Tips

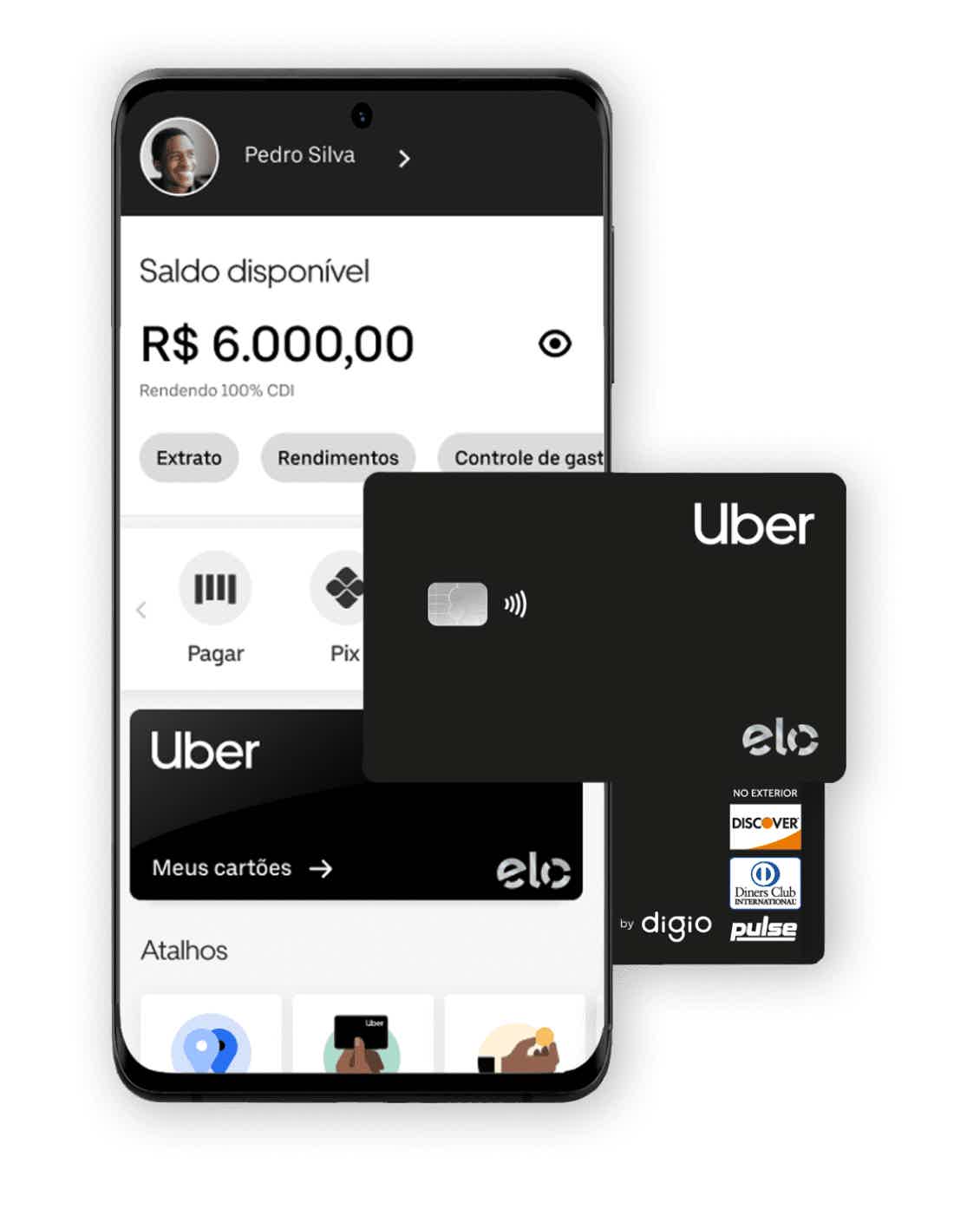

Discover the digital Uber account

With the Uber digital account, you have instant transfers of your rides and deliveries and you can even make transfers and withdrawals. Check more here!

Advertisement

What is the digital Uber account and how does it work?

The Uber digital account arrived to make life easier for all those who use the platform to earn money. With it, partner drivers and couriers have several advantages and functions available.

So, let's talk about this novelty from Uber so that you know all its features.

Well, the Uber Conta is a digital account created by Uber in partnership with the Digio bank.

One of its main characteristics is that the user receives instant transfers of his earnings after the race or delivery. Before the account, this transfer was weekly. Now, the value is already available as soon as you perform the service. Much more practical and useful, isn't it?

Using its functions is also very easy, as all control is digital, done through the Uber Conta app.

In addition, it is important to remember that the use of services will vary according to the category of the holder in Uber Pro, the loyalty program for partners.

So, if you are an Uber driver or delivery person, check out all the pros and cons of the digital account below. Thus, you know all its features and decide if it is a good option for your needs. Let's go?

What are the advantages of the Uber digital account?

Well, let's start by talking about the positive points of Uber Conta.

As already mentioned, its main advantage is that you receive earnings from rides and deliveries instantly, as soon as the service ends. Soon, it becomes much easier to control your finances and have more control over your daily earnings.

In addition, your account control is 100% digital. So, you can use the app to check your balance, make transfers and pay bills, among many other functions. In addition, you can also make withdrawals at ATMs in the Banco24Horas network without paying anything.

Another benefit is that the Uber card has the Elo brand and has no annual fee. So, in addition to not having to worry about this card expense, you can still take advantage of several advantages offered by the brand, such as issuing virtual cards and payment by QR Code.

In addition, you can make free transfers using the PIX and at least one free TED transfer per month is available.

One more novelty is that the money that is in the balance of your digital account is automatically invested with yields of at least 100% of the CDI. This percentage is greater than the savings yield and you can redeem the dividends every day.

In addition, the Uber digital account also offers an exclusive cashback program to its users. So, when you shop at Uber Loja, you get part of the money you spend back and even get special discounts. There are more than 100 partner virtual stores, such as Submarino and Netshoes, among many others.

Finally, partners will be able to try the Veloe service with no monthly fee for two years. It makes it easier for users to pay tolls and parking.

What are the downsides?

Now that we've talked about the advantages of the Uber digital account, let's talk about its negative points so you don't have any surprises.

So, the first downside is that your benefits will be based on the user's category in Uber Pro. That is, the higher your level, the greater the advantages.

For example, although PIX transfers are unlimited and free for all users, TEDs and withdrawals will vary. Check below the category and number of free operations per month:

- At Uber Azul there are 2 transfers by TED and 1 monthly withdrawal.

- As for Uber Gold, there are 2 TEDs and 2 withdrawals.

- Uber Platina is entitled to 4 monthly TEDs and 4 withdrawals.

- And Uber Diamante can perform unlimited TEDs and withdrawals.

In addition, the percentage of cashback received in the benefit program also varies according to your level in Uber Pro. So, the cashback will be greater in the higher categories, reaching up to 13% of the total spent.

Another disadvantage is that the account is being gradually released to partners, so not everyone will have access to the service. However, the company intends to implement the complete operation in a few months so that everyone can take advantage of its resources.

It is worth remembering that drivers and couriers who do not want to join the Uber Conta can continue to receive weekly transfers in their preferred bank account.

How to make the Uber digital account?

So, now that you know everything about the Uber Conta, find out how to create yours and enjoy all its benefits.

First, you must access the website www.ubercontabrasil.com.br and click on the “I want to open my account” button.

Then, fill in your requested personal data and send a photo of your document. In addition, you must read and accept the Privacy Policy and Terms of Use.

In addition, you will have the option of contracting Veloe, if you are not yet a user of the service.

Finally, you need to download the application that is available for both Android and iOS systems. To do this, go to Google Play or the App Store, search for Uber Conta in the search bar and click on the install button.

Ready! Now you can access your account through the application and use all its functions in a practical and easy way.

However, as already mentioned, the Uber digital account is being gradually released to partner drivers and couriers. So, after registering, you will receive a communication by email and through the application as soon as the account is released for you.

Therefore, if you have not yet received a notification from Uber, you must wait for the invitation informing you that the account is available to you.

Now you know everything about Uber Conta! So, analyze all its positive and negative points and decide if it is a good option for your financial life.

And if you want to continue reading and discover more tips on finance, check out our recommended content below!

Discover the Uber credit card

With the Uber credit card, you can participate in the Mastercard Surpreenda or Vai de Visa programs. Check here for more benefits!

Trending Topics

What is the best payroll loan 2021?

Choose from the 7 best payroll loan options 2021 and enjoy all the advantages of a credit that accepts negatives. Check out!

Keep Reading

Which score is good for a credit card?

Find out which score is good for credit card approval and how to quickly increase your score with Serasa Turbo Score. Check out!

Keep Reading

How to choose the best PagBank card?

Find out once and for all which is the best PagBank card for you by knowing all 4 options that the company offers!

Keep ReadingYou may also like

Nubank Ultraviolet Card or BMG Card: which one is better?

When it comes to the advantages of credit cards, some people are at a loss. That's because many don't know that it's possible to have plastic to go shopping and still earn money. With the Nubank Ultravioleta card or the BMG card you can have both. Want to know which is the best? So, follow our comparative content below.

Keep Reading

Real Estate Auction Offers Amazing Discounts In March!

For those who want to fulfill the dream of owning their own home, the real estate auction can be an excellent alternative. In this sense, several online platforms are offering properties with discounts of up to 80%! Check more here.

Keep Reading

Discover the International Superdigital card

Do you know the Superdigital Internacional card? It offers many benefits. Want to know which ones? So, read on and check it out!

Keep Reading