Cards

Advantages of the Marisa credit card

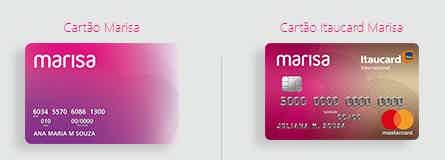

In this article, you will learn about the advantages of the traditional Marisa card and the Marisa Itaucard card, as the company offers both to customers.

Advertisement

Advantages Marisa card

If your name is dirty and, even so, you want to have a quality card, get to know the Marisa credit card, it offers the possibility of applying for people who have negative credit.

Also, the card, in partnership with Banco Itaú, provides its customers with various benefits and advantages.

In addition, you will receive several discounts in physical stores and also in internet stores.

The Marisa Itaucard credit card has the Mastercard brand, which means that the card is accepted in basically all stores and establishments in Brazil and around the world.

With the card, in addition to other advantages, you have the Mastercard Surpreenda program and the Semper Presente Itaucard service.

In addition, the card offers several additional insurance services.

Finally, if you want to know the card in depth, continue reading this article and learn about its main advantages.

Benefits of the Marisa Itaucard card

The Marisa Itaucard card is currently one of the best cards on the market, as it has many benefits and offers many advantages to its customers.

With this card, which has the Mastercard brand, you will be able to access almost all stores and services that are located in national and international territory.

So now, let’s list the main and best advantages of the card:

Discounts on your first purchase

If you haven't made any purchases using Marisa's credit card yet, you'll have a good advantage!

The company provides, for those who have the card and, even so, did not make the first purchase, the advantage of receiving 10% discount on their first product.

So, if you don't have your card yet, ask for it now and go straight to make your first purchase at Marisa stores.

birthday discounts

This discount is another benefit that, in the current market, almost nobody offers.

With this service, you can receive, during your birthday month, some discounts during your purchases.

If you go shopping in your birthday month, you will receive 10% discount.

That's a good birthday present, isn't it?

seasonal offers

From time to time, Marisa promotes various offers to its customers, especially those who have the store card.

These offers can reach, incredibly, discounts of up to 70%.

Did you think the advantage ended there?

These offers are available for the company's physical stores and also for its online store.

Then, you will get giant offers, being able to use them with just a phone or a computer. That's pretty good, isn't it?

More discounts

Do the discounts end there? No, the store, together with Banco Itaú, offers even more discounts.

So, if a theater or cinema has a partnership with Itaucard, Marisa card customers will receive a 50% discount when buying a ticket.

It's a lot of discounts, isn't it?

rewards program

Nowadays, many companies are creating services aimed at exchanging money spent on products for points, which can later also be exchanged.

Before proceeding with the explanation of this rewards program, it is traditionally called Semper Presente Itaucard.

With this program, you receive, for every U$1.00 dollar, exactly 1 point.

Okay, but what is this point for? You can, as you receive more points, exchange them for other services and products in the store.

Therefore, you will receive, for every U$1.00 dollar, 1 point, which can, when in large quantities, be exchanged for various cool things in the store.

However, this program can, oddly enough, get better!

Did you find that the company provides too few points for money spent? If yes, would you like to earn more points?

If you answered yes to both questions, find out how to earn more points below.

If you pay 1% more than your invoice amount, you will be able to double the number of points earned.

Finally, these are some of the benefits that the Semper Presente program offers its users.

additional insurance

With the Marisa card, you also have access to several benefits that almost no other card offers, such as insurance.

Within these additional insurances, we find the following services: Assistance Compra Certa Marisa; Peaceful Purchase Insurance; Super Protected Bag.

dental plans

Also, something very unusual nowadays is that the company offers dental plans to those who want to consume it.

So, if you want these plans, which are special to card customers, get in touch with the company and ask for your plan now.

The company's dental plans are divided into two: Marisa Odonto and Marisa Odonto Plus.

Marisa credit card application

With the advancement of the internet, many things have changed in the market.

Nowadays, many stores are producing apps and other services, all using the internet.

The application is made available by Itaú bank itself.

Therefore, with the application, which is available for users of Android and IOS devices, you will be able to monitor, in real time, all your money and all your finances.

Also, you will have at hand all the history of your expenses.

In addition, you can only redeem points from the rewards program (Sempre Presente Itaucard) through the application, as you will find all your balances and accumulated points there.

You can, in addition to these things, generate virtual cards to shop online, all this with more security.

Finally, after downloading the card, you will receive notifications of the closing and expiration of your invoices.

Then, you will be able to access several other resources by downloading Marisa's application.

call centers

If you want to contact the company, due to any questions or problems, please contact the following numbers:

Capitals and metropolitan regions: 3003 3030

Other locations: 0800 720 3030

Find out how to apply for your Marisa credit card

So, if you liked the advantages of the Marisa card, click on the button below and find out how you can apply for the Marisa card, which is growing every day in Brazil.

About the author / Gustavo Cezar

Reviewed by / Junior Aguiar

Senior Editor

Trending Topics

How to apply for the Creditas loan

The Creditas loan offers three types of credit for you to choose the one that best fits your finances. See how to apply!

Keep Reading

Which debt to negotiate first?

Ever feel like you need to organize finances but don't know where to start? So see now which debt to negotiate first and make no mistake

Keep Reading

PicPay salary portability: how to make yours!

With PicPay salary portability, your money is yielding more than savings. See in this post how to do this process.

Keep ReadingYou may also like

Ourocard Entrepreneur Card for 2021

Do you want an annuity-free card that will help you with your dream of starting a business? So, get to know the Ourocard Entrepreneur Card for 2021.

Keep Reading

Receive up to R$1000.00 in cashback with Inter bank's new campaign!

Banco Inter's new Indicate e Earn promotional campaign offers R$10.00 in cashback for each friend you bring to fintech. With 100 indications, it's R$1000.00 for you to use in shopping at the Super App mall! Want to know more? Then read on!

Keep Reading

Discover the types of Serasa eCred Loans

Still not familiar with Serasa eCred? It is a banking correspondent for partner institutions and facilitates access to financial products for negatives. Learn more below!

Keep Reading