Money

11 investment options for 2019

Advertisement

The global economic scenario is one of uncertainty. The trade war between the US and China and the slowdown of developed economies impacted the national scenario. Furthermore, pension system reform is likely to be the agenda that will have the greatest impact on our country in the near future.

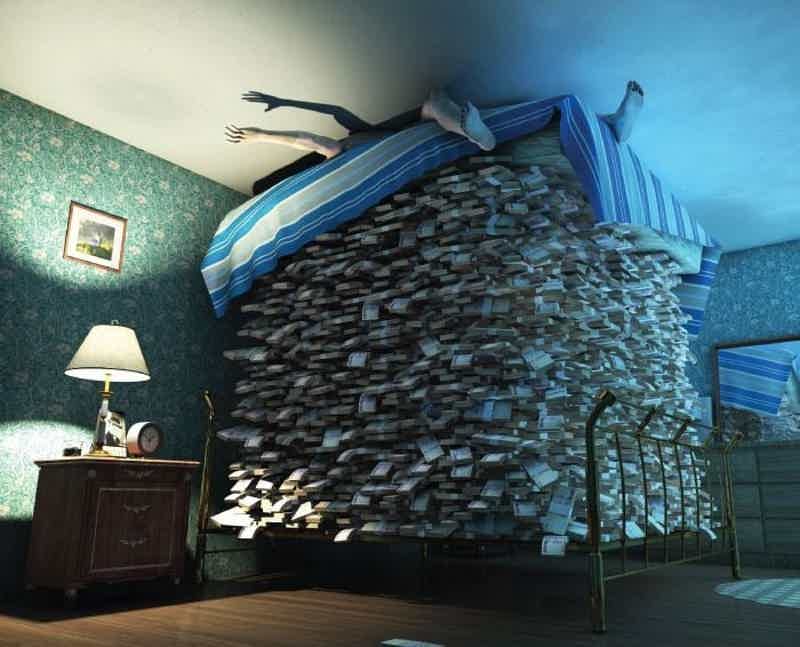

Even with all this uncertainty, there is no shortage of investment options with potential. There's no reason to leave your money on the mattress. Advance to discover the best investment options for 2019.

Stock market

2018 was a very positive year. The Ibovespa advanced by 15% and the prospects for 2019 remain positive after the election results. The improvement in the business environment should impact the stock market and encourage healthy returns through the end of the year.

But don't fall into the stock-picking trap. No company is perfect, and you'll do much better in the long run by putting more than one egg in the basket.

Cryptocurrencies

Last year was not a good year for cryptocurrencies and their reputation has suffered because of it. However, for some experts, this is just a sign of maturing in the market.

Don't expect the results of 2017 to repeat, but don't be surprised if 2019 turns out to be the year of cryptocurrency recovery.

Investment Funds

Simply put, funds are vehicles that facilitate access by small investors to diversified portfolios, managed by trained professionals.

Investment funds are always a good long-term investment option. Continue advancing in the article and see some examples of specific funds that should appreciate in 2019.

Multimarket Funds

It is the main category of funds, as they “mix” different types of investment, such as equities and fixed income.

The country's economic momentum suggests that Brazilian stocks will appreciate. As Multimarket Funds are generally stock-based, they can be a good option for 2019.

Real Estate Funds

The real estate market is already showing signs of strengthening, and Real Estate Funds are the easiest way to invest in commercial real estate and further diversify your investments.

In addition to diversification, very positive results are expected with this type of fund, given that economic growth has a direct impact on this type of investment.

Credit Funds

Credit funds allow simultaneous investment in various types of debt, such as corporate credit and debentures. Like other types of funds, it is an easy way to expose yourself to yet another different instrument.

In general, it is expected that the longer the investment period, the higher the interest available at the end of the investment.

CDBs

Bank Deposit Certificates will never go out of style. These are types of investment that attract conservative and bold investors.

What you should pay attention to is the type of Fixed Income. In 2019, that decision will depend heavily on how optimistic you are about the much-discussed Pension Reform.

LCIs and LCAs

Letters of Credit are attractive investments as they are guaranteed by the FGC up to R$ 250,000. They are similar to CDBs, with the difference that they are exempt from Income Tax.

That said, they don't outperform CDBs in terms of return, making them attractive options for short-term investments.

Treasury Direct

Treasury Direct is a fixed-income public bond issued by the National Treasury. It is a simple way to “lend” money to the government in exchange for interest.

Treasury Direct will always be a robust safe investment alternative, and a better option than leaving your money in savings.

Debentures

Debentures are CDBs issued by non-financial companies.

In large part, they are indexed in relation to inflation – measured by the IPCA indicator – and therefore are interesting alternatives to add to your portfolio.

social security

Don't forget to prepare for your retirement.

Regardless of the year and economic status of the country, constantly investing in a form of pension will guarantee your future and financial health when you retire.

After all, which option to choose?

Different investment options have completely different risk and return profiles. Stocks, for example, have a higher return than government bonds in the long run. But its price fluctuates a lot.

That's why portfolios that mix different instruments – like some of those mentioned in this article – tend to present positive returns with healthy risk profiles – giving you enough peace of mind to sleep at night, without worries.

Trending Topics

How to apply for a Bradesco payroll loan

Learn how to apply for a Bradesco payroll loan and start paying in just 120 days with interest from 2.14% per month. Look!

Keep Reading

How to work online in 2022

Discover how to work online, whether as a freelancer, reseller and many other options that are booming within the networks. Check out!

Keep Reading

Discover the Z1 credit card

The Z1 credit card is the perfect option for young people! He has no annuity and still prevents them from getting into debt. Check out!

Keep ReadingYou may also like

How to get Sick Pay

Finding out how to get Sickness Benefit is essential to quickly apply for your benefit. To find out how to secure yours, just continue reading the article!

Keep Reading

How to apply for the Mister Money loan

The Mister Money loan offers several types of credit for you to choose from and even accepts negatives in some of them. Find out here how to request this 100% service online and with excellent payment conditions.

Keep Reading

Montepio + Vida credit card: what is Montepio + Vida?

The Montepio + Vida credit card is a great option for a financial product, as you can use it and also help a needy entity. Do you want to know more about him? So read our post and check it out!

Keep Reading