loans

How to anticipate FGTS by Sim? See the process

By anticipating FGTS through Sim, you have access to money that is already yours in advance and manage to receive it in your bank account preferably in just 1 business day. Learn all about this loan in the course of this text.

Advertisement

Online loan available for negatives

For those who have already opted for the birthday withdrawal from their guarantee fund, but would like to access this money earlier, they can do so by anticipating the FGTS by Sim.

This financial institution, which belongs to the Santander group, allows the public to gain early access to money that is already theirs.

This way, it is easier for you to carry out your current projects! In addition, by anticipating the FGTS through Sim, you access a loan modality that has lower interest rates and more interesting payment conditions.

Therefore, in the post below you will learn more details about how the FGTS advance by Sim works and you will find out if this is a good loan option for you.

What is Sim's FGTS anticipation?

Namely, Sim's FGTS anticipation is a type of loan that the financial institution offers to its public so that they can access money that is already theirs.

This is done from the birthday withdrawal. Nowadays, every Brazilian worker can choose to receive part of his FGTS balance in the month of his birthday.

That way, everyone who has a balance in the fund can access that money automatically every year.

What Sim does here is allow the worker to have early access to this money to use in their current plans.

Who has the right to advance the FGTS?

To anticipate the FGTS by Sim, you must meet some basic requirements to be eligible for this type of loan.

As it is a credit that uses your FGTS balance, you must meet some basic criteria for the loan to be carried out.

Namely, the main requirements that this type of credit has are the following:

- Be over 18 years of age;

- Have a balance greater than R$ 300.00 in the FGTS;

- Have adopted to the birthday serve;

- Be regularized with the Federal Revenue;

- Have a checking or savings account at a bank;

- Authorize the Sim to access your FGTS data.

Of all the requirements listed above, the birthday withdrawal option and the option to authorize the Sim to consult their data can be done when taking out the loan.

But, anyway, they are actions that need to be completed so that the loan can be contracted.

What are the rates and deadlines to anticipate the FGTS by Sim?

Another important information to know about anticipating FGTS by Sim are the conditions that this loan has.

Therefore, those who prepay through Sim can access monthly interest from 1.89% that will be added to their loan installment.

Incidentally, Sim only allows you to anticipate a portion of your birthday withdrawal. But, you don't have to worry about paying for it, as it will happen automatically.

When carrying out the anticipation, the Sim will contact Caixa Econômica Federal so that it will be possible to automatically deduct the amount of the loan installment from its guarantee fund.

In addition, when applying for credit, you can access the money within 24 working hours in your bank account of your choice.

Is it worth anticipating FGTS?

After knowing more about the anticipation of the FGTS, it is normal to be in doubt whether it is really interesting to continue taking out this credit.

After all, the guarantee fund is there to help you in times of emergency, so it's normal to be a little apprehensive about accessing that money beforehand.

For this reason, we decided to separate below the main advantages and disadvantages of this type of credit so that you know if this option is really interesting for you.

Benefits

In summary, the anticipation of the FGTS can indeed offer several advantages for those who request it! Below you can find three of them.

You access money that is yours

The main advantage of making the anticipation is that you will be lending money that is already yours.

The birthday withdrawal that is released every year is money that you have, but that is only released once a year.

That way, by anticipating the FGTS by Sim, you can have early access to that money and take advantage of it in current projects!

Available for negatives

Another great advantage of this loan is that it can be easily approved for those who are negative.

Thus, if you have a dirty name and cannot access other loans, by anticipating the FGTS through Sim you can have the approval you are looking for.

Online and fast process

Finally, the entire loan contract takes place online, where you can access the credit you need from the comfort of your home.

In addition, the entire process of applying for a loan at Sim is done very quickly, allowing you to have the money in your account within 24 hours.

Disadvantages

Although anticipation has great positive points, we cannot deny that it also has some disadvantages as you know below.

Your background is locked

When advancing the FGTS by Sim, the part of your balance equivalent to the loan may be blocked until it is paid off.

This is done to ensure that the loan payment will be made. However, it may prevent you from accessing the full amount of the fund if you lose your job or want to buy a property, for example.

Access to only 1 installment

Another disadvantage is that from Sim you can only access 1 portion of your birthday withdrawal.

Namely, nowadays there are financial institutions that grant access to up to 10 installments of the birthday withdrawal.

How to anticipate FGTS by Sim?

Now that you know more about how FGTS works through Sim, it's time to learn how the hiring process happens in practice.

Therefore, to advance the FGTS by Sim, you must first allow the institution to access your FGTS data. For this it is only necessary that you:

- Download the FGTS application;

- Access your fund account;

- Adopt to serve-birthday;

- Click on “Authorize banks”;

- Search for Banco Santander Brasil SA.;

- Allow him to query your data.

That way, at the end of this process, you just need to go to the website of the financial institution and start taking out the loan following the previous guidelines.

As she now has access to her guarantee fund data, it will be possible to anticipate the FGTS by Sim without major problems.

However, if you want to know more about FGTS, then access the recommended content below.

Find out if you have balance to withdraw

Find out how you can view the amount available for withdrawing your FGTS.

About the author / Leticia Jordan

Reviewed by / Junior Aguiar

Senior Editor

Trending Topics

Itaú Consigned Loan or C6 Consig Loan: which is better?

Want to decide between Itaú Consignado loan or C6 Consig loan? In today's article we will show you the pros and cons of both.

Keep Reading

How to apply for the Caixa Internacional card

Find out here how to apply for your Caixa Internacional card and benefit from all its advantages, such as the Caixa Points Program.

Keep Reading

How to enroll in the Minha casa, Minha vida program

Learn how to enroll in the Minha Casa Minha Vida program and acquire your own property through subsidies that help with the installments!

Keep ReadingYou may also like

Is buying a house financed by Caixa worth it?

Buying our own home is undoubtedly one of our biggest wishes, isn't it? With that, we can now buy a house financed by Caixa, housing financing with up to 240 months to pay and coverage of up to 90%. It's one of the easiest ways to make this dream come true, and with just a few steps, you have the opportunity to own a new property to bring even more quality to you and your family. In short, learn more about it here.

Keep Reading

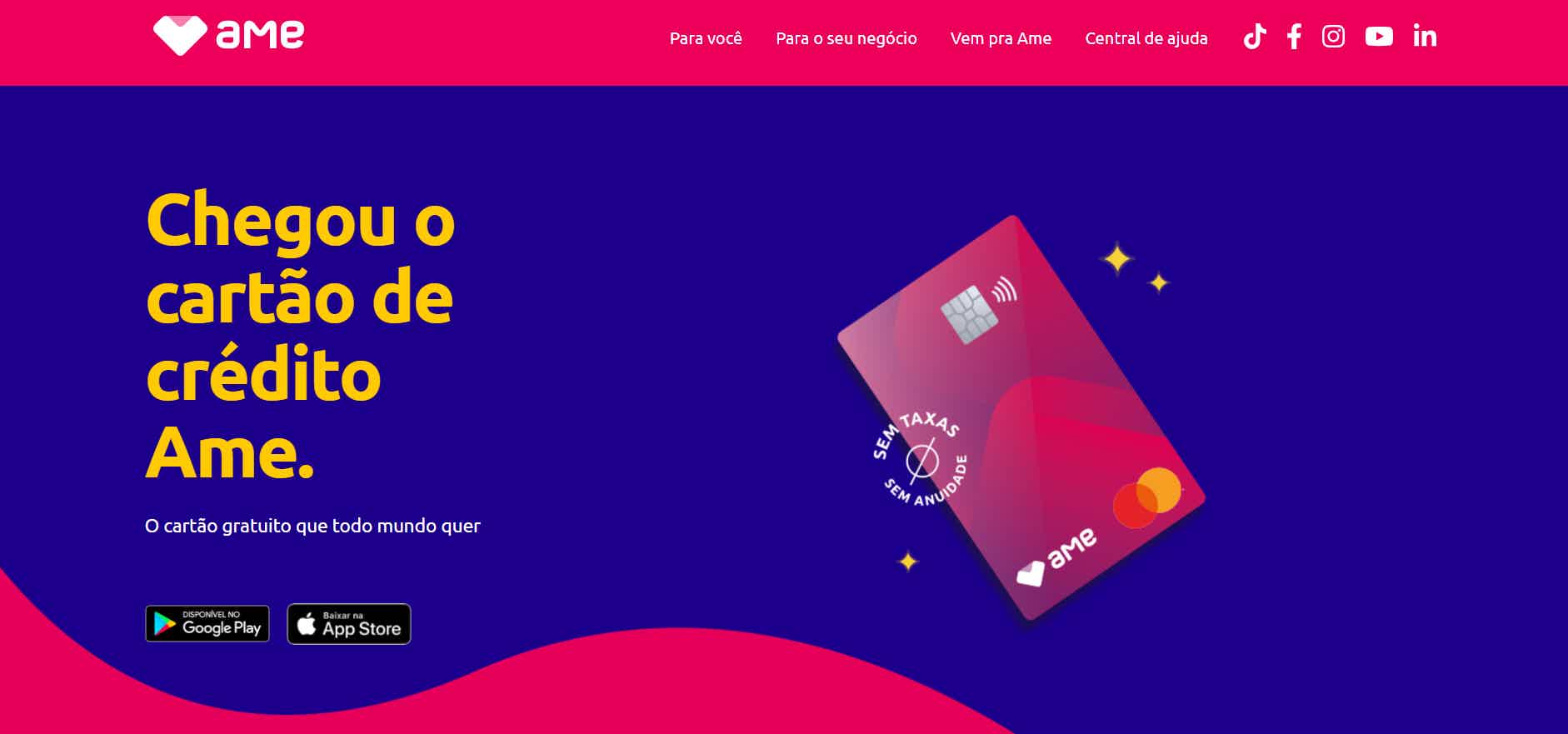

Find out what are the main advantages of the Digital AME card

If you like new alternatives, find out about the main advantages of the Ame card, a modality that will optimize your payment relationships and online purchases!

Keep Reading

How to Apply for a Credit Card Next

Learn how to apply for the Next Visa credit card. Follow the steps outlined in this article to apply for yours!

Keep Reading