Cards

Access Card or Superdigital Card: which is better?

How about a comparison between the Acesso card and the Superdigital card? Both are available for negatives and are also ideal for international purchases. Check out!

Advertisement

Access x Superdigital: find out which one to choose

After all, why choose between the Acesso card or the Superdigital card?

Well, the answer is simple, that's because both cards are prepaid and don't require any proof of income.

Although many people have a clean name, many are negative, making cards like these useful and widely used, as they allow international purchases in credit mode, for example.

In short, the Acesso card charges an annuity when it is recharged, but it does not have any bureaucracy in its order, which is done over the internet for free, for example.

On the other hand, the Superdigital card does not charge any fee, it can be used for international purchases and even for Netflix subscriptions, that is, just load and use it without paying anything extra.

So, if you're curious, follow the details of these two options below and decide between cheap and very accessible options!

How to apply for the Access card

Tired of wanting to buy on credit and having a dirty name? With the Access card it is possible without any proof of income. Know more!

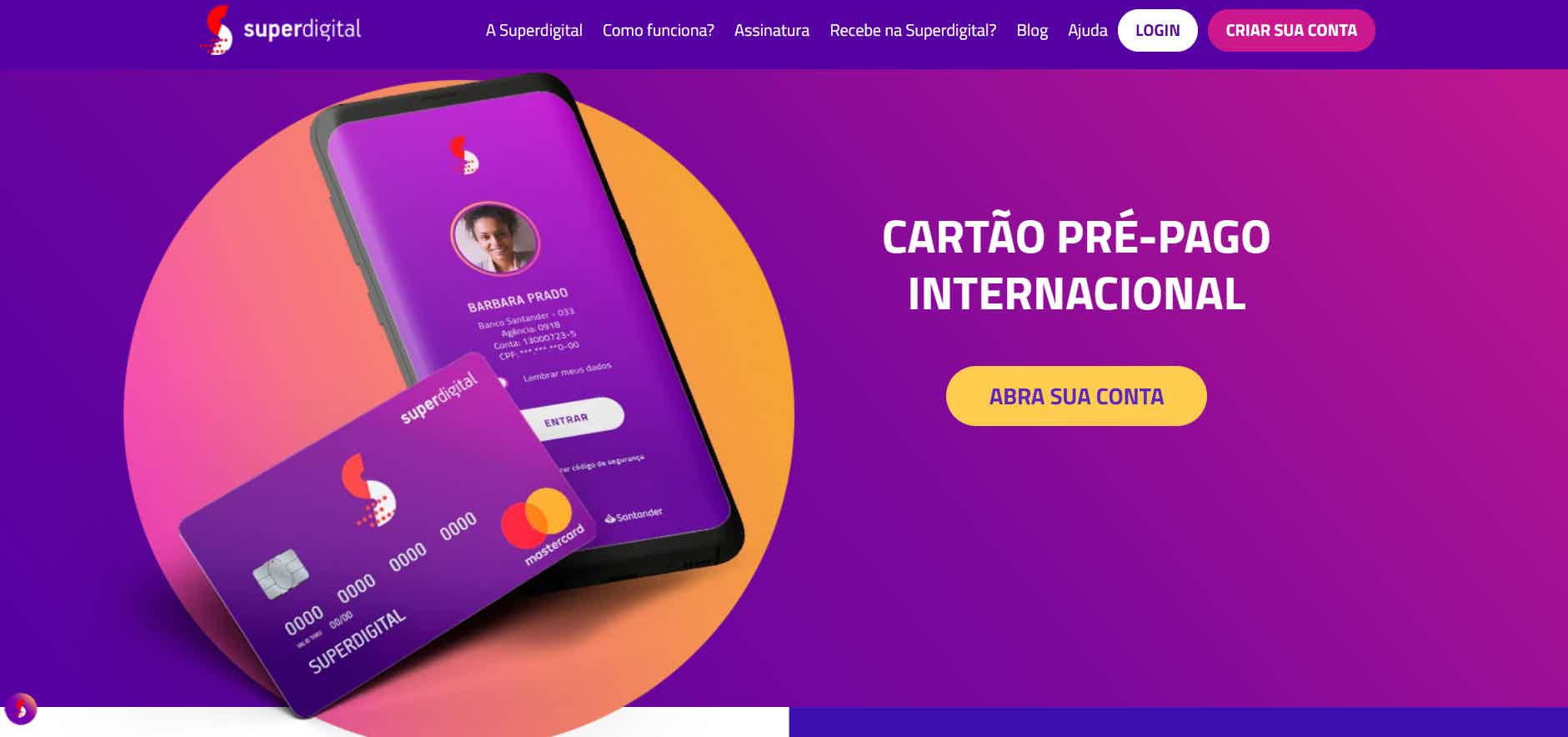

How to apply for the Superdigital card

Why not have an international credit card, with a digital account and accepted for negatives? Ask for Superdigital!

| Access Card | Superdigital Card | |

| Minimum Income | not required | not required |

| Annuity | 12x of R$ 5.95 | Exempt |

| Flag | MasterCard | MasterCard |

| Roof | International | International |

| Benefits | Don't worry about proof of income or documents Order and activate your card online International purchases without any monthly invoice Make bank transactions by digital account | Accepted in any online store and apps Buy worldwide on credit Never pay any fee for using it Get up to 10 free virtual cards for dependents |

Access Card

As well as other credit cards, the Acesso card is ideal for those with negative credit who want to start financial planning or just purchases using credit.

In this way, when placing an order, the customer does not commit to high installments or large fees, only to carry with money what he will use for purchases.

The Access card can be requested and activated over the internet. In this case, the customer also has a digital account that can be operated like any other, making withdrawals and transfers when necessary.

Undoubtedly, it is ideal for people with negative credit who need to pay for subscriptions, and when they have an active Itaú or Banco do Brasil account, it is possible to list the accounts and receive top-ups on the same day, which is very useful for those in a hurry!

Superdigital Card

First, the Superdigital card is among the easiest options on the market, with no monthly fee, such as annuity, membership or maintenance. Basically just order and use.

However, the customer pays certain fees when there are withdrawals or any transaction at ATMs in the Banco24h network, such as printing statements. Despite this, it is very cheap to have this card.

That's because if you don't want to use it that month, Superdigital still doesn't charge you anything for it, but the ideal would be to use it to discount subscriptions, such as Netflix, Spotify, among others.

In addition, have a free card, with a digital account operated by an application with even a loan available. If you are curious, stay with us and discover more advantages.

What are the advantages of the Access card?

Since it is a card for negatives, the Access card is even useful for financial organization and creating savings for children, as it allows additional cards for people aged six and over, for example. So check out the details below.

- Pay streaming subscriptions and make international purchases;

- Order online and activate without leaving home;

- All movement is done through the application;

- Don't worry about monthly bills: use only when recharged;

- Have you deposited and need to withdraw? Do this at Banco24h network ATMs.

What are the advantages of the Superdigital card?

Just to exemplify, know that the Superdigital card can be requested, but also canceled whenever the customer wants, without any bureaucracy or charging fees, therefore, better understand other benefits below.

- Count on a digital prepaid credit card;

- Pay no annuity, membership or maintenance fees;

- Through credit analysis, try a loan through the SIM network;

- Move the account with transfers and payments, including PIX;

- Pay apps such as Netflix, Uber and iFood.

What are the disadvantages of the Access card?

Although there are advantages, some problems arise, such as the excessive charging of fees. Just to illustrate, the client pays R$5.95 every month of annuity, except when there is no balance. In addition, you have to disburse R$100.00 or R$14.90 to activate the card.

If the recharge does not exceed R$500.00, there is also a fee of R$2.50 every month. Finally, the customer needs to pay a fee of R$6.50 if he recharges through a deposit, so try to put money on the card in another way.

What are the disadvantages of the Superdigital card?

In any case, there is no use of the credit card without top-up, so you will have to disburse before starting to use it. Furthermore, this is a credit card that does not allow any payment in installments.

Finally, there are some fees even though the card appears cheap. To highlight, most transactions at the Banco24h Network ATMs are charged, reaching R$6.40 for withdrawals.

Access Card or Superdigital Card: which one to choose?

So, which prepaid card is better, the Acesso card or the Superdigital card?

Once negatives can be used, both cards are ideal for those looking for low rates, payment in credit mode for streaming services and applications.

Therefore, before choosing, check which one offers less bureaucracy and will weigh less on your pocket, since the ideal would be a credit card with zero fees and endless shopping possibilities.

Also, if you haven't made up your mind yet, don't worry. Since while you were reading this text we prepared another comparison, click on the link below and put more options in your ranking to choose the best card! Keep with us.

Dotz card or Inter card?

International flag, points program and zero annuity. Discover both options!

Trending Topics

Havan card or Saraiva card: which one to choose?

Decide between the Havan card or the Saraiva card: they do not charge an annuity, they offer a free additional card and 40 days to pay for purchases. Check out the comparison!

Keep Reading

Get to know the Oi Prepaid Card

The Oi prepaid card is Mastercard and has several benefits such as withdrawals and cell phone recharge. Check out!

Keep Reading

How to enroll in Prime Cursos courses?

Find out how to register on the Prime platform and courses, to strengthen your resume and stand out in the job market.

Keep ReadingYou may also like

How to apply for Floor and Decor card

Do you want to know how to have your Floor & Decor card to gain advantages when renovating your home? In addition, it has no annual fee and offers exclusive discounts. So, follow the step-by-step application process here.

Keep Reading

Credibom quick loan: what is Credibom?

Do you already know Credibom? This is an excellent option for those who want a quick personal loan without bureaucracy. Continue reading and check it out!

Keep Reading

IRPF exempt taxpayers can receive a refund if they declare the tax!

Individual taxpayers with taxable income below R$28,559.70 do not need to declare IRPF. However, sending the statement can yield extra income in case of refund! See more here!

Keep Reading