Cards

Itaucard Click Card Review 2021

With the Itaucard Click card, you have access to the benefits of the bank, in addition to the advantages of the brand, and also, it has zero annuity and international coverage! Want to know more? So, click here and check out our review!

Advertisement

Enjoy a Platinum card, with no annual fee and rewards program

Banco Itaú is undoubtedly one of the largest financial institutions in Latin America. With more than seventy years in the market, it is always looking for new ways to conquer and retain its customers with innovative solutions. So, today we are going to talk about one of these financial products in our Itaucard Click card review.

So, check out the table below and read on to find out everything about this card. Thus, you can assess whether it is the financial product you were looking for. Let's go?

| Annuity | Exempt |

| minimum income | not informed |

| Flag | Visa or Mastercard |

| Roof | International |

| Benefits | Free annual fee; iupp benefit programs; Flag loyalty programs; Digital control. |

How to apply for the Itaucard Click card

The Itaucard Click card offers free annual fee and international coverage, in addition to the benefits of Visa and Mastercard! See here how to order yours!

Itaucard Click card review: everything you need to know

Well, Itaucard Click is one of Banco Itaú's main technologically integrated products. That's because, in addition to controlling all your transactions through the app, you can also register the card in your digital wallet and make approximation payments using just your cell phone or smart watch. Amazing, isn't it?

So, the card has a number of features that make it one of the most accessible and user-friendly on the market. And in our Itaucard Click card review, we'll talk about all of them for you.

So, read on and find out about a card with many benefits that could be ideal for moving your financial life!

annuity and coverage

First of all, the Itaucard Click card offers both the Visa and Mastercard brands and in both options the annual fee is free. So, you don't pay any monthly fee to have yours and save a little money at the end of the month.

In addition, regardless of the chosen flag, the card has international coverage. So, you can use it to shop at millions of stores in Brazil and abroad, whether in physical or virtual establishments, in a safe and uncomplicated way.

rates to rates

In our Itaucard Click card review, we couldn't fail to mention which services are charged, right? So you can assess whether the card is really worth it. So, check out what these fees are, below.

As we mentioned earlier, the card offers annuity exemption and does not charge maintenance fees. This way, you can use your Itaucard Click without worrying about these extra values.

However, it is important to always pay the full amount on the due date of the invoice to avoid revolving interest, which can reach up to 12.16% per month depending on the customer's profile. In addition, default interest of 1.00% + iOF and a fine of 2% is charged on the total amount.

flag and benefits

Well, Itaú offers the Visa and Mastercard brands and you choose which one you want on your card. So, to help you with that decision, let's talk about what advantages they offer.

Therefore, the Mastercard brand is one of the most recognized in the world and is accepted in millions of establishments. Even more, you can register your card in the Mastercard Surpreenda loyalty program. With it, you accumulate 1 point for every purchase you make and can exchange the accumulated points for discounts at several partner stores and restaurants.

In this sense, Visa is also one of the most credible brands in the world and is accepted in almost all physical and virtual commercial establishments. Thus, it also offers a rewards program, Vai de Visa. With it, you get discounts on courses, you can help social causes and you can also participate in prize draws or cashback for invoice discounts.

Advantages of the Itaucard Click card

So, our Itaucard Click card review wouldn't be complete if we didn't talk about its benefits. So read on to find out what they are!

First, we can highlight the annuity exemption as its main positive feature. You pay no monthly fee and can enjoy all the benefits of the card without worrying about any fees.

You can also ask for a limit increase after three months of using the card. To do this, just keep your name clean and your invoices up to date. Itaú analyzes transactions made with your purchases and may increase your credit limit based on your financial profile.

In addition, Itaú offers its own rewards program: the iupp. With it, you earn 3 points for every R$1.00 spent at the iupp mall and you can exchange the accumulated points for various products and services.

In addition, the card offers discounts on cultural programs and restaurants associated with Itaú. Just as it is one of the bank's products with the greatest technological integration. In this sense, you have the option of registering the card in digital wallets, such as Apple Pay, Google Pay and Samsung Pay, and generating virtual cards through the app to make your purchases on the internet with much more security.

Get to know the Itaucard Click card

Do you want a card full of benefits, with no annual fee and international coverage? Then Itaucard Click is the right product for you! Click here and find out!

Disadvantages of the Itaucard Click card

So, the main negative point of the Itaucard Click card is that the credit analysis is rigorous and seeks information from the Federal Revenue Service, as well as credit protection agencies. In this way, if you have restrictions on your name or have a low score, it is unlikely that your application will be approved.

Furthermore, you do not need to be an Itaú customer to request yours, but this way you do not have access to the benefits offered by the bank.

card application

Well, Itaú offers an exclusive application for managing your cards: the Itaucard app. With it, you have access to all the functionalities of your Itaucard Click in the palm of your hand and you can check your credit limit, purchase history, invoices, discounts available to you and much more!

So, the app is available for smartphones on the App Store or Google Play and is very easy to use. So you can enjoy all the benefits of your card with just a few taps and a lot of technology!

application process

So, you can already see that the Itaucard Click card came to make your life easier, right? With the request process is no different!

In this sense, you can apply from the comfort of your home through the official website of the institution. Just go to the “cards” option, then “choose Itaucard” and then “list of cards” to select Itaucard Click. Then, you click on “ask now” and fill out the form with some of your personal data, such as your full name, CPF, email and telephone number.

Thus, Itaú performs a credit analysis and if your application is approved, you receive notification by SMS through the number informed in the registration.

Unfortunately, the request cannot be made over the phone, but you can call the SAC through the number 0800 724 4845 to solve any doubts. Service is available 24 hours a day, seven days a week.

So, now that you know everything about the Itaucard Click card, what do you think about requesting yours? Check out the recommended content below for more details on this process and don't miss this opportunity!

How to apply for the Itaucard Click card

The Itaucard Click card offers free annual fee and international coverage, in addition to the benefits of Visa and Mastercard! See here how to order yours!

About the author / Aline Barbosa

Reviewed by / Junior Aguiar

Senior Editor

Trending Topics

Find out if you have FGTS balance in 2022

Find out if you have a FGTS balance in 2022 and also find out how to withdraw the corresponding amount. Check out the full step-by-step here.

Keep Reading

Crefisa Card or Itaú Card: which is best?

If, on the one hand, the loan will be negative, on the other, credit without an annual fee is possible. Decide between the Crefisa card or Itaú card.

Keep Reading

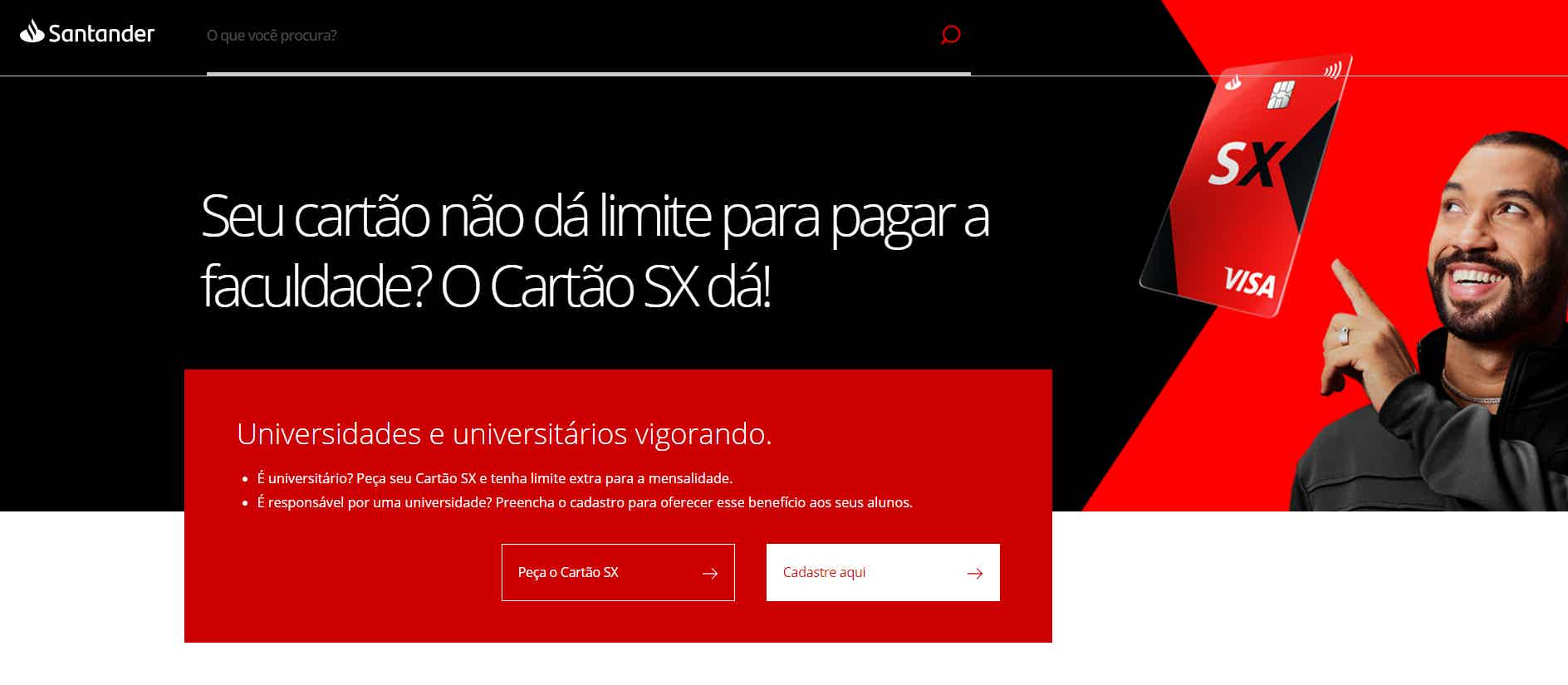

How to apply for a Santander Universitário SX card

The Santander Universitário SX card offers easy credit analysis and does not require proof of income. See how to apply!

Keep ReadingYou may also like

Discover the Flip app

Do you want to control your investments in an easier and more practical way? Meet the Fliper app, an intuitive way to manage your assets.

Keep Reading

Get to know the Bradesco Visa Like card

Do you know the Bradesco Visa Like card? It offers a great Cashback Program. Want to know more? So, read on and check it out!

Keep Reading

How to apply for Accident Assistance

Want to know how to access Accident Assistance? Read the post below and check out the step-by-step process of applying for the benefit.

Keep Reading