Tips

5 best digital accounts for negatives

Having a dirty name is a problem for hundreds of Brazilians. Thus, digital accounts came to innovate and bring facilities to these people. Check out!

Advertisement

Discover the best digital accounts for negatives

One of the biggest dilemmas for people with a dirty name is not being able to open an account at a bank branch, but do you know which are the 5 best digital accounts for negatives?

In addition to providing the same advantages as conventional banks, digital accounts allow negatives to enjoy the same services as other banks.

So, we are going to show you which are the best digital accounts for negatives, as well as some useful information on the subject.

Can anyone with a dirty name open a digital account?

Initially, this is one of the biggest advantages of opening a digital account, the possibility of opening negative accounts.

This is because digital accounts offer all the services that other conventional banks do, however, they do not need to offer credit to customers, so there is no reason to restrict negative ones.

So, we will see further advantages among the top 5 digital accounts for negatives.

5 best digital accounts for negatives

Because they are much less bureaucratic, digital accounts have become a rage among Brazilians.

So, among so many digital accounts, we'll show you below which are the five best digital accounts that can be made by people with a dirty name!

Banco Inter

So let's start by talking about Banco Inter, former Banco Intermedium, which is one of the first digital banks to emerge, and is also one of those that present the best proposals.

This is because Banco Inter is a fully digital bank, where all its services are performed online, through the institution's application or website.

In addition, it is a completely fee-free bank, that is, there are no fees for:

- Account opening;

- Maintenance or;

- Account closure, as well as, there are no fees for transferring payments between accounts, that is, there are practically nothing fees.

However, the inter bank may charge interest fees in case of overdraft or other similar services.

Another point is that Banco Inter's investment platform is considered one of the most versatile on the market.

Thus, among the services offered by Banco Inter, which operate 24 hours a day and are free of charge, we have:

- Unlimited TEDs: In this item, the customer can do TEDs at any time of the day and as many times as they want, since they are free.

- Withdrawals from the Banco 24h network;

- Purchases and transfers via QR Code;

- bill payments;

- Cash deposit by bank slip;

- Check deposit by image;

- Complete investment platform;

- Loans and financing;

- Credit card with no annual fee: Exemption of fees.

- Insurance (there are several types of insurance available to the customer);

- Mobile recharge: Directly in the inter bank app.

Finally, the inter bank is one of the most accessed by customers looking for an accessible digital account, mainly for negatives, as well as presenting optimized services for its users.

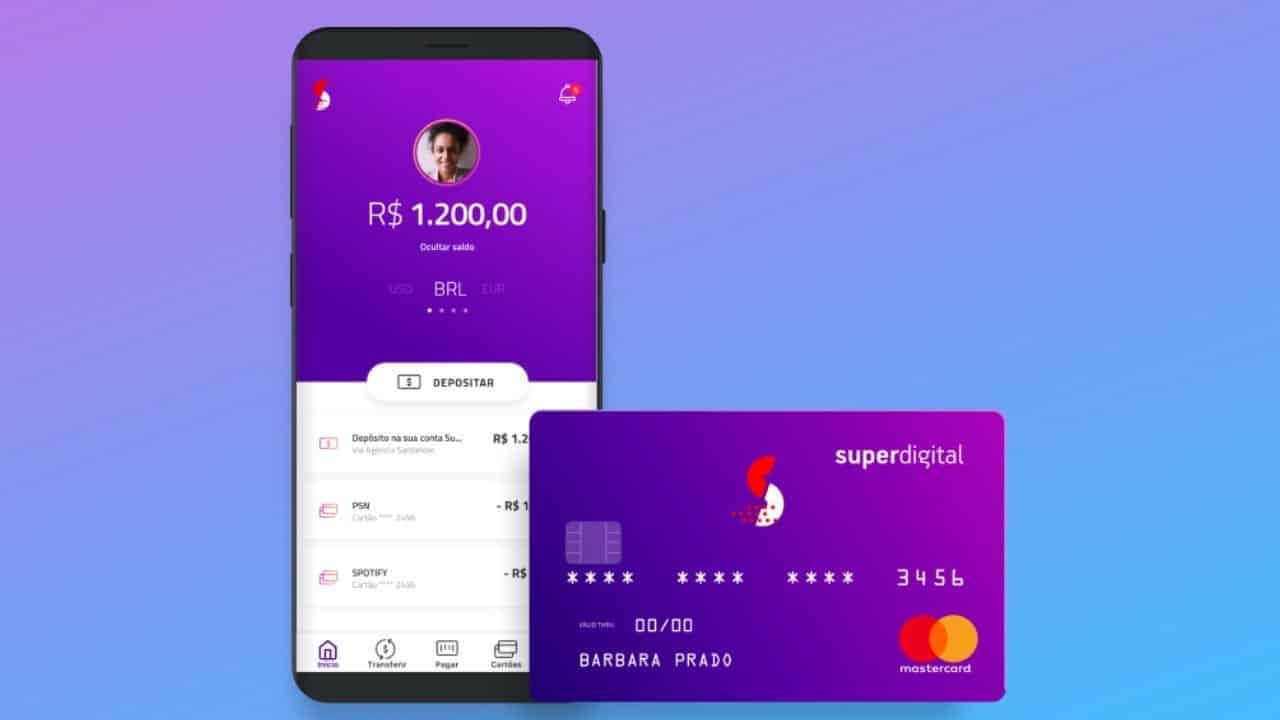

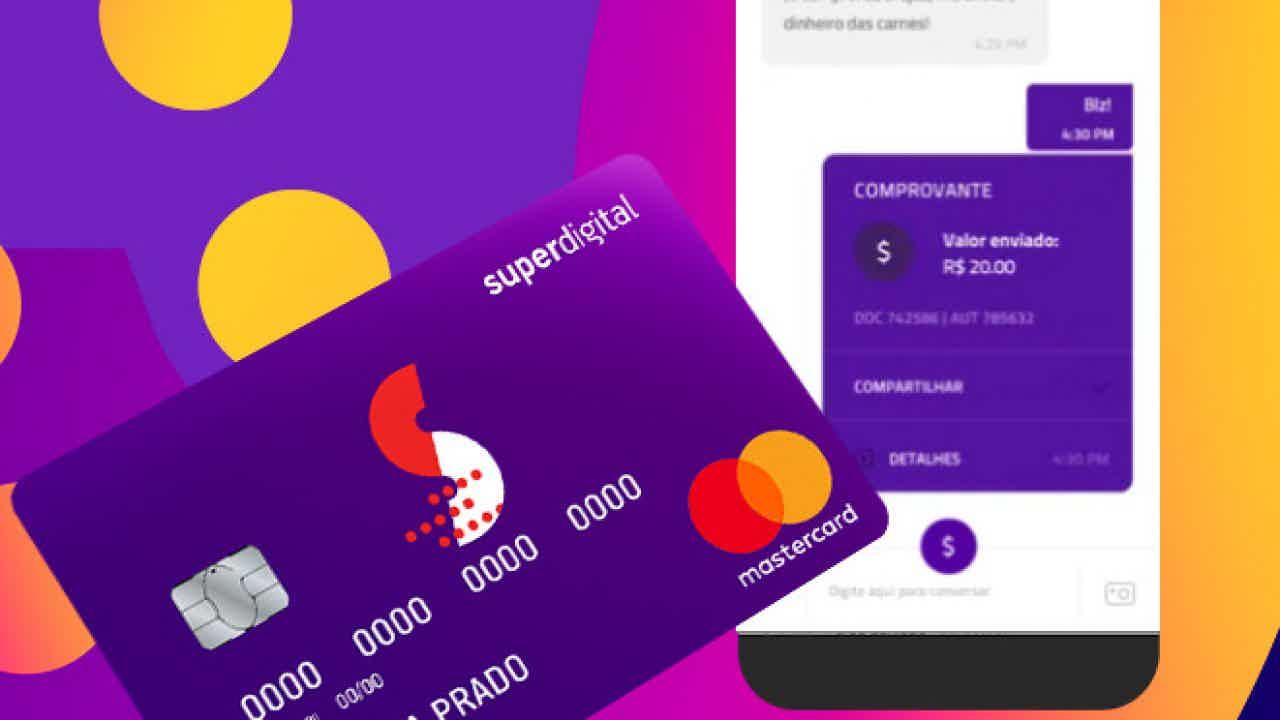

Superdigital

Digital banks are here to stay. That's because many people can't stand the idea of appearing in person at a bank to solve problems.

However, there are conventional banks that have also joined their own digital accounts, such as Banco Santander, to make life easier for customers.

Therefore, superdigital, is a fintech acquired by Banco Santander in 2017, which has several services and advantages for its customers, and already has more than two million accounts opened.

So, to open the account, just:

- Be of legal age, that is, be over 18 years of age;

- Be enrolled in the CPF, i.e. individual registration. And then customers will have access to the various benefits of the account that are divided into:

- Payments directly through the mobile app;

- Exchange in up to nine currencies;

- Cell phone recharge services;

- Single ticket recharge, among other services.

In other words, superdigital is a bank that seeks to provide its customers with simpler methods for solving problems.

Superdigital account opening

To make life even simpler, the account can be opened in less than five minutes using your cell phone, and there is no need to:

- Proof of income;

- There is no credit score analysis;

- There is no consultation with credit restrictions services, such as SPC and SERASA.

At superdigital, the customer will find two models of service packages: One for individuals, and another for MEI – Individual micro entrepreneur.

For MEI, the account is free, offers a credit card and up to five virtual cards for customers to shop online.

Unfortunately, still dealing with the MEI account, there are services that are paid separately, such as withdrawals at Banco24horas cashiers for around R$6.40 each, and transfers to accounts at other banks, worth R$5.90 each.

As for the physical account, a monthly maintenance fee of R$9.90 per month is charged, well below the value of other conventional banks.

However, this amount can be waived if the customer spends an amount of R$500 per month on the bank card.

What are the services offered by superdigital?

In the service package of the individual digital account, the customer will be entitled to a free withdrawal and transfers every month.

In addition, there are other free services such as deposit by bank slip up to a limit of two bank slips per month, and checking the balance by message on the cell phone.

However, if the customer wants to view the balance or statement in the 24hour bank, the cost is R$2 (two) reais, and, in case of loss, theft or misplacement of a credit card, to request a new card, the cost is R$14.00 (fourteen) reais.

For withdrawals abroad, made through the account, the cost will be R$19.90, and for issuing a bank slip, the cost will be R$2.90.

At superdigital, the credit card is international, under the mastercard brand, and does not charge an annuity, and because it is a mastercard, the services of the MastercardSurpreenda program can be used.

Thus, the card is sent to the customer's home, after receiving any amount in the digital account, however, this does not work as a fee, it is just a way of activating the account.

In addition, the deadline for receiving the card is up to ten business days, and may arrive in less days.

About the superdigital card

The superdigital card is not a credit card, but a prepaid card, that is, when the customer goes shopping, the amount is debited from the current account immediately after the transaction is proven, functioning as a credit card. debit.

The superdigital account offers several benefits for those who have an individual checking account, and receive their salary at the bank itself.

This occurs in the so-called “super account” subscription, which is the one in which the customer pays the amount of R$9.90 per month, instead of a withdrawal together with free transfers per month, the customer will be entitled to four withdrawals.

In addition, if when opening the account, the customer chooses not to pay the monthly fee, he can choose the so-called “super zero” subscription.

Furthermore, a very interesting curiosity is that if the customer's account is zero in a given month, the monthly fee is not charged, thus preventing the risk of being negative.

And, one difference that superdigital has for the vast majority of digital banks, is that as it is a fintech of the Santander group, superdigital accepts deposits into an account, in cash, directly through the Santander bank ATM.

Finally, superdigital also offers the simulation and contracting of personal loans directly through the app, being a great choice among digital accounts for negatives.

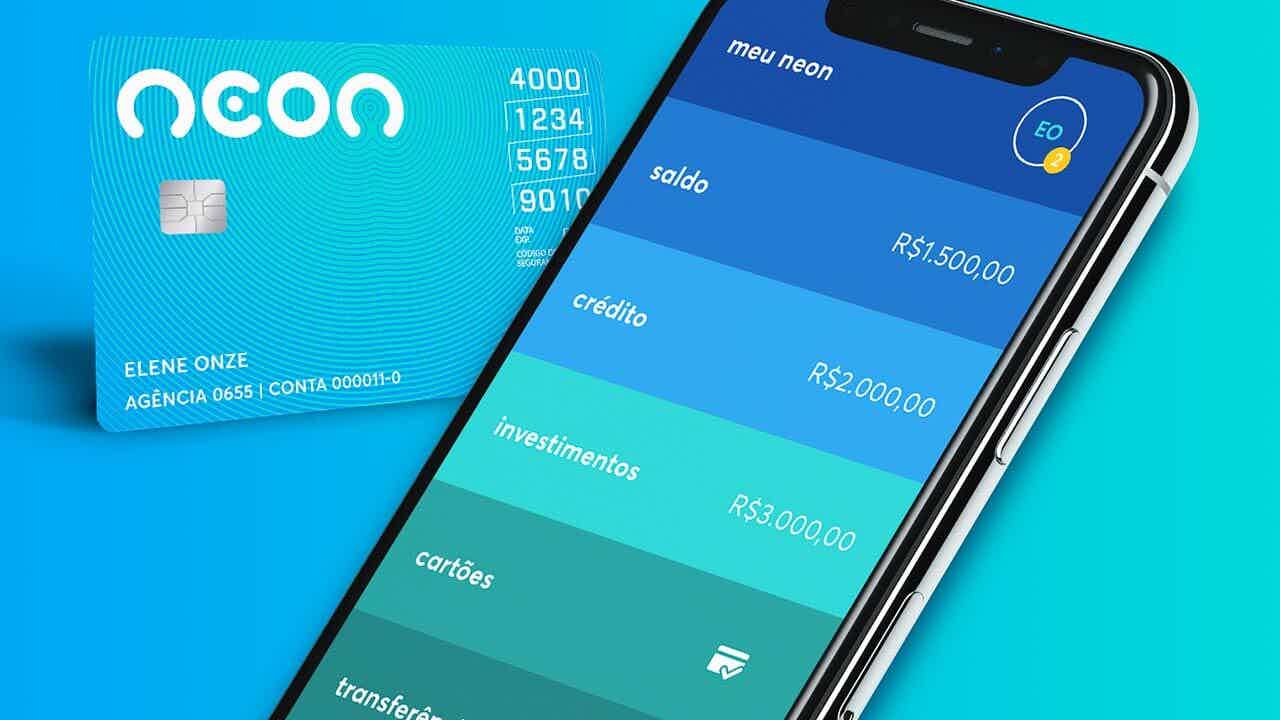

Neon Bench

Neon Pagamentos has several service options within the Neon bank's digital app, including a legal entity account.

Banco neon, like other digital banks, is a bank without queues, without bureaucracy, completely digital, with accessible services.

To download the digital account, just install the Neon bank app on your cell phone, fill out the registration form, similar to that of the inter bank, as mentioned above, and wait for your digital account to be approved.

Thus, after approval of the digital account, the customer will need to make a deposit in the amount of R$100 in the current account, so that the account is activated, and the physical and virtual debit cards are released.

An advantage of this bank is the absence of annuity or monthly fee, and it also offers an international Visa card, also being a prepaid card.

Among the advantages of the neon bank, we have:

- Visa brand program, which is the VaideVisa program;

- International flag visa card;

- Zero annuity;

- Zero monthly fee.

It is important to know that the physical and virtual cards will only be available to the customer, in the debit function, that is, it is not possible to:

- Make large or smaller installments of purchases;

- Share purchases;

- Make purchases without money on the digital account.

In the credit function, the neon bank virtual card is used for internet purchases, however, it is only for making the purchase, as the debit continues to be automatic.

So, any purchase that the customer makes with the neon card will only be approved if he has enough balance.

Does neon bank charge fees?

Neon bank rates also have great advantages see:

- Account opening: free;

- Account termination: free;

- Account maintenance: free;

- Card issuance: free;

- Exemption of fees for transfers between neon bank accounts.

However, not everything is rosy, so if the customer wants to transfer between different bank accounts, the bank offers 1 free transfer per month.

However, after using the transfer, the customer will need to pay a fee of R$3.50 per TED, if he wants to make a new transfer.

On the Banco24horas networks, withdrawals cost R$6.90 in addition to the deductible, as the customer will also be entitled to one free withdrawal per month.

As for issuing bank slips, the customer will also be entitled to issue one free bank slip per month, and above that, a fee of R$2.50 is charged per ticket issue.

For international purchases with the neon card, there will be an IOF tax (6.38%) plus 4% on each purchase made with the card.

Finally, to open the digital account, you just need to be over 18 years old, have a valid CPF, and goodwill, the account can be opened in a simple and quick way!

Agibank

The agibank bank belonged to the agiplan bank, which changed its name, and became a 100% digital bank, to make life easier for customers.

Thus, the new digital bank agibank reformulated the old account, as well as bringing great improvements to customers, see:

- Possibility to pay and generate slips;

- Make transfers to other institutions;

- Make purchases using QR Code;

- Receipt of salary through digital account.

It is also important to know that digital accounts can be for individuals and companies, that is, multiple functions, international, mastercard brand, in addition to participating in the MastercardSurpreenda program.

After the arrival of the agibank card, in addition to using lottery outlets to make withdrawals, the customer will also be able to use the ATMs.

What other advantages does agibank offer?

Among other advantages we have:

- Personal, payroll and private credit;

- Anticipation of the thirteenth;

- Life insurance;

- home insurance;

- vehicle insurance;

- Consortia;

- Investments.

There is also the possibility of investing in CDB – Bank Deposit Certificate, however, to find information on profitability, the customer should consult the bank.

Regarding fees, the bank presents the following:

- Account monthly fee: zero;

- TEDs: 3 per month free. Above that, R$10 by TED;

- National credit card annuity: R$200;

- International credit card annual fee: R$300;

- Second via credit card: R$40;

- Emergency credit assessment: R$40;

- Pay bills by credit card: R$20;

- Credit card withdrawals: R$40.

So, this account is also a good choice among digital accounts for negative accounts, however, it has high fees compared to other banks.

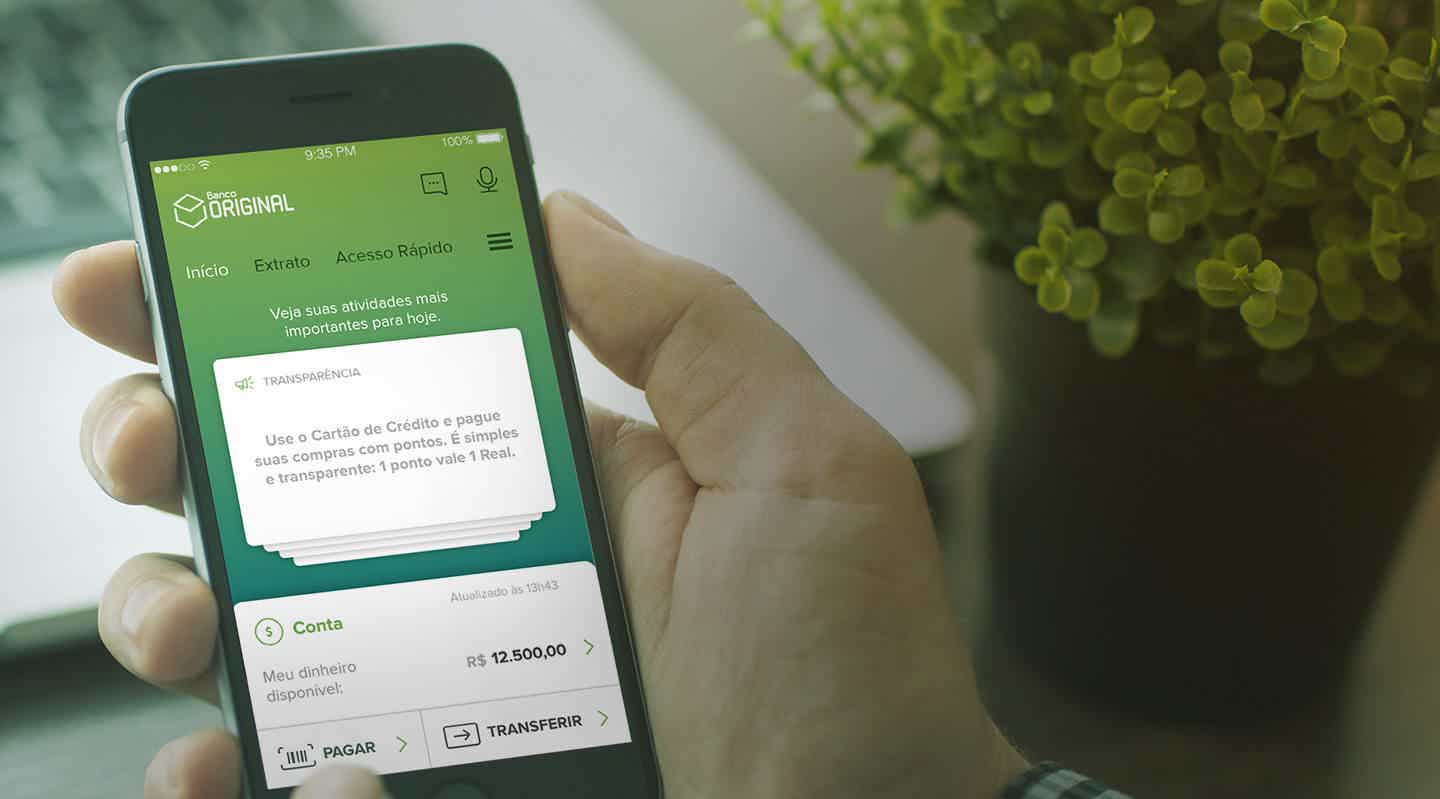

Original Bank

Banco Original was the first 100% digital financial institution to allow the opening of a current account completely through an application.

At the outset, we need to say that the original bank is focused on consumers with high purchasing power, but also on those with income from R$2,500 (two thousand five hundred) reais.

The original bank allows Gold, Platinum or Black credit card with the first annuity totally free.

Like other digital banks, the digital account can also be opened completely online, bringing convenience to customers' lives.

In addition, the customer can make payments, investments and transfers through the original bank application, in a simple way.

Another advantage is the clearing of checks by cell phone, through image, providing more efficient ways of solving problems.

What are the advantages of the original bank among the top 5 digital accounts for negatives?

The original bank also provides:

- Initially, no account maintenance fees;

- Then, there is the management of expenses within the platform automatically, to help with the control of finances;

- Therefore, we have the loyalty program for Gold and Platinum cards, with cashback. This offer allows you to earn points for invoice payments or purchases;

- As well as service with the official manager via SMS, whatsapp, chat, telephone, video call, and other ways to serve customers, bringing security;

- Personalized investments according to each profile

One of the positive points of Banco Original is that it presents the best investment experiences for customers, as well as teaching you how to control expenses, that is, it is worth getting to know this bank in the best way.

- Free withdrawals from the entire 24-hour bank network;

- Control of all investments through the app in real time, helping to organize yourself;

- Card works by approximation, making problems with credit or debit card machines unfeasible;

- Credit and debit option on the same card.

The original Bank is a little more sophisticated than the other banks, however, it has great advantages by providing a differentiated experience for customers.

Why open a digital account?

As we mentioned above, digital accounts are current accounts, which work in the same way as traditional accounts, however, there are no maintenance fees.

Thus, the main function of the digital current account is to provide the same services that traditional accounts provide, but in an optimized and simple way.

Therefore, the operations of the digital accounts must be done through an app on the cell phone, ATMs or through the website.

That is, in addition to the amounts charged outside the digital account package, the services that will be free will change depending on the bank, as we showed earlier.

How to choose among the 5 best digital accounts for negatives?

So, before choosing the best digital account, the customer needs to know which services are offered, and which ones are free.

This is because not all banks offer the digital account, precisely because it is not mandatory.

Just like, according to studies by Protec, the digital account is the best choice for people who are used to using electronic services and are looking for speed, as well as security and practicality.

In addition, there are numerous proposals for digital accounts for negative accounts, which does not happen so easily in other accounts.

So, to understand a little more about the subject of digital accounts for negatives, also visit the link below:

About the author / Joyce Viana

Reviewed by / Junior Aguiar

Senior Editor

Trending Topics

Leader Card: How it works

Check here the main characteristics of the Leader card, such as exclusive discounts and differentiated installments in the chain's stores!

Keep Reading

How to use the Auxílio Brasil value through the Caixa Tem app

Brazilians use the Caixa Tem app to transfer benefit amounts. Find out here how to use the amount of Auxílio Brasil through the Caixa Tem app.

Keep Reading

How to increase the score with Serasa Turbo

Increasing your score with Serasa Turbo is a way to raise your score and improve your market visibility. Read this post and learn more.

Keep ReadingYou may also like

How to apply for the GlobalCard credit card

Do you want an account that allows you to send and receive money from abroad and also have a credit card? Find out how to open a GlobalCard account and purchase the card. Check out!

Keep Reading

Discover the BTG+ Digital Account

The BTG+ Digital Account is the new launch of the largest Brazilian digital bank. You have several advantages, in addition to a Home Broker from the brand itself, with investments that can give you a return of more than 40%.

Keep Reading

The best card for you is Superdigital

Do you already know the Superdigital credit card? If not yet, this is the perfect opportunity to get to know it and find out how it works.

Keep Reading