Financial education

Stolen credit card and improper purchase: what to do

See our content and find out what to do if you have your credit card stolen. As well as learn to protect yourself from inappropriate purchases. Check out!

Advertisement

Check here how to resolve the main problems with your credit card

Without a doubt, you know someone who has been through the terrible situation of having their credit card stolen, right? But what to do when this happens? And how not to be harmed by this situation?

Well, today we have special content to help you with the entire process that must be carried out in the event of theft or improper purchase using your card. As well as tips to prevent other people from having access to your data. Want to know more? So, continue reading below!

What to do in the case of a stolen credit card?

First of all, credit card theft has become a huge problem these days. This is because plastic provides great purchasing power and can be used both in physical establishments and for online purchases without many complications.

Well, if you've had your credit card stolen, there are some steps you need to follow and now we're going to talk about what they are.

First, you need to report the theft immediately to the financial institution responsible for issuing your credit card and request it to be blocked or canceled. An important tip is to ask the attendant to provide the protocol number and send the recording of the conversation to your personal email. This way, if due to some internal error the administrator does not proceed with the cancellation, you can prove that you made the request.

Once the card issuing bank is aware of the theft, the next step is to file a police report with the Military Police. So, you can do this in person at the police station closest to your home or online via the PM website.

How to get the first credit card?

Do you know how to get the first credit card? Because we will give you all the tips and other useful information about it!

How to cancel a purchase on a stolen credit card?

So, what should you do if you didn't identify the theft quickly enough and had one or more purchases approved before blocking the card? Well, this can be a big problem if you don't know your consumer rights very well.

First of all, you must contact the card operator and inform them which purchases were made incorrectly. So, request the plastic blockage to prevent this from happening again.

Therefore, the administrator responsible for your card carries out an investigation into what happened, and upon proving fraud, refunds the amount spent to you. It is important to note that, by law, the operator must refund the amount even if you have already paid the invoice.

What to do in the case of an improper purchase?

First of all, you must contact the card operator and inform the attendant that you do not recognize the purchase made. It is the administrator's full responsibility to protect your data and they cannot charge you for a purchase you did not make.

Improper purchases due to card cloning are caused by the bank's security flaws and the bank must be responsible for any damage caused to you. Therefore, demand the cancellation or refund of the purchase.

The administrator has the technological means to identify when and where your card was used, and it is also their responsibility to report the incident to the police.

How to protect your card from inappropriate purchases?

Well, there are some methods you can follow to avoid headaches with inappropriate purchases made on your credit card. This way, you can make your purchases more safely and without worrying about possible fraud.

Firstly, avoid writing down your passwords on a piece of paper or in your cell phone's notepad. Other people may have access to this information and use your card without your consent.

It is also very important not to pass on your card information or photos to third parties via instant messaging applications. Everything related to your card is your responsibility, and if this information falls into the wrong hands, you will be the one who will pay for it.

Furthermore, many administrators offer an SMS service that notifies the customer of each purchase made. It is a paid service, but very useful for controlling your card spending and preventing misuse.

Furthermore, when shopping online, avoid accessing unknown websites and find out the reputation of the store you are purchasing from. So, give preference to using virtual cards that you can generate through your bank's application. They are disposable and can be used for a single purchase, offering you more security.

So, did you like our article on what to do when your credit card is stolen? So, don't waste time and check out the recommended content for more card tips!

How to use your credit card without going into debt

Have you become a credit card hostage and no longer know what to do to avoid getting into debt? So, read this post, we will help you use it!

About the author / Aline Barbosa

Reviewed by / Junior Aguiar

Senior Editor

Trending Topics

Discover the Spotify Credit Card

The Spotify credit card was created for users who use the platform and consume the premium service offered! Learn more here!

Keep Reading

How to apply for a loan with a car guarantee Banco do Brasil

Find out here in this post how the online request for a Banco do Brasil car loan works.

Keep Reading

Online loan Banco Paraná: what is Banco Paraná?

Do you already know the payroll loan Banco Paraná? So keep reading because we are going to tell you all about this loan! Check out!

Keep ReadingYou may also like

What is the best Caixa credit card?

Are you in doubt about which is the best Caixa credit card? Read the post and learn about the main features of some cards, before ordering yours!

Keep Reading

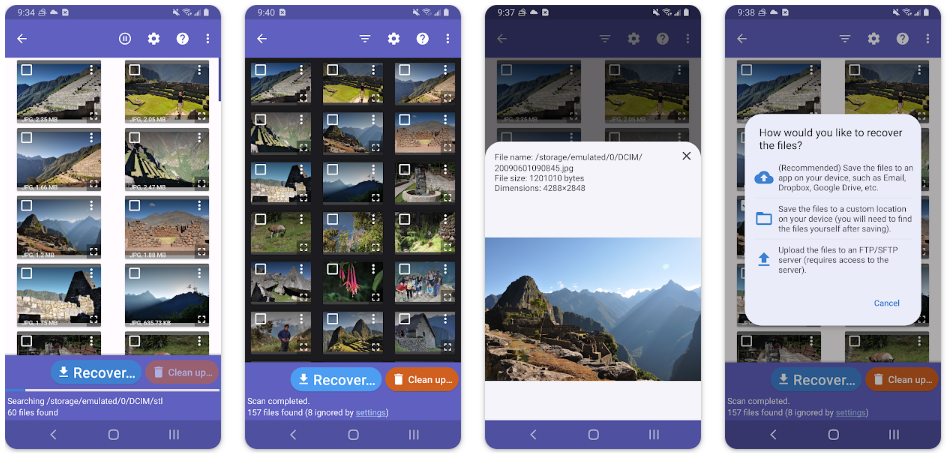

Diskdigger: how to recover deleted photos from your cell phone with the application

DiskDigger is the ultimate solution to recover lost photos and images on your device. Learn how to download the app and never lose an important photo again! At the end of the article, we direct you to the download page.

Keep Reading

Is PicPay credit card good?

In today's post we will talk about the PicPay credit card. The card is free of fees, has a higher yield than savings and also offers cashback. Continue reading and find out if the PicPay card is any good.

Keep Reading