Cards

PagBank Card or Havan Card: which one to choose?

If you like shopping, as well as looking for fee exemption and an accessible card for negatives, the PagBank card or Havan card may be what you need. So, read our comparative text and find out more!

Advertisement

PagBank x Havan: find out which one to choose

If you are looking for a card with international coverage, absence of proof of income, customer benefits program and several other benefits, the Pagbank card or Havan card may be the alternative you are looking for.

That's why, today, we're going to show you everything about these two cards so that you can choose the option that best suits your needs. Follow!

How to apply for Pagbank card

Card exempt from annuity, exempt from proof and that accepts negatives? Come to PagBank.

How to apply for the Havan card

Although it can only be used in chain stores, the Havan card offers many benefits at the time of purchase. Next, see how to request yours in a simple and practical way.

| Pagbank | Havana | |

| Minimum Income | not required | not required |

| Annuity | Exempt | Exempt |

| Flag | MasterCard | no flag |

| Roof | International | National |

| Benefits | Spending only from the balance available on the card Card recharge through account balance, bank slip, deposit or online debit Digital and streaming services Exclusive discounts and perks | No annuity Accepted at Havan's 134 physical and online stores Payment of the first card purchase within 40 days |

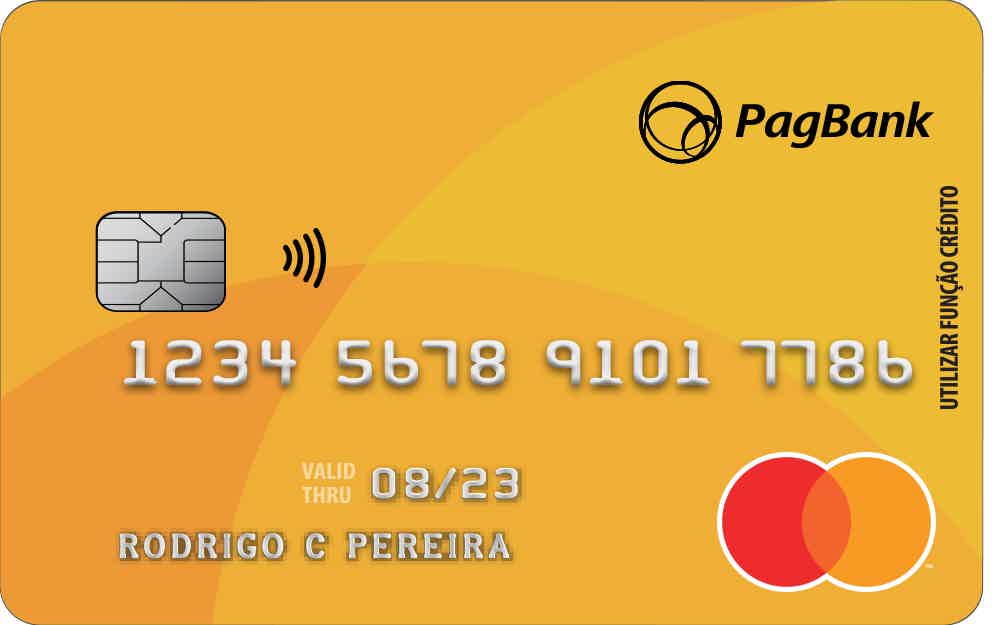

PagBank card

So, the PagBank card is a prepaid financial product that works as if it were a debit card, but with the amounts discounted at the time of purchase.

This is because when you insert this card into the machines, you will have to choose the credit method, but it will make the immediate discount as if it were a debit card.

So, in order for you to be able to use this card, you will always need to have a balance in your PagBank account, recharging it frequently.

And, in addition, the PagBank card is international, that is, you can use it to make purchases in national and international stores.

In addition, it has the Mastercard flag, giving you access to partner establishments, as well as the benefits of the Mastercard flag, such as the Mastercard Surpreenda program.

So, to apply for the card, just install the application, open a PagBank account and apply for your credit card in a simple way and without any bureaucracy.

Therefore, the Pagbank card is a financial product that has several benefits for users, in a way that makes their financial life simpler and more accessible.

Havana card

Well, the Havan credit card is a financial product that was created to be used in more than 134 physical and digital stores in the Havan network.

That's because it's a credit card, but it works a little differently from other cards, for example, because it doesn't have a flag.

To apply for the Havan card, you don't need to pay anything for it, neither annuity nor membership fee.

Thus, through this card, you can make a purchase at any of the chain's stores in person or online, with exclusive conditions for customers who purchase products with the card.

So, if you are a frequent customer of Havan stores, this card is a great alternative for you.

What are the advantages of the PagBank card?

So, the PagBank card has several advantages for users, such as international coverage, because through it you can use the card to make purchases in national or foreign stores.

And, in addition, to apply for the card, it is not necessary to prove income, as well as you do not need to pay an annuity.

It also has the Mastercard flag, that is, it gives you access to all Mastercard partner establishments, as well as to the benefits of the network, such as the Mastercard Surprise Program.

Therefore, the PagBank card is a great ally when shopping at any store.

What are the advantages of the Havan card?

Well, despite the fact that the Havan card can only be used in the chain's stores, it has several advantages, the first of which is the fact that you have access to various special promotions, discounts and sweepstakes valid exclusively for customers.

And, in addition, payment of the first installment of the card takes place within 40 days, as well as you can pay your purchases in up to 10 installments without interest and without down payment.

In addition, you can also make the choice of the due date of your card invoice more flexible.

Another advantage is that you do not pay a membership fee or annuity, that is, the card is completely free, as well as the duplicate is also free.

And, in addition, to simplify your financial life, you can consult your statement online any day or time.

Therefore, the Havan card is a great ally for making purchases at Havan chain stores.

What are the disadvantages of the PagBank card?

So, the PagBank card has some disadvantages, for example, not all withdrawals are free, because after 5 withdrawals an amount of R$7.50 is charged per transaction.

And, moreover, as it is a prepaid card, if you are a person who likes to pay for purchases in installments, the PagBank card is not for you, as you cannot pay for purchases in installments.

Furthermore, if you want to use the card, you will need to have a balance on it, that is, you will need to recharge it frequently, and you cannot have an emergency balance if necessary.

Therefore, the PagBank card is a good card, but it has some negative points.

What are the disadvantages of the Havan card?

Well, the Havan card despite having several advantages, it also has some disadvantages, the first of which is the fact that it is not accepted in any store, because the Havan card can only be used in the Havan chain stores.

And, in addition, the card does not have a cashback program, as well as, it does not have any points accumulation program, that is, it is a disadvantage since even if you buy a lot on the network, you will not earn values or products in exchange.

Furthermore, the approval of the Havan card is subject to credit analysis, that is, depending on your income or credit score, your application may be denied.

Therefore, the Havan card, despite being a great shopping card, also has its negative points.

PagBank Card or Havan Card: which one to choose?

So, the PagBank card or the Havan card are very different cards, but they offer interesting proposals seeking to retain their customers. Thus, if you are looking for security, credibility and a good card for shopping, they can be a good alternative.

But if you still have doubts, check out another card comparison in the recommended content below.

Saraiva card or Pan card?

Whether the Saraiva card or the Pan card, both have annuity exemption and international flag. Check out more information about them here!

About the author / Joyce Viana

Reviewed by / Junior Aguiar

Senior Editor

Trending Topics

Understand credit card bank Inter initial limit

Understand here the characteristics of the Banco Inter credit card and how the initial limit is determined. As well as learn how to boost your credit!

Keep Reading

Financial Planning 2022: tips for getting organized

Performing good financial planning it is possible to get out of debt and prosper. Here are some tips we prepared. Check out!

Keep Reading

How to sign up for the Burger King Young Apprentice

Learn how to enroll in the Burger King Young Apprentice to guarantee benefits, such as paid vacation and salary. Check the step by step here.

Keep ReadingYou may also like

Government announces the granting of the Auxílio Brasil benefit to a new group of Brazilians

As a way to support a part of the Brazilian population in a state of social vulnerability, the Federal Government and the Ministry of Citizenship announced the inclusion of pregnant women in the Auxílio Brasil benefit. See more here!

Keep Reading

Discover the Crefaz payroll loan

With the Crefaz payroll loan, you have access to credit with reduced interest to be paid in up to 48 months. For more details, just continue reading the full article.

Keep Reading

How to invest in Inter?

Banco Inter is a complete financial platform that offers cards, loans, different types of accounts and also works as a brokerage. This way, check out how to start investing in Inter and don't pay brokerage to buy and sell shares. Learn more later.

Keep Reading