Cards

Neon Card or Agibank Card: which one to choose?

Be it the Neon card or the Agibank card, both seek to offer quality services! Check out more about them here!

Advertisement

Neon x Agibank: find out which one to choose

At first, the Neon card or the Agibank card are two card options that are very similar to each other, for example, both have credit and debit functions and international coverage. That is, you can choose which function to use and even shop at national and international stores.

So, both present attractive proposals for customers, as well as having a digital account so that you can monitor and control all your card's financial transactions. So, pay attention to the pros and cons, so that you make a good choice!

How to apply for the Agibank Mastercard card

Find out how to apply for the Agibank bank credit card, the digital inclusion card.

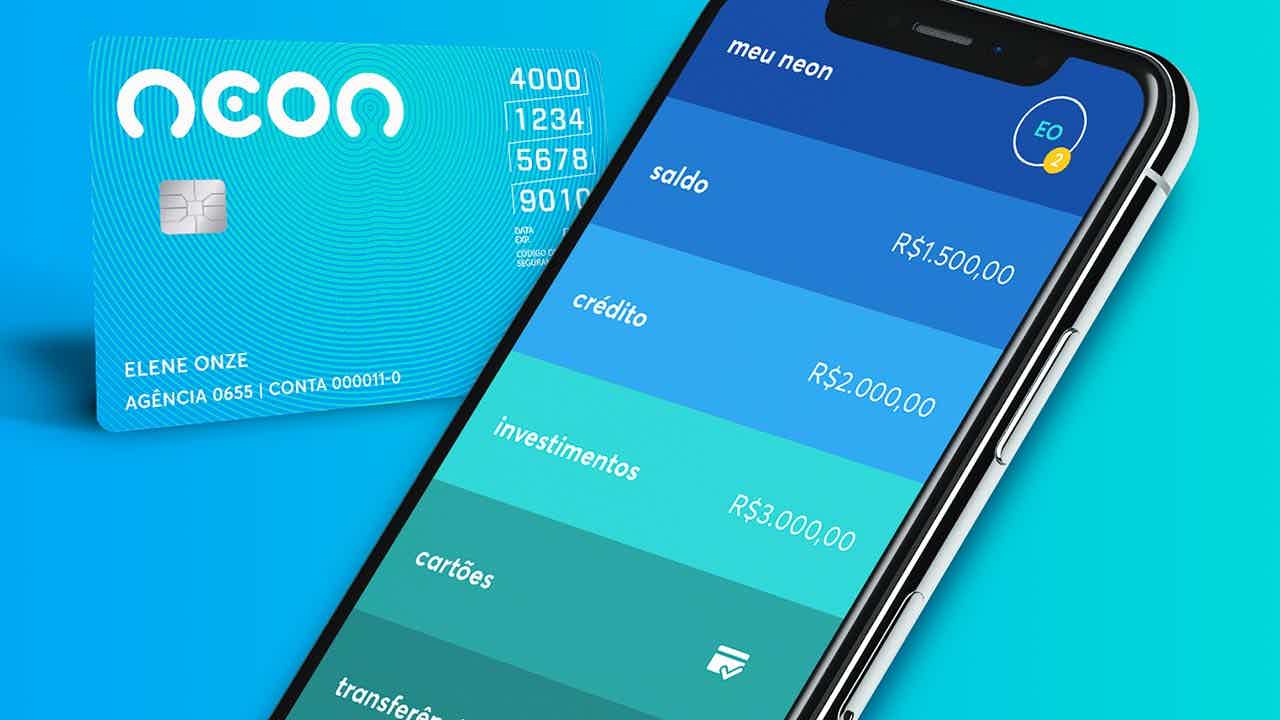

neon card

Well, the Neon card is a credit card model that does not charge an annuity, that is, you do not need to pay fees to keep using the card and you can also make purchases in national and international stores because it has coverage International.

Another function of Neon is that it has a free digital account that gives access to all card services such as payment of bills and financial transfers. Simply open an account at Neon and request the physical and digital versions of the card.

To apply for the Neon card is not a difficult task. It is enough for the customer to be over 18 years of age, with their RG and CPF in order, and to make the request through the Neon bank app. After making the request, the bank will start the credit analysis.

Therefore, the Neon card is a credit card model that has several advantages and services that aim to provide security and maintain transparency for customers. All this, combined with the technology that only Neon provides to users!

Agibank card

Initially, the Agibank credit card is a card that belongs to the Agibank bank. In this regard, it was created at the request of customers to bring a more versatile card with new proposals, for example, the card works in debit and credit versions and can be used for national and international purchases.

In addition, it has the proposal of exclusivity, that is, it can only be used by people who have an account at Agibank. So, before applying for the card, you need to open a bank account. There are several benefits such as annuity exemption in the first year of use.

To apply for the Agibank card is simple, just download the Agibank app, open the digital account and fill in all your personal data. After that, just apply for the Agibank card! Therefore, it works in a fast and intuitive way!

What are the advantages of the Neon card?

Well, the Neon card does not charge an annuity, that is, you do not pay to maintain the card's services. And yet, it has an app full of functions!

And in addition, the Neon card has a Visa flag with international coverage and all the advantages of the Vai de Visa program that only Visa provides, as well as discounts with partner stores!

There is also the option to pay bills via automatic debit and requesting and closing the account in the Neon bank application are completely free. And yet, the customer is entitled to a free mental withdrawal and several other benefits!

What are the advantages of the Agibank card?

Well then, let's get to know the advantages of the Agibank card. Initially, the digital account is one of the biggest advantages, as it has several functions such as bill payment and various investment methods.

Another advantage is that the Agibank app allows you to make purchases with QR Corde, to bring more security and practicality to customers, as well as being able to receive salary through your current account and make withdrawals at the 24-hour Bank.

Therefore, the Agibank card relies on the help of technology and the Visa flag to provide customers with an advantageous and attractive service program!

What are the disadvantages of the Neon card?

At first, one of the biggest disadvantages of the Neon card is the fees charged by the bank, which are usually high as fees for transfers and account installments. And yet, the approval of the Neon card tends to take a long time!

Therefore, compare the options available on the card market with digital accounts to find out if this card is a good option for you, as credit analysis, as well as the fees charged, can become a long-term problem!

What are the disadvantages of the Agibank card?

Well, the annual fee of the Agibank credit card is one of the disadvantages of this card.

This is because, despite the exemption for the first year, after this period, it is high and other bank services are also charged for amounts above conventional banks!

Furthermore, for investors, it is also not a good card option due to its high CDBS values. Therefore, make a comparison before choosing Agibank!

Neon Card or Agibank Card: which one to choose?

Well, the Neon card or the Agibank card are card options with very similar conditions, for example, both have credit and debit functions. The fact is that the flags differ and the fees charged as well as the annuity.

Therefore, make a financial analysis of the cards available on the market and see which of these card options is best for you! And if you still have doubts, check out a new card comparison below that we bring in recommended content:

Santander SX card or Original card

The Santander SX card or Original card are credit card options for those looking for security and quality services. Check out!

About the author / Joyce Viana

Reviewed by / Junior Aguiar

Senior Editor

Trending Topics

How does the Gshow Who Wants to Be a Millionaire program work?

Ever heard of Gshow Who Wants to Be a Millionaire? This framework works from questions and answers. See more in this article!

Keep Reading

Will Bank card with international coverage

If you want to simplify your financial life, discover the Will Bank card with international coverage. Read this post and learn more!

Keep Reading

Discover the Pan Mastercard Zero Annuity credit card

Learn all about the Pan Mastercard Zero Annuity credit card. It is international, has a free annual fee, Club Deals and a personalized app.

Keep ReadingYou may also like

Find out about the Disability Retirement Benefit

Disability retirement is granted to people who have an illness or have suffered an accident that prevents them from working. Want to know more? Continue reading and check it out.

Keep Reading

Where to take an Ead technical course?

Do you want to acquire technical knowledge without leaving home? It is possible! Continue reading and check out Ead technical course options.

Keep Reading

How to apply for the Caixa Gold card

The Caixa Gold card offers great benefits to customers, such as insurance and free assistance, as well as payment by approximation. Want to know how to order it? So, read the post and know the process.

Keep Reading