Cards

Online PagBank card: free and with a guaranteed limit

Do you want a complete credit card with a guaranteed limit of up to R$100,000? Then, get to know the PagBank online card and be amazed! To learn more about it, just continue reading with us!

Advertisement

Check out the main features and advantages of the PagBank card

A credit card is a great way to take care of your finances and also to get the help you need in times of unexpected purchases, hardships and emergencies. For this, the PagBank online card is a complete option, as in addition to having no annual fee, it has a guaranteed credit limit.

With Visa, international coverage and other exclusive benefits, you can enjoy the convenience of online payments and exclusive promotions and discounts for customers, in addition to a complete investment platform.

| Annuity | Exempt |

| minimum income | not informed |

| Flag | Visa |

| Roof | International |

| Benefits | No annual fee, guaranteed limit, exclusive discounts, Visa brand |

Did you like this option and want to know more about the advantages and how the card works? Then, come with us and check out the main information throughout the article! Let's go!

PagBank card online

The PagBank online card is that complete option that, when we need a credit limit more quickly, is the number one alternative.

With it, you guarantee a limit for use whenever you invest your money in CDB on the platform, in a simple and easy way.

Have you invested your money? It automatically becomes a limit, without the need for a credit check, and is therefore a viable option for those who have restrictions in their name. Awesome, right?

Furthermore, if you transfer your salary, you can have a credit limit of up to 100% of your salary. Of course, we cannot forget to mention that your order is 100% online and the management of the invoice and purchases is also, making your day-to-day easier.

It also has no annual fee, is safe, guaranteed by the FGC and yields twice as much as a savings account every day. Are you interested in this information? Then, continue reading with us and find out much more about the PagBank card!

How to apply for PagBank card

If you are interested and want to have a PagBank card to call your own, be sure to check out the complete application step-by-step guide here, check it out!

How does the PagBank account card work?

The PagBank online card works simply and without bureaucracy. There are two different options: the PagBank account card and the PagBank credit card.

The debit card can be used for purchases and payments worldwide, with your available balance.

Online payments can be made at any time of the day, with no fees and no small print: it's all safe and simple.

And also, when you request your card in the credit function and receive approval, just make your first investment in CDB on the PagBank platform and this amount will be converted to your limit immediately.

All this without credit analysis, and can reach the value of up to R$$100 thousand, which you can use as you wish.

Benefits

The PagBank online card has many benefits and stands out in the market for them, and it could be what you need to change your financial life.

Below, check out the main advantages of the PagBank card.

- Limit increase whenever you invest your money in CDB on the platform;

- Automatic limit adjustment, without the need for credit analysis;

- It is a viable option for those who have restrictions in their name;

- Your limit can reach up to R$100,000 if you make investments;

- It is possible to have a credit limit of up to 100% of your salary, if you make portability;

- Your order is 100% online and the invoice and purchase management too;

- No annuity;

- Secure card guaranteed by FGC;

- Free digital account that yields twice as much as savings every day;

- International coverage;

- Make online purchases in Brazil and abroad safely;

- Payment for transportation applications via the app;

- Subscription to movie, music, etc. apps;

- Approximation payment;

- Exclusive promotions and discounts for customers;

- etc.

Disadvantages

However, although the PagBank online card has several benefits, it also has some disadvantages that must be taken into consideration when requesting yours, such as those described below.

- The issuance of the card is subject to credit analysis (only the increase in the limit linked to investments is not);

- It is mandatory to have a PagBank digital account to request a credit card;

- The card application is online, so if you are not used to this method, it may not be the best option for you at the moment;

- The management of purchases, transactions and invoices is online, so if you are not used to it, this method may not be the option you need at the moment;

- Requesting the card depends on an invitation from the institution, but if you make investments or transfer your salary, this process is easier;

- etc.

What is the limit of the PagBank online card?

The limit of the PagBank online card can be up to 100% of your salary or up to R$100 thousand, if you have investments on the platform.

Remembering that anyone who invests their money in PagBank's CDB already guarantees their credit limit and the opportunity to request their free card, with no annual fee.

How do I increase my PagBank card limit?

There are several ways to increase your PagBank card limit online, and one of them is to frequently use the digital account services (to apply for the credit card, you must be a current account holder).

The account has several useful features, such as top-ups, withdrawals, loans, online payments at any time of the day, etc. Therefore, the more you use these services, the greater the chances of increasing your limit.

Another way to ensure your limit increases is to transfer your salary to your PagBank account or, as you already know, invest in the bank's CDB and ensure your limit increases in proportion to the amount invested.

How to get a credit card from PagBank?

Requesting your credit card is super simple and easy. Just open the PagBank app and log in with your credentials.

After that, wait for the invitation from the institution. To make the process easier, simply transfer your salary or invest in a CDB.

After that, click on the cards tab on the left side of the screen and select the “credit card” option. Then, request the “request card” option and, immediately after, click on finish and, finally, on “request card” again.

Finally, just wait for the institution's response with the approval of the credit card.

So, what do you think of the PagBank credit card? It offers several benefits in just one place, right?

We hope that our content has helped you with the main questions about the card and that you will soon be enjoying all of its benefits.

If you would like to know more details about the application process, simply click on the recommended content below.

Until later!

How to apply for PagBank card

If you are interested and want to have a PagBank card to call your own, be sure to check out the complete application step-by-step guide here, check it out!

About the author / Maria Luisa Barbosa

Reviewed by / Junior Aguiar

Senior Editor

Trending Topics

7 best digital wallets 2022

Want to know which are the best digital wallets? In today's article, we'll show you the 7 best on the market. Check out!

Keep Reading

How to get out of over-indebtedness?

In Brazil, the number of over-indebted Brazilians grows more each year, but do you know how to get out of over-indebtedness?

Keep Reading

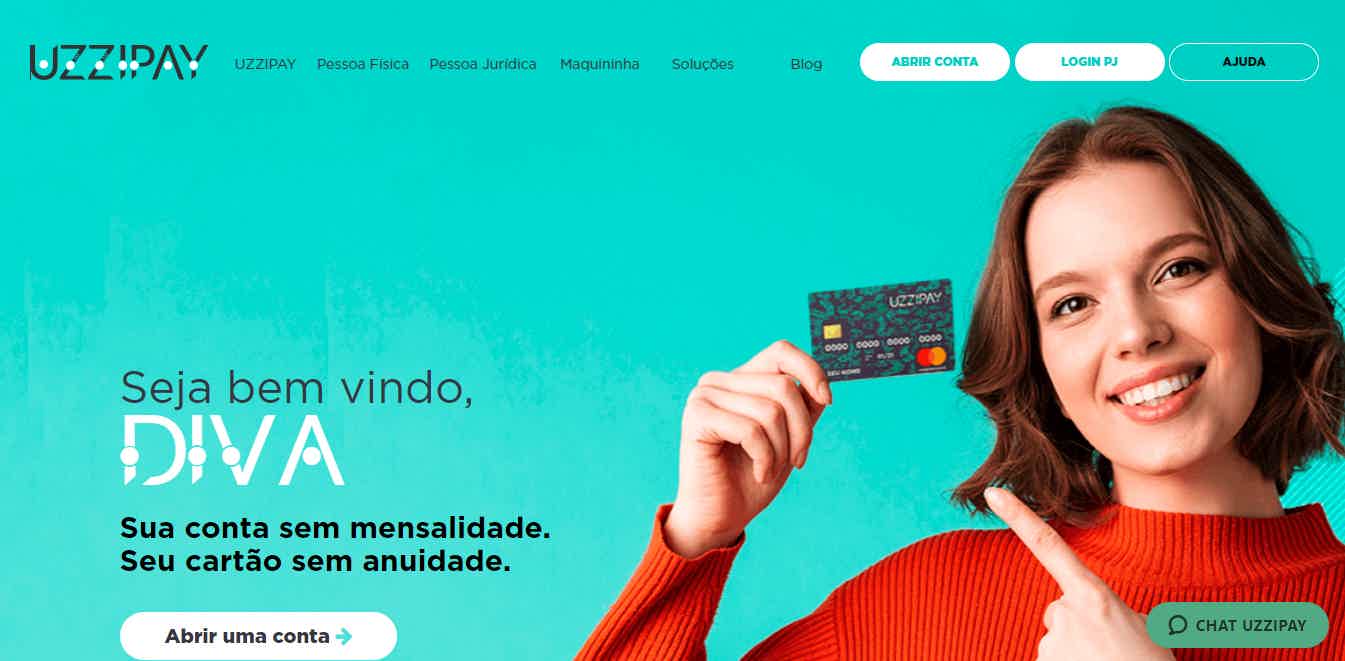

Discover the UZZIPAY digital account

Find out how the UZZIPAY digital account works and how it can help save the Amazon when you open it.

Keep ReadingYou may also like

Did you know that you can use Emergency Aid via CAIXA Tem to pay for your purchases?

Although the Federal Government has suspended the payment of the Emergency Aid benefit, some retroactive quotas are still being paid. In addition, the CAIXA Tem app is evolving more and more and now beneficiaries can use it to pay for purchases in physical stores and online.

Keep Reading

Nubank or Inter account: which is the best digital account?

Choosing a good digital account to take care of and manage our finances can be a difficult task, as we currently have so many options. However, two alternatives that bring many benefits to customers and are zero annuity and abusive fees are the Nubank or Inter account. Do you want to know more about the two accounts and a comparison of their main features? Continue with us throughout the post!

Keep Reading

5 sites to sell miles

There are several options for sites to sell miles and we tell you which are the 5 that are among the main ones here in this post. Check out!

Keep Reading