Cards

8 main questions about Americanas card

Do you know how to apply for the Americanas card? Do you know how long it takes to get approved? Today we are going to answer the main questions about the Americanas card. Follow!

Advertisement

Learn all about this financial product

The Lojas Americanas credit card is a card that works to offer more comfort and security to the chain's customers. Thus, at the time of the request, several questions arise for customers, so if you want to know about the main questions about the Americanas card, continue reading and check it out!

How to apply for the Americanas card

In this quick article, you will find out exactly how to order your Americanas card in a practical way.

Discover the 8 main questions about Americanas cards

1. What is the Lojas Americanas card limit?

Initially, the limit amount is released after credit analysis.

For example, you can have a limit of R$450.00 or a limit of more than R$5,000.00.

This will depend on the analysis of several factors. Therefore, before opting for this card, check your CPF status, your credit score and the institution's criteria to get an idea of how much your limit would be.

2. What is the annual fee for the Americanas card?

So, the annual fee for the Americanas card is 12x R$15.70, one of the best annual fees on the market.

3. What do I need to apply for a Lojas Americanas card?

Well, to request it, you just need to have proof of address, proof of income, CPF and RG, as well as other documents that may be requested when ordering the card.

The process can be done both on the official website and in physical stores in Americanas.

4. How do I know if the Americanas card has been approved?

So, don't worry, because the American stores will send you an email informing you of approval or rejection.

And, in addition, you can also receive an SMS message on your cell phone at the time of the request made on the institution's website.

5. How long does it take to approve an Americanas credit card?

Well, Banco Cetelem responsible for issuing the financial product takes approximately 10 days to approve the card application.

And after that period, you can receive the card at your residence within 14 days.

6. How does the Americanas credit card work?

So, the Americanas credit card is a financial product created by Lojas Americanas to bring more convenience to customers who usually shop frequently at the store.

And, in addition, it has an annual fee considered low in relation to other cards on the market.

Just as it has exclusive discounts and offers at Americanas stores, additional credit for purchases in store in installments, as well as an additional card.

The Lojas Americanas card also has a cashback program, that is, you receive cash back on all your purchases.

In addition, it has a Visa flag, so customers can enjoy many advantages associated with it.

It also has international coverage, that is, you can shop at partner establishments and at national or foreign stores.

Know all the features of the card

In today's article, you will find out exactly all the features of the Americanas card and see if it is an option for you.

7. What are the advantages and disadvantages of the card?

Well, the advantages of the Americanas card are many, the first of which is the fact that it is an international card, that is, you can shop at national and foreign establishments.

And, in addition, it has a Visa flag. Therefore, you can enjoy many associated advantages, such as the Vai de Visa program.

Additionally, Americanas stores customers enjoy exclusive discounts and installments when making purchases with the Americanas card.

Another advantage is that you get access to the Mais Sorrisos Program where you can accumulate points whenever you use the card and exchange it for products.

On the other hand, Americanas also have some disadvantages, for example, a rigorous and thorough credit analysis.

And, in addition, the institution also charges an annuity of 12 installments of R$ 15.70, as well as fees for emergency credit assessment, revolving credit, withdrawals and other services offered by the store.

Therefore, before opting for this card, analyze and compare it with other cards on the market to find out if it is the best option.

8. Who is the card for?

Therefore, the Lojas Americanas card is indicated for customers who like to shop online, as most of the advantages are discounts and installments in the Americanas stores themselves.

So, if you want to apply for your card today, click on the recommended content below for step-by-step instructions.

How to apply for an Americanas card

In this quick article, you will find out exactly how to order your Americanas card in a practical way.

About the author / Joyce Viana

Reviewed by / Junior Aguiar

Senior Editor

Trending Topics

Find out how to get your license for free

Get to know the step-by-step process for enrolling CNH Social, see all the requirements and the States participating in the program

Keep Reading

13 digital accounts with credit card

Want to find out what digital credit card accounts are? In this article, we will show you the best options on the market. Read more!

Keep Reading

Is it possible to withdraw money without a card?

Did you know that it is possible to withdraw money without a card? In this article, we will show you how this process works. Read it now and check it out!

Keep ReadingYou may also like

Discover the Banco Pan loan

The Banco Pan loan is ideal for INSS retirees and pensioners, civil servants or pensioners. Learn how it works and enjoy the benefits!

Keep Reading

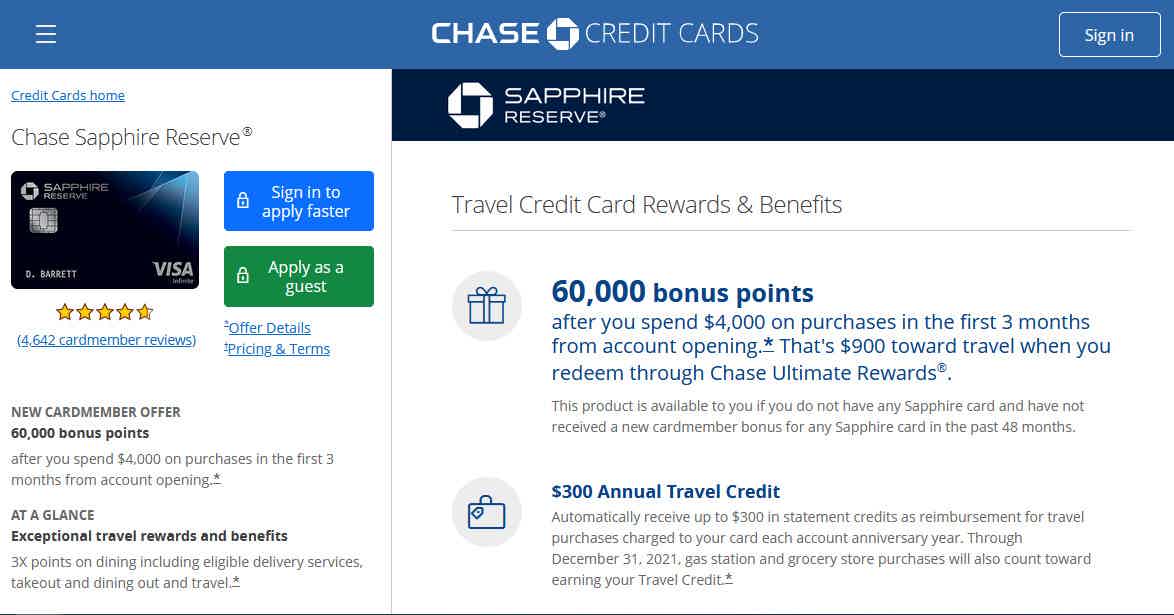

How to Apply for the Chase Sapphire Reserve Card

Traveling without worries, being able to receive part of the expenses back and even bonuses and points for the next vacation is all you need. Want to know how to have it? Follow here.

Keep Reading

Caixa Econômica Federal releases credit of up to R$1 thousand for people with name restrictions!

Getting a loan is not the simplest task when you have a dirty name in the market. With that in mind, Caixa Econômica created the Sim Digital. The project seeks to help people with name restrictions and MEIs to get lines of credit with special conditions. Know more.

Keep Reading