digital account

Discover the Bradesco university account

If you are a student and looking for a good checking account option, the Bradesco university account may be a good alternative for you! Learn all about it in this post and find out if it meets your needs.

Advertisement

Bradesco university account: here you will find great student credit options

If you are a student and looking to have a current account, the Bradesco university account can be an option with very interesting benefits for your profile.

From there, you can pay your semester in up to 12 installments, in addition to having access to the various online courses that are worth additional hours.

| open rate | not informed |

| minimum income | not required |

| rates | not informed |

| credit card | Yes |

| Benefits | Access to online courses Discount at Cinemark Discount on CNA courses |

In this article, you will learn about the main features of this account, in addition to checking its advantages and disadvantages to make a good decision!

Main characteristics of Bradesco

The Bradesco university account is a great option for students who need to carry out some financial transactions in their daily lives. And besides, the best part is that you don't need to prove your income to perform the opening!

From this Bradesco account, the student can have a financial service specially tailored to their needs. In this way, you can access different products in an easier way than in other checking accounts.

In addition, those who opt for the Bradesco university account can access university credit more easily to pay for their studies. In addition to being able to find financial services that guarantee your enrollment and the purchase of materials necessary for your studies.

From the account, the student can also plan for an exchange program and thus study abroad. Just as Bradesco thinks about the education of university students and manages to offer free online courses and a discount for CNA language courses.

The student may also be able to access the Visa Gold University credit card, in addition to being able to make investments through the account.

Who the university account is for

The Bradesco university account is a very interesting option for those starting their careers and attending their first university. From it, the student can access several benefits that guarantee a better future.

By providing credit for studying, in addition to promoting online courses and discounts on language courses, Bradesco guarantees that students will be able to build a more solid and stable career in the future.

This makes it easier for you to develop the skills that the job market is looking for in your area, as you will be able to have more access to studies.

What is the limit of the Bradesco university account?

By having the Bradesco university account, the student can access various financial services, such as loans, financing and also the credit card.

Thus, in the category of loans and financing, students can access a wide range of services. However, each of them has its own limit.

For example, with the Bradesco university account, the student can finance 100% of the value of his semester in up to 12 installments. It is also possible to access a financing of educational material of up to 70% of the value.

However, the limit for other financial services will be defined based on a credit analysis carried out on the student's profile. Therefore, it is not possible to say exactly the value of the limit for all the services that the Bradesco university account offers.

Is the Bradesco university account worth it?

To find out if a current account is really worth it for you, it is important to analyze its positive and negative points.

Only then will it be possible to make a clearer and more objective choice. Therefore, check below the main advantages and disadvantages of the Bradesco university account.

Benefits

Among the advantages of the Bradesco university account, we can mention the fact that it has several services focused on the studies of university students.

In this way, from it, it is possible to access discounts on online courses, language courses and also on Cinemark to take advantage of breaks between studies.

In addition, the wide variety of loans and financing offered to students to be able to pay for their studies or access new experiences, such as an exchange program, is something very important for university students today.

Finally, the account also helps students learn to manage their personal finances. To this end, they provide various content on financial education that provide initial guidance on how students can take care of their finances.

Disadvantages

One of the main disadvantages of the Bradesco university account is the fact that it is not a fully digital account.

In this way, it ends up becoming a not very attractive option for young people, who are always impacted by digital banks and their simpler and free possibilities.

How to make a Bradesco university account?

The Bradesco university account manages to offer several benefits to students. So, if you liked what you've seen so far, you can now continue creating the account.

To help you with this, we have separated in the post below a complete step-by-step with all the guidelines you need to create the Bradesco university account. Check out!

About the author / Leticia Jordan

Reviewed by / Junior Aguiar

Senior Editor

Trending Topics

C6 Consig Loan Review 2022

Check out in this C6 Consig loan review how this credit modality works and how you can apply for yours!

Keep Reading

How to apply for a bank loan

Do you want to learn how to apply for a bank loan from Paraná, ideal for negatives and with a payment period of 84 months? Read on!

Keep Reading

How to apply for a Pan Mastercard Zero Annuity card

See how to apply for the Pan Mastercard Anuidade Zero card and enjoy this international card with an application and exclusive discounts.

Keep ReadingYou may also like

Discover the Itaú Credicard credit card

The Itaú Credicard credit card has no annual fee, offers special discounts with more than 40 partners and can be controlled quickly and conveniently using the Credicard On app. Still don't know this card? So read this post and check it out!

Keep Reading

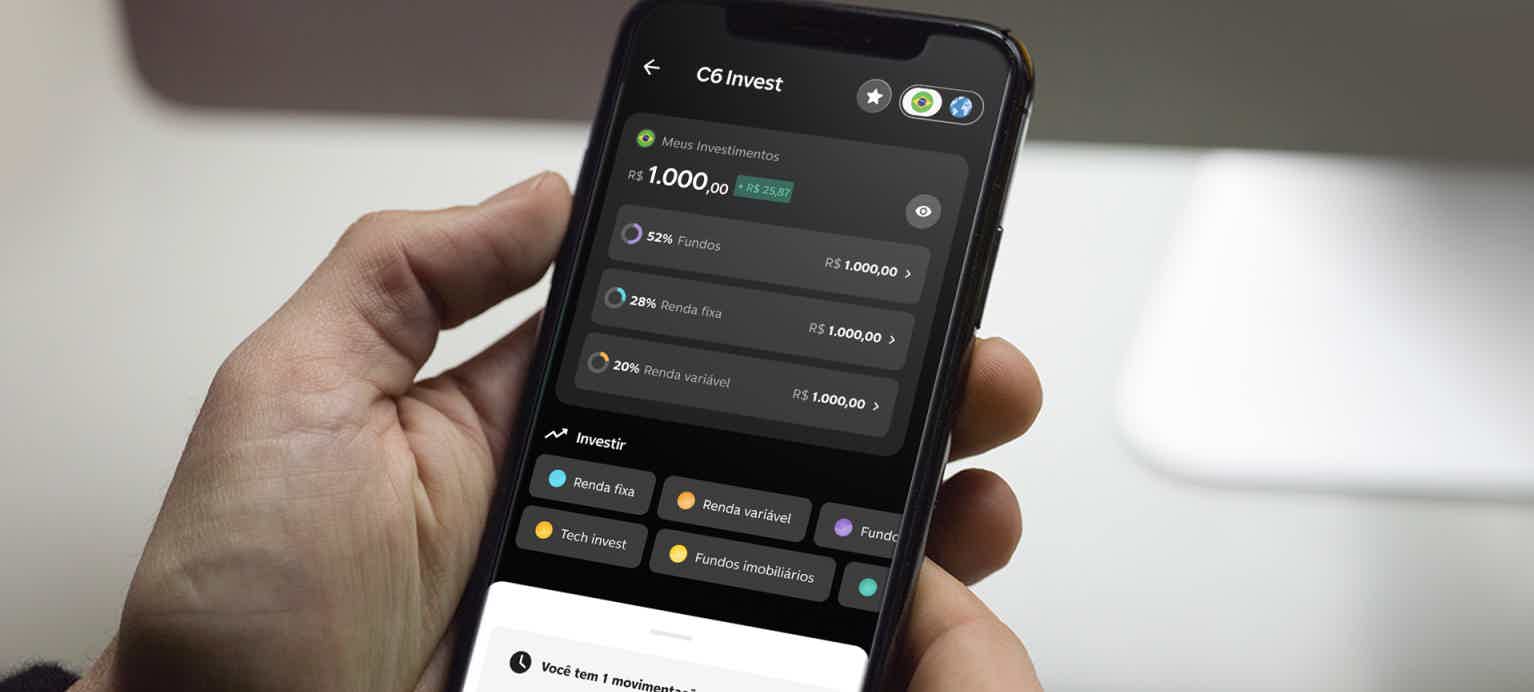

Investments in real estate funds by C6 Bank guarantee up to R$1,200.00 per month in passive income!

Thanks to advances in technology and the creation of investment platforms by digital banks, today it is possible to safely apply your savings to guarantee short-term or long-term profitability. With C6 Invest, you can earn passive income through real estate funds and earn up to R$1,200.00 per month for life. See more here!

Keep Reading

Discover the EuroBic Gold credit card

The EuroBic Gold credit card offers many advantages, such as exclusive free insurance and contactless payment. In addition, it is ideal for everyday shopping. Do you want to know more about him? So read this post and check it out!

Keep Reading