to add limit in Nubank

If you are negative and can't get a credit card to call yours. How about getting to know the card to add a limit at Nubank? Continue reading and check it out!

Keep Reading