loans

Personal Loan Review Creditas 2022

With Creditas, you can choose between two types of loan and benefit from the lowest rates on the market. Check out everything about this financial product in our review.

Advertisement

Creditas personal loan: one of the largest credit companies with the lowest rates on the market

This is a review about the Creditas personal loan, one of the main digital platforms that acts as a bank correspondent and offers loan services to its users. In other words, an exponent in the financial market with great national recognition.

Currently, Creditas has two different types of personal loans, loans secured by property and secured by vehicles. In addition, both have very low rates and excellent credit limits.

Therefore, it is worth checking all the details about the Creditas personal loan and verifying whether it is worth applying for!

| Minimum Income | not informed |

| Interest rate | As of 0.89% am |

| Deadline to pay | Up to 240 months |

| release period | Right after signing the contract |

| loan amount | Maximum value of R$3 million |

| Do you accept negatives? | Yes |

How to apply for the Creditas loan

Creditas offers you up to R$3million in credit, with an interest rate starting at 0.89% am and up to 240 months to pay.

Creditas loan review: everything you need to know

Creditas is one of the main financial platforms that have been operating since 2020 as one of the main digital secured credit platforms throughout Brazil. Even surpassing traditional Brazilian banks.

This recognition has been taking place over the last few years, in which technology has been advancing and Creditas has accompanied and evolved a lot, along with digital platforms.

Currently, Creditas offers two different types of personal loans, loans secured by property and secured by vehicles. Both loans work with a type of guarantee as well as payment of installments.

This allows Creditas to work with one of the lowest rates on the market when it comes to loans, in addition, the amounts that the customer can access, both balance and installment, are above average.

Therefore, it is worth keeping track of all the details of the loans within this review on the Creditas personal loan that we have prepared. So, let's start talking about tariffs and fees!

fees and tariffs

Regarding loan fees and charges, it can be said that at Creditas they are much cheaper. In addition, lower rates are charged than conventional loans, where neither automobiles nor real estate are used as collateral.

In this sense, the rates are much lower because there is a guarantee that the loan payment will be made on the correct dates due to the assets placed at stake.

Therefore, Creditas has two types of personal loans, property guarantee and vehicle guarantee, and each of them has its values. So, see:

- Loan rates with property guarantee vary from 0.89% am +IPCA;

- Car secured loan rates range from 0.99% am +IPCA.

As we can see, even though they are different interest rates, the two remain low initially and can be considered one of the lowest rates on the market. Much of this is the responsibility of Creditas, one of the leading credit companies.

But with regard to interest, they may increase depending on the loan amount and payment terms.

Payment term and installment conditions

In this topic of the review on the Creditas personal loan, we are going to find out some details about how the loan payment term can affect the interest rates.

In principle, the repayment terms of both loans are different from each other. So, here's how the deadlines look:

- The loan with property guarantee has up to 240 months to pay;

- The vehicle secured loan has up to 60 months to pay off.

In advance, we can see that there is a good difference in the months available for loan applicants to pay off the loan. But this happens on account of loan amounts.

In this sense, the loan that has the property as collateral works with values that start at R$30 thousand and go up to R$3 million available for request. The loan with vehicle guarantee, ranges from R$5 thousand to R$150 thousand.

We will follow these and other points in the next topic, which will contain the advantages and disadvantages of the loan.

Advantages of the Credits loan

One of the main advantages of the loans that we show here is the number of months that applicants have to pay the loan installments.

Remembering that the loan with property guarantee has 240 months due to the values of the properties that are higher than the vehicles.

In this sense, the amounts available for request are very high, which could reach R$3 million in the case of loans secured by real estate. Vehicles, on the other hand, can reach up to R$150 thousand. Values that, compared to other loans on the market, far exceed the average of most of them.

Furthermore, because the loans have a guarantee, the fees for late payments are much lower. Because, in the event of serious delays, Creditas can exercise the right to collect the asset that was put up as collateral at the time of contracting.

Another advantage is the ease of hiring. Therefore, taking out the loan is very simple and intuitive. In this sense, almost the entire process is carried out within the site.

In addition to being simple, the simulation and request process are online. That is, they can be carried out by cell phone, tablet or computer. This greatly facilitates the process, as it is not necessary to deliver documents or appear in agencies or physical spaces in general.

Disadvantages of the Credit loan

Regarding the disadvantages, variable rates are an example. Therefore, due to the fact that the number of installments is high and the amounts available for request as well, interest rates may increase slightly depending on the amounts.

Furthermore, in the event of serious delays in payment, Creditas has the right to collect the property or vehicle involved in the negotiation.

application process

Creditas is highly regarded in the financial market. In addition, it is one of the exponents when we talk about technology and ease of procedures that are carried out by customers throughout Brazil.

In this sense, this is fully reflected in the procedure for applying for personal loans that the company makes available on its website. All in all, the application process is very simple.

Follow the steps below to apply:

- Access the Creditas website;

- Then, select the desired loan modality;

- After that, fill in the entire form with personal information and loan details;

- Then, finalize the request and send it to Creditas.

In this way, the request process is carried out. Then, after approval, the customer will receive a response from Creditas about the loan and the digital contract to sign and receive the amounts related to the loan.

Anyway, it's simple and 100% online all the request as we can see in this review about the Creditas personal loan. But if you still have doubts, access our recommended content and learn in detail how to apply for your loan.

How to apply for the Creditas loan

Creditas offers you up to R$3million in credit with an interest rate starting at 0.89% am and up to 240 months to pay.

About the author / Marina Poncio

Reviewed by / Junior Aguiar

Senior Editor

Trending Topics

How to choose the best PagBank card?

Find out once and for all which is the best PagBank card for you by knowing all 4 options that the company offers!

Keep Reading

Ali Credit payroll loan: what is Ali Credit?

Ali Credit is a digital 100% platform for applying for payroll loans in two ways! See below and clear your doubts.

Keep Reading

Saraiva Card or Santander SX Card?

To decide between the Saraiva or Santander SX card, know that both have points programs and international flags. Know more!

Keep ReadingYou may also like

Discover the Revolut Metal credit card

Like to travel and don't want to worry about complicated exchange rates? So get to know and have the Revolut Metal credit card for yourself.

Keep Reading

Mobile Secured Loans: How does it work and what are its benefits?

If you need quick cash and can't prove income or are negative, a cell phone secured loan may be the solution you're looking for. To learn more about him, just continue reading and check out more information!

Keep Reading

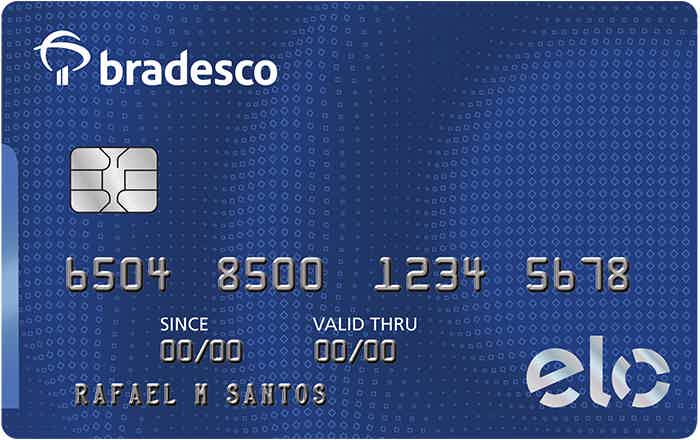

Get to know the Bradesco Elo Internacional Basic card

Do you know the Bradesco Elo Internacional Basic card? He can help you with everyday shopping. Continue reading and find out more!

Keep Reading