Cards

Discover the Caixa Grafite card

The Caixa Grafite card has the Elo banner and its exclusive benefits, such as Elo Flex. In addition, it has international coverage and participates in the Caixa points program. Know more about him here.

Advertisement

Caixa Grafite Card: exclusive benefits for unique customers

Apply for the Caixa Grafite card and have at least R$4,000.00 of initial limit to spend inside and outside Brazil. Therefore, the coverage is international and this is just one of the advantages that this card offers. In addition, you can enjoy Elo benefits and much more.

Therefore, we have prepared this exclusive content so that you understand the benefits and particularities of the Caixa Grafite card. Check out!

| Annuity | 12x of R$ 34.50 |

| minimum income | not informed |

| Flag | Link |

| Roof | International |

| Benefits | Points program and Elo FLEX |

How to apply for the Caixa Grafite card

With the Caixa Grafite card, you have access to Elo Flex benefits, international coverage and an exclusive Caixa points program. Find out how to apply here.

Main characteristics of Graphite Box

With the Caixa Grafite card, it is very easy for customers to pay for purchases in up to 24 interest-free installments. To do this, just check the availability of installments at Caixa partner.

In addition, the card has a service of points that are proportional to the use of the card. That is, the more you use the card, the more points you have to exchange for products or services.

The Elo banner offers Caixa Grafite customers exclusive benefits such as the Elo Flex program. With it, count on services such as Elo Wi Fi, Basic Residential Service, Auto Emergency II, Travel Insurance and Purchase Protection Insurance.

Who the card is for

Caixa Grafite is recommended for people over 18 years of age. In addition, the annual fee for this card is one of the highest among Caixa cards.

Therefore, this makes the target audience for people with higher income and who are willing to pay a higher price for using the card. In addition, the bank performs credit analysis, which makes it impossible to approve negative ones.

Is the Caixa Grafite credit card worth it?

In order to define whether a card is worth it or not, we must balance its cost with the advantages, benefits and functions available to the cardholder.

In this sense, the Caixa Grafite card has an annual fee of R$ 414.00 in 12 installments of R$ 34.50. In other words, it is one of the most expensive annuities among Caixa cards. In addition, it does not have two flag options like some of the other cards that Caixa offers. So these are points that work against the card.

However, we must realize that the Elo banner, in its composition, also brings benefits of its own and quite positive. Anyway, we can say that it is worth requesting the Caixa Grafite card.

Benefits

Among the advantages of the card, we can highlight the Elo FLEX program which, in turn, is a set of benefits in various segments such as: pets, bike and Auto. In addition, we have international coverage so you can shop anywhere in the world.

We cannot forget to mention the Caixa points program in which your purchases are transformed into points that, in turn, can be exchanged for incredible rewards. In addition, we still have access to travel packages and promotions to travel with family and friends.

Disadvantages

Regarding the disadvantages, we have the annual fee of R$ 414.00 in 12 installments of R$ 34.50 which, in turn, is one of the most expensive among Caixa cards. Also, there is no way to apply for the card online. That is, it can only be requested at the Caixa agency or Caixa Aqui correspondents.

How to make a Caixa Grafite credit card?

The first thing we should inform you, which is quite common with most cards linked to large banks, is that we cannot apply for cards online. Therefore, the only way that Caixa makes available is in person. That is, appearing at the branch or correspondent closest to you and delivering the necessary documentation.

In this sense, you must present your CPF, identity and proof of residence and income to Caixa. Then, sign the membership form and wait for approval. Also, if you want to know more information about the card application process, read our recommended content below.

How to apply for the Caixa Grafite card

With the Caixa Grafite card, you have access to Elo Flex benefits, international coverage and an exclusive Caixa points program. Find out how to apply here.

About the author / Marina Poncio

Reviewed by / Junior Aguiar

Senior Editor

Trending Topics

Interrupted Stories: check out how to participate in this framework

Learn how the Interrupted Stories framework works and see how it can make your biggest dream come true in a simpler way!

Keep Reading

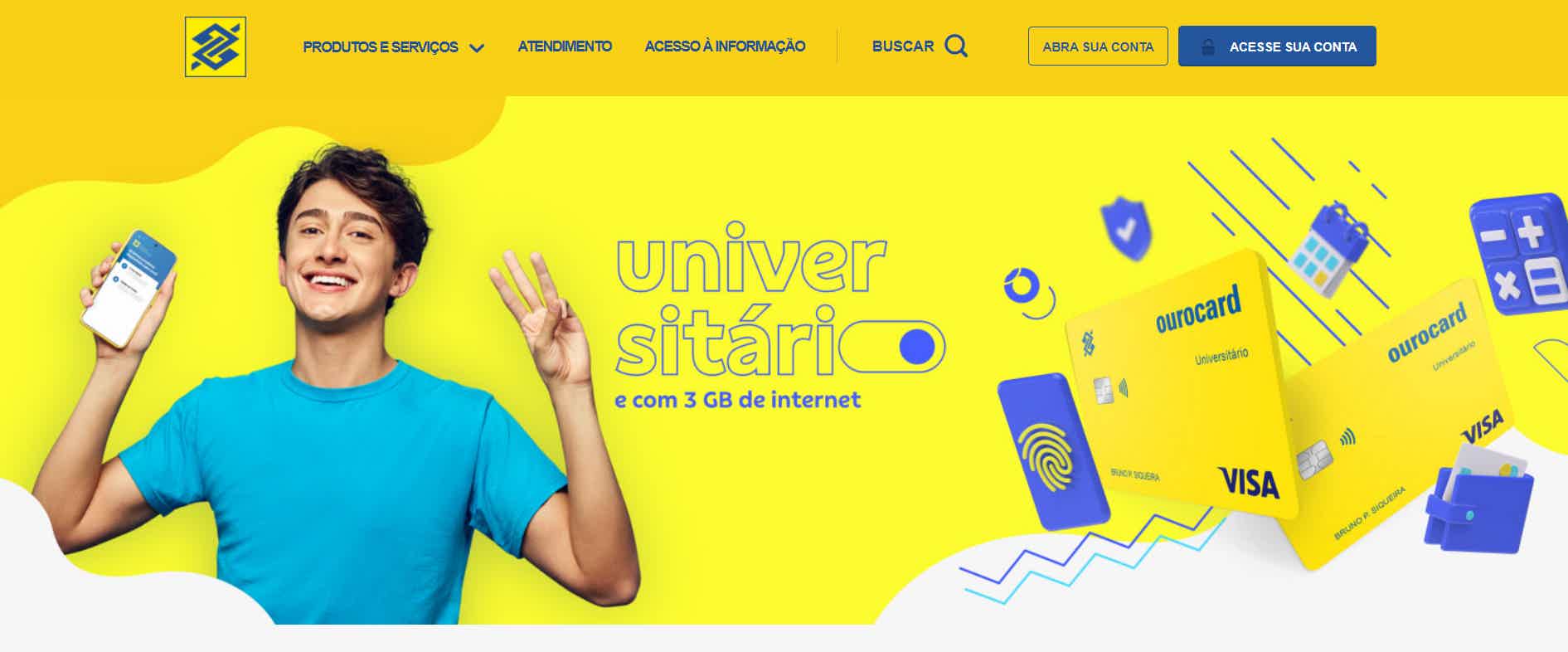

Discover the BB Universitário credit card

Discover the BB Universitário credit card, the card with exclusive benefits for students, such as a free annual fee! Check more here!

Keep Reading

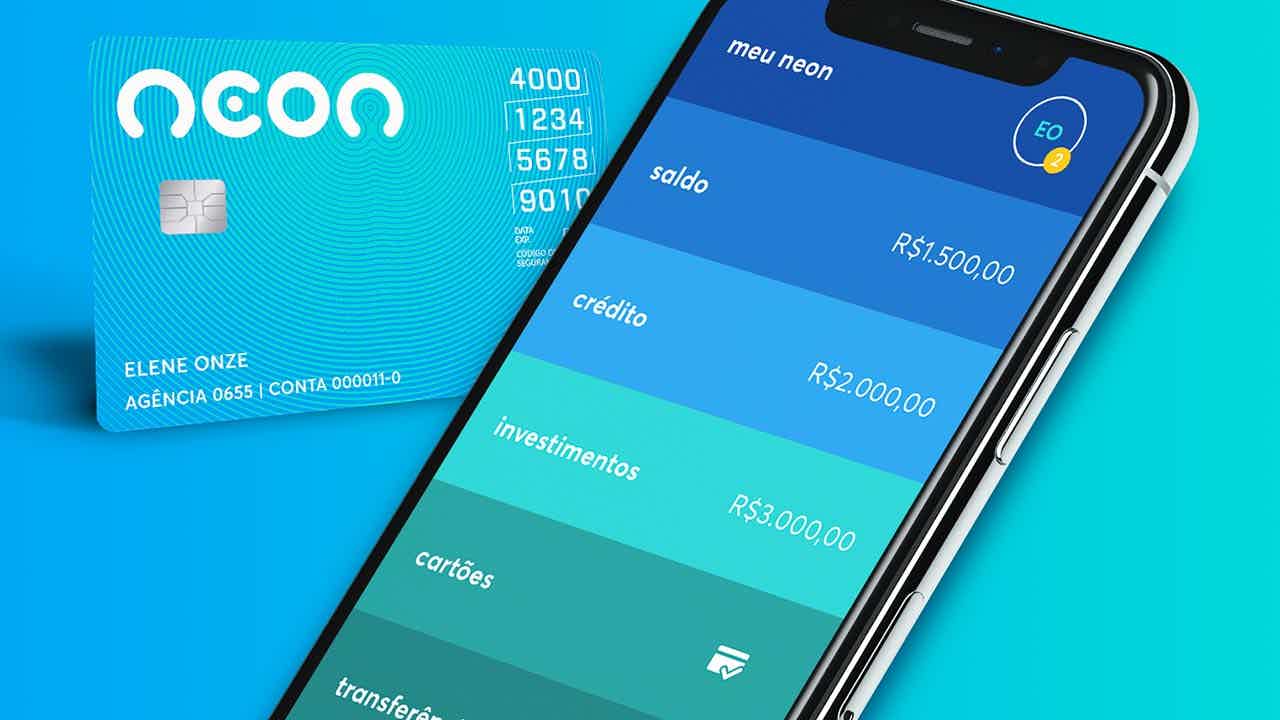

Neon Card or Pan Card: Which is Best for You?

Need to decide between the Neon Card or the Pan Card? So know that both have Visa flag discount programs! Learn more here!

Keep ReadingYou may also like

Caixa Tem releases up to R$1,000 in personal loans through the new application

Aimed at the low-income population, the new Caixa Tem credit may be the ideal solution to catch up on bills, but it is important to pay attention to the rates! Check out more about the loan here.

Keep Reading

Discover how to invest through the Inter app safely and in a few steps

Learning to invest your money shouldn't be a seven-headed bug. With Banco Inter's investment platform, it is possible to buy and sell securities in a practical and safe way. Want to know more? Read on!

Keep Reading

Discover the Credluz loan

With the Credluz personal loan, you have up to 24 months to pay and the amount is charged directly to your electricity bill! In addition, it is available for negatives. Read this post and learn more about it!

Keep Reading