Cards

PagBank Card or Casas Bahia Card: which one to choose?

Are you looking for a credit card with no or low annual fees, discounts at partner stores, as well as a free digital account and services to make your purchases easier? Then the Pagbank card or Casas Bahia card may be the alternative you are looking for. Check it out!

Advertisement

PagBank x Casas Bahia: find out which one to choose

Initially, the Pagbank card or Casas Bahia card offer several advantages to users, such as a discount program for customers who use the cards and partnerships with other establishments.

So, if you’re looking for a card that offers all of this and more, these two financial products could be a good option. With that in mind, keep reading and check out all the information we’ve put together about them. Let’s go!

How to apply for Pagbank card

See how to request PagBank that gives you exclusive discounts and digital and streaming services, as well as exemption from minimum income and annuity.

How to apply for the Casas Bahia card

The Casas Bahia card gives you 10% off your first purchase, 3 insurances, and several other offers! Want to know how to apply for it? Check it out!

| Pagbank | Bahia Houses | |

| Minimum Income | not required | R$788.00 reais |

| Annuity | Exempt | R$167.88 reais for the holder R$68.88 reais for additional cards. |

| Flag | MasterCard | Visa or Mastercard |

| Roof | International | National |

| Benefits | Spending only from the balance available on the card Card top-up via bank slip, deposit or online debit Digital and streaming services | 10% off your first purchase 50% off at Cinemark |

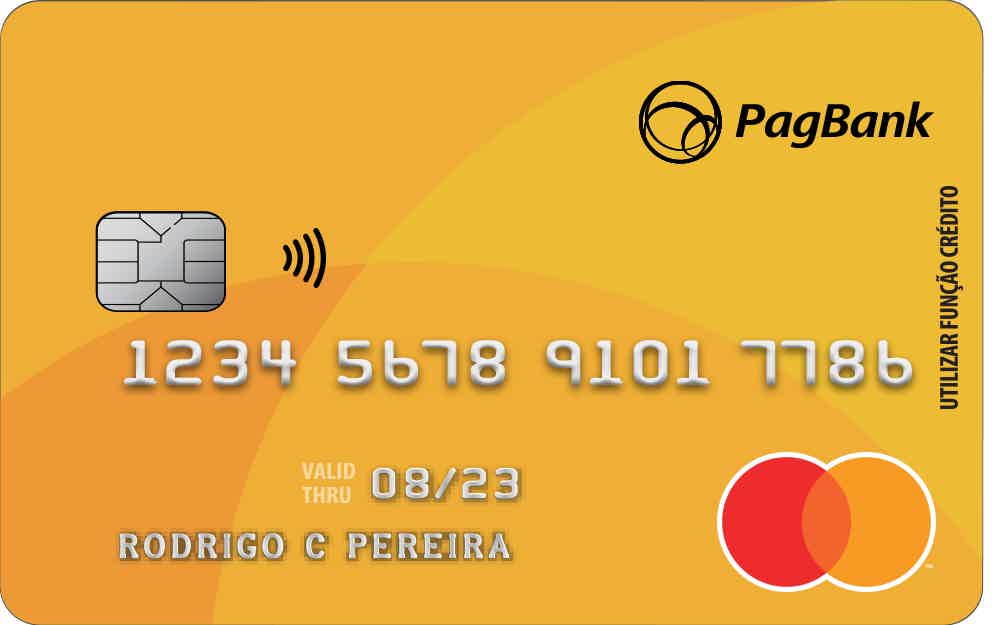

PagBank card

It is worth noting that the Pagbank card is an international financial product with no annual fee, and through it, you can have access to investments that yield much more than savings.

Furthermore, through the digital account created when you request the card, you can make withdrawals from Banco24Horas, as well as free and unlimited transfers via TED or PIX.

In addition, you can also top up your cell phone for free and receive 2% of the amount back, as well as access to online loans with rates up to 3 times lower than those of other banks. And, you can also make payments on your cell phone using the QR Code.

So, the PagBank card gives you access to several free or low-fee services. By the way, it is important to mention that this financial product is prepaid, so it is only possible to make purchases in the credit mode, that is, it works as if it were a debit card, as the amounts are immediately discounted from the balance of the digital account.

Casas Bahia Card

Well, the Casas Bahia card is a financial product that was created by the brand's network in partnership with Banco Bradesco with the aim of simplifying the lives of customers who enjoy shopping in these stores.

And, in addition, with the card you can buy electronics, household appliances, furniture and all products available in the store, as well as get discounts on various products.

Furthermore, the card can also have the brand of your choice, as you can choose between Mastercard and Visa, making it even easier when making purchases.

Finally, the card is very simple to apply for, but you must present proof of income and not have any restrictions with credit agencies.

What are the advantages of the PagBank card?

So, the PagBank card has several advantages for users, such as access to the PagBank account application that allows you to use several services, such as investment programs and unlimited payments via TED or PIX.

And, in addition, you can top up your cell phone for free and receive 2% back, as well as having international coverage that gives you access to several national and international stores without having to pay any annual fee.

Furthermore, through the app you can also pay bills, bank slips, pay via QR Code and have access to your bank statement and deposit via slip.

Therefore, the card is just one part of a large number of advantages that PagBank can provide you. To do this, simply install the application, create your account with the institution and request the financial product.

What are the advantages of the Casas Bahia card?

Well, the Casas Bahia credit card has several advantages, the first of which is the fact that you get a 10% discount on your first purchase with the card, that is, you already get a super advantage the first time you use the card.

And, in addition, it also guarantees payment in up to 24 installments on all purchases made through the program, as well as access to the Mastercard Surpreenda or Vai de Visa programs, depending on the card brand you choose. In fact, being able to choose the card brand is another advantage.

In addition, you also have up to 3 protection insurance models to choose from on your card, as well as access to the Casas Bahia app to make purchases.

Therefore, the Casas Bahia card can be a good alternative if you are already a regular customer of the chain, as most of the discounts are in the brand's stores.

What are the disadvantages of the PagBank card?

So, the PagBank card has some disadvantages, even though it is a great card. This is because, first of all, it does not have a virtual card.

Furthermore, withdrawals are not completely free, as when the number of withdrawals is reached, a fee of R$7.50 is charged per withdrawal.

Furthermore, you cannot pay for your purchases in installments, because the card works as a prepaid card, so you always need to have credit to use it.

Therefore, before opting for this card, check out all the disadvantages to see if it is the best alternative.

What are the disadvantages of the Casas Bahia card?

Well, the Casas Bahia card also has some disadvantages, such as the high annual fee, as well as the requirement to prove income.

So, for those with bad credit or unemployed, it is not a good alternative, as most of the discounts are only available at Casas Bahia themselves.

So, before opting for this card, see if the annual fee will be worth it to have access to additional benefits and services.

PagBank Card or Casas Bahia Card: which one to choose?

So, the PagBank card or Casas Bahia card, as you can see, bring several advantages to users, aiming to provide more practicality when making purchases, as well as having security and the credibility of the issuing bodies.

But if you still have doubts, check out another card comparison in the recommended content below.

Saraiva card or Pan card?

Whether the Saraiva card or the Pan card, both have annuity exemption and international flag. Check out more information about them here!

About the author / Joyce Viana

Reviewed by / Junior Aguiar

Senior Editor

Trending Topics

Discover free Udemy courses

Check out the top free Udemy courses and learn how this online teaching platform helps you develop new skills!

Keep Reading

Nubank Ultraviolet Card or Trigg Card: which is better?

Decide between the Nubank Ultravioleta card or the Trigg card, which offer cashback, international coverage and many other advantages. Check out!

Keep Reading

How to use virtual card

Do you want to do your online shopping with much more tranquility and security? So, click here and learn how to use the virtual card!

Keep ReadingYou may also like

Which credit card without SPC and Serasa consultation?

Did you know that even those who are negative can get a credit card without consulting SPC and Serasa? That's right! Check here the best options on the market for you to invest in your financial life and conquer your dreams!

Keep Reading

Discover the benefits of the Sicredi Black card

Do you love to travel? Then learn how to accumulate up to 2.2 points for every dollar spent on purchases and use them on airline tickets, as well as hotel rates.

Keep Reading

Need money? See how to get a personal loan in minutes!

Gone are the days when getting a loan was a time-consuming and bureaucratic task. Today there are numerous ways to apply for a line of credit without even having to leave your home. See more here!

Keep Reading