Cards

Discover the Pan Mastercard Gold credit card

Get to know the Pan Mastercard Gold credit card and guarantee access to the Mastercard Surpreenda program, Use+ and Pague Menos program, cashback program and the Offers Club.

Advertisement

Pan Mastercard Gold: access the Club of Offers and guarantee discounts at dozens of Pan bank partners

Learn all about the Pan Mastercard Gold credit card and see how it can be a great ally in your purchases through the Offers Club, cashback program and Mastercard Surpreenda. So read on, we'll tell you all about this card.

How to apply for the Pan Mastercard Gold card

Learn how to apply for the Pan Mastercard Gold card and have access to cashback, Club Deals and the possibility of waiving the annuity.

How does the Pan Mastercard Gold credit card work?

In the search for a credit card with good conditions, we found several options on the market, so the Pan Mastercard Gold card was launched by Banco Pan to be a differential in the lives of customers.

This is because, despite charging annuity, you have the possibility of zeroing the annuity, that is, according to your expenses, the annuity can be zeroed.

And, in addition, the card also has an Offers Club, that is, you guarantee access to several offers from Pan bank partner companies.

As well as owning the Mastercard brand, you have access to all the benefits of the brand, such as the Mastercard Surprise program, Purchase Protection Insurance, Extended Warranty and Mastercard Global Service.

In addition, to apply for the Pan Mastercard Gold card, you need to enter the Pan bank website, fill in the form with all the data and proof of income of R$2500. Then, just wait for the credit analysis to proceed with receiving the card.

What is the Pan Mastercard Gold credit card limit?

So, the limit of the Pan Mastercard Gold card was not informed by the institution.

Is the Pan Mastercard Gold credit card worth it?

Check out the advantages and disadvantages of this card below.

Benefits

Among the advantages of the Pan Mastercard Gold card is the Club of Offers program, so you will have access to discounts at several partner establishments.

And, in addition, you have the possibility to zero the annuity with the Use + Pay Menos program, that is, the more you use the card, the less you will pay in annuity.

In addition, you have the PAN Mais program, in which you can convert your purchases into points that can be exchanged for products, services, airline tickets and other rewards.

Therefore, the Pan Mastercard Gold card is a great alternative if you want a card that offers multiple rewards, making your purchases easier.

Disadvantages

So, despite several positive points, the card also has negative points, such as the minimum income requirement and the annuity charge.

This is because, to exempt yourself from the annuity, you must spend at least R$ 3 thousand, otherwise the annuity will be charged.

How to make a Pan Mastercard Gold credit card?

So, you can apply for Pan Mastercard Gold card through Pan bank website. So, to see the step-by-step process on how to apply for this card, click on the recommended content below.

How to apply for the Pan Mastercard Gold card

Learn how to apply for the Pan Mastercard Gold card and have access to the unique conditions of the partnership between Pan bank and the Mastercard brand.

About the author / Joyce Viana

Reviewed by / Junior Aguiar

Senior Editor

Trending Topics

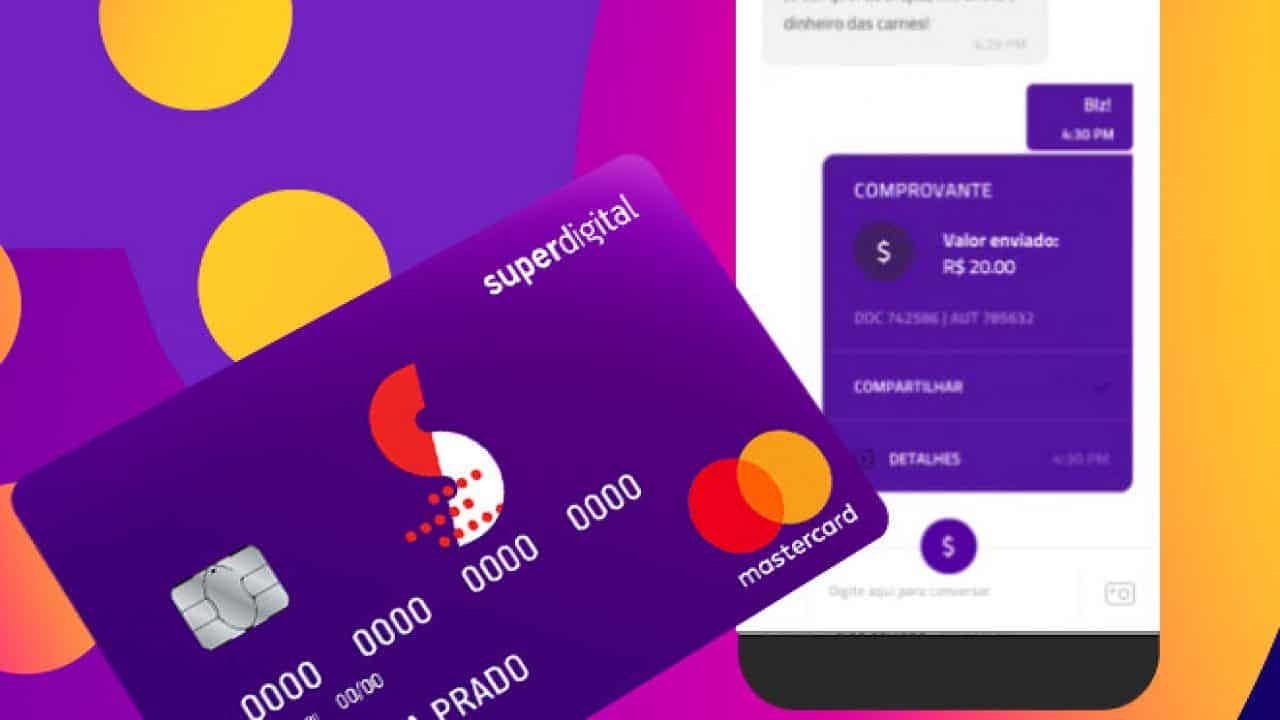

Superdigital card or Bradesco DIN card: which one to choose?

Either the superdigital card or the Bradesco DIN card, both are prepaid, offered by reliable banks and full of offers! Check out!

Keep Reading

How to register with Serasa Empreendedor?

See how to sign up for Serasa Empreendedor, a free tool that will help you with the management, finances and health of your business. Check out!

Keep Reading

Get to know Sicredi Renovation Credit

Get to know Sicredi credit for renovation and how it can help you buy those materials and pay for services you need! Check out!

Keep ReadingYou may also like

Discover the Marisa Credit Card

Do you want to apply for a card, but you have a dirty name? The Marisa credit card may be a good option for you. In addition to international coverage, it offers exclusive discounts and you can pay your purchases in up to 12 interest-free installments on the store's website.

Keep Reading

Online Cashew Card: zero costs and flexible benefits

Are you looking for a card to unify your employees' CLT benefits and that has affordable rates? So, the Caju online card is a great option, as it has no administration fee or issuance. To learn more about this option, just continue reading with us!

Keep Reading

How to subscribe to the Social Water Tariff benefit

To register for the Social Water Tariff benefit, you need to meet certain requirements. Learn more below!

Keep Reading