lists

7 personal finance tools

Want to organize your financial life but don't know how to start? Then see 7 personal finance tools that will help you.

Advertisement

personal finance tools

Many people seek to find good personal finance tools. Taking care of your own money has therefore become a major concern these days. In addition to managing it, people want to learn how to get the most out of their income.

However, this subject is still not as discussed as it should be. Thus, it is difficult to select these alternatives for financial care and control. For that, a lot of research is needed.

Therefore, this post will make this process a little easier. Here, you will stay on top of everything about the topic. See which are the best personal finance tools. Make your money work for you.

The current scenario and its relationship with finance

It hasn't been easy keeping the bills up to date. The budget is often cut and is not enough to deal with unforeseen events. Not to mention the lack of financial education.

Many people do not know how to manage their finances, as they have never had contact with it. Undoubtedly this impacts on the way the individual sees his money.

So then, these alternatives in the form of apps are excellent. They bring a more practical model of organizing your income. To live more peacefully, it is important to pay attention to this.

7 personal finance tools

There are several tools that can help you in this mission. Each of them has its own peculiarities. For this reason, the best alternative for those who decide is you. All based on your needs.

So, here are 7 extremely useful tools to better control your finances. See the pros and cons of them and choose which one is more interesting.

How to organize your finances: Step by step

Are your finances in a mess and don't know what else to do? See now the practical step-by-step to organize your financial life

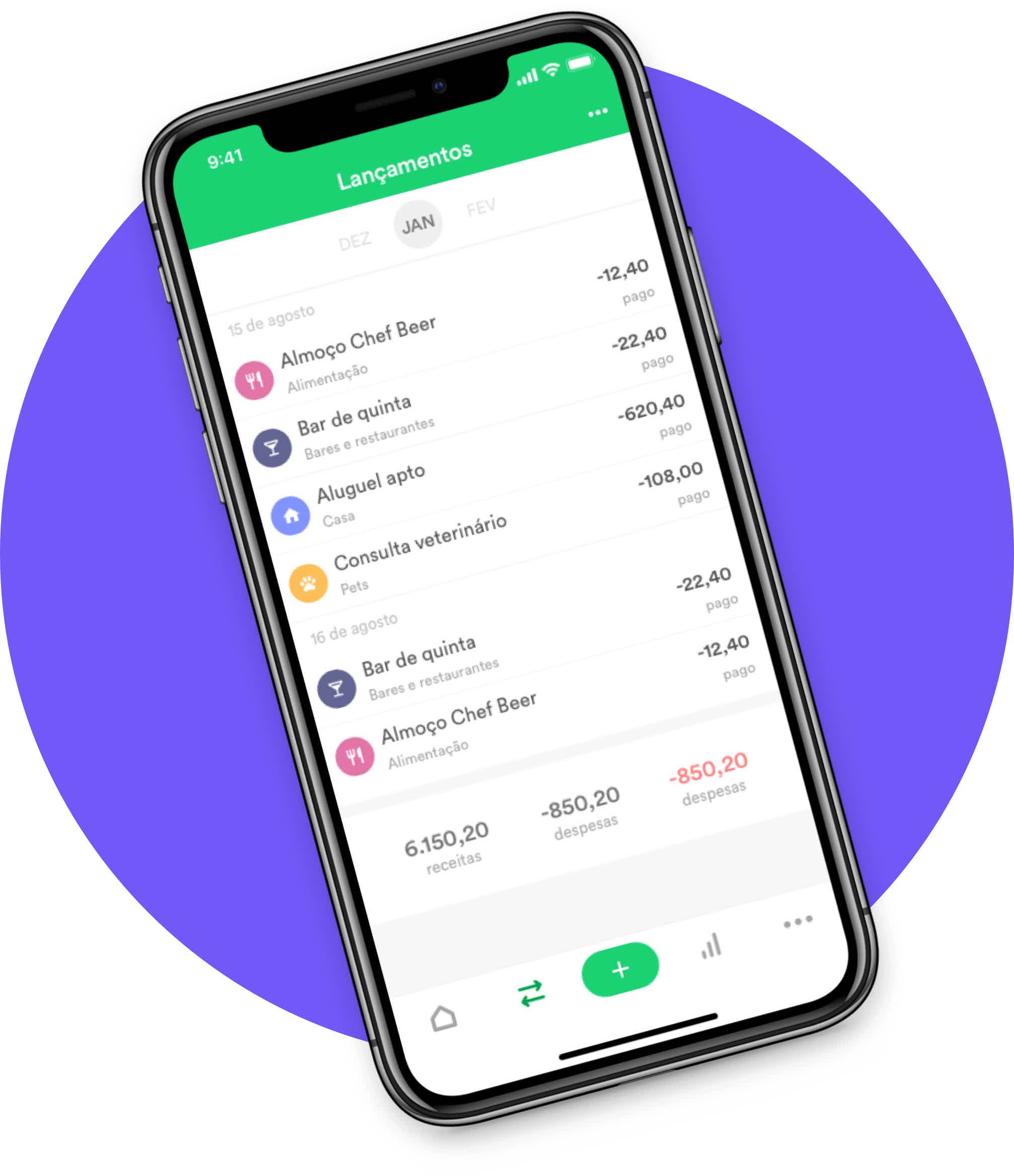

1- Organize Finance

The Organizze Finance application can be easily accessed through your browser. Also, it works on Android and iOS phones. Therefore, it is one of the simplest tools on this list.

However, this by no means means that it lacks incredible quality. So with this app you can set all your goals. Also, it is possible to place account expiration alerts.

In addition, you can control absolutely all your credit cards in one place. Many people complain that finance tools are not usually easy to understand.

However, that logic does not apply here. The look of Organizze is very simple and its interface is very intuitive. Thus, it fulfills its role well for all types of users.

This is therefore one of the personal finance tools It has a free and paid version. The first has some limitations.

However, this does not prevent its good use. Now, if you want access to all the features, you need to subscribe to a monthly plan. With it, many more options are unlocked.

2- My Savings

Another example of versatility is the Minhas Econômicas app. It works on iOS and Android browser. Therefore, it is a very interesting tool for those seeking simplicity and practice at the same time.

With this app, you can manage your finances without any problems. The most interesting thing about it is that you don't have to spend anything. Unlike many other examples on this list, it doesn't have a paid version.

So, to use it, just enter your data regarding what comes in and goes out monthly. Thus, it will generate graphs and spreadsheets to make it easier to understand your situation.

Although its advantage is that it is free, it also harms a little. Thus, it cannot provide many services to its users.

For example, you don't have the option to automate your information. Furthermore, it is not possible to import several financial operations at once.

However, if you are not looking for a lot of functionality, this application is ideal for maintaining basic personal control.

3- Pocket Guide

An application that has a very clear proposal. It seeks to help the user to carry out their financial planning. All this completely and without any complications.

To that end, it offers several interesting features. Among them, there is the categorization of expenses and the possibility of creating goals for each one of them. This tool works in your browser and on Android and iOS systems.

Guia Bolso has a number of benefits. The main thing is the ability to automatically synchronize your expenses and income. So, if you want to take advantage of this option, just provide your internet banking access data.

Now, you might be wondering if that wouldn't be dangerous at the very least. The tool warns that it uses a type of encryption to check your bank account.

That way, she can't perform any transaction through the app. So, you don't have to worry about this kind of risk. Even with that, many people don't feel safe sharing this information.

Therefore, this also ends up being one of its biggest disadvantages. Also remember that you can use Guia Bolso without this alternative. And just don't enable it.

5 tips to start your financial control

Financial control is not so easy in everyday life, is it? We don't always know where to start, but we know it's important. Then see 5 easy tips

4- Furniture

This is therefore one of the personal finance tools which has different ways of access. It is available to use in your browser or on mobile phones.

In the case of the latter, it doesn't matter if it's Android or iOS. The main objective of Mobilis is to help you when it comes to setting your own goals.

In addition, it is possible to track and record each expense. Not to mention that this application offers you a complete budget analysis. However, anyone who thinks that this report is difficult to understand is wrong.

It is laid out in the form of graphs, so that you can understand everything in just a second. Mobilis has numerous advantages in its use. The main one is in doubts about gratuity. You don't have to pay anything to use it.

However, it has 2 plans, one for free and one paid. In the first, you can classify all your income and expenses. Also, the user can synchronize the information with the server daily.

Therefore, you do not lose any data in case of device defect or theft. In this way, the “free” version is very interesting. However, it does have its limitations.

So if you want to use it, understand some points. You will have a limited number of releases in the month here.

Not to mention that this version doesn't allow you to access the web. However, for those just starting out, it's perfectly viable. It all depends on your real organization needs.

5- Mr. Money as personal finance tools

You don't have to spend a penny to use Mr. Money. This tool only requires you to register with some simple data. With that, you can start taking control of your finances.

The site in question has a very strict security scheme. Also, it makes use of a technology so that you and any user have your information protected.

This is the same alternative, SSL used by banking websites. So, all your data is properly encrypted even before it travels over the internet.

Also, if you use Chrome, know that the site here has an extension that can be easily installed. Thus, recording your expenses and earnings is even simpler.

Furthermore, Mr. Money features a mobile version. All of them are complete, so you can use them however you like. Finally, there is a more complete paid version.

However, you can safely use the free option. It meets the needs of most of its users very well. Therefore, it is worth using.

6- Finance: One of the personal finance tools

An application that allows you to manage your finances more intelligently. With it, you can sync more than one bank account.

Finance therefore has a very interesting option. One of personal finance tools that helps you control your expenses in a very simple way. Just take pictures of your vouchers.

In addition, it has the other various functions. Among the main ones, it is possible to mention, cash flow, how much to spend and what is the best option: installments or cash. The application provides a shopping list. This last one has 3 alternatives.

Thus, there are day-to-day purchases, medium-term purchases and dreams. So Finance is a very complete option for anyone who wants to record every step of their expenses and organize them.

7- Citizen's Calculator

A tool made available directly by the Central Bank. It works based on information provided by the user. Thus, it manages to help the consumer in the expenses of each day.

The Citizen's Calculator is a free application. It operates on Android, iOS and Windows Phone. Among its functions, it can help you solve the following questions.

- What are the pros and cons of buying in installments and in cash?

- Which transaction is more interesting when you take interest into account?

- Saving money: is it better to have savings or invest in an application?

In addition to helping you control your finances, this tool allows you to think bigger. With it, you can access the following information.

- price index;

- Reference rate;

- Savings;

- SELIC;

- CDI.

All these points are important for you to make your money work for your own benefit. Thus, understanding how the universe of investments works becomes easier and didactic.

Finance Apps: Can Everyone Use It?

Without a shadow of a doubt. Now, in fact, the apps are ideal for those who are more tuned in and use their cell phones for a long time. The advantage of this is that you are always close to this tool.

That way, you can update any changes to your financial planning. Here, you have a variety to choose from. There are numerous applications, each with different functions.

The above list already gives you a good idea of how interesting they can be. In addition, many tools allow automatic synchronization with some bank accounts.

This is a pro and a con at the same time. It has been proven that taking money in hand causes a much greater emotional impact. This logic remains when manually updating spend.

Therefore, this alternative can make you lose some of that feeling. Even so, many people prefer the apps.

Everything is a matter of conscience and habit. Anyway, anyone can use these personal finance tools without any problems.

Are spreadsheets good tools to control your personal finances?

Spreadsheets are one of the tools most recommended by financial educators. However, even today they are seen as very complex. So, if you don't have much affinity with Excel, you will find it difficult to handle them.

Even so, the spreadsheet is useful. With it, it is possible to have a kind of X-ray of your finances. In this way, you can have a clear view of which categories are spending more.

Not to mention it helps you compare your behavior on a monthly basis. With this, you become able to make spending projections and set up a reserve. In the spreadsheet file, it is more practical to visualize the numbers for the entire year.

This allows you to understand what developments have emerged and where you need to improve. In addition, this tool serves as a good incentive not to spend yourself unnecessarily. Many people believe that they need to create their own template in the spreadsheet.

In fact, this is indeed an option. However, today there are numerous ready-made templates on the internet. So all you have to do is download and start entering your personal details. One tip is to look for simpler options.

Thus, there is no difficulty in understanding how each element works there. A disadvantage of this alternative is that it does not have an automatic synchronization option.

That way, you need to invest time updating your financial planning.

Agenda and Planner: good options or not?

Now, imagine that you don't like technological alternatives very much. That way, there's no problem. It is still possible, therefore, to organize your finances efficiently. That's where calendars and planners come in.

Here then, you have no way to automate your data. So everything has to be entered manually. This refers from large expenses to those that seem small. Only then can you keep your planning true to your reality.

Conclusion

Now, without a doubt, this is a much more laborious option. Not to mention that it is much more difficult to establish forms of comparison. So, the tip is, only choose this alternative if you are willing to invest more time in it.

Ultimately, that's all you need to know about personal finance tools. So any of them can help you get organized. Now it is your turn. See which one best suits your needs.

What is and how to make an emergency reservation

Did you know that an emergency reserve can guarantee up to 6 months of expenses in case something unforeseen happens? Find out how it works and how to start yours

Reviewed by / Junior Aguiar

Senior Editor

Trending Topics

Biz Capital loan: how it works

Biz Capital offers a loan without bureaucracy and low interest rates to help Brazilian entrepreneurs. Check out more about him here!

Keep Reading

Online Bradesco Visa Gold Card: purchase protection and special installments

Get to know the Bradesco Visa Gold card online and enjoy several benefits at your disposal from the first use. Check it out and learn more!

Keep Reading

Ame digital card: what is it, how does it work and what are the advantages?

See in this post how the Ame digital booklet works and how it allows you to buy online in installments from the bank slip!

Keep ReadingYou may also like

Méliuz Card or Dotz Card: which one to choose?

How about Méliuz card or Dotz card? To find out which is the best financial product, read our post and check out all the information.

Keep Reading

Olé Consigned Card or Pan Card: which card is better?

Olé Consigned Card or Pan Card? If you have doubts between these two credit cards with good benefits, our article can help.

Keep Reading

Discover the Global C6 Bank Account

Global C6 Bank Account is a new type of international digital account. Check out more about this service that can make your life easier!

Keep Reading