Cards

Will Bank card with international coverage

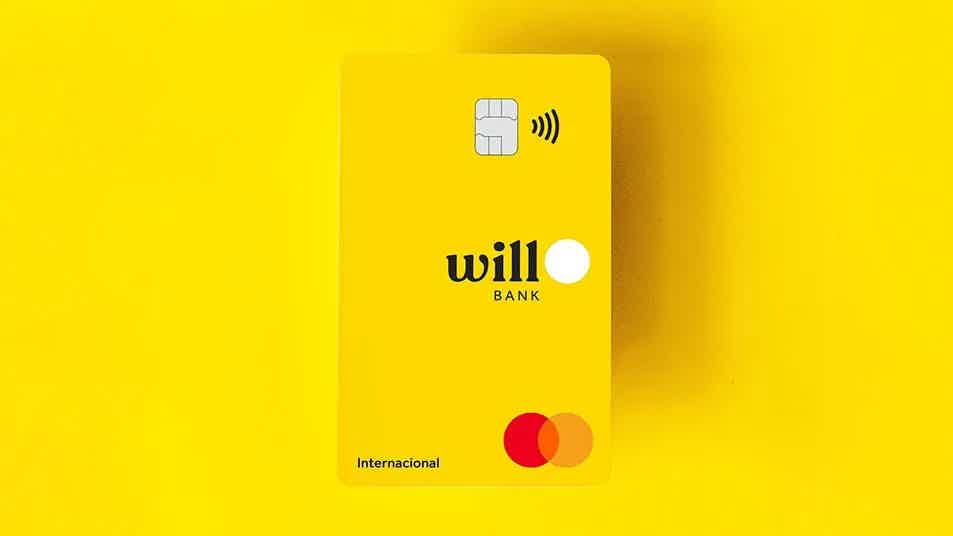

Want a paperless card? Discover in this article the Will Bank card with international coverage. It has no annuity and comes with the proposal to make your financial life easier. Discover all the details in our article. Check out!

Advertisement

Discover the Will Bank card with no annual fee

The Will Bank card with international coverage is a new card that offers digital account and credit services. Because it is new, many people wonder if the card is reliable. And yes! Rest assured, it is authorized by the Central Bank.

Therefore, Will Bank is a card with no annual fee, with the Mastercard brand and international coverage. That is, you can use it anywhere in the world. Continue reading and see all the details of the Will Bank card!

| Annuity | Exempt |

| minimum income | not informed |

| Flag | MasterCard |

| Roof | International |

| Benefits | Manage expenses through the application; Mastercard Surprise; |

Will Bank card: full review

First of all, it is important to say that the Will Bank card is a new card. Therefore, part of its construction is still being done. That is, the application is in Beta format.

In this way, your customers are part of this construction. On the one hand, this is very good. This way, your customers can participate in processes that are still under development. For example, giving your opinion on what is missing from the application, etc.

In addition, the Will Bank card has international coverage and the Mastercard brand. That is, it is accepted in several establishments around the world. In this article, you will find out all the Will Bank card details. Check out!

What is the Will Bank credit card limit?

First, speaking of the Will Bank credit card limit, the bank is still approving new customers. Therefore, you may apply for your account but still not be approved.

In this sense, Will Bank recommends that you use your digital account frequently. In this way, the bank can better understand your financial habits. Thus, it can give you a limit compatible with your income.

Advantages of the card

Although it is a new card, Will Bank has several advantages. First, we can mention the free annuity. That is, you do not pay any fees to have your Will Bank card with international coverage.

By the way, this is another advantage: the Will Bank card has international coverage and the Mastercard brand. This way it is accepted in several establishments around the world.

In addition, the Will Bank card has contactless technology. That is, you make your purchases in a much more practical and simple way. Together, the card offers a free digital account that can be monitored by the app.

Therefore, all the management of your expenses can be controlled by one place. That way, it gets much easier to take care of your financial life.

Disadvantages of the card

When we talk about disadvantage, there is only one clearer one. Unfortunately, the Will Bank card with international coverage does not have any benefit program. Therefore, if you are looking for a card with a score or cashback, you may need to look for another option.

Will Bank card statement: how to consult

Like everything on the Will Bank card, the invoice can be consulted online. That is, just access your application to see all your expenses for that month. Therefore, all control can be done in an easy and simple way.

Will Bank card phone: Call Center number

In short, the Will Bank card is a mostly digital card. As a result, the bank does not yet have a call center available by telephone. However, Will Bank guarantees that its service is very fast through the available channels.

That way, if you need to ask any questions or solve a problem, you can contact us through the website or the app.

Make a Will Bank card: how to make a card online?

At first, the only way to apply for the Will Bank card is online. Therefore, it will be necessary to follow the step by step:

- Enter the Will Bank website;

- Go to “Join”;

- Fill in basic information such as name, CPF and email;

- Request your account and card.

This way, your request will already be received by the bank. After this step, just wait for Will Bank's analysis. Therefore, they will understand your habits and financial history. That is, after approval, you can start using your digital account and card.

How to apply for the Will Bank Basic card

See the details of the Will Bank card with international coverage and no annual fee!

Will Bank card: how to be approved?

Basically, as we already mentioned, the Will Bank card is still in the process of being created. In this sense, it is common for not many people to be approved for a credit card, for example.

However, Will Bank recommends that, if you have a digital account, keep it active. This is because, in this way, the bank can get to know you better. That is, understand what your financial profile is.

As we often say, having a good relationship with the bank is fundamental. This lets him know you are trustworthy and offers you more benefits and services.

Mastercard Surprise

In short, Mastercard Surpreenda is a scoring program available to those who have a Mastercard branded card. The Will Bank card has international coverage and the Mastercard brand. That is, it gives you access to various benefits.

By the way, being part of Mastercard Surpreenda is a great advantage. Because Will Bank does not give any access to advantage, points or cashback clubs. That is, if this is a priority for you, you will not be completely helpless.

Superdigital Card: another credit card option with international coverage for you

Finally, you know a little more about the Will Bank card with international coverage. Therefore, the card is a good option for those who are starting out in financial life and are looking for an account without bureaucracy. However, if you are not approved there, we will give you another similar option.

In this sense, with the Superdigital card you can have a credit card even with a negative name. This is because the bank does not consult the SPC or Serasa. So the choice between the two is a personal one. That's because the services offered are very similar, and it really depends on your financial reality at the moment.

| Superdigital Card | Will Bank Card | |

| Annuity | Exempt | Exempt |

| minimum income | not required | not informed |

| Flag | MasterCard | MasterCard |

| Roof | International | International |

| Benefits | Mastercard Surprise | Mastercard Surprise |

How to apply for the Superdigital card

See how to apply for the Superdigital card with international coverage and no annual fee!

About the author / Leticia Maia

Reviewed by / Junior Aguiar

Senior Editor

Trending Topics

Discover the best prepaid Mastercard cards 2021

Get to know the best Mastercard prepaid cards and enjoy all the advantages that the brand can bring you, such as Mastercard Surpreenda.

Keep Reading

Unicred Black Card or Sicredi Black Card: which is better?

Don't be in doubt between the Unicred Black card or the Sicredi Black card, check out our content and see which one suits your financial profile!

Keep Reading

Hidden Devices Detector: discover the app to detect hidden microphones

Can't find out if you have a bug at home? Don't worry, keep reading and find out with Hidden Devices Detector.

Keep ReadingYou may also like

Get to know the Ibicard Fácil credit card

Learn more about the Ibicard card with an annual fee of just R$36 reais, national coverage and Mastercard brand benefits.

Keep Reading

Get to know Millennium BCP Personal Credit

Have you ever thought about hiring up to €15,000 to go on a trip or fill your house and do everything online? If so, get to know the Millennium BCP Personal Credit that makes it possible for your goals to come true. Check out!

Keep Reading

N26 Metal Debit Card: What is N26 Metal?

Get to know the N26 Metal account and card and see what are the exclusive advantages for those who like to travel and enjoy life without complications.

Keep Reading