Cards

Where can I apply for a prepaid card online?

Check out our step-by-step guide to applying for your prepaid credit card online. Also, find out how it works and see card tips for you to choose from.

Advertisement

See the step-by-step and clear all your doubts about how to apply for a prepaid card online

First of all, the prepaid credit card is the perfect solution for those who are afraid of carrying cash in their wallet. In addition, it is very practical to deposit your child's allowance or even to pay employees. That way, if you are interested and want to acquire one too, check out how to apply for a prepaid card online!

By the way, the procedure is quite simple and should only take a few minutes. In addition, we also brought some suggestions for prepaid cards for you to know step by step. See more below!

Apply for a prepaid card online: what is needed

Well, a prepaid card basically works like a prepaid cell phone. That is, you need to recharge it to use it. Furthermore, your application is much simpler than a regular credit card.

In this way, depending on the financial institution, you only need to request and pay the card issuing fee. Most of the time, banks do not require a minimum income to subscribe to this type of product.

However, there are some banks that provide the prepaid card only to account holders. Thus, you will need to open an account at the institution to later apply for your card. But don't worry, usually these accounts are free and have no fees.

In this way, you will only need to present your personal documents, such as RG and CPF, for example. In addition, it is important to enter your address correctly, as the card will be sent to the specified location.

Online prepaid card: step by step to apply

So, as we have already explained, applying for prepaid cards is quite simple, since it does not require a credit analysis. By the way, some companies offer the product to negative people as well. Therefore, the target audience is quite wide.

Therefore, check below some ways to apply for a prepaid card in general. This will give you an idea of how the process works.

Request through the website

First, the vast majority of prepaid cards can be requested online, directly from the official website of the financial institution. So, you just need to search and choose which bank best suits your needs and access the portal.

Then search for the chosen credit card type and click to view the details. In this way, you must find the request button on the card page. Then, click to request and fill in the fields with the information that will be requested.

By the way, don't worry, as they tend to be basic personal data, in addition to an address to deliver your card. After that, just download and pay the ticket for the issuing fee or the first recharge and that's it! Have you seen how simple it is to apply for a prepaid card online? Now all you have to do is wait for the plastic to arrive at the address given!

Request via app

Well, in addition to the option to apply for a prepaid card online through the website, you can also sign up through the chosen bank application. Therefore, make sure that the required app is available for both Android and iOS users. So you just need to download it from your app store.

Thus, register a username and password in the card app, as well as make your request through the application menu. Furthermore, if you need to open an account to request the prepaid card, you can also carry out the procedure through the app.

In addition, the data you must provide must be the same as the request made on the website. That is, it is a simple and quick procedure that should not take more than a few minutes to complete. Then all you have to do is pay the ticket for the acquisition fee or the first top-up and wait for the card to arrive at the address you entered!

3 options to apply for a prepaid card online

So, if you are interested in all the practicalities that the prepaid card has to offer, check out, below, some options to request. In addition, it is important to inform that there are several options on the market, these are just a few suggestions. Follow!

1. Access

First of all, the Prepaid Access card is available in two versions, physical and digital. However, it is important to inform that the digital prepaid card can only be used for online purchases.

Therefore, when requesting a prepaid card online, choose the card of your choice and then choose the value of the first top-up. In this sense, remember that when you recharge R$100.00 or more, you will not have to pay the card issue fee.

However, there is a monthly fee of R$5.95, but you only pay when there is a balance. That way, your account never goes negative.

Furthermore, after completing the request with your personal data, you must wait for the physical card to arrive at the address provided. Therefore, the delivery time is 10 working days.

| minimum income | not required |

| Annuity | 12x of R$5.95 |

| Flag | MasterCard |

| Roof | International |

| Benefits | Mastercard Surprise; Differentiated annuity. |

How to apply for the Prepaid Access Card

See now how to apply for the Access prepaid card with a simple, quick, easy and safe step by step. Order yours and start shopping

2. Superdigital

Firstly, Superdigital is a fintech from Banco Santander that offers online and simplified 100% service. In addition, she has a prepaid Mastercard credit card. However, to apply for it, you will need to open a digital account with the finance company.

In this way, open your account through the Superdigital app which, according to fintech, takes less than 7 minutes to complete the procedure. By the way, it is important to inform that the application is available for both Android and iOS.

Then you just need to create your registration and fill in your personal data. Also, Superdigital's digital account is free, so you don't have to worry about fees.

So, log in to your application and access the “Organize” option to find the card. Furthermore, it is important that you provide a valid address for your prepaid card to be delivered.

| minimum income | not required |

| Annuity | Exempt |

| Flag | MasterCard |

| Roof | International |

| Benefits | Mastercard Surprise; Additional cards. |

How to apply for the Superdigital prepaid card

Check now how to apply for the Superdigital prepaid card with a simple and practical step by step. Make your request and start shopping safely!

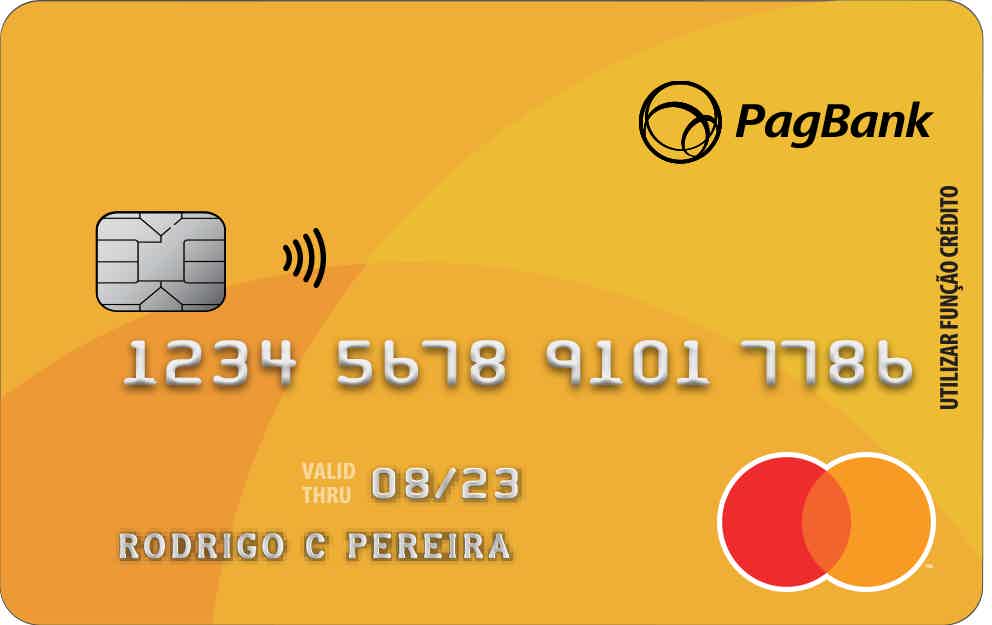

3. PagSeguro

So, a good option for anyone who wants to apply for a prepaid card online, but is negative, is the PagSeguro card. Incidentally, the card has international coverage and has the Mastercard flag that allows you to participate in the Mastercard Surpreenda program.

Well, you can apply for your PagSeguro prepaid credit card through the official website of the finance company or through the application. Thus, the app is available both on the Play Store and the App Store. That way, you can download and register before ordering your prepaid card.

Furthermore, if you prefer to apply through the PagSeguro website, you only need to access the portal and choose the product to join. Then, click on “Order yours now” and fill in the fields with your personal data.

In addition, the card takes about 15 business days to arrive at the address provided. Therefore, be careful when filling in the address so as not to cause unnecessary delays.

| minimum income | not required |

| Annuity | Exempt |

| Flag | MasterCard |

| Roof | International |

| Benefits | Contactless technology; Mastercard Surprise. |

How to apply for the PagSeguro prepaid card

Learn all about how to apply for your PagSeguro prepaid card. Read this article and find out all the ways to apply right now.

How to recharge prepaid card online?

So, now that you know how to apply for a prepaid card online, let's help you recharge your plastic to use it. In general, you can recharge your prepaid card in several ways. So choose which one is best for you.

First, you can recharge through a bank slip, generating the slip through the card application. Also, you can also debit your account or transfer DOC or TED.

Furthermore, for prepaid cards linked to a current account, you can also top up through the self-service terminals. Or, you can go to a bank branch and recharge it through the cashier. That way, there are several options for you to recharge your prepaid card and use it to make your purchases!

How to generate a virtual credit card?

First of all, check if your prepaid card offers this feature. Generally, the option is available directly in the financial application responsible for the prepaid card. Then go to your app and click on the card option.

Thus, you must find the option to generate your virtual card. The application should ask for your password to perform the procedure, inform it. Then you should view the digital card with all the necessary information. Ready! Now just use it to do your online shopping.

By the way, if you have any restrictions on your name and want to know how to be approved for a credit card, access our content below and check it out!

How to choose a bad credit card

Needing to choose a credit card for negatives? There are good options like prepaid and payroll. Check here how to choose yours!

About the author / Aline Barbosa

Reviewed by / Junior Aguiar

Senior Editor

Trending Topics

How to Maintain Financial Balance in 2021

A good financial balance is spending less than you earn. All with financial education, planning and cutting costs. Check it out!

Keep Reading

Live football for free: how to watch online

If you want to see your team shine on the field, but you can't afford a sports channel right now, here's how to watch live football for free!

Keep Reading

Learn how to find the best warehouse jobs

Find the best warehouse jobs, find out how to stand out and where to find a job as a warehouse manager.

Keep ReadingYou may also like

BTG+ or Inter: which is the best card?

The BTG+ card and the Inter card offer several advantages to their customers. Do you want to meet them? So read our post and check it out!

Keep Reading

FinanZero loan online: personalized credit offers

FinanZero loan online is one of the best options for those who need fast cash. It works online, which makes it very practical and accessible. To learn more about this option, just continue reading the article.

Keep Reading

Discover the BMG Consignado credit card

The BMG Consignado credit card allows you to shop anywhere, does not charge an annuity and also gives you a limit of up to 1.6x your benefit or salary. Want to know how it works? So, check out all the information below.

Keep Reading