Cards

All the advantages of the Magazine Luiza card

Get to know now all the detailed advantages of the Magazine Luiza card and find out if it is a good option for you.

Advertisement

Magazine Luiza card advantages

If you are interested in knowing more about the Magazine Luiza card, as well as its advantages, keep reading this article and learn what benefits you receive by acquiring the card.

Magazine Luiza is undoubtedly one of the largest and most influential companies in all of Brazil.

Magazine Luiza card options

In addition, it provides two types of card to its customers, who can freely choose which one to choose.

The Magazine Luiza Ouro card is, in practice, the company's best and most advantageous card, as it is free of annual fees and offers more benefits to its users – it is intended for the store's existing customers.

The other option is the Magazine Luiza Preferencial card, which, unfortunately, charges its customers an annuity and gives them less benefits than the Ouro card.

If you don't want to have the Magalu Ouro card at the moment, the Preferential card also provides many benefits to customers, but to a lesser extent. So rest assured!

Also, both cards are branded as Mastercard, which makes them more advantageous and beneficial than other cards, since, due to the brand, the card will be accepted by almost all stores and establishments.

With the Mastercard brand, you can receive several benefits, which are offered by the brand itself.

Magazine Luiza Gold and Preferred Card

As much as there is a good difference between both cards, both the Gold and Preferred cards have several features and benefits that make them unique in the market.

Payment in up to 10 installments

The first advantage of the Magazine Luiza card is the possibility, if you wish, to pay your purchases in up to 10 installments.

Also, your card limit will be used with the amount of the installment, which can be spent 3x more than the original amount.

Mastercard Flag

Another benefit of the Magalu card is its flag, which is from Mastercard.

With it, you will be able to shop all over Brazil and, if you want, around the whole world.

Nowadays, fortunately, it is very difficult to find an establishment that does not accept the Mastercard brand, which makes it very useful.

withdraw money

Due to Magalu's partnership with Banco Itaú, clients have many advantages.

Then, it will be possible to withdraw money from the Banco Itaú cashier, being able to pay it back in up to 40 days.

Offers Magazine Luiza card

You will receive, at all times, exclusive offers from Magazine Luiza, either by email or on your card statement.

Mastercard Surprise Program

With this program you can, oddly enough, receive accumulated points, which are earned through purchases, and exchange them for products in the store.

So, with every purchase made at Magazine Luiza's own store or at other partners, you will receive points for shopping.

With the accumulation of these points, you can exchange them for products and other services offered by the store.

additional cards

If you are a Magazine Luiza customer, you can order up to 4 additional credit cards.

So, if you are within the data that are required to order more cards, feel free to order yours.

Itaucard benefits

Due to the partnership between Magazine Luiza and Banco Itaú, the latter usually offers benefits to people who use the card.

The first Itaucard benefit is a discount of up to 50% on tickets and theater plays that are promoted by Itaú bank itself.

Also, Itaucard offers exclusive discounts and offers for you to shop at partner stores, such as Extra, Natura and, finally, O Boticário.

In addition, Itaucard provides an application to its customers. Then you will be able to take care of your money in real time, as well as monitor your transactions.

Magazine Luiza card limit

First of all, know that the card limit is not defined at all, varying from person to person.

Then, your limit will be set according to your credit history, so that if you have a negative history, your limit will be lower.

However, if Banco Itaú offers you, for example, a limit of R$1,000.00 reais, you can spend 3x that amount at Magazine Luiza stores.

So, if your limit is, for example, R$1,000.00 reais, you can spend, in Magazine Luiza stores, R$3,000.00 reais.

Therefore, if you are a loyal Magazine Luiza customer, think very carefully about her card, as it can help you a lot.

What are the costs of the Magazine Luiza card?

Card costs depend on the type of card you choose.

If you choose the Ouro card, you will not have to pay an annual fee, that is, you are exempt from paying an annual fee for the credit card.

Preferred, in turn, requires its users to pay an annual fee.

This annual fee is currently R$119.88 reais.

However, in addition to the annual fee, other small services will also be charged.

Exactly R$5.50 reais is charged for the purchase and financial transaction alert service.

Also, it is necessary to pay a fee of R$12.00 reais for each withdrawal made at ATMs by Banco Itaú.

In addition, if you need to make an emergency withdrawal, you will be charged R$18.90 reais for each withdrawal.

Finally, you are charged, to issue the second copy of the card, around R$9.90 reais.

Mastercard Flag

The Mastercard brand allows the option to buy international products and services, as well as access to most stores here in Brazil.

In addition to providing the Mastercard Surpreenda program, which generates the exchange of accumulated points for products, Mastercard offers another great benefit.

Purchases can be paid in up to 10 installments. You can pay the invoice in up to 24 installments with interest.

As said, Mastercard is currently accepted in most, if not all, stores in Brazil and around the world, which is another positive point for the card.

If you are interested in the card and its benefits, click the button below and find out how to apply for one.

About the author / Gustavo Cezar

Reviewed by / Junior Aguiar

Senior Editor

Trending Topics

Banco do Brasil Tender: know the details of the public notice

Check out everything about the Banco do Brasil contest and see a simplified summary of the most important information in this contest's public notice!

Keep Reading

What's the best digital account of 2022?

In this article, learn about the characteristics and advantages of various digital accounts. So, find out which is the best digital account of 2022 and make yours!

Keep Reading

Find out how to have a salary above 1700 reais

The joiner earns very well and you can be one. To do this, you must understand what he does and where he can find a job quickly. Look here!

Keep ReadingYou may also like

Discover the Bankinter Gold card

The Bankinter Gold card has a credit limit of up to €30,000 for purchases, payments to the state and transfers. See more information about this card here and find out if it's right for you.

Keep Reading

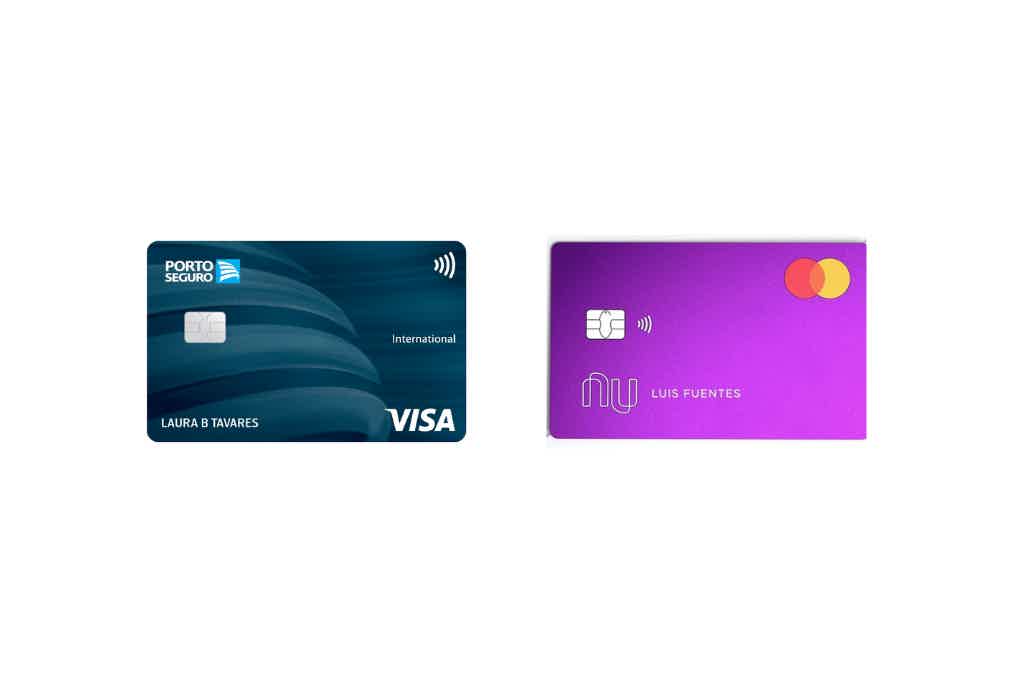

Porto Seguro Card or Nubank Card: which is better?

For those looking for more modernity and lower fees on their credit cards, one of the two best opportunities is here, Porto Seguro card or Nubank card. If you're curious to learn more about these alternatives, stay with us!

Keep Reading

Febraban, Recovery and Serasa organize a joint effort to negotiate outstanding debts with up to 99% discount!

Three of the main debt renegotiation companies organized a joint effort to help defaulting Brazilians regularize their situations. The action runs until March 30th and promises special conditions for everyone. Check out!

Keep Reading