Cards

Méliuz Card or Neon Card: which one is best for you?

If you are in doubt between the Méliuz card or the Neon card, know that both have very different proposals such as cashback and digital account. Check out!

Advertisement

Find out which credit card to choose

Initially, the Méliuz card or Neon card, two are very simple credit card options to apply for, which provide programs such as cashback, no annual fee and several other options for you to make an evaluation and see which is the best option for you!

So, let's show you a little more about Méliuz and Neon cards that have several advantages worth checking out! Check out:

How to apply for the Neon card

Discover now how to order your neon card and enjoy the benefits associated with the international Visa flag.

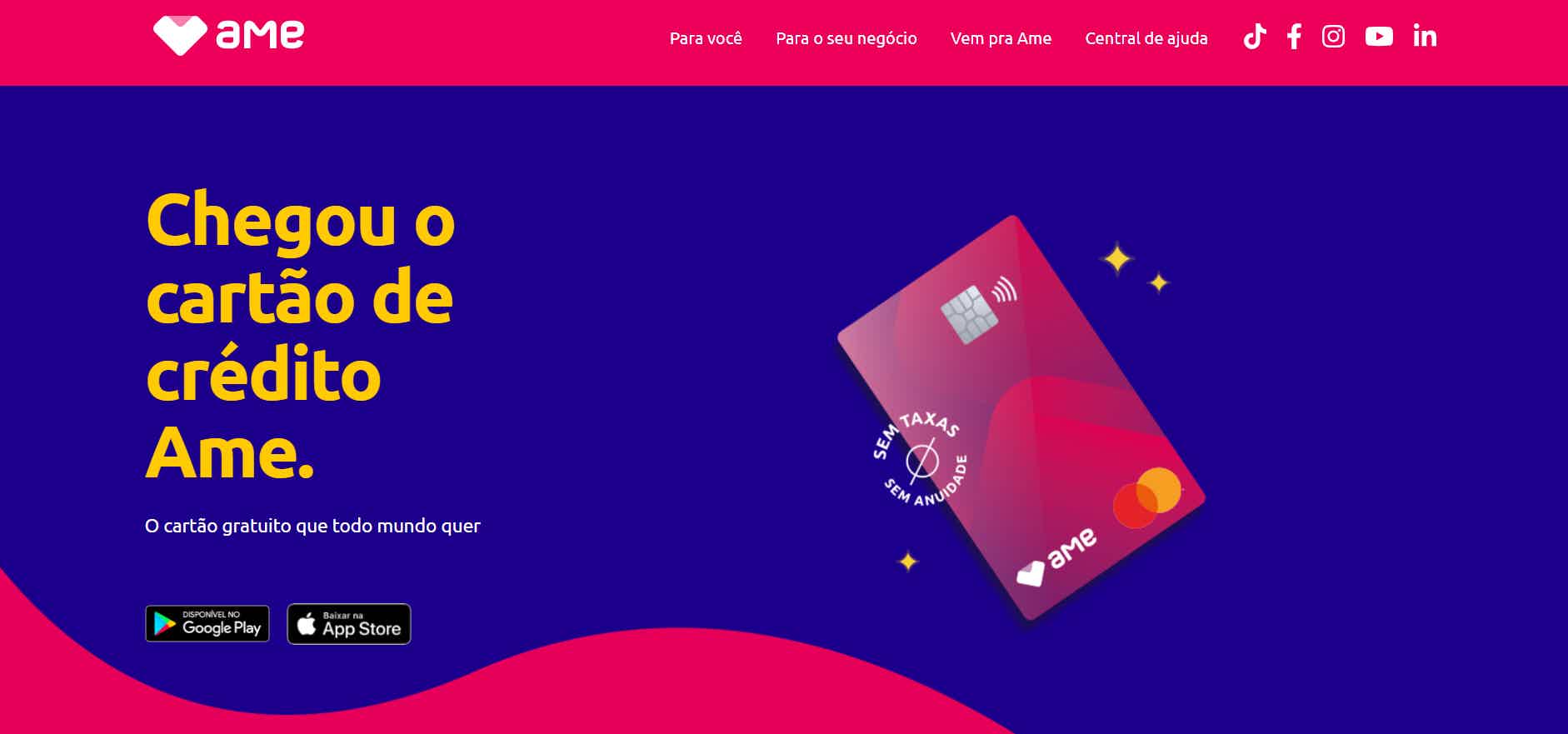

How to apply for AME card

The AME card offers exclusive benefits, in addition to cashback and international coverage with the Mastercard brand. See here how to apply!

Méliuz card

Initially, the Méliuz card is issued by Banco Pan and is considered one of the best cards in Brazil. This is because it has no annuity and also returns up to 1.8% of the money. So let's get to know a little more about the Méliuz credit card.

Well, the Méliuz card is issued by the Pan bank, but it is not linked to any account. That is, to apply for the card, you do not need to be an account holder at Banco Pan or any other bank, just apply normally.

Furthermore, the Méliuz card presents a differentiated cashback proposal, offering 1.8% of cashback to users, who can redeem the amount in their checking or savings accounts when the minimum limit of R$ 20 is reached.

To apply for the Méliuz card, just download the Méliuz application, which is available in versions for Android and iOs, or, you can access the Méliuz website. After that, fill in all the personal data and wait for Banco Pan to carry out the credit analysis, which usually takes about 20 days.

So, if the Méliuz card is approved, it will be sent within a maximum period of 15 working days. It has a Mastercard flag, international coverage, that is, you can shop in stores in Brazil and in the world, as long as it is in physical stores.

Therefore, Méliuz has every reason to be considered one of the best credit cards in Brazil, due to the various advantages it provides to its customers and, for working towards security, convenience and transparency in its services!

neon card

At first, the Neon card is a credit card with no annual fee, that is, no fee for annual maintenance of the credit card, with international coverage, allowing you to purchase products and services in national and international stores. Furthermore, it is conditioned to an exclusive digital account for customers.

Well, in the Neon bank digital account, you can access various financial services, including transfers, payment of bills and access to all your credit card transactions, bringing security and transparency.

So, the digital account of the Neon bank is 100% digital and, when registering with the Neon bank, you will be able to acquire the digital and physical versions of the Neon card, being able to use it in any of the two versions. That is, the technology of the Neon bank is another attractive factor.

To apply for the Neon card is very intuitive. It is enough for the user to be over 18 years of age, with an updated RG and CPF, and request it through the Neon bank app. After making the request, Neon bank will do a credit analysis to find out if your card will be approved or not.

Therefore, the Neon card is another advantageous and super attractive credit card option that also contains a technological app and full of functions! So, if you're looking for convenience and a card that gives you several advantages, Neon is a great option!

What are the advantages of the Méliuz card?

So, let’s get to know the advantages of the Méliuz card:

- At first, the first advantage is the absence of annuity. That is, you do not pay a maintenance fee to keep using your credit card;

- Another advantage is the Mastercard brand with international coverage. So, you can shop in Brazil and anywhere in the world and still have access to Mastercard programs and offers;

- Cashback program in which the Méliuz card returns up to 1.8% of the money to be used as you wish;

- Another advantage is an app so you can track your card statement and cashback (you can track it on the website too);

- And yet, you don't need to have an account to access the credit card, just make the request through the app or the website;

- There are several partner stores like Amazon; Burger King; Bahia Houses; Netflix; Damn Raia, Netshoes; iFood; Cultura Bookstore; Spotify; Americans; Urban fish; Fast shop; Havana; AliExpress and several other partner stores to bring more comfort to customers;

- Ame + Méliuz Program: Program that works as a digital wallet that you can use to make purchases in stores such as Americanas, Submarino and also Shoptime.

Therefore, the Méliuz card brings several offers, mainly for people who like to shop with discounts and exclusive offers!

What are the advantages of the Neon card?

Well, let's get to know the advantages that the Neon credit card has:

- At first, the first advantage of the Neon card is the absence of annuity, that is, there is no charge for maintaining the credit card;

- Another advantage is the Neon bank app, where you can access all card movements, the statement, make transfers and even pay bills through the Neon bank app;

- And in addition, the Neon card has the Visa flag with international coverage, being able to make purchases in stores inside and outside Brazil;

- Invoice payment can be made via direct debit;

- Requesting and terminating the Neon card is completely free and can be done through the Neon bank app itself. That's because the card is conditioned to a digital account;

- A free monthly withdrawal from the 24-hour bank.

Therefore, the Neon card is an attractive option, but it requires you to register with the Banco Neon digital account to have access to the credit card!

What are the disadvantages of the Méliuz card?

Well, among the disadvantages of the Méliuz card, one of them is the fact that there is no virtual card for online purchases. That is, purchases need to be made in physical stores, which becomes a very bad idea since most current cards allow online purchases.

And besides, the withdrawal function is only available to some users, obeying certain criteria, which is also a big disadvantage. And the card does not have a mileage accrual program, which is also a program that exists in several card models.

What are the disadvantages of the Neon card?

At first, one of the biggest disadvantages of the Neon card is the fees charged for the services offered by Banco Neon. This is because the bank charges fees for transfers, invoice installments and interest for late payment of invoices.

And in addition, another disadvantage of the Neon card is the approval of the card, which tends to take a little longer than other digital bank cards. That's because Neon does a credit analysis, so the analysis is done at the credit bureaus and therefore takes a little longer.

Méliuz Card or Neon Card: Which is Best for You?

Well, the Méliuz card or Neon card are safe, transparent card options that offer very different proposals such as cashback and digital account. So, carefully analyzing the advantages and disadvantages of each one of them is super important!

So see which of these options is best for you and which one suits your interests best! And if you still have doubts, see below a recommended content of new credit cards for you to review! It is recommended that you review, especially if you have a dirty name!

Pan Card or Original Card: which one to choose?

To decide between the Pan card or the Original Card, know that both have programs like cashback and approximation payment! Check out!

About the author / Joyce Viana

Reviewed by / Junior Aguiar

Senior Editor

Trending Topics

Bradesco Prime Platinum Card or Sicoob Platinum Card: which is better?

Confused about which card to choose? Find out here the differences between the Bradesco Prime Platinum card or the Sicoob Platinum card and decide!

Keep Reading

Samsung free courses: technology training

Samsung's free courses offer knowledge in various aspects of the area. Find out here how they work and how to apply.

Keep Reading

Discover the APag card machine

The APag card machine can offer a free digital account and already has access to an internet connection. Learn more about her here!

Keep ReadingYou may also like

Discover the BNI Europe card

The BNI Europa card is ideal for anyone looking for more facilities in their day-to-day life and an annual fee-free card. Do you want to see it? Continue reading here and learn all about this card option that will surprise you!

Keep Reading

Discover the Havan Credit Card

Learn all about the Havan card and buy with special discounts, exclusive installment conditions and much more convenience.

Keep Reading

Card machine with the lowest fee: Senhor Finance 2021 ranking

We know that choosing the ideal card machine for your business is not always an easy task. So we ranked those with the lowest rates in 2021. Want to know what they are? So check out the post below.

Keep Reading