Cards

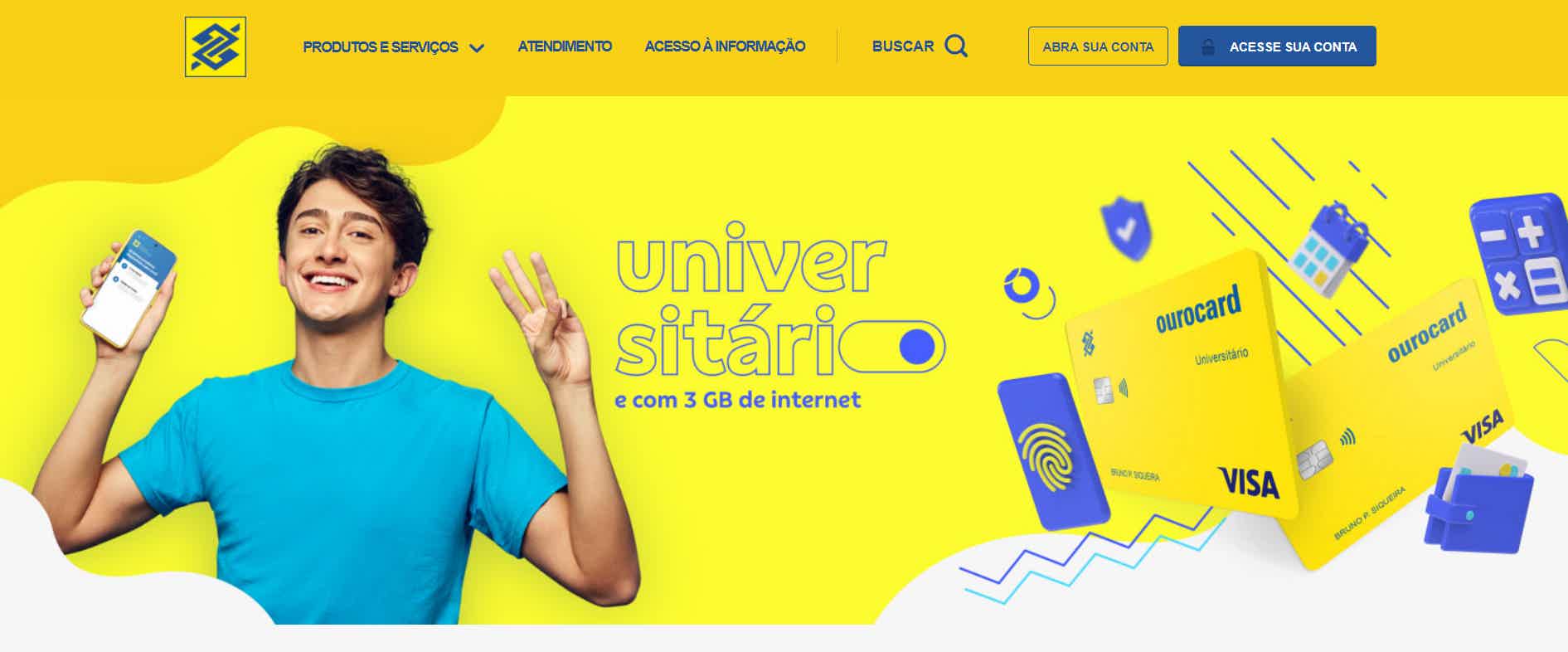

Discover the BB Universitário credit card

The BB Universitário credit card does not require proof of income when applying. In addition, you have an initial limit of R$1,500.00. There are many benefits aimed at the university student. Check more here!

Advertisement

BB Universitário Card: discounts on events and free annuity

Firstly, the BB Universitário credit card is aimed at young people, that is, university students. In fact, it offers several benefits, such as discounts on events, a personalized card and annuity waiver.

So, the bank makes a very easy credit analysis and the initial card limit is R$1,500.00. Want to know more about this financial product? So, read on and check it out!

How to apply for a BB Universitário card

The BB Universitário card has a simplified pre-analysis and does not require proof of income. See how to apply!

How does the BB Universitário credit card work?

Well, Banco do Brasil offers an exclusive Ourocard credit card for students, the BB Universitário. By the way, this is an easily accessible card, as it is aimed at young students. Therefore, requesting it is also very simple, you can do the whole process online.

In addition, the BB Universitário credit card has the Visa flag. That is, you can use it in thousands of establishments internationally that accept this flag.

Furthermore, as it is a university card, Banco do Brasil does not require a minimum income. However, at the time of application you will need to present proof of schooling, in addition to other personal documents.

There are also several other benefits of BB Universitário. So, continue reading to find out more.

What is the limit of the BB Universitário credit card?

Therefore, the card limit may vary according to the applicant's profile. However, BB Universitário has a pre-approved limit of R$1,500.00.

In addition, you do not need to prove income, since it is a card aimed at the university public.

Is the BB Universitário credit card worth it?

Although it is difficult for a young student to get credit, the Ourocard BB Universitário card offers an easy approval card with several benefits. However, there are many card options on the market. So, it is important to know the advantages and disadvantages before joining.

Benefits

First of all, the most attractive advantage of the BB Universitário credit card is the exemption from annual fees. So you don't have to worry about being charged surprise fees.

In addition, the card has the Visa brand and, therefore, has the benefits that the brand offers. To know more about them, you can go to the official Visa website. In fact, customers also have discounts on entertainment, culture and sports events sponsored by Banco do Brasil.

In addition, the cards offer contactless technology. That is, you make payments by approximation, in a safe and practical way. You can even customize your card with the image you want. That way you can leave the card even more with your face.

Finally, you still have the ease of the application to manage your expenses with the card. The app is available for both Android and iOS.

Disadvantages

Although the card is offered to students, you can only join if you are part of the stipulated age group between 16 and 28 years old. Therefore, even if you are a university student, if you are over 28 years old, you will not be able to apply.

As such, there are other card options on the market that may suit your needs. So, do a lot of research before signing up.

How to make a BB Universitário credit card?

Well, applying for this card is very simple. First you must download the Banco do Brasil application. Then, you must login to the app and register your password. In addition, you will need to take a photo of the necessary documents to submit for approval.

Then, when approved, you can access the application again and request your University card. But don't worry, it arrives in up to 10 business days for you.

Are you interested and want to know more details on how to join? So check out the content below and find out!

How to apply for a BB Universitário card

The BB Universitário card has a simplified pre-analysis and does not require proof of income. See how to apply!

About the author / Aline Barbosa

Reviewed by / Junior Aguiar

Senior Editor

Trending Topics

Artificial intelligence to create music: discover the 5 best websites

Discover how artificial intelligence is transforming the way music is created. Explore new sounds and possibilities with technology!

Keep Reading

FinanZero 2022 personal loan review

This FinanZero personal loan review will show you all the features, advantages and disadvantages of the service. Check out!

Keep Reading

How to increase the score with Serasa Turbo

Increasing your score with Serasa Turbo is a way to raise your score and improve your market visibility. Read this post and learn more.

Keep ReadingYou may also like

How to open a BBVA Gestão current account

The BBVA Gestão current account has everything you need to manage your company's finances. Because, with it, it is possible to centralize the balances in a single current account. To learn more about this complete option and how to open an account, just read on with us!

Keep Reading

Confira quais são documentos exigidos para o IRPF 2022 pela Receita Federal

O prazo de entrega do IRPF 2022 já começou, e para não correr o risco de preencher o documento de forma incorreta, é importante saber quais os documentos são exigidos pela Receita. Então, saiba quais são eles aqui!

Keep Reading

Discover the MOVA Loan

MOVA loan is a novelty that appeared in the Brazilian financial market, with better conditions and without intermediary banks. Check it out!

Keep Reading