Cards

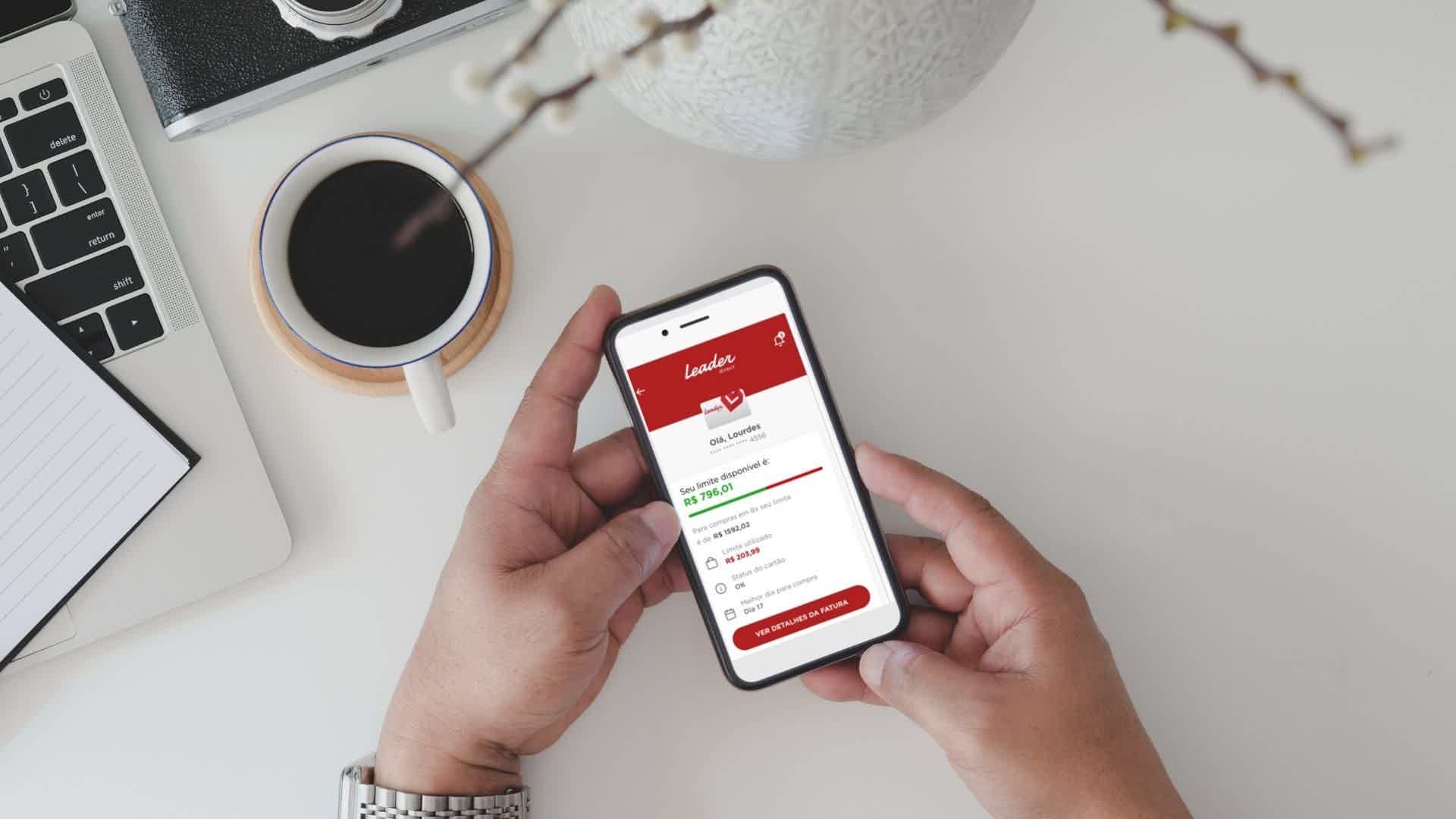

Leader Card Review 2021

The Leader card is offered by the Leader department retailer network. For customers, this card offers good payment conditions, various advantages and also discounts. Want to know if he's worth it or not? So, check out the full review we did on this card, below.

Advertisement

Card with discounts and special payment conditions at Leader stores

First of all, it is important to say that this Leader card review serves both customers and those who intend to buy on the network. Issued by Bradescard, with this card, Leader network customers can have several exclusive advantages.

But to have it, you need to register at the store, as well as request the card. Therefore, even if you are not yet a customer, you can start shopping at the store and enjoy its benefits.

So, if your goal is to learn more about it and whether or not it's worth having, keep following this content and find out!

| Annuity | R$118.80 |

| Minimum Income | Minimum wage |

| Flag | Visa |

| Roof | National |

| Benefits | Discounts and special installments |

Leader card review: everything you need to know

First of all, we prepared this Leader card review both for those who already know it and for those who haven't heard about it. The Leader chain of stores was founded in 1951, in Rio de Janeiro. Since that date, it has grown a lot, which is why it created, together with Bradescard, both the Visa card and the private label plastic that can only be used in the store.

So, now that you know a little more about the store, let's talk about the flag card? Find out more details below in our Leader card review, below!

annuity and coverage

The Leader card has an annual fee of R$118.80 and is charged annually. Unlike many cards, they do not add the amount of this annuity to the bill every month. You only pay once a year, on a date defined in your card agreement.

Therefore, you should find out about the payment date or when it can be made. That way, you are not in arrears and can make the best use of the card, without worrying about an extra amount on your bill every month.

The card coverage is national only, that is, you can only use it within the country. It is accepted in several stores, and you can pay your purchases in installments whenever you need it. Conditions and fees may vary by establishment. So stay tuned.

fees and tariffs

In addition to the annual fee reported above, this card has other fees and charges for its use. The revolving interest rate, for example, can reach 15.99% per month. The interest rate for installment purchases in the store reaches 7.90% per month.

Similarly, the installment interest rate at other establishments reaches 7.99% per month. And finally, interest rates for installments, easy installments and cash withdrawals or installments are 11.90%, 13.90% and 11.90% per month, respectively.

Likewise, the card also charges certain fees. For example, for withdrawals from service networks in the credit function, you must pay a fee of R$12.00. And if you happen to need an emergency credit assessment, you'll pay R$18.90.

flag and benefits

The product of this review, Leader card in this case, has a National Visa flag. It is accepted in many establishments across the country. However, even though it is Visa, it is not accepted in other countries, so the card must only be used in Brazil.

However, that doesn't mean it doesn't have benefits. For example, you can take advantage of the extended warranty on certain products under this banner. In addition, it offers price protection insurance and purchase protection insurance.

In addition to these free benefits, which are already included in your card, the flag gives you access to others. For example, you can have a dental plan, award-winning super protection, access to a study platform and financial protection. These options are paid, but you can choose to have them or not.

Advantages of the Leader card

Along with the benefits of the flag, the Leader card also offers its advantages. Among them is the 10% discount on the first purchase made on the network. Plus, you have up to 40 days to pay for certain purchases.

If you prefer, you can pay your purchases in 5 interest-free installments or even 12 fixed installments. In addition to exclusive promotions in the store, you can even pay the withdrawals you make in the credit function in up to 10 installments on your invoice.

Finally, if you want to gift your friends or family with a card as well, you are entitled to 2 additional cards for over 16s. Furthermore, as it is a Bradescard (issued by Bradesco bank), both the cardholder and the additional ones get 50% discount on Cinemark tickets and on the purchase of popcorn and soda or 500ml juice.

Disadvantages of the Leader Card

Despite being a good card, the Leader also has its negative points. Even though it is not an exclusive store card, it has its limitations. For example, its fees can be considered high compared to other credit cards.

Another point is that its flag is only national. Some cards on the market have an international flag and do not have an annual fee. This is even one of the negative points. Even if you don't use the card, either here or abroad, you need to pay the annual fee.

Other than that, it doesn't offer any big perks like a points or cashback program. Finally, its approval can be considered difficult, as it requires a minimum income of the current minimum wage.

card application

The card presented in this review does not have a management application. On the website, they inform you that any questions you can go to a physical store or contact the customer service center.

If you are in a capital or metropolitan region, you can contact us at 4003 6144. In other locations, you can call 0800 880 6144. If you prefer, you can also access the website and send your question via chat or email .

application process

Applying for the Leader card is a little different from other cards. To get your card, you need to go to a physical store unit. On the official website you will find a list of units spread across Brazil.

Invoice payment must also be made at the physical store, as well as limit increase or card unlocking. In addition, you can contact the call center at the numbers given above.

Finally, if you want to know another review, be sure to check out the content that we recommend below.

Americanas Card Review 2021

Check out the Americana card review that we brought for you. It has a cashback program, Visa flag, national coverage, discounts and differentiated installments.

About the author / Sara Martins

Reviewed by / Junior Aguiar

Senior Editor

Trending Topics

SBT vacancies: how to check the options?

Check out 3 main positions with SBT vacancies available and find out the average salary that employees at this company can earn!

Keep Reading

How to apply for Bradesco real estate credit

Apply for Bradesco real estate credit. The simulation is fast, as everything is done over the internet. The hiring, on the other hand, is at the agency. Here's the step by step!

Keep Reading

The Key to Unlimited Internet: Discover Amazing Apps to Find Your Neighbor's Wi-Fi Password

Your connection dropped and you need internet? See in this post how to find out the neighbor's Wi-Fi password and thus stay connected!

Keep ReadingYou may also like

Santander credit card and Limit: apply now for the perfect one for you

Get to know all the Santander credit card and limit options in the high, medium and basic categories, as well as choose the best option for your pocket.

Keep Reading

Right Agreement: negotiate Bradesco debts

Do you have outstanding debts with Bradesco bank? Know that it is possible to make the payment with unmissable payment conditions through the Agreement Right platform. Learn more here.

Keep Reading

Get to know BNI Puzzle Personal Loan

In need of quick credit? Then, get to know Puzzle BNI Personal Credit, which only depends on you to hire online and has credit of up to €6,000 for 96 months. Check out!

Keep Reading