Cards

Santander SX: more advantages of the new product

The Santander SX card offers many advantages to its customers, such as discounts with partners, exclusive installments and the possibility of waiving the annuity. Read the post and learn more!

Advertisement

Santander SX: great benefits for you

As part of a large publicity campaign carried out by Santander to inaugurate the PIX (the new banking operations system of the Central Bank), the SX is the bank's biggest advertising launch in 2020.

The card is international, so it allows purchases in all stores on the planet. In addition, it can function as a credit or debit function (for account holders).

It is a product for all financial classes and age groups. For that reason, it has a minimum threshold value of R$ 250.00.

Want to know more advantages about this card? So, read on and check it out!

How to apply for the Santander SX card

With the Santander SX card, you have the possibility to waive the annuity, as well as take advantage of discounts with Esfera partners. Find out how to apply here!

What are the advantages of the Santander SX card?

Annuity

There are two ways to waive the annuity at Santander SX once and for all.

The first way, for bank account holders, is just to enter the Santander account and register the CPF and cell phone number as a Pix key. With that, all annuities are zeroed.

For new customers, who have the card but not an open bank account, the annuity fee will be waived every time the monthly bill exceeds R$ 100.00. However, whenever the invoice does not exceed this amount, 1/12 of the annuity will be charged, that is, R$ 33.25.

online card

As it is International, SX allows you to shop at any store in the world, whether traveling or over the internet.

Santander Pass

The SX technology allows you to make payments by approximation at the “machininhas”, without the need to enter a password.

In addition to providing more dynamism and speed in transactions, it also means that it is possible to synchronize the card with various devices, such as “smart” watches and cell phones to pay without even pulling out the card!

App Way

With the Way app, you can track your card in the palm of your hand, as well as control your credit limit and monthly expenses.

Sphere Program

In the Esfera program, you have access to several benefits, including discounts and advantages at partner establishments. In this case, you can get up to 50% off at Esfera partner stores.

Withdrawals

Withdrawals are also possible with the credit function! When the end of the month arrives or an emergency arises, it is always important to have options at hand.

Just look for an ATM and make a withdrawal from the function, with no need to go through credit assessments.

Go from Visa

You also have the possibility to participate in the Vai de Visa program. In this case, it is possible to take advantage of exclusive offers for Visa partners, as well as compete for incredible prizes.

extended installment payment

Your invoices can be paid in up to 24 installments, offering much more comfort and possibilities to pay for your purchases.

So, do you want to know how to apply for your Santander SX card? The process is very simple! Click on the recommended content below and find out.

How to apply for the Santander SX card

With the Santander SX card, you have the possibility to waive the annuity, as well as take advantage of discounts with Esfera partners. Find out how to apply here!

Trending Topics

What is the best website for online courses with a certificate?

Want to professionalize without leaving home? Check out this list of the best online course sites with a certificate and start your studies now!

Keep Reading

Discover the Riachuelo credit card

The Riachuelo card can be requested in three ways with exclusive advantages and special benefits. Learn more here!

Keep Reading

Bradesco loan or Caixa loan: which one to choose?

Do you know the best loan between Bradesco and Caixa? No? So, read this post and see the analysis we did! Check out!

Keep ReadingYou may also like

Superdigital Card or Pan Card: which is the best card?

Superdigital card or Pan card? If you also have this doubt click and learn more about each one of them before deciding.

Keep Reading

What is the Gold Sicredi card limit?

Here's the question: do you know what the Gold Sicredi card limit is? What we can say is that the limit is customizable and can vary according to some factors. We tell you everything about this subject in this post here, check it out!

Keep Reading

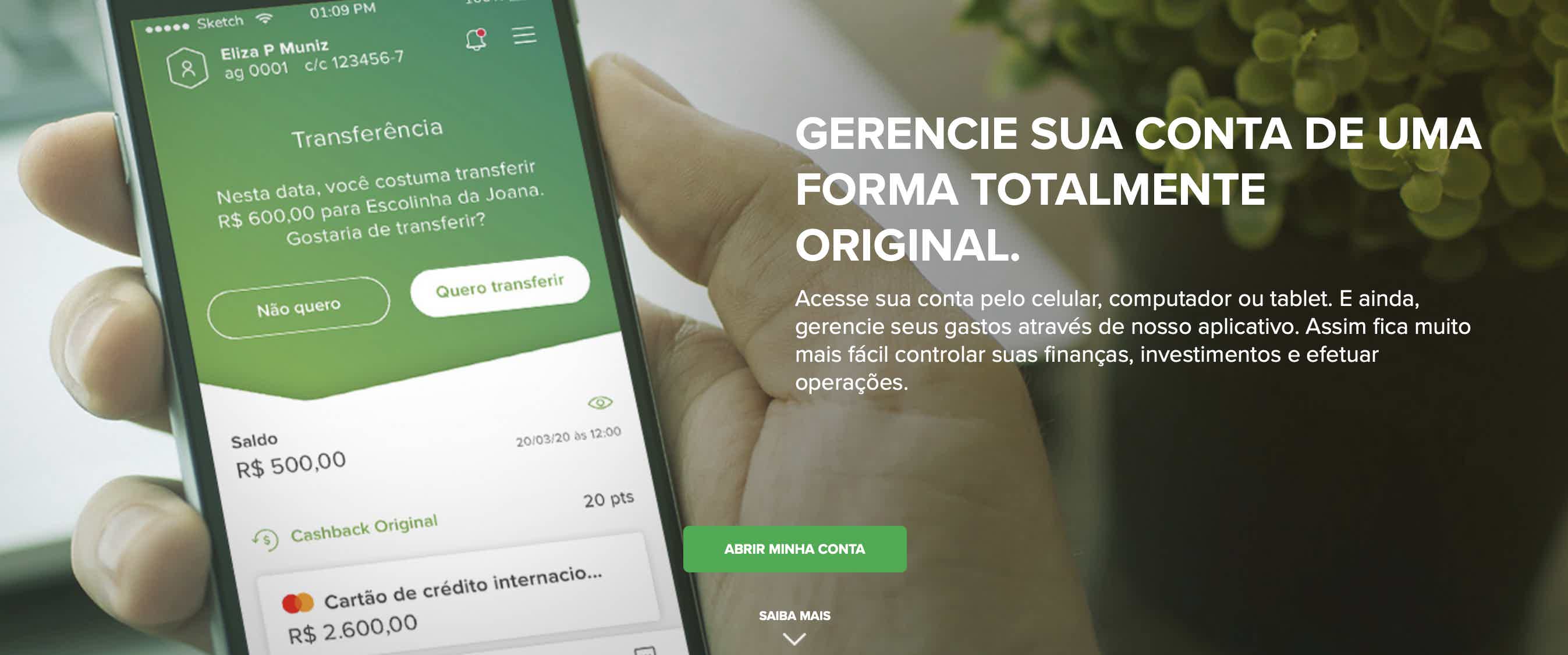

Know the original account

For those looking for more facilities in their routine and a safer way to manage their money, the Original account is certainly the best choice. Directly in the app, you have access to your current account, credit, personal credit, etc. All this without hidden fees and annual fees. Did you like it? So, learn more about it here.

Keep Reading