Cards

Afinz Card or Santander SX Card: which is better?

There are several similarities between the Afinz card and the Santander SX card, such as international coverage, discounts with partners and different conditions for customers. But, do you know what the differences are? So, read this post and check it out!

Advertisement

Afinz x Santander SX: find out which one to choose

Firstly, the Afinz card or the Santander SX card are two credit card options that offer discount programs derived from the international Visa flag, as well as an application to control spending that provides more security and autonomy.

So, stay tuned in this article, as we will show you the advantages and disadvantages of these cards, so that you can compare them and make the best decision. Check out!

How to apply for the Afinz card

Do you want to learn how to apply for the Afinz card that has the Você Bem Program and an application with discounts? So check it out!

How to apply for the Santander SX card

The Santander SX card offers discounts at Esfera partners and the possibility of waiving the annuity. Learn how to request it by following the post step by step.

| Afinz Card | Santander S CardX | |

| Minimum Income | not informed | R$ 500.00 for account holders R$ 1,045.00 for non-account holders |

| Annuity | R$ 227.88 | R$ 399.00 Exempt if you join the PIX system Free with a minimum spend of R$ 100.00 |

| Flag | Visa | Mastercard or Visa |

| Roof | International | International |

| Benefits | Up to 40 days to pay; Additional cards with 50% discount on the annuity; Exclusive installments; You Well Program. | Discounts at Esfera partner stores; Possibility of exemption from the annuity; Two flag options; Banner benefits. |

Afinz Card

Then, the financial services platform Afinz launched a new credit card in partnership with the Visa flag to replace the old Sorocred card. With this change, the financial product gained other differentials, such as the Você Bem Program.

Furthermore, with this program you don't have to worry about paying for an expensive medical plan, as it guarantees discounts on medical exams and consultations, as well as on dental procedures. But, if your case is medication, rest assured, as it also offers discounts on these products.

On the other hand, if you need a boost in your studies, Afinz also offers the Você Bem Educação Program, which gives you discounts on free courses and up to 80% off the Instituto iNove, which is an online platform for online education courses. distance (EAD).

The Afinz card has an international Visa Gold flag, so you can use it in Brazil and abroad. In addition, you can access benefits such as purchase and price protection, as well as travel and vehicle insurance.

So, the Afinz card, as we can see, is a product unlike anything you've ever seen and it brings several other advantages. So, continue reading to learn more about the features of this credit card.

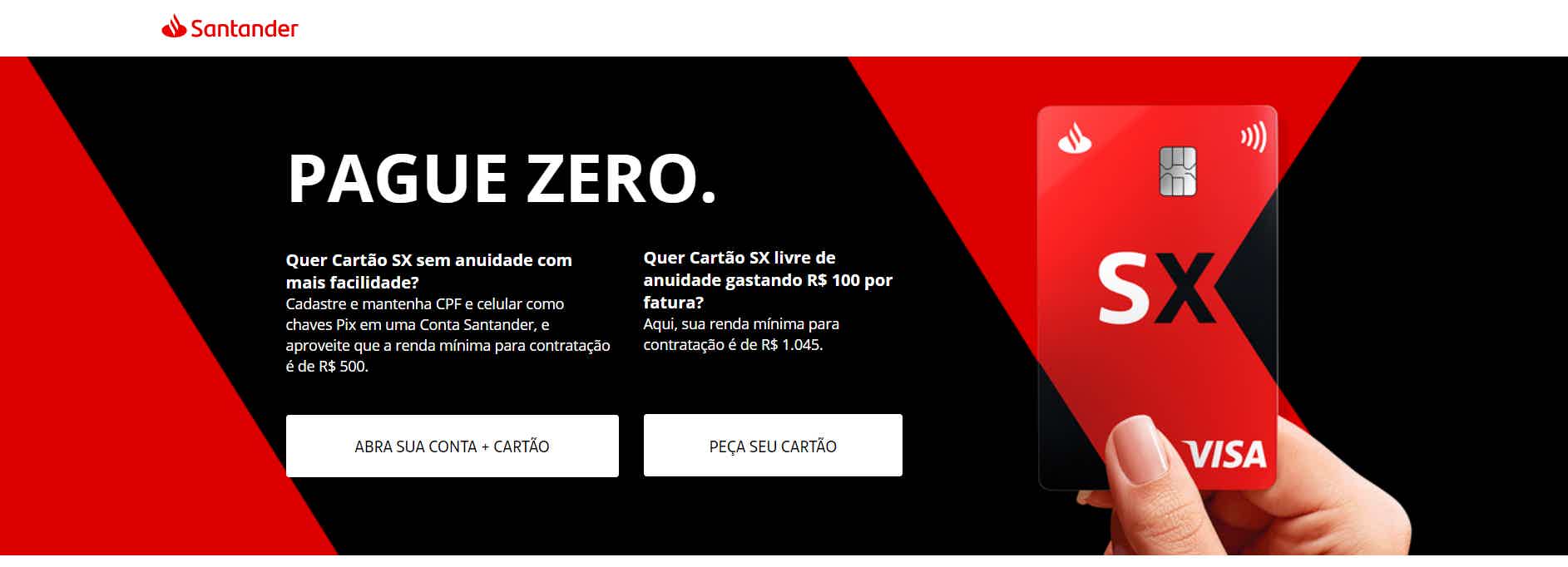

Santander SX Card

Firstly, the Santander SX card is a financial product created by Banco Santander in partnership with the Visa brand to replace the former Santander Free that no longer served Santander customers in the best possible way.

Therefore, the Santander SX card can be issued both under Visa and Mastercard. So, you choose the one that best meets your needs, for example, Visa brings the Vai de Visa program that gives you discounts in hotels and restaurants. On the other hand, Mastercard brings the Mastercard Surprise program, in which you can accumulate points and exchange them for products or services.

And, in addition, applying for this card is very simple, as all you have to do is go to a Santander branch or apply through the institution's website.

In addition, the card requires a minimum income of R$ 500.00 for account holders and R$ 1,045.00 for non-account holders, that is, in the credit analysis this data will be verified, so we recommend that before choosing the card, you open your account at Santander.

And yet, it also charges an annuity in the amount of R$ 399.00 or 12x R$33.25, however, you can reset this amount if you join the Pix system at Santander or spend at least R$100.00 on the monthly bill, considered a very attractive proposition.

Thus, you can also request up to 5 additional cards and have access to exclusive conditions for customers.

What are the advantages of the Afinz card?

So, the Afinz card has very attractive conditions for customers. Initially, it is a card with national and international coverage, that is, you don't have to limit your purchases only to Brazilian stores, but you can also do them in international stores.

And, in addition, it has a period of up to 40 days to pay for your purchases, as well as exclusive installments. And if you need an additional card, Afinz releases it for you with a 50% discount on the annuity.

In addition, you also guarantee access to the Você Bem Program, which gives you discounts on exams, medical and dental appointments. And if everything is fine with your health, you can get discounts on online courses.

Among other advantages, Afinz gives you all the support you need in a credit card, that is, you can control everything that happens with your card through the Afinz application and, who knows, you can even start making your investments at the institution.

What are the advantages of the Santander SX card?

First, the Santander SX card is an international financial product. In addition, wherever you are you can take advantage of the special conditions of the Visa or Mastercard Gold flag, including the Vai de Visa program that gives you discounts in hotels and restaurants or the Mastercard Surpreenda program in which you exchange points for amazing products.

That's because, you can choose which flag you want for your card, remembering that both are accepted in more than 200 countries.

And, in addition, you can request up to 5 additional cards in addition to yours, that is, you can distribute Santander SX cards to all family members. And yet, everyone will also have access to up to 50% discount with Esfera partners.

In addition, the Santander SX card charges an annuity fee, however, you can zero this fee. To do this, just spend monthly invoices above R$100.00 or register the Pix key in your Santander account, so you won't have to worry about the annuity.

What are the disadvantages of the Afinz card?

Among the disadvantages of the Afinz card are the credit analysis, as well as the annuity charge. This means that if you are looking for a free card or one that does not charge an annual fee and is more affordable, Afinz is not the best alternative.

What are the disadvantages of the Santander SX card?

It is undeniable that having a credit card with no annual fee is a very attractive condition, but unfortunately the Santander SX card charges an annual fee. However, there is the possibility of exemption from this tariff and the conditions for this are easy to achieve.

And, in addition, even before approving the card for the customer, Santander carries out a credit analysis at protection agencies, such as the SPC and Serasa, to check possible restrictions on the customer's CPF and, thus, decide whether or not to approve the card. credit card.

Afinz Card or Santander SX Card: which one to choose?

So, the Afinz card or the Santander SX card are two options with several advantages, such as international coverage, discounts with partners and benefits associated with the brands.

This means that, in order for you to choose the best card alternative, you must make a thorough comparison of the characteristics between both. However, keep in mind that these cards are not suitable for people with no name restrictions, as they are from institutions that carry out credit analysis.

So, see which of these cards best meets your expectations. On the other hand, if you are still in doubt which is the best credit card for you, do not despair, because below we have another comparison between cards. So click on the recommended content below and check it out!

Santander SX card or Pan card: which one to choose?

The Santander SX card or Pan Card are credit card options for those looking for practicality, security and autonomy in using their credit card! Check it out!

About the author / Joyce Viana

Reviewed by / Junior Aguiar

Senior Editor

Trending Topics

F1 TV: how to watch Formula 1 on official streaming

Discover F1 TV, the streaming service dedicated to Formula 1 fans. Learn how to subscribe, download the app and make the most of it.

Keep Reading

How to send resume to Riachuelo? check here

Learn in this article how to send your resume to Riachuelo and thus access several open positions in this large chain of stores!

Keep Reading

Discover the Saraiva credit card

Understand how the Saraiva credit card works, an excellent card option with no annual fee and two benefit programs. Check out!

Keep ReadingYou may also like

How to open a Montepio Base account

In Montepio's Base current account, you can transfer money, make withdrawals, register direct debits and move your balance using a debit card. Did you like it? Then check below how to open your account with fixed commissions.

Keep Reading

How to open account at Necton brokerage

Learn step-by-step to open an account at Necton brokerage. After that, invest with advice, have discounts on fees and more. Learn more in the post below.

Keep Reading

How to apply for PayPal card

Find out how to apply for a PayPal card, with no annual fee and no minimum income requirement.

Keep Reading