Cards

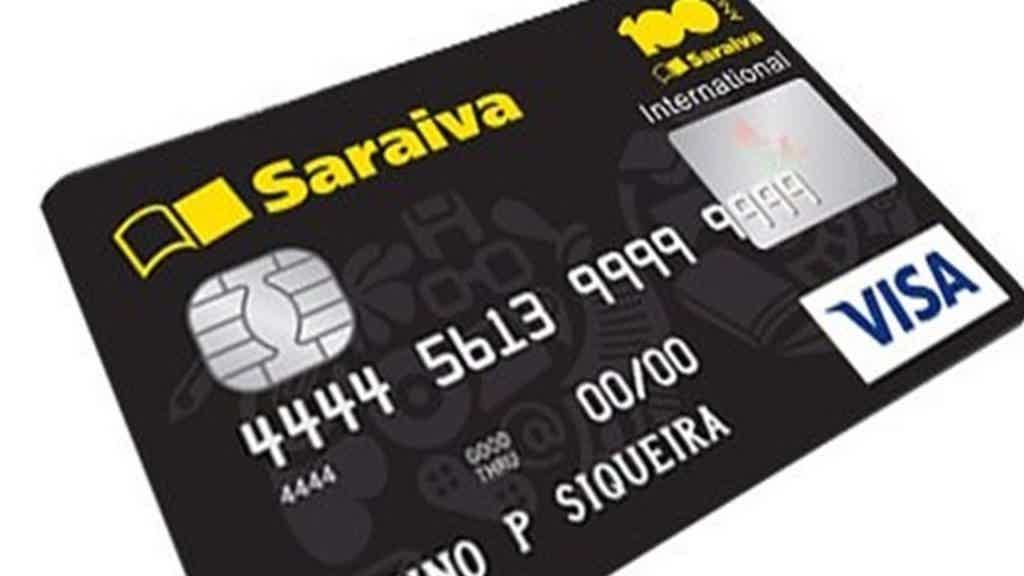

Discover the Saraiva credit card

The Saraiva credit card has no annual fee and is an international Visa. In addition, it can be applied for online with no minimum income requirement. Follow the details!

Advertisement

Saraiva credit card, with no annual fee and no minimum income requirement

O Saraiva credit card is offered by Livraria Saraiva in partnership with Banco do Brasil. It is completely free and can be requested without needing proof of income. If you want to know more about the benefits of the Saraiva card and how to apply for one, follow the text below and we will explain the details.

| Annuity | Exempt |

| Flag | Visa |

| minimum income | not required |

| Roof | International |

| Benefits | Saraiva Plus, Latam Air Miles Plus |

How to apply for the Saraiva card step by step?

Find out now everything you need to know to apply for a Saraiva credit card. Follow the step-by-step process to apply for your card.

Discover the Saraiva card

The Saraiva credit card is offered in partnership with Banco do Brasil. Therefore, to carry out all the monitoring of the card, it is necessary to download the Ourocard bank application, available for IOS and Android.

In addition, it has a Visa flag and international coverage. It is worth remembering that due to the partnership with Banco do Brasil, it will define the credit card limit, but after six months it is possible to request a limit increase.

Benefits

One of the main advantages of the Saraiva credit card is the annuity exemption. Also, you don't need to have a minimum income.

Another advantage is that you can participate in two different reward programs at the same time. Saraiva Plus, which accumulates points to exchange for discounts on the Saraiva network and Air Miles, you can exchange points on Latam Pass.

Disadvantages

The main disadvantage of the Saraiva credit card is that, due to the link with Banco do Brasil, account holders have more opportunities to be approved. Also, the card is not very advantageous for those who do not like to accumulate miles to travel or are customers of Saraiva stores.

How to apply for Saraiva credit card

To apply for the card, follow these steps:

- Access the cards area of the Banco do Brasil website or app;

- Go to Cartão Saraiva and then to “Order yours now”;

- Enter your personal data;

- Complete the registration and wait for credit approval.

Alternative recommendation: Inter Card

If you are a consumer of the Saraiva network, this card is an excellent option on account of Saraiva Plus. But, if you are looking for another card with several benefits, see the comparison we made with the Inter Card:

| Saraiva card | Inter Card | |

| Minimum Income | not required | Minimum wage |

| Annuity | Free | Free |

| Flag | Visa | MasterCard |

| Roof | International | International |

| Benefits | Saraiva Plus, Air miles | Cashback Program |

Did you like the content? So enjoy and learn how to apply for your Inter credit card in the following article!

How to apply for Inter credit card

Do you want to know how to apply for Inter's credit card, one of the best on the market? Then read our text and find out!

About the author / Gustavo Cezar

Reviewed by / Junior Aguiar

Senior Editor

Trending Topics

Discover the iDinheiro loan

The iDinheiro portal facilitates the search for various personal loans on the market. Learn how this is possible from this post!

Keep Reading

More advantages of OpaPay Mastercard, the credit card for people with bad credit

There's no denying it: the OpaPay Mastercard has several advantages that make it a truly differentiated product compared to others on the market.

Keep Reading

Fies or Pravaler: which is the best option?

Fies or Pravaler? Check out a complete comparison and find the best alternative for you who want to study at a college.

Keep ReadingYou may also like

With the notices published, check the registration dates at Sisu, Prouni and Fies

The Sisu, Prouni and Fies programs are the main gateways for those wishing to enter university. However, it is necessary to keep an eye on the ENEM note that should be released on February 11th to then register.

Keep Reading

How to redeem the money invested in Banco Inter?

Do you have money invested in Banco Inter and want to know how to redeem it? It's simple and doesn't even take 2 minutes! Continue reading and stay up to date with the entire process step by step.

Keep Reading

Coronavirus pandemic and international war heighten threat of stagflation in Brazil

Expectations of economic improvement for Brazil in 2022 are not the best. This is because the impacts on the global economy caused by the war, in addition to the effects of the pandemic, had a great impact on the increase in inflation in the country. Check out more below.

Keep Reading