Cards

Ton Card or Impact Bank Card: which is better?

Learn more about two free prepaid cards, ideal for people with bad credit and that don't charge any annuity. So, decide between the Ton card or the Impact Bank card.

Advertisement

Ton x Impact Bank: find out which one to choose

Although there are other options on the market, choosing between the Ton card or the Impact Bank card can be beneficial for your pocket!

This is because they are cheap credit cards, and in the case of the Ton card there are options for small entrepreneurs who seek to receive for their sales without having a CNPJ.

On the other hand, the Impact Bank card only asks for a monthly fee and does not carry out any credit analysis for the customer to buy in credit mode, for example.

In addition, without further ado, we will bring you more details about both so that you can buy credit in establishments abroad without any impediment. Check out!

How to apply for the Ton card

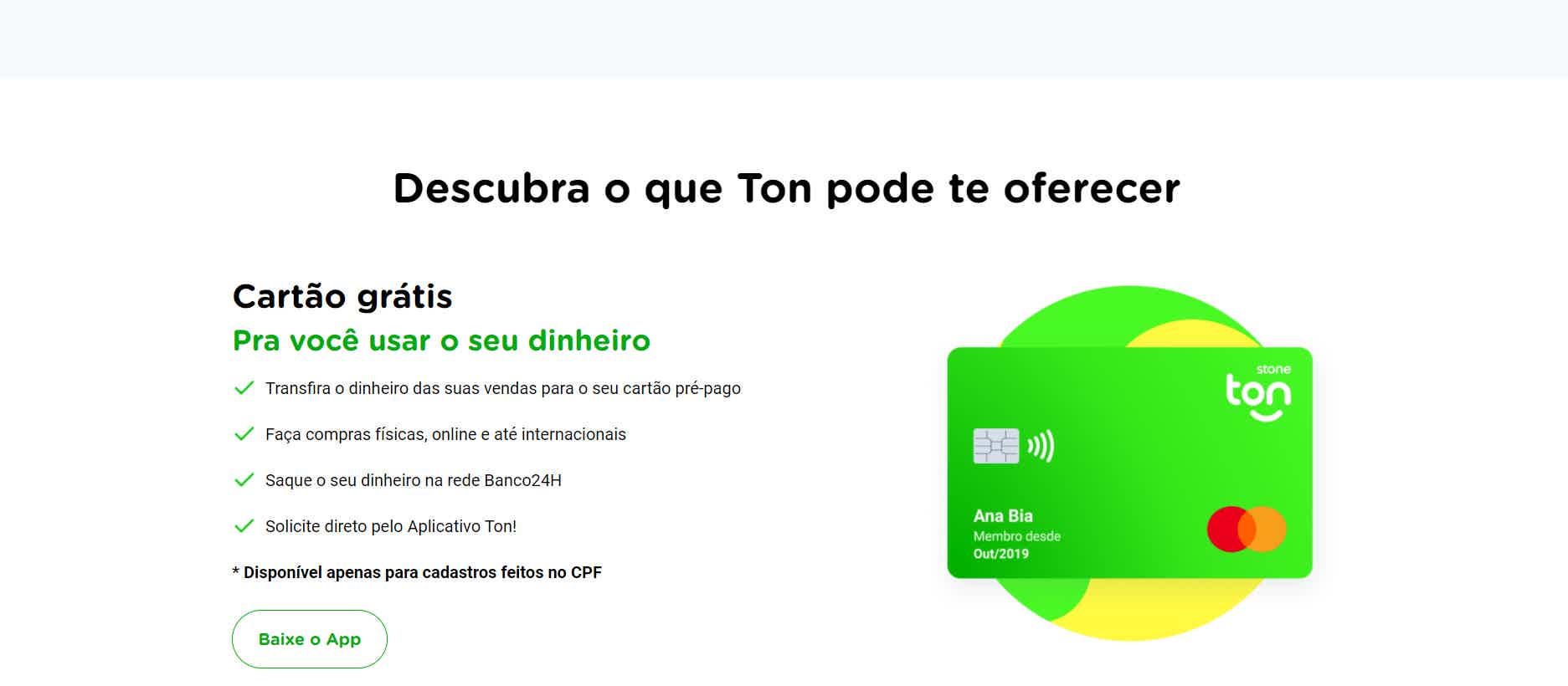

No CNPJ to have a card machine and pay in installments? With Ton you can use your CPF, in addition to a free prepaid credit card with an international flag.

How to apply for the Impact Bank card

Learn how to apply for an Impact Bank card, which offers a Mastercard brand, international coverage and several other exclusive benefits! Check out!

| ton card | Impact Bank Card | |

| Minimum Income | not required | not required |

| Annuity | Exempt | depends on the plan |

| Flag | MasterCard | MasterCard |

| Roof | International | International |

| Benefits | Pay no monthly fee when using the card machine Bank with a free, digital prepaid card Receive money from direct sales on your digital card Evolve your business with a card machine without having a CNPJ | Move the account and enjoy the cashback Make purchases on your credit card with a free digital account Both small and medium-sized businesses can take advantage of Donate money to NGOs and institutions through the digital account |

ton card

Firstly, the Ton card belongs to Stone and is focused on small businessmen who need alternatives to receive for their sales, as it does not have a CNPJ, for example.

Therefore, the Ton customer who only has the CPF can order the card machine and opt for three plans, the same number of credit or debit card machines, paying only for the installment and adhesion fees.

According to the Ton card, it is possible for people with a negative name to get the prepaid credit card, however, you will have to try to be sure, in addition, choose between the GigaTon, MegaTon and basic Ton plans.

Each one has different benefits and rates, as well as the machines that are divided between T1, T2 and T3, the last one with a higher value, however, complete with payment by approximation, printing or not of receipt and Wi-Fi connection.

Impact Bank Card

First of all, know that Impact Bank has an environmental and sustainable focus, directing values to a fund that is focused on a fair distribution of income and help for various social projects, that is, R$ 0.10 per transaction will be directed to the fund .

The Impact Bank free account is digital, has a prepaid card with credit modality without installments, with monthly payment plans for individuals and companies, who pay between R$15.00 and R$26.00.

In order to provide broad access, it does not charge any monthly fee and the application is approved in just one minute via the website, without proof of income or analysis of documents, except for companies.

Furthermore, it is also ideal for businesses that need a card machine and facilities, since, unlike traditional bank accounts, the digital account is not bureaucratic.

What are the advantages of the Ton card?

First of all, the Ton card has a free account to be opened by anyone, but it is focused on those who want to expand their business with a simple card machine. So, check out more details of the advantages below.

- Order your card machine even without CNPJ and do not pay for the digital account;

- Did you get paid for sales? Transfer to the digital account and receive within 1 business day;

- With TapTon, use your cell phone as a card machine;

- Have the option of three plans and machines, from the cheapest to the most expensive.

What are the benefits of the Impact Bank card?

Why not invest in a bank without high costs and that also creates funds to encourage and maintain actions for the neediest people and the environment? In addition to these points, there are other benefits to this option, such as those described below.

- Choose between plans and pay a fixed monthly fee;

- Do not spend on annuity, membership or maintenance fees;

- Open the digital account through the website in just one minute;

- Have a business account without high costs;

- Pay Netflix, Spotify and other apps with credit.

What are the disadvantages of the Ton card?

Although it has numerous advantages, the fees and tariffs related to the card machine are a bit high, that is, to have a complete equipment you will need to pay more than R$400.00 of membership fee, which can be paid in installments.

In addition, if you do not choose the highest value plan, such as GigaTon, the percentage for installment payments in up to 12 installments to be charged is 21.47%, forcing some entrepreneurs to pass on part of the amount to the customer, for example, which may not be economical.

What are the disadvantages of the Impact Bank card?

What most draws attention to the Impact Bank credit card is how easy it is, but at the same time, there is a cost to take advantage of it, that is, know that every month you will pay a monthly fee that can reach R$26.00 in the basic plan for individuals and R$40.00 for companies.

Furthermore, it is a digital bank that is still in its infancy, so it cannot yet offer loans, investments or any long-term savings plan, only the digital account and free transactions.

Ton Card or Impact Bank Card: which one to choose?

Finally, which would be ideal: Ton card or Impact Bank card?

In short, the two cards are ideal for small businesses, they have a free credit card, with a high chance of approval for people with a dirty name, which is more certainly valid on the part of the Impact Bank card.

Therefore, define your greatest need: is it to receive for your purchases without CNPJ or just to have a credit card that does not require proof of income?

Thus, you will reach the verdict! But if it doesn't, don't worry, as below we've prepared another ideal comparison for your profile. So, check out more credit card options for negatives who want to undertake!

Ton card or OpaPay card: which one to choose?

Learn more about both cards that don't charge annuity and even allow credit card purchases for negatives!

Trending Topics

How to apply for the Mundo Livre International Card

Mundo Livre International Card can be an excellent choice for negative credit cards. Click and find out how to order yours!

Keep Reading

Pan Bank loan online: 4 credit offers for you

Get to know the 4 types of Banco Pan loan online and find out the amount of credit you can access with them!

Keep ReadingYou may also like

Quick mini credits in Portugal 2022

Accounts tightened and you need to hire quick mini credits? Don't worry, we'll help you. So, check out our list of quick mini credit options in Portugal 2022 here.

Keep Reading

How to open a CGD current account

The "M" CGD current account is available for membership at the branch and offers debit and credit cards, unlimited transfers, access to credit and insurance with discounts and allows investments. See how to join.

Keep Reading

How to apply for a Zema payroll loan

Do you want a loan with good payment terms and term? So, find out how to apply for the Zema loan. Continue reading and check it out!

Keep Reading