Cards

Sicoob Gold Card or Sicredi Gold Card: which is better?

The Sicoob Gold card and the Sicredi Gold card offer international coverage, in addition to the points program and brand benefits. But what is the best alternative? Find out here!

Advertisement

Sicoob Gold x Sicredi Gold: find out which one to choose

First of all, the Sicoob Gold card or the Sicredi Gold card are two great credit alternatives for members of their respective cooperatives, as they provide financial freedom and greater purchasing power. With international coverage and all the security of Visa or Mastercard flags, they are the ideal options to change the way you see your finances and make your dreams come true!

So, how about knowing the main characteristics of the two cards, in addition to their pros and cons, as well as all the benefits they offer? This way, you have access to all the necessary information to make an informed decision and take advantage of all the practicalities of the chosen product. Let's go?

| Sicoob Gold Card | Sicredi Gold Card | |

| Minimum Income | not informed | not informed |

| Annuity | not informed | not informed |

| Flag | Mastercard or Visa | Mastercard or Visa |

| Roof | International | International |

| Benefits | rewards program | rewards program |

Sicoob Gold Card

First, Sicoob is considered one of the main credit cooperatives in activity in the country. With more than 5 million members, one of the institution's main objectives is to offer financial solutions to its members through products and services that transmit quality and security.

So, one of the products available is Sicoobcard Gold. It offers international coverage with all the credibility of the Mastercard or Visa flags. In other words, you can choose the flag issuing your card and also have the advantage of shopping at millions of accredited physical or virtual establishments around the world.

In addition, you also participate in Sicoob's rewards program, Sicoobcard Prêmios, and you can register your card in the brand's benefit programs, such as Mastercard Surpreenda and Vai de Visa.

However, the Sicoob Gold card is only available to Sicoob members. That is, you need to join the cooperative before checking product availability.

Sicredi Gold Card

First of all, Sicredi is the first cooperative society created in the country. With thousands of branches spread across 23 states, it has more than 4 million members, and offers financial products and services similar to those of a traditional bank. But, with the differential of benefits such as participation in the company's profits, since a Sicredi member is considered a member, not a client of the cooperative.

Among the products offered to its members is Sicredi Gold. A credit card with international coverage issued under Visa or Mastercard. This way, you can make your purchases in physical establishments or online in Brazil and abroad, and you can also count on the credibility of two of the best known credit companies in the world.

In addition, cooperative members who have the Sicredi Gold card participate in the cooperative's rewards program by accumulating points on purchases made in dollars. And, they can also take advantage of the benefits offered by Mastercard Surpreenda or Vai de Visa.

What are the advantages of the Sicoob Gold card?

Nowadays, one of the most attractive aspects of credit cards are the rewards programs they offer, and Sicoob Gold is no different. In this sense, when purchasing your card, you participate in the Sicoobcard Awards program. With it, you earn points for every purchase you make, and you can exchange the accumulated points for cashback on your invoice, hundreds of products, miles and many other exclusive benefits.

In addition, Visa and Mastercard brand programs offer discounts at several accredited establishments. To participate, just register the card on the official website of the programs and use your Sicoob Gold frequently to earn points and redeem your benefits.

Furthermore, the Gold tier also provides essential services such as international travel assistance, as well as purchase protection and price protection. And, you can consult your card transactions and make withdrawals at any self-service terminal in the Banco24Horas network.

What are the advantages of the Sicredi Gold card?

So, one of the main advantages of the cards that belong to the Gold category are the assistance they offer to those who use them frequently and have the habit of making international trips. In this sense, you have the various insurance offered by the brand, in addition to services such as purchase protection and price protection.

In addition, Sicredi offers four ways to pay invoices if you have any financial unforeseen circumstances. This means that in addition to full payment, you have minimum payment, installment, and down payment options. Thus, you manage to organize yourself financially and avoid complications with credit protection bodies.

And, with the Sicredi rewards program, you earn points when you make purchases in dollars with your card, and you can exchange the accumulated points for cashback on your invoice, airline tickets and hundreds of products available on the cooperative's official website. Or, if you prefer, you can also transfer your points to frequent flyer programs, such as LATAM Pass and Smiles.

Furthermore, by registering your card on the Mastercard Surpreenda or Vai de Visa websites, you can enjoy even more benefits, such as discounts at thousands of partner establishments of the flags.

What are the disadvantages of the Sicoob Gold card?

Well, one of the negative aspects that draw attention to Sicoob Gold is the lack of information about the product on its official website. In this sense, the minimum amounts required for income are not available, in addition to fees, such as annuity and card maintenance.

In addition, the product is only available to Sicoob members and the application process is quite bureaucratic. That is, you first need to become a member of the cooperative by paying the initial capital fee. Then, you must go to your physical branch to verify that your financial profile meets the conditions imposed by Sicoob.

What are the disadvantages of the Sicredi Gold card?

Undoubtedly, the main downside is that to access the benefits of Sicredi Gold, you must first become a member of the credit union. So, the process is bureaucratic and can only be done in person at one of the agencies spread across Brazil.

In addition, you need to prove a minimum income and this amount is not available for consultation on the Sicredi website. In addition, a credit analysis is carried out to verify your ability to pay. And, even after becoming a member of the cooperative, the card is only available if your financial profile is in accordance with the institution's requirements.

Sicoob Gold Card or Sicredi Gold Card: which one to choose?

First of all, the choice between two credit products is a personal one, and you must take into account all the characteristics presented here before deciding between the Sicoob Gold card or the Sicredi Gold card.

So, both alternatives offer advantageous benefits such as the Gold category, in addition to international coverage and exclusive points programs. However, to have access to the cards, it is necessary to go through a bureaucratic process of association to the cooperatives. And nowadays, there are several options in the financial market that offer the same advantages without demanding so much from their customers.

Therefore, carefully assess whether the Sicoob Gold card or the Sicredi Gold card are what you are looking for to leverage your financial life. And before making a final decision, check out the recommended content below with two other options to further expand your knowledge!

Nubank Ultraviolet or Inter: which is better

Discover details and decide between the Nubank Ultravioleta card or the Inter card. Both have a cashback program and benefits associated with the brand. Check out more about them!

About the author / Aline Barbosa

Reviewed by / Junior Aguiar

Senior Editor

Trending Topics

How to apply for a loan with a car guarantee Banco do Brasil

Find out here in this post how the online request for a Banco do Brasil car loan works.

Keep Reading

Discover all Bradesco cards

After all, do you know all Bradesco cards? Be it Elo, Visa or American Express, Bradesco has the ideal card according to your profile.

Keep Reading

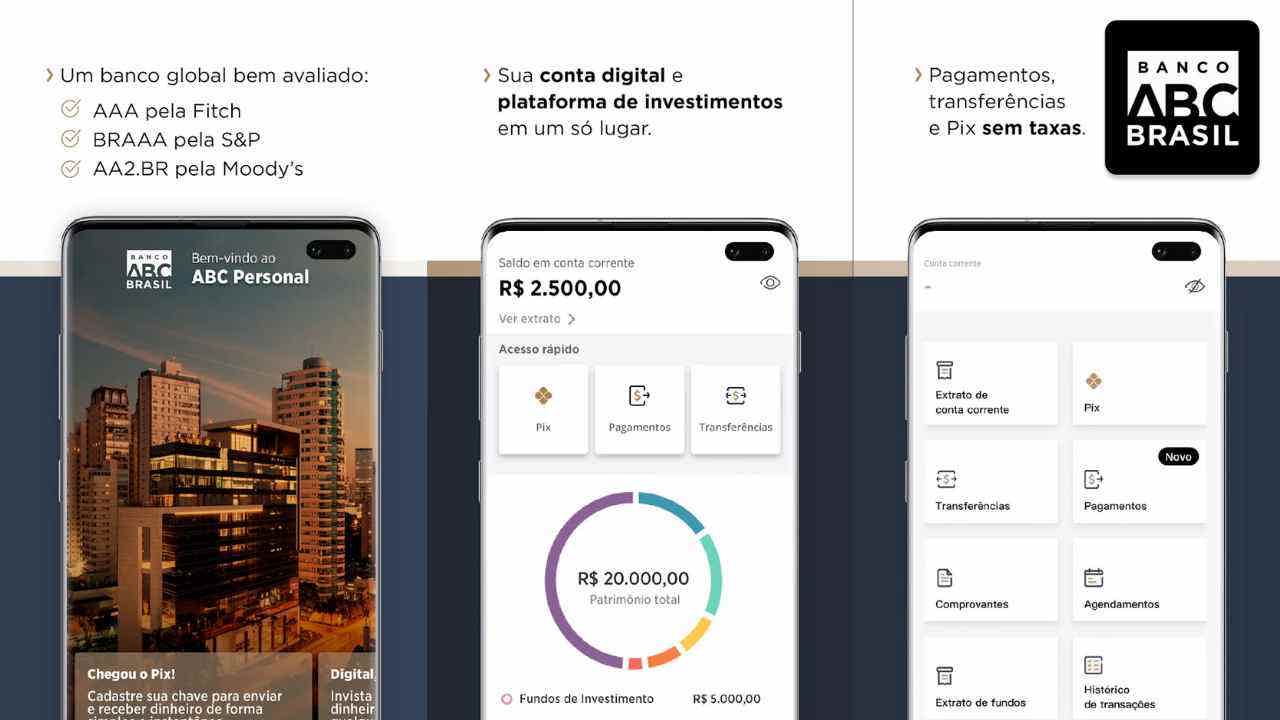

How to open an ABC Personal account

Learn how to open your ABC Personal account without leaving home. As well as take advantage of the opportunity to invest in fixed income funds without paying fees.

Keep ReadingYou may also like

Agibank Card or Santander SX Universitário Card: which one to choose?

So, Agibank card or Santander SX Universitário card? Which one is right for you? Want to know the answer? So, read our post right now.

Keep Reading

Discover the Voltz digital account

Do you know the Voltz digital account? This option offers you several benefits free of bureaucracy, such as the free maintenance fee and the international Mastercard credit card with no annual fee. See more here!

Keep Reading

How does Serasa Score Turbo work?

Serasa Score Turbo is a way to help you improve your credit score, scoring more with each debt paid. Know more!

Keep Reading