Cards

How to apply for your Atacadão card in a simple way

Find out right now everything you need to do to apply for your wholesale card. Our team has separated the step by step for you to be able to submit your request today.

Advertisement

See how to apply below.

The Atacadão card is a simple but very functional card with great advantages, especially for those who are already customers of the chain. Today you will learn all about how to order yours.

Today's article is very straight to the point, so you'll learn step by step everything you need to apply for your Atacadão card.

This card is an excellent option for those who make frequent purchases on the Atacadão chain as a whole, that is, wholesale at drugstores and gas stations.

If you want to apply for the card right now, just click below

It is important that you know exactly the advantages and disadvantages of having the card so that you can make the right decision and not have problems in the future.

Documents required to apply for the Atacadão credit card

- Personal identification documents: CPF and RG or identity card.

- Proof of address.

- Proof of income

How to apply for an Atacadão credit card

You can apply for the Atacadão card at any of the chain's stores.

The answer on the credit analysis is instantaneous and you can leave the store with your card. You can also apply online, as follows:

1 – Access the Atacadão Card website and click on “order yours” to request your Atacadão card

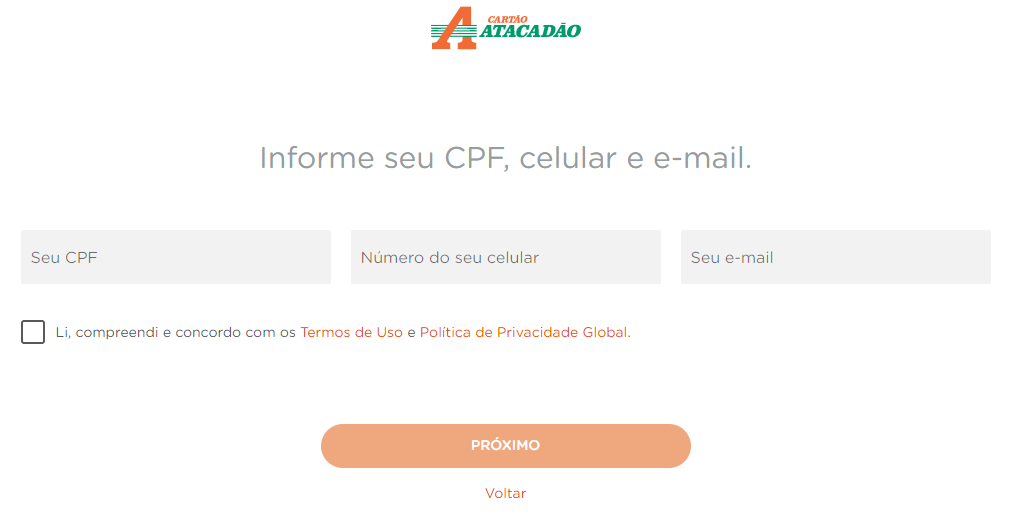

2 – After that, you will start to fill in the first data to continue the process to request your Atacadão card.

In this initial stage, you will provide your CPF, your cell phone number and your email as shown in the photo below.

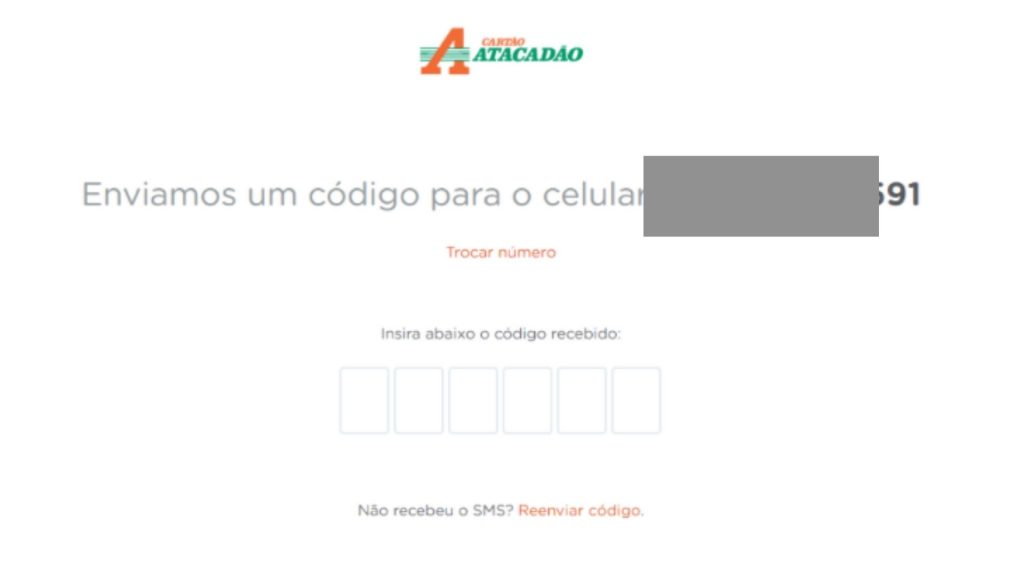

3 – They will send a confirmation code on your cell phone and you will fill it in normally.

If the code doesn't arrive on your cell phone, just ask them to resend the code. Thus, you will fill in the data to request the Atacadão card.

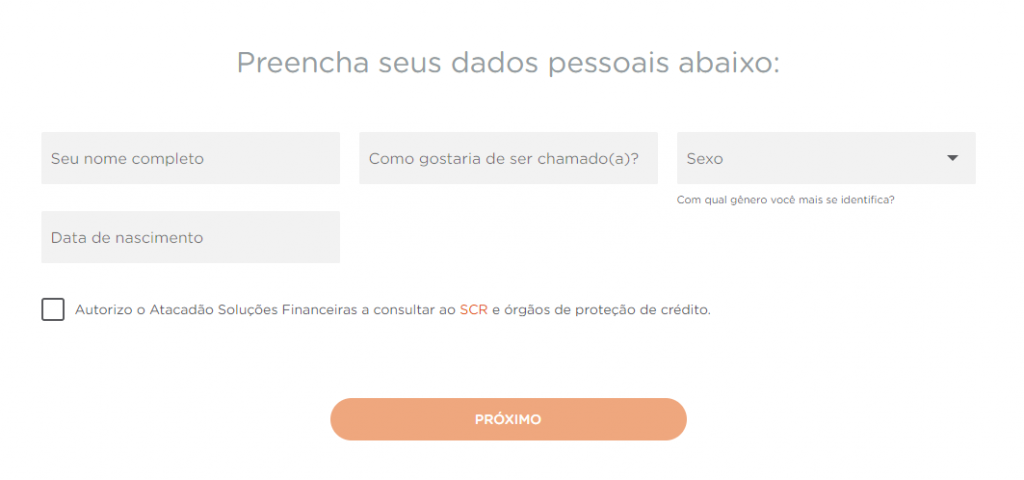

4 – After that, they keep asking for more personal information for the process to continue.

Here you will need to enter your full name, what you would like to be called, your gender and your date of birth.

5 – If necessary, you will provide more data and then just wait for more information via your email.

In general, the process to apply for the Atacadão card is very simple, you just need to provide your details and follow all the necessary steps. No major difficulties.

extra information

- To clarify doubts about the use of the Atacadão Card call: 4004-8899 – Metropolitan areas or 0800-722-8472 – Other locations.

- You are subject to credit analysis by the CSF SA bank, which is a financial institution that takes care of Carrefour and Atacadão cards.

If you want to clear up any doubts, want access to other technical information or even want to apply for the Atacadão card, just click on the button below and you will be redirected to the card's official website.

About the author / Gustavo Cezar

Reviewed by / Junior Aguiar

Senior Editor

Trending Topics

Believe Who Wants: check out how to participate in this framework

Find out in this post how the Believe in Who Wants framework works in practice and check out the main advantages of participating in it!

Keep Reading

8 best apps to learn English free

Do you want to know the best apps to learn English for free? See in this article some options for studying English on a daily basis.

Keep Reading

How to advance FGTS through Agibank? Check the process

Learn how to anticipate the FGTS through Agibank and what special conditions this bank can offer you in this credit modality!

Keep ReadingYou may also like

What are the consequences of delaying or not paying IPVA?

The property tax on motor vehicles, better known as IPVA, is an annual tax that must be paid in full to maintain vehicle regularization. But what happens if the taxpayer fails to make the payment? Check it out here!

Keep Reading

How to adjust BB card limit by Whatsapp?

Adjusting your credit card limit is now much more practical and easier. Don't depend on the app and Internet Banking anymore, take the opportunity to adjust the BB card limit via WhatsApp! Want to know how to use this feature and other bank services via WhatsApp? Read on!

Keep Reading

Get to know Bankinter Mortgage Credit

Do you already know Bankinter Mortgage Credit? If not yet, take the opportunity now to find out all about this credit that gives you up to 40 years to pay, allows amortizations and with online contracting. Check out!

Keep Reading