loans

Right Agreement Loan or Inter Payroll Loan: which is better?

Enjoy low rates and immediate approval! Decide between the Right Agreement loan or Inter Payroll loan!

Advertisement

To decide between the different options on the market, you need to have accurate information! That's why we brought you interesting personal credit options. Learn more and choose between the Right Agreement loan or Inter Payroll loan!

In the case of the Agreement Right loan, it is a credit offered by platform partners. In other words, this is a trading site that offers offers to get you out of the red.

On the other hand, the Inter Consignado loan has a low interest rate, without consulting the credit bureaus. In addition, civil servants and retirees who need quick cash take advantage.

In conclusion, we will bring information, advantages and disadvantages of both. Know that only with information will it be possible to access the best. So keep reading!

| Sure Deal Loan | Inter Payroll Loan | |

| Minimum Income | depends on the company | not informed |

| Interest rate | depends on the company | from 1,30% am |

| Deadline to pay | 9 to 180 months | 36 to 120 months |

| release period | depends on the company | Up to 3 business days |

| loan amount | R$2,000 to R$100,000 | R$1.224 to R$400.000 |

| Do you accept negatives? | Yes | Yes |

| Benefits | Ensure payment of debts on sight Receive trade proposals in minutes Simulate loans for pre-approved negatives | Pay few fees for this consignment Guarantee high values without consultation with the SPC/Serasa Simulate before hiring and get a discount on the payroll |

Sure Deal Loan

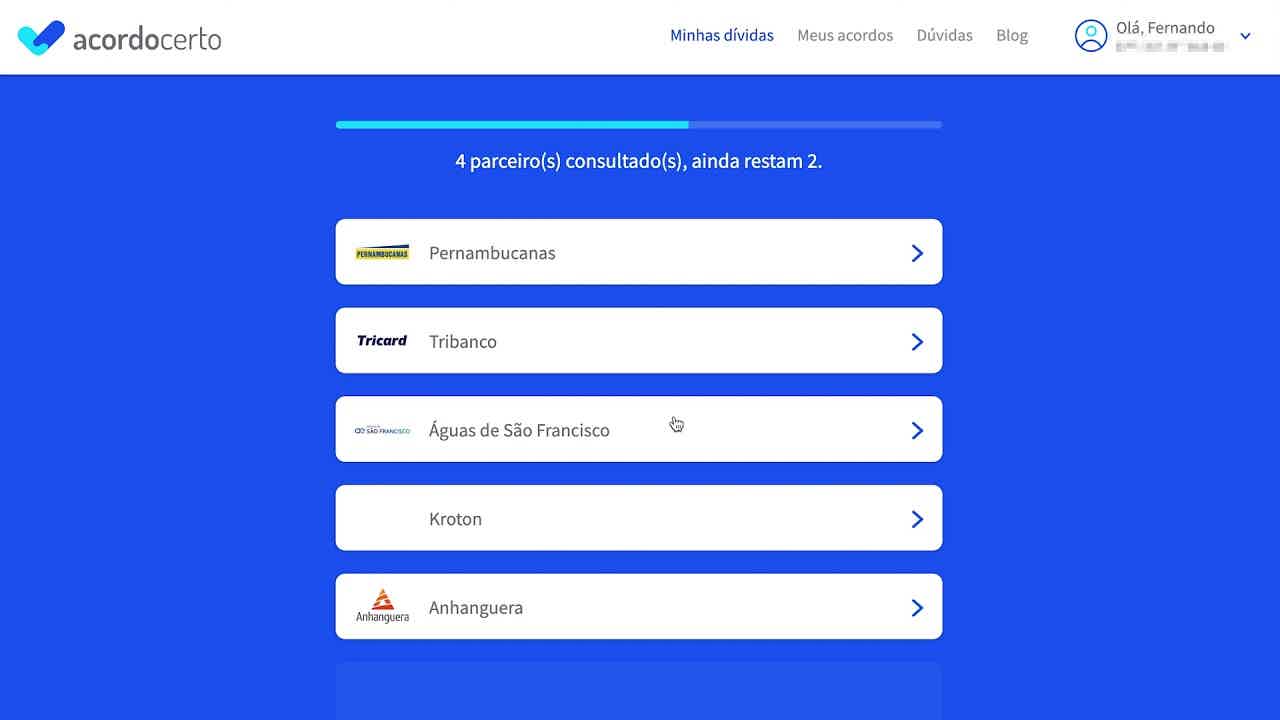

Firstly, the loan through the Certo Agreement is directed to negative creditors. Certainly, the platform offers as many trades as possible for each case.

Just to exemplify, there is a subsequent registration to access the proposals. After that, the platform searches for your CPF, which debts exist with the company's 30 partners. Most are willing to negotiate debts with installments of at least one hundred reais.

In a few minutes, negotiate and decide on the number of installments. Likewise, pre-approved loans for your case may appear on the same platform.

This means that you will be directed to one of the loan partners' page. They are: Jeitto, Banco BMG, Digio, Geru, Simplic, Mercatório and Rebel.

So get a high value and pay off debts. Without leaving the platform, you can safely clear your name. All this, in a few minutes.

Inter Payroll Loan

Inter bank is the former Intermedium bank. Therefore, it has existed since 1994, and today it is a digital account with a credit card and lines of credit.

In the same line, there is the credit card and the payroll loan. In other words, the installments are deducted from the payroll. In this case, only public servants and retirees can access.

Thinking about it, this modality has low interest rates. The most important thing is the credit analysis: there is no consultation with the SPC/Serasa. In addition, the simulation is done by the website.

Then, select the amount on the home page, in addition to the number of installments. After that, send your data and wait for the proposal! Know that on the same page, you can check the installments with interest application.

Finally, even with the negative name, have access to the high amount. If there is any interest, check out more about the advantages and disadvantages of both options.

What are the advantages of the Right Agreement Loan?

First of all, it is very difficult to need credit and have your name negative: the answer from traditional banks will almost always be no. With this platform, reality has changed.

Since it is a site specializing in bad debt, the main advantage is the numerous opportunities to clear your name. That is, quickly access a debt survey, which, without the platform, would take days. Whereas I would even have to leave the house to check it out, like in the old days.

Therefore, on the same page, negotiate debts and see pre-approved credit. Without bureaucracy, you will be directed to the credit company's page. Complete the application and pay the debts, keeping only the installments pending. It could be a good way out, right?

What are the advantages of Inter Payroll Loan?

Unlike other payroll-deductible loans, this one is for bad debts. Certainly, civil servants or retirees take advantage of low interest rates, starting at 1.30% per month. This means that the fewer installments, the lower the value in the end.

It is also advantageous not to have to leave the house to have the money in your account. Since the application is online, so is the signature. Finally, eight categories can take advantage of these benefits.

In other words, civil servants, retirees, members of the armed forces. Also know that the customer has protected credit. This protection guarantees the discharge of the contract, in addition to the return of what was paid. Valid only in cases of death or disability of the contractor.

What are the disadvantages of the Right Agreement Loan?

Although it has advantages, it is important to highlight the problems. Primarily, the Agreement Right platform does not offer loans: it is an intermediary.

Even so, credit assignment is not guaranteed. Since it is based on the analysis of the partners already mentioned. If you happen to have many restrictions, it may be that no proposal appears.

Also, analyze whether the agreements are advantageous before closing the deal. This is because the installments can be heavy, further complicating your financial situation. Especially if you make a deal that you can't afford: that creates an even bigger debt.

What are the disadvantages of Inter Payroll Loan?

The limitation of public access to the loan is the main disadvantage. This is because only a group of workers and retirees access credit this way without consulting bureaus.

Also know that the more installments, the greater the amount paid at the end of the loan. In summary, a loan of R $20,000.00, divided into 120 months ends at R $34,926.00.

At the end of the contract, it is R $14,926.00 more. This means a rate of 0.95% per month, which seems low. But if you look at the YTD, the rate is 12%. Then, analyze the simulations to be sure of the cost-effectiveness!

Sure Agreement Loan or Inter Loan

Consignment: which one to choose?

So, which one is ideal: a Certo Agreement loan or an Inter Payroll loan?

Above all, both guaranteed for negatives. As long as they follow certain rules, this audience has a chance of getting high prices for fair installments.

These are loans taken out over the internet. The customer knows exactly how much he will pay over the course of the contract. All this before closing a deal with any company.

The Inter bank option is for civil servants and retirees. While the Agreement Right platform does not exclude anyone in the selection of offers.

Finally, evaluate your financial history before deciding. What is the status of income, CPF and also whether there are conditions to pay for long installments.

Furthermore, the one that is least bureaucratic should be chosen. But if you haven't reached the ideal, think more.

Therefore, below, we have prepared a new comparison with other options. Continue your analysis and decide which best suits your financial needs.

Superdigital loan or Jeitto loan?

Personal credit with immediate approval, with chances for negative. Find out which by clicking below!

About the author / Monica

Reviewed by / Junior Aguiar

Senior Editor

Trending Topics

Americanas invoice card: how to consult?

Americanas invoice card: do you know how to check it? So, click here and learn more about where and how to access this document, as well as other information.

Keep Reading

Get to know the BMG credit card for negatives

The BMG card for negatives has helped many people to recover their credit and make their purchases. See now how this card works.

Keep Reading

How to apply for the Bradesco Neo card step by step

Discover the step-by-step process on how to apply for the newest Bradesco bank card, the Neo credit card.

Keep ReadingYou may also like

Bradesco Visa Infinite Card: what is the Bradesco Visa Infinite Card?

The Bradesco Visa Infinite card offers incredible benefits to its customers. Do you want to know more about him? So, read on and check it out!

Keep Reading

Discover the Boost credit card

Check out everything about the Boost credit card, from ActivoBank, which has an exempt commission and gives discounts at the NOS cinema network. Learn more later.

Keep Reading

Pan Bank loan online: great credit options for you

If you want to catch up on your finances, the Banco Pan online loan can be a great option. With an excellent rating from customers and a good reputation on Reclame Aqui, the bank and its financial solutions prove to be very reliable. To find out more, just continue reading.

Keep Reading