Cards

PagBank Card or Bradesco DIN Card: which one to choose?

Either the PagBak card or the Bradesco DIN card, both have prepaid models and have exclusive offers! Check out!

Advertisement

PagBank x Bradesco DIN: find out which one to choose

Initially, the Pagbank card or Bradesco DIN card are two prepaid card options offered by PagBank and Bradesco, which are those who prefer to resolve financial issues without having to go to a bank branch in person.

The fact is that both have attractive proposals for customers with more than one card option, as well as international coverage for shopping in Brazil and in other countries. In this regard, they are also good options for negatives, as PagBank, for example, does not do credit analysis.

So, let's show you some features of these cards so you can choose the best option!

How to apply for Pagbank card

If you liked the options and advantages of the Pagbank prepaid card, find out right now how to apply without bureaucracy.

How to apply for the Bradesco Din card

Are you convinced that the Bradesco Din card is the best for you? Then see how to apply in our online post or through other channels.

| Bradesco DIN | prepaid PagBank | |

| minimum income | not required | not required |

| Annuity | Exempt | Exempt |

| Flag | Visa | MasterCard |

| Roof | National and international | National and international |

| Benefits | Transfers to Bradesco Accounts and other financial institutions – via the Bradesco DIN App, website and Bradesco ATMs Withdrawals at Bradesco, Banco24Horas and Bradesco Expresso ATMs 50% discount on cinema ticket, small popcorn and 500ml soda or juice at Cinemark network throughout Brazil | Control in your hands: spend only the balance available on the card Top up using your account balance, bank slip, deposit or online debit Digital and streaming services Exclusive discounts and benefits |

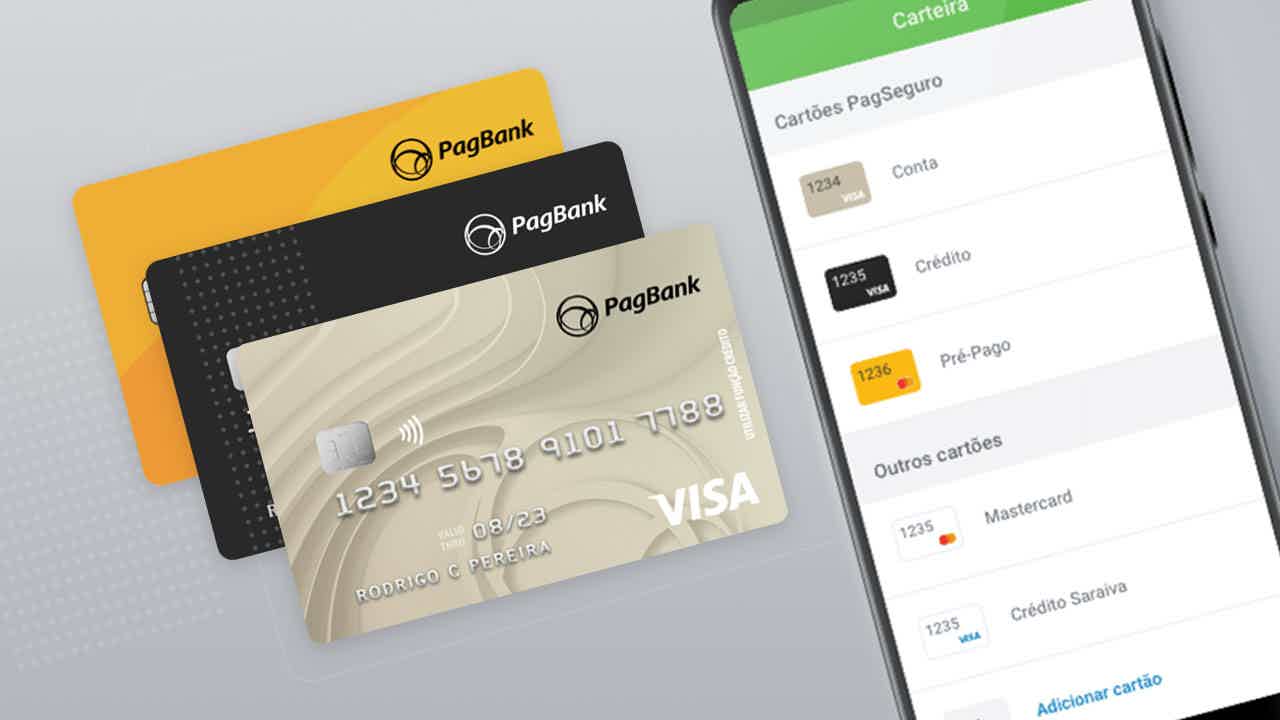

PagBank card

Initially, the PagBank card is a card issued by the Pagbank bank, which does not have an invoice and does not charge an annuity. That is, you do not need to pay a card maintenance fee.

And yet, to use it, you just have to opt for the cash payment in the credit card machine. The fact is that the amounts will be deducted from the balance in the PagBank account.

This means that the card works like a prepaid card, and it is necessary to have a balance in the account to be able to use it. And in addition, only customers who have a PagBank bank account can access the card, which is free and has international coverage.

This card also does not do credit analysis and does not require proof of income, being a great option for people with a dirty name. To access PagBank, simply create a free account in the PagBank application. After that, choose the “cards” option and ask for your Pagbank card!

There are three PagBank cards available: PagBank Prepaid Card, PagBank Credit Card and PagBank Account Card. In this, each one has a Visa or Mastercard brand, with exclusive offers and programs specific to each brand!

Anyone can access a PagBank card, as long as they are a PagBank account holder. And then, the request will also be limited to one PagBank account!

Bradesco DIN Card

Well then, the Bradesco DIN card is a card that works in prepaid mode and belongs to the Bradesco bank. In this, you can use it to perform various types of services such as transfers and bill payments, being safe and transparent!

This is because, as it is prepaid, the customer can only use the card if he has an available balance in the account, as well as with the PagBank card. And for that, you just need to top up your card with cash and then start making purchases in cash, being able to make transfers and even make cash withdrawals.

And another advantage of this card is that it is Visa and has international coverage, that is, you have access to all Visa offers and programs and you can even make purchases in Brazil and abroad.

The Bradesco DIN card also does not carry out a credit analysis, that is, it does not consult the name in the credit bureaus, being a great option for those with negative credit. Furthermore, it is not necessary to prove income or even have a current account at Bradesco or another bank.

What are the advantages of the PagBank card?

Initially, the PagBank card has some advantages that are similar in all 3 card models. They are: Purchases in Brazil and abroad in online or physical stores using the credit function. In addition, digital and streaming subscriptions, as well as withdrawals on the Banco 24 Horas, Saque e Pague, Rede Plus and Rede Cirrus networks.

It also allows payment by approach and it is not necessary to have a PagSeguro machine to request the card.

And in addition to these advantages, there are some that are unique to each card. For example, in the case of the PagBank prepaid card, it offers recharges via bank slip or online debit through the PagBank account. Plus, free shipping for PagBank customers with a Mastercard flag.

In turn, there is the Pagbank Credit Card, which offers services such as being able to pay purchases in installments using the credit function; use the balance of the PagBank account to pay the card bill and the balance is released instantly. And you can also withdraw the limit of the card!

The PagBank Account Card has advantages such as the Vai de Visa program with exclusive offers from the Visa brand. In addition, you can use the balance in your account without having to top up and there are no costs to request and receive the card.

What are the advantages of the Bradesco DIN card?

Well, Bradesco DIN has several advantages and exclusive offers. Check out:

- At first, Bradesco DIN does not have a credit analysis;

- And in addition, with the card you can shop online;

- Another advantage is that you have an app to send and receive money and still control all financial transactions;

- unlimited withdrawals

- There are 50% discounts on the Cinemark network and free ELO Wi-Fi connection for Bradesco DIN users.

Therefore, Bradesco DIN has an app where you can access all your card transactions and best of all, you don't need to have a Bradesco bank account to access the Bradesco DIN card! You can order the card right away!

What are the disadvantages of the PagBank card?

Well, a disadvantage of the PagBank card is the charge for withdrawing money from the Banco 24 Horas network, which costs R$7.50, as well as the transfer by TED, which costs R$1.99 per month. In this, the customer gets 5 free transfers monthly.

What are the disadvantages of the Bradesco DIN card?

Among the disadvantages of the Bradesco DIN card, the biggest one is the fact that it is a prepaid card. This is because you can only use the Bradesco DIN card if you have an available balance in your account, which may not be as advantageous for customers.

Therefore, the Bradesco DIN card may not be an option for people looking for quick credit and who want to make purchases in installments because it is prepaid!

PagBank Card or Bradesco DIN Card: which one to choose?

Well, the PagBank card or Bradesco DIN card are very interesting card options with several advantages such as international coverage, Mastercard and Visa offers, and they are also a great option for those with negative credit because they do not carry out a credit analysis.

Therefore, consult your financial situation and choose the best option for you. And if you still have doubts, check out a new card comparison below:

Saraiva Card or Pan Card?

Whether the Saraiva card or the Pan card, both have annuity exemption and international flag. Check out more information about them here!

About the author / Joyce Viana

Reviewed by / Junior Aguiar

Senior Editor

Trending Topics

How to apply for the Meu Vasco BMG card

There are several channels created so you can apply for the Meu Vasco BMG Card. See here and learn how to order yours today.

Keep Reading

Superdigital personal loan: what it is and how it works

Check out the Superdigital loan that has extended terms to avoid default and assistance to make your life easier.

Keep Reading

How to apply for the BRBCard Prepaid Card

BRBCard Pre-Paid Card can be an excellent choice for anyone who wants to control spending or is negative. Click and check how to apply!

Keep ReadingYou may also like

Get to know the Buscapé card with free annual fee

Find out how the Buscapé card works, which gives you up to 2% cash back, has no annual fee and always guarantees the best prices. Want to know more? So, check out the post below.

Keep Reading

How to pay a bank slip with a credit card?

Financial unforeseen events happen, and sometimes we need to resort to alternative means to pay an unexpected bill. Now, several institutions offer payment via credit card. But, is it worth requesting the service? Check out!

Keep Reading

La Redoute + credit card: what is it?

Do you want exclusive discounts on fashion, decoration and furniture from the La Redoute online store? So check out the advantages of this store's card here and have one for yourself.

Keep Reading