loans

BMG Consigned Loan or C6 Consig Loan: which is better?

If you are unsure about which loan to choose, we will show you the differences between the BMG payroll loan and the C6 payroll loan. Continue reading and discover the pros and cons and which is the best option for you to achieve your financial goals!

Advertisement

BMG Consignado x C6 Consig: find out which one to choose

If you want to know about loans with special conditions, today we will show you. The BMG payroll loan or C6 payroll loan are two exclusive loans for INSS retirees and pensioners, as well as federal public servants.

In this way, both can be contracted online and in person. In addition, they offer exclusive conditions. This is because the bank analyzes your financial history when setting interest rates and payment terms.

Furthermore, with a payroll loan, the installments are debited directly from your salary or benefit. Therefore, institutions are able to offer better rates, as there is already a payment guarantee.

So, continue reading and see which one to choose: BMG payroll loan or C6 payroll loan.

How to apply for the C6 payroll loan

Want to find out how to apply for the C6 payroll loan? Look here!

| BMG Payroll | C6 Consig | |

| Minimum Income | not informed | not informed |

| Interest rate | From 2,14% per month | not informed |

| Deadline to pay | Up to 96 months | Uninformed |

| release period | up to 24 hours | Uninformed |

| loan amount | depends on the benefit | depends on the benefit |

| Do you accept negatives? | Yes | Yes |

| Benefits | fair rates Loan control via the app | fixed installments online hiring |

BMG Payroll Loan

BMG Bank is one of the leading banks when it comes to payroll loans. This is because they offer loans, cards and several other products in this modality. Therefore, the target audience is INSS retirees and pensioners, as well as federal public servants.

In addition, it also accepts military personnel and workers with formal employment contracts. However, all modalities must be consulted. This is because some institutions have an agreement and others do not.

In this way, BMG credit is discounted directly from your payroll. Therefore, as we have already mentioned, the bank is able to have a guarantee and offer lower rates. In other words, you get a longer term for much lower interest rates.

In fact, the rates vary from case to case, but are 2,14% per month and 29,38% per year. Furthermore, payment can be made in up to 96 installments.

In fact, after taking out the loan, you still have 7 days to cancel the credit. In other words, if you change your mind or need to cancel it, it is still possible. Just contact BMG.

Finally, applying for a BMG loan is very simple. You can apply through the website, WhatsApp, or even in person. After contacting us, BMG will ask you to confirm your identity. After that, they can then give you a credit offer.

C6 Consig Loan

In short, the C6 Consig loan is quite similar to the BMG loan. This is because it is also designed for retirees, pensioners and federal public servants. In this case, the C6 does not include workers with formal employment contracts or military personnel.

In this way, as with other payroll loans, C6 offers much lower rates for this loan. In addition, the institution has a specialized service to assist its customers when taking out the loan.

Remember that taking out a loan requires research and planning. With this in mind, with C6 Consig you have consultants who will help you find the best conditions.

Furthermore, the installments of the C6 consig loan are fixed, that is, the interest does not increase over time. Therefore, this loan becomes a good option for those who want to pay off debts or bills.

By the way, C6 consig accepts people with bad credit, but you still need to perform a credit analysis. This way, the bank can analyze what it can offer you and what the best conditions are.

What are the advantages of the BMG Consignado loan?

When we talk about the advantages of BMG payroll loans, we can mention a few. Firstly, BMG is a bank that specializes in payroll loans. Therefore, the services are specialized for this modality.

Secondly, the interest rates are 2.14% per month and 29.38% per year. However, BMG analyzes each profile individually to offer the best conditions. In other words, when you submit your documentation, they give you a personalized offer.

Furthermore, a major advantage of the BMG payroll loan is the repayment term. This is because you have up to 96 months to pay off your loan. However, if for some reason you are unable to do so, you can still renegotiate.

What are the advantages of the C6 Consig loan?

In general, a major advantage of C6 consig is the ease of hiring. This is because you can hire online or in person. In other words, whichever way is easiest and most practical for you.

By the way, when it comes to sending and signing the documentation, the process is also online. Therefore, you just need to contact us via WhatsApp and you can send all the necessary documents, as well as the contract signatures.

One advantage of payroll loans, in general, is the lower interest rates. This is because the bank already has a guarantee that the installment will be paid. Therefore, the installments are debited directly from the salary or benefit.

What are the disadvantages of the BMG Consignado loan?

One disadvantage of the BMG Consignado loan is that it is intended exclusively for a group of people. In other words, unless you are retired, a pensioner or a civil servant, you will not be able to apply for this loan.

In fact, BMG is a bank focused on payroll-deductible products. Therefore, all services are aimed at this audience.

What are the disadvantages of the C6 Consig loan?

Initially, a disadvantage of the C6 consig loan is the fact that there is not much information on the website. Since it is an online loan, it is essential to make the credit conditions clear.

However, it is not possible to find out much on the website. Furthermore, C6 does not offer online simulation. To simulate the loan, you need to contact them via WhatsApp or in person at a bank correspondent.

BMG Consignado Loan or C6 Consig Loan: which one to choose?

Ultimately, choosing between a BMG payroll loan or a C6 payroll loan is a very personal choice. This is because each has its advantages and disadvantages. In other words, it is up to you to relate these points to your financial reality.

The BMG payroll loan has the credibility of a bank that specializes in these services. The C6 consig, on the other hand, has exclusive rates and personalized support. Therefore, you need to understand well what you are looking for.

Furthermore, we will show you another loan option. So, access the recommended content below and discover the differences between the BMG loan and Bom Pra Crédito!

About the author / Leticia Maia

Reviewed by / Junior Aguiar

Senior Editor

Trending Topics

Méliuz Card or Neon Card: which one is best for you?

If you are in doubt between the Méliuz card or the Neon card, know that both have very different proposals such as cashback and digital account. Check out!

Keep Reading

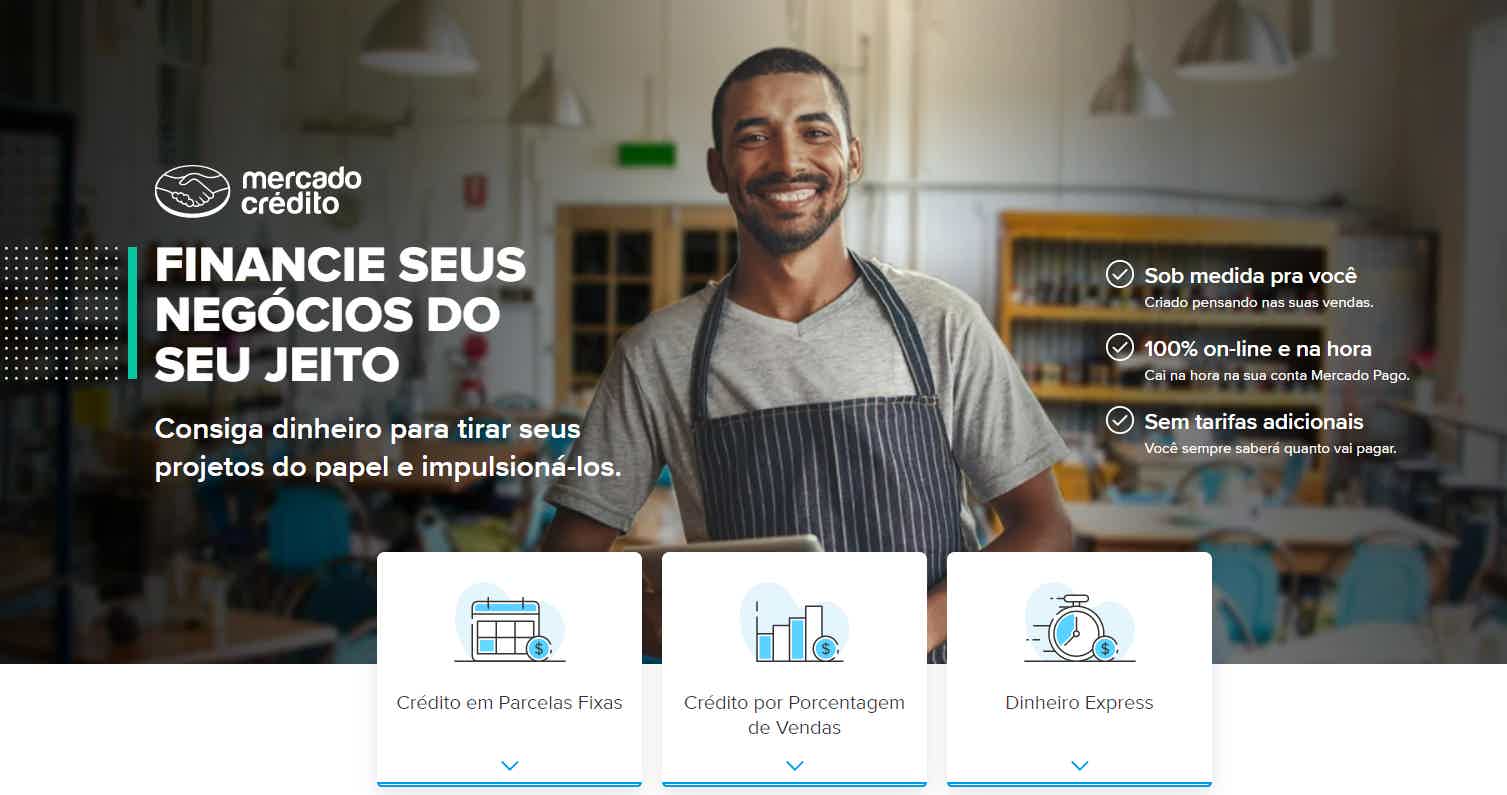

How to apply for a Mercado Pago loan

The Mercado Pago loan offers three types of credit. In this article, we will show you how to apply for yours. Learn more here!

Keep Reading

C&C credit card: what is the C&C?

The C&C brand has its own credit card for use in its stores, with exclusive benefits for its customers. Meet here!

Keep ReadingYou may also like

How to open account at XP Investimentos brokerage

Check out how to open your account with zero fees at one of the largest brokerages in Brazil. In addition, XP does not charge a brokerage fee for managing fixed income and also has several advantages. Read this post and check it out!

Keep Reading

PicPay: How to earn money with PIX

Have you heard about the advantages of PicPay? And how to earn money with the PIX in the app? Because in this article we explain everything you need to know, check it out!

Keep Reading

Discover the Girabank credit card

With the Girabank credit card, you have everything you need in just one place, from annuity exemption, national coverage, access to the digital account to the benefits program. Learn more here!

Keep Reading