Cards

All the benefits of the Riachuelo card

The Riachuelo card has been growing more and more in the country, but are its advantages really good?

Advertisement

Riachuelo card features

To discover the features and other advantages of the Riachuelo card, continue reading this article!

If you are a loyal customer of the store, this is one of the best credit card options for you.

With it, you have access to several benefits and special discounts that only the card can offer. It would be nice to go shopping and still gain several advantages, wouldn't it?

Also, it does not charge any annual fees. This means that you will not have to pay any fees per year to use the Riachuelo card.

Finally, you receive, during your first purchase using the card, around 10% off.

Therefore, you are entitled to receive 10% off your first purchase.

Do you want to discover the other features of the card? So, be sure to read this article until the end!

If you don't know all the characteristics of the Riachuelo card, click on the button below and discover the main attributes of the card, which grows more every day.

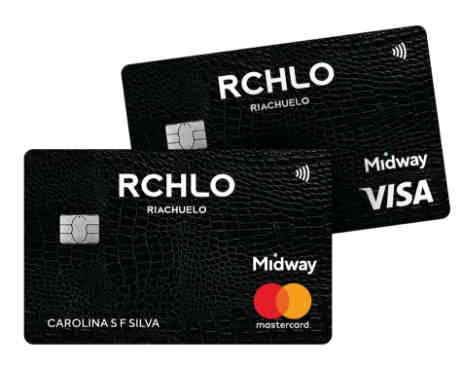

About Riachuelo store cards

The store offers its customers three types of card.

The first option is the Private Label card, which is provided by the store itself. The card is the result of a partnership between Riachuelo and the Midway institution.

With Private Label, you will have many discounts and benefits when shopping at the Riachuelo store.

These benefits are, for example, the possibility to make purchases in cash, to choose different payment methods and also to decide the best purchase date for you.

This card, like traditional cards, has a defined limit according to its own attributes. That is, your limit will be based, for example, on your credit history.

In addition, you can even make purchases with large installments.

As you pay for your purchases in installments, your card limit decreases.

However, as you pay your installments, your limit will return to normal. So, rest assured and, at the same time, worried, as it is possible, if you do not pay the installments, that your limit will be restricted.

If you have, after a long time, a good track record in Riachuelo stores, it will be possible, incredible as it may be, to start paying for your purchases within 40 days of making them.

For this, you need, above all, to make a purchase in the store after closing the invoice.

These are some of the characteristics of the Private Label card. Let's see now the characteristics of the other two cards: the Visa and the MasterCard.

Riachuelo Visa and Mastercard credit card

With these two cards, you will receive, as with the Private Label card, several discounts and benefits when shopping at Riachuelo stores.

In addition, you will have the credit function, which can be used, in addition to Riachuelo stores, in partner stores.

In addition, both cards have their own benefits program.

The Mastercard card offers the Mastercard Surprise program. With this program, you will be able to exchange points, which are accumulated with each purchase made, and exchange them for any product available in the store.

So, with every money spent at Riachuelo stores or any other partner, you earn several points.

As you accumulate these points, you can exchange them for any product or service of interest. It's a good show, isn't it?

The Visa card, in turn, offers the Vai de Visa program, which has the same mechanisms as the Mastercard Surpreenda.

In short, regardless of the card you choose, you will have different programs and benefits.

Both cards, unlike Private Label, ask their customers to pay an annual fee of R$87.00 reais.

Therefore, the customer who wants to use one of these two cards will have to pay, once a year, a fee of, as mentioned, R$87.00 reais.

Finally, you will have the option to control, if you want, your card (Private Label, Visa, Mastercard) through an application.

Advantages of the Riachuelo credit card

Now that you know the main characteristics of the three cards that Riachuelo offers, find out about their advantages and benefits below.

Application

Among the advantages of the store is its application.

With it, customers will be able to manage all their money in real time, doing it in an easy and totally intuitive way.

In addition, by downloading the application, you will have access to several other resources, such as: checking your best day to buy; change the expiration date; manage your expenses and invoices.

The Riachuelo application is available for both Android and iOS users.

So go to Google Play or the App Store and download yours now.

Payment options Riachuelo card

Fortunately, Riachuelo offers several special payment conditions to its customers.

Then, you may have the option to start paying for your purchases as early as 40 days after you make them.

In addition, you can, if you want, split your purchases in 8 installments so that, this way, you can have, incredibly, 120 days to pay for your purchases.

However, if you choose this second option, you will have to pay an interest rate, which can be, depending on the case, quite high.

Various offers and promotions

As mentioned, you get a 10% discount on your first purchase.

In addition, you will have several discounts when buying products from the store, as well as several special payment options.

The store will always send you the latest news and promotions by email.

Therefore, make your registration in the store and then be attentive to your messages received in the email.

easy payment

With this function, you will be able to make your payments through the application that the store offers.

It will also be possible to make payments at the Riachuelo store itself, as well as at ATMs, lottery boxes, etc.

Request your Riachuelo card!

Did you like the features of the card and its advantages? Then click the button below and learn how to order yours.

About the author / Gustavo Cezar

Reviewed by / Junior Aguiar

Senior Editor

Trending Topics

LATAM Pass Itaucard Visa Gold credit card: how it works

Do you want to know how the LATAM Pass Itaucard Visa Gold card works? Then, read more about this international travel discount card here.

Keep Reading

How to apply for the Santander real estate consortium

With the Santander real estate consortium, you have access to excellent credit conditions. Find out how to apply for your consortium here.

Keep Reading

Porto Seguro Card or Neon Card: which is better?

Discover the best option between Porto Seguro card or Neon card. Both have international coverage and a reward program. Check out!

Keep ReadingYou may also like

How to start investing in fixed income in 2021

If you are thinking about investing in fixed income, then you are in the right place. Here you will find out about the best investment options for 2021, in addition to a brief analysis of the economic scenario for the first half of the year. Check out!

Keep Reading

Vivo Itaucard Cashback Platinum Visa credit card: how it works

Anyone who is an Itaú customer can count on many special conditions on the different cards they offer. The Vivo Itaucard Cashback Platinum Visa, for example, in addition to cashback offers special discounts at Vivo. Learn more about how this partnership works.

Keep Reading

Discover the Caixa Infinite card

With the Caixa Infinite card, you have access to several VIP lounges in airports around the world and several other benefits. Read on to find out what they are!

Keep Reading