Cards

Increase PagBank card limit with CDBs: how to do it?

PagBank's investment platform now allows you to increase your limit by investing in the CDBs it offers! This functionality is also available for negatives. See how the process works here.

Advertisement

Get to know the function that increases the limit even of negatives

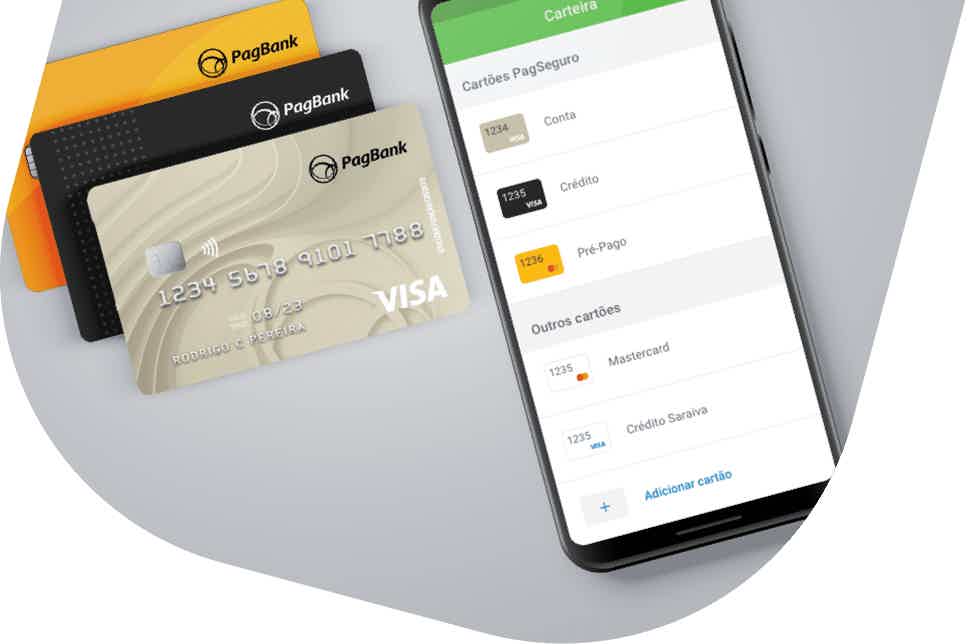

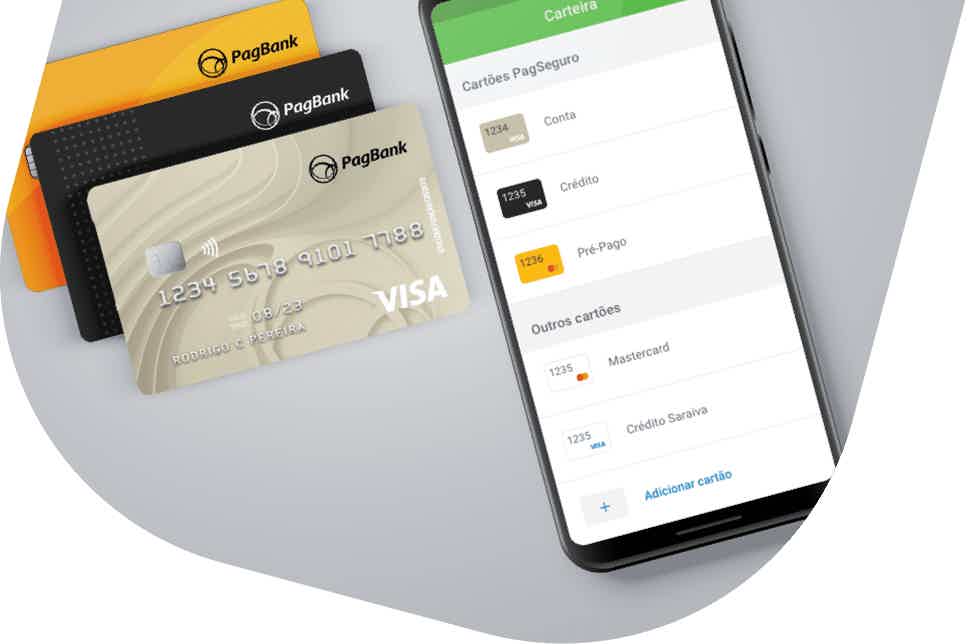

Recently, PagBank released a new feature for its users that can help them have more purchasing power. Now, it is possible to increase the PagBank card limit with CDBs that exist to invest there!

PagBank was already known for making available on its platform some CDB securities where the user can invest their money and achieve much higher returns than savings. Applications were simple to make and all protected by the FGC.

Thus, with the novelty, users will be able to access a higher limit every time they make an investment equal to or greater than R$300.00 in the CDBs that are offered in the application. And the best thing about it is that the function is also available for negatives.

Therefore, if you want to know more about this new feature and how you can invest in CDBs on PagBank and increase your limit, just continue with this post!

How to invest in CDB on PagBank?

First, it's important to understand a little more about the application itself. Therefore, a CDB, which stands for Bank Deposit Certificate, is a type of investment where you lend your money to a bank for a certain period.

Thus, the bank or financial institution uses the money to finance its financial operations. After the hiring period, he returns that money to you with interest, which is the income from that application.

Basically, everyone who has an investment brokerage account or banks that allow access to CDBs, such as PagBank, can make one or more investments in this type of investment.

Therefore, to invest your money in PagBank CDBs, just follow the following step by step:

- Access the PagBank application and choose a CDB title to invest;

- Add the total amount you would like to apply to the bond;

- On the next screen, check all the data about the application;

- Complete the application for your money to be invested in the CDB.

The process is very simple, and all investments made in the CDBs offered by PagBank are protected by the FGC, which stands for Credit Guarantee Fund.

From it, if the bank that issued the CDB goes bankrupt, you can get back the money applied from that body. Thus, your application is protected and you can receive all your money back!

How to apply for PagBank card

See here how easy it is to get your international Visa card with no annual fee from PagBank.

How to increase the PagBank card limit with CDBs?

Now that you understand more about the CDB and how it is possible to invest in this security from PagBank, the time has come for you to check how it is possible to increase the limit of your PagBank credit card using this functionality.

Basically, the new function was created because PagBank wanted to further expand its investment platform. And for that, nothing better than linking an investment with something that the Brazilian people want most: increasing the credit card limit.

And, by doing so, PagBank still allowed all users to have access to the functionality, whether they were denied or not. Thus, those who have a dirty name and are looking to build a good credit history can find an opportunity here.

Therefore, to find out how to increase the limit of your PagBank credit card with investments made in the CDBs that the institution offers, just follow these three simple steps.

Step 1: Access the investment area in the application

Therefore, to invest and transform the amount invested into a limit on your credit card, you must have already created a free PagBank account and requested the card.

With that done, just access the PagBank application and click on the option called “Products and investments”. From here, you can choose the “Investments” option and then click on “Fixed Income”.

Step 2: carry out the application in the CDB

On the screen that appears, you will be able to access the CDBs that exist on the PagBank investment platform for you to apply your money.

Thus, to carry out the application of the money, just follow the step by step that we added at the beginning of the text. Therefore, you just need to click on the title, define the amount to be invested and complete the operation.

Here it is important to pay attention to the amount you will invest. To be able to turn it into a limit on your credit card, you need to make an investment between R$ 300 and R$ 100 thousand.

Step 3: Adjust your card limit

So, after making the investment, you can continue adjusting your card limit in the application itself, where you will see that you will have a higher limit according to the amount invested.

By following these three simple steps, you can already make an investment that increases your credit card limit on PagBank!

But, if you haven't requested the PagBank card yet, just check in the post below how the request is made and how you can have your card at home to increase the limit with CDBs!

How to apply for PagBank card

Check out the complete step-by-step to order this complete card and without annuity.

About the author / Leticia Jordan

Reviewed by / Junior Aguiar

Senior Editor

Trending Topics

Discover the uConecte personal loan

The uConecte personal loan is approved in a few hours and is ideal for those who need money quickly. Check more here!

Keep Reading

Do you know your financial profile?

Financial profile is an essential factor to understand how you relate to money and define goals and objectives. Click and learn more!

Keep Reading

Sorocred invoice: how to consult?

Need access to your card statement? Consulting the Sorocred invoice takes just a few seconds. Want to know how? So follow along!

Keep ReadingYou may also like

New unemployment insurance rules: What you need to know

Did you know that unemployment insurance rules have changed? So, if you need to request the benefit, it is important to understand how the resource update works, in addition to the amounts to be received and the number of installments available for your profile. Want to know more? Read on!

Keep Reading

Discover the Discover It® Miles credit card

The Discover It® Miles credit card is a perfect financial product for those who need to use it on a daily basis and like to travel. If you want to know about it and all the advantages it offers, follow our content.

Keep Reading

No connection, no hassle: experience offline GPS app freedom

Offline gps apps allow you to navigate gps without internet connection required. With them, you can download maps for offline use, get accurate routes, and explore remote areas without losing your way.

Keep Reading