Cards

7 frequently asked questions about the CEA card

Check out our post and find out everything about the CEA card that offers 10% discount on the first purchase made in CEA stores, installments and unique conditions, such as paying in 3 interest-free installments on your telephone, water and electricity bills.

Advertisement

Learn all about this financial product

If you like shopping at CEA stores, you will be interested in this card. Well, with the CEA card you have exclusive discounts and installments at the chain's stores. So, continue reading to check out the answers to frequently asked questions about this financial product. Let's go!

| Annuity | R$ 221.88 |

| minimum income | Minimum wage |

| Flag | visa gold |

| Roof | International |

| Benefits | Discount on first purchase differentiated installment plan Theft insurance and assistance Withdraw directly from C&A stores and the Banco24horas network |

How to apply for the C&A Bradescard card

The C&A Bradescard card allows customers to make purchases with exclusive benefits at any store in the network. So, request it right now.

Everything you need to know about the CEA card

Now, it’s time to check out the card’s main frequently asked questions. Let's go!

1. What is the annual fee and coverage for the CEA card?

So, the CEA card charges an annual fee of R$ 221.88, this means that, in order for you to have access to all the advantages and services of the financial product, you will need to pay this fee every year, being able to divide it up to 12 times.

And, in addition, the card has international coverage, that is, you can use it in any CEA store around the world and in partner establishments of CEA, Bradesco bank and the brand. So, you can already imagine the number of available options you have, right?

2. What are the card fees and charges?

As we mentioned, the card charges an annual fee of R$221.88 reais, as well as requiring proof of a minimum income of one minimum wage, that is, if you cannot prove your income, you will not be able to apply for your card.

It is worth highlighting that the revolving interest of the financial product is 15.90% am. Just like you have to pay R$ 12.00 and R$ 16.00 to make national and international withdrawals, respectively.

3. What is the flag and its benefits?

Still about the card, let's talk about the flag. Therefore, the brand that integrates the card is Visa. And, through it, you have access to several benefits, such as the Vai de Visa Program, purchase protection insurance, 24-hour Visa assistance, original extended guaranteed insurance, price protection insurance, among others.

4. What are the advantages of the CEA card?

Among the advantages of the CEA card, the first of which is the fact that you can request up to two additional cards to the card holder.

And, in addition, you have insurance and assistance against theft, meaning the card gives you all the security you need so you can make purchases anywhere in the world.

Furthermore, it has separate limits for purchases and withdrawals, as well as you can make withdrawals directly at C&A stores and on the Banco24Horas network and also get a 10% discount on your first CEA purchase.

Furthermore, you can pay water, electricity and telephone bills in up to 3 interest-free installments, being a great help in keeping your main household bills up to date.

Discover the CEA Bradescard credit card

The CEA Bradescard credit card is offered by one of the most famous clothing stores in Brazil. Check out the advantages here and see how to order.

5. What are the disadvantages of the CEA card?

Despite having several advantages, the card has some negative points. Initially, the fact that it charges an annual fee and requires a minimum income are points that may restrict some people's access to the card.

And, in addition, the fact that the card can only be requested in person, this is because there are several cards on the market that can be requested as digital 100%.

Furthermore, the card does not have any cashback or rewards program, meaning customers are unable to acquire traditional benefits that can be found in financial products offered on the market.

6. How does the card application work?

So, through the Bradesco bank app you can have access to your invoice, balance, limit and everything that happens with your credit card. And, in addition, through the CEA app you can make purchases using the card.

7. How to apply for the CEA card?

So, to request the CEA card, you need to go to any of the CEA stores in person, with personal documents, such as proof of income, proof of residence, ID and CPF, in hand to order your card and wait credit analysis.

So, to learn step by step how to apply for the CEA card, click on the recommended content below.

How to apply for the C&A Bradescard card

Apply now for this card full of exclusive advantages with the Visa brand.

About the author / Joyce Viana

Reviewed by / Junior Aguiar

Senior Editor

Trending Topics

How to open a Porto Seguro account

Learn step-by-step on how to open a Porto Seguro account and have an account with guaranteed protection, cashback and free 100%!

Keep Reading

5 low-income home loan options

Do you need a mortgage for low income? We'll show you 5 options for you to hire. Continue reading and find out!

Keep Reading

Discover the Avista credit card

The Avista credit card is a great option for anyone looking for a card without a lot of bureaucracy. Think this is the card for you? Check out!

Keep ReadingYou may also like

Is it mandatory to declare the purchase of a motorcycle in the 2022 Income Tax?

The deadline for delivering the Income Tax declaration is approaching, and many taxpayers still do not know the conditions for including vehicles purchased in the base year. Learn more about it here!

Keep Reading

How to open a Best Non-Resident current account

The Best Non-Resident current account is a great option for those outside of Portugal who want to carry out their transactions in different foreign currencies, in addition to taking advantage of several exclusive benefits. Check here how to open the account.

Keep Reading

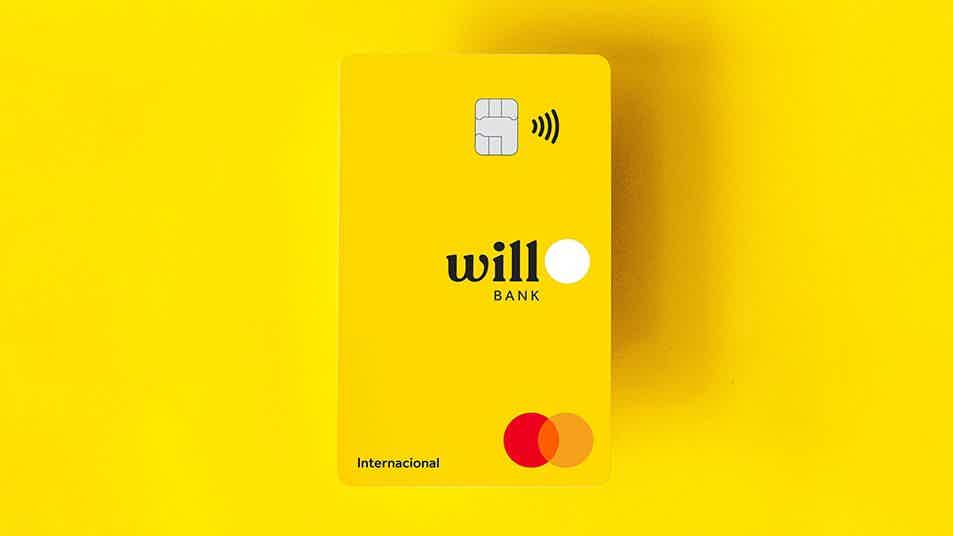

Will Bank 2022 card review

The Will Bank card is the ideal product for anyone looking for a digital account card. This is because it offers numerous benefits to its users without charging anything for it. Want to know more? Check out our review.

Keep Reading