Cards

Advantages of the C6 Bank credit card

Find out now about all the main advantages of the c6 bank card and find out if this revolutionary card could be an attractive option for you.

Advertisement

About C6 Bank

Discover all the advantages of the C6 card, which, although it is a new product, is revolutionizing the market.

C6 Bank was created in 2018 by a group of former employees of a competing bank.

They created the C6 bank to, according to what they say, be in the market to compete with the big banks in the market, such as, for example: Inter, Nubank and Neon.

The Bank does not have, although it has a very competent online service, any physical branch to serve its customers.

However, this is not really a big problem, as the company's online service is undoubtedly one of the most efficient on the market today.

The card does not charge any annual fee from its customers. So you won't have to pay a fee once a year to use the bank card.

Furthermore, your personal transactions can be authenticated by the chip and also by your password.

However, the card user's name, in internet transactions, must be written completely, without missing any part.

About the C6 Bank card

The card is multiple, that is, it has several functions.

Therefore, the card has both a credit and a debit function.

In addition, it will be possible to invest, if you are interested, in CDB, along with the other services that a common card offers.

However, if you make purchases online using the card, you will need to pay a cost of 4% on the total purchase price + IOF.

So, as much as you have the option of making international purchases with the card, it is necessary that, after making them, you pay those two fees mentioned above.

On the other hand, you don't have to pay any fees when making withdrawals and transfers.

You can make your withdrawals and transfers through Banco24Horas, which is known by many people as one of the best banks.

Advantages of the C6 Bank card

The card is one of the most recent options on the market and, even so, it already offers several features and benefits to all its customers.

The benefits of the card are marked by having technologies and also many amenities.

Furthermore, the bank provides an application that, due to its quality, can be downloaded by both Android and iOS users.

So go to Google Play or the App Store and then download the card app.

Finally, if you are more comfortable using the internet, you will certainly make the most of the bank's resources and also the application.

Annuity Exemption

As mentioned, the C6 Bank credit card does not require the customer to pay the card's annual fee.

So, you won't have to pay any fee once a year for your use of the card.

This is a great advantage of the card, since, even today, many companies still charge the annual fee for the card.

Therefore, many people who use cards from other companies have to pay, at least once a year, a fee for the card.

You can save a good amount with the exemption of this fee, right?

Practicality

If you want to make the card, know that, fortunately, it will be a very practical and bureaucratic task.

The bank seeks to bring practicality to all its services and programs.

If you want to apply for the card, you will first need to enter the bank's website, or the card application, and then create an account with the bank.

After that, just make a small registration to finalize the card request.

Finally, it is possible to see that the bank thinks, above all, of providing greater convenience to its customers.

card multiplicity C6 Bank

The C6 bank credit card has multiple functions.

So, it offers both the credit function and the debit function, being able to choose one of the two whenever you want.

Therefore, when you want to make your purchases paying, for example, by debit, you will have this option.

Finally, you will be able to use these resources both nationally and internationally.

expense control

Would you like to instantly receive your balance forecast in the card app? If so, that's exactly what the bank does!

So you can control, in a simple and easy way, all your invoices and purchases.

Finally, the bank values the transparency of its resources, which directly helps all its customers.

card customization C6 bank

If you want to have a unique card, made and chosen according to your tastes, customize your own card.

So, you can choose, according to your wishes, the color of your card.

In addition to choosing the color of your card, you can also put the name you want on the card.

If you want to put a nickname or something like that, you can do that!

However, remember this: when shopping online, you need to put your full name.

C6 Taggy

With this benefit, you are freed from having to wait in queues during toll booths.

The C6 Taggy is a sticker you get for free after making the card.

Then, after receiving it, install this sticker on your car window and then you won't have to wait in queues during the toll booth.

The sticker opens the space immediately after coming into contact with the toll booth sensors.

However, the toll amount will be charged directly to your C6 bank account.

Best of all, you don't have to pay any annual or monthly fees to get access to this feature.

Mastercard Surprise

This is a program provided exclusively by the card brand, which is Mastercard.

With the program, you receive points, which are earned after a purchase with the C6 card.

As you collect these points, you can exchange them for any product available in stores.

So, the more products you buy, the more points you will receive and, consequently, the more products you will receive from this program.

Another great benefit, right?

Order now!

If you are interested in the card and its features, click the button below and find out how to order yours.

About the author / Gustavo Cezar

Reviewed by / Junior Aguiar

Senior Editor

Trending Topics

Discover the Telha Norte credit card

The Telha Norte credit card is ideal for those who are going to renovate or build, offering an additional limit and discounts. Check out!

Keep Reading

I can't access Caixa Tem: how can I receive the Brazil Aid?

To receive the Auxílio Brasil, it is necessary to access the Caixa Tem account. But what to do if I can't access Caixa Tem? Find out the answer here.

Keep Reading

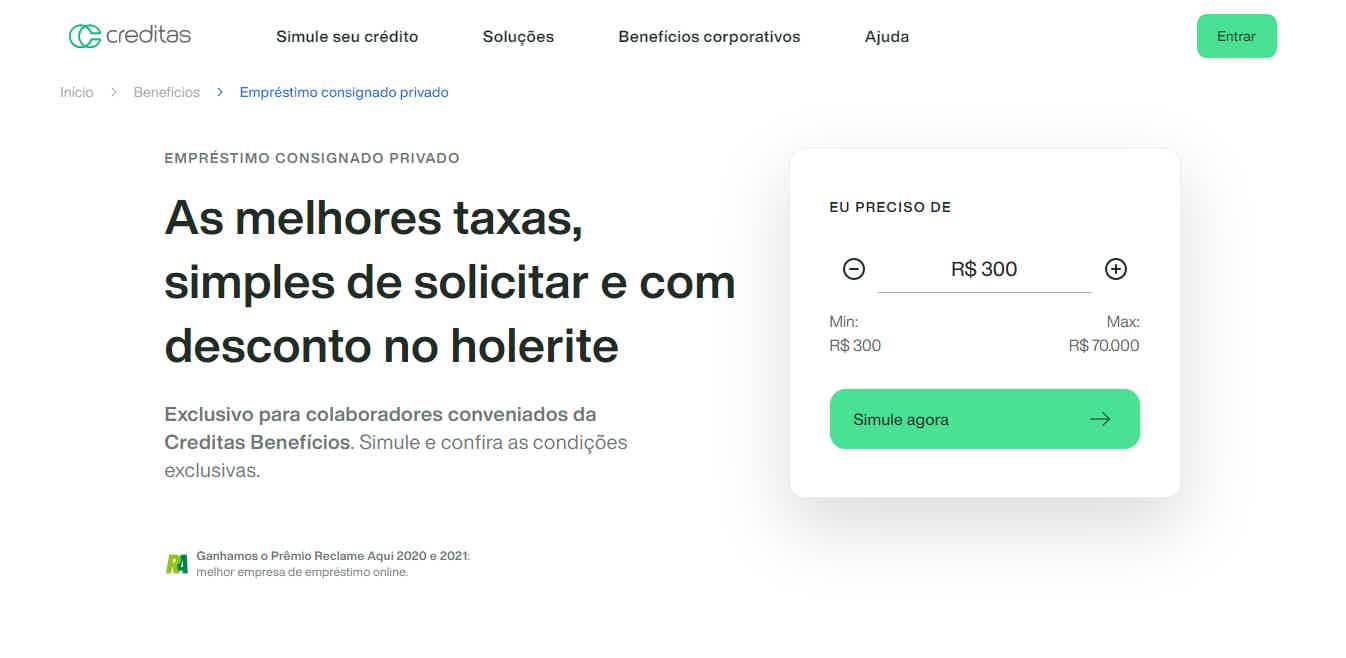

Discover the Creditas payroll loan

Get to know everything about the Creditas payroll loan and understand how it works and how it offers better conditions for you!

Keep ReadingYou may also like

Discover the CTT credit card

Discover the advantages of the CTT credit card and get yours without leaving home.

Keep Reading

How to apply for the Dotz Card

Dotz Card is an annual fee-free option that gives you access to the Dotz points accumulation program. Find out how to apply here!

Keep Reading

Discover the best car models for resale in 2021

Check out our list below and find out which are the best car models for resale in 2021.

Keep Reading