Cards

CEA 2021 Card Review

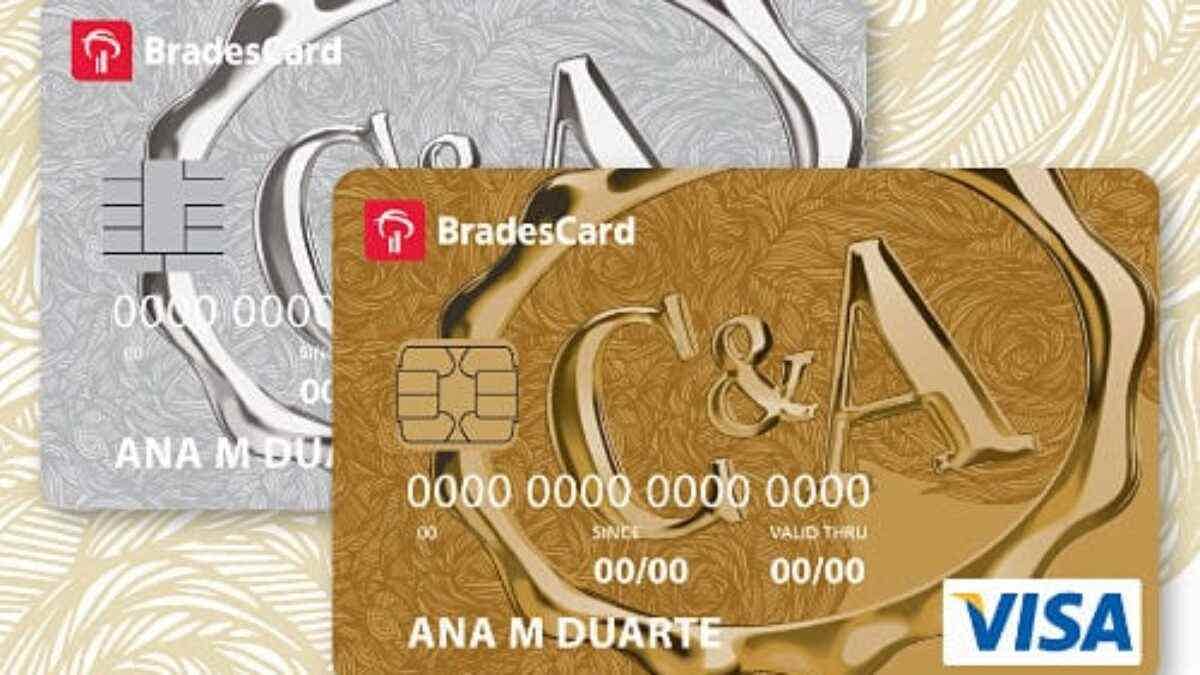

In this CEA card review you will see the advantages and disadvantages, as well as decide if this is the ideal card for you. With Visa or Elo flags of your choice, the CEA card is international and has exclusive benefits. Check out!

Advertisement

Exclusive discounts at partner stores with Bradescard security

First, C&A is an international chain of stores and one of the largest department stores in Brazil. In partnership with Bradescard, it offers international credit cards with Visa or Elo flags. So, check out our CEA card review with its main features and advantages. Let's go!

| minimum income | Minimum wage |

| Roof | International |

| Flag | Visa or Link |

| Annuity | Visa Gold – R$221.88 International Link - R$221.88 Elo Mais – R$245.88 Graphite Link - R$329.88 |

| Additional card available? | Yes |

| Benefits | Discount on first C&A purchase; Discounts at cinemas and other stores; Exclusive application; Withdrawal at a physical store or Banco24h; Additional cards. |

How to apply for the C&A Bradescard card

The C&A Bradescard card allows customers to make purchases with exclusive benefits at any store in the chain. Check how to apply!

C&A card review: everything you need to know

Well, the C&A cards emerged in partnership with Bradescard which, in turn, is responsible for issuing Banco Bradesco cards. Therefore, C&A cards are completely secure and also offer some exclusive benefits.

So, created in 1841, C&A is present in 24 countries in Europe, Latin America and Asia. In Brazil, it is one of the largest department stores in the country and sells everything from clothing to cell phones and electronics.

Therefore, in addition to being able to use the cards at C&A stores, you can also use them at any other establishment that accepts the chosen flag: Visa or Elo. That way, you can still choose between four types of cards, depending on your consumer profile.

So, keep reading this C&A card review and check out more advantages.

annuity and coverage

In this sense, there are different annuity values, depending on the choice of card. Therefore, carefully analyze the proposals before joining.

Therefore, according to Bradescard's official website, the cards with the lowest annual fee are Visa Gold and Elo Internacional with an annual fee of R$221.88. Next comes the Elo Mais card, with an annual fee of R$245.88.

Finally, the company offers the Elo graphite card, with an annual fee of R$329.88. Although this is the option with the highest annual fee, it is also the card with the most benefits offered.

Incidentally, it is important to say that the annual fee applies if the customer makes purchases outside C&A stores. That is, if you use the card only at C&A stores, you will not have to pay this amount.

Although this is a very interesting advantage, the cards offer other benefits such as discounts at movie theaters and book stores. In this way, you will not be able to enjoy these advantages or you will end up paying a high annuity fee.

rates to rates

Well, the C&A card has no membership fees. However, be aware of the interest if you use the cash withdrawal benefit in stores or at Banco24h terminals.

flag and benefits

Along with the Visa flag, the Elo flag is also offered when making your C&A cards. Both allow you to shop at millions of accredited establishments around the world.

Incidentally, both brands offer loyalty programs such as Vai de Visa and Livelo. That is, with them you have discounts on trips, restaurants, and purchases in general. To learn more, visit the website of the chosen flag and check it out.

Advantages of the C&A card

In this sense, the C&A card has several exclusive benefits that make it very attractive.

Firstly, customers with Bradescard C&A are entitled to a 10% discount on their first purchase at the store. In addition, you can pay for purchases made at C&A in up to 5 interest-free installments.

In addition, Elo cards also have access to Wi-Fi at 60 million points in more than 100 countries. By the way, if you choose the C&A Elo Grafite card, you still have access to VIP lounges at airports.

Also, the cards grant discounts of up to 50% in Cinemark cinemas and in the drink and popcorn combo.

Finally, with C&A cards you can also withdraw cash in stores or at Banco24h terminals and pay up to 24 times. But be aware, the amount will be charged on the invoice and you will pay interest equivalent to a loan.

So, there are many benefits, right? Learn more about the C&A card in the recommended content below.

Discover the C&A Bradescard credit card

The C&A Bradescard credit card is offered by one of the most famous clothing stores in Brazil. Check out the advantages and find out if it's worth asking for yours!

Disadvantages of the C&A card

Well, the disadvantage that draws the most attention to the C&A card is the annual fee. Although it is only actually carried out if the customer uses the card outside C&A, this is a condition that even limits some of the product's benefits.

For example, the card entitles you to a 50% discount at Cinemark cinemas. But keep in mind that if you use this benefit, you will have to pay an annuity.

In addition, to apply for the card, you must go to a physical C&A store in person and present the required documents. Thus, there are several other options on the market that offer a fully digital service in addition to cards with no annual fees.

Therefore, make sure that the C&A card is ideal for your profile before signing up.

card application

Certainly, a C&A card application could not be missing to manage all its functions. In this way, the app used is that of Bradescard, the company that manages the cards. It is available for both Android and iOS.

In fact, through the application, the customer can consult invoices and limits, issue a duplicate invoice, block their card in case of theft, in addition to making payments.

Therefore, you can download your Bradescard app through Google Play or the AppStore.

application process

So, after reading our CEA card review, are you interested in how to apply for yours? So keep reading and we explain here.

At first, the only way to join is to go to a physical C&A store. Therefore, the Bradescard application is only for people who are already customers and it is not possible to apply for the card through it.

Furthermore, it is important to say that you must be over 18 years old to purchase your C&A credit card. Just as you must also present proof of income for the last 3 months, and you cannot have your name negative at Serasa.

In addition, you must go to a C&A store and go to the Call Center. You will then submit your documents and undergo a brief credit analysis. After your approval, you will receive your card and you will be able to unlock it to use it the way you want.

However, are you still in doubt and want to know more about the application process for this card? So, access the content below and learn more!

How to apply for the C&A Bradescard card

The C&A Bradescard card allows customers to make purchases with exclusive benefits at any store in the network. Therefore, check out how to apply for this card!

About the author / Aline Barbosa

Reviewed by / Junior Aguiar

Senior Editor

Trending Topics

How to carry out consignment portability?

Do you know how to do consignment portability? With it you can change banks, continue with credit with better conditions.

Keep Reading

How to pay the Itaú bill in installments?

Do you need to pay your Itaú bill in installments? Check out in this post how you can do this through the bank's website and application.

Keep Reading

How to apply for the BMG Barcelona card

The BMG Barcelona card has no annual fee and also has cashback on purchases. Read this post and discover the step by step to request it!

Keep ReadingYou may also like

Discover the UZZIPAY digital account

If you're looking for a digital account with no monthly fees, no bureaucracy and that helps keep your finances up to date, UZZIPAY may be the solution you've been looking for! To learn more about it, its benefits and main features, just continue reading with us.

Keep Reading

The trilogy of films about the relationship between Prince Harry and actress Meghan Markle is shown on cable TV

With a relationship that shook the structures of the British monarchy and left the world's press in a state of shock, Prince Harry and actress Meghan Markle had their lives transformed into a series of films, and you can check out all the details on Pay TV through from the Lifetime channel. Understand.

Keep Reading

How to enroll in the Smiling Brazil Program

If you want to have free dental treatments, how about signing up for the Brasil Sorridente Program? Through it, you have access to several quality services to maintain a healthy smile. Check here how to participate.

Keep Reading